Authored by Charles Hugh-Smith via OfTwoMinds blog,

Clinging to magical-thinking fixes that change nothing on the fundamental level hastens collapse.

Here we stand on the precipice, and all we have in our kit is a collection of delusional magical thinking that we label "solutions." We are not just morally and financially bankrupt, we're intellectually bankrupt as well.

Here are three examples of magical thinking that pass for intellectually sound ideas:

1. Mainstream neo-classical/ Keynesian economics. As economist Manfred Max-Neef notes in this interview, neo-classical/ Keynesian economics is no longer a discipline or a science–it is a religion.

It demands a peculiar faith in nonsense: for example, the environment–Nature– is merely a subset of the economy. When we've stripped the seas of wild fish (and totally destroyed the ecology of the oceans), no problem–we'll substitute farmed fish, which are in economic terms, entirely equal to wild fish.

In other words, the natural world cannot be valued in our current mock-science religion of economics.

Other absurdities abound. Stripping the seas of wild fish adds to GDP, so it's all good, right? Dismantling newly constructed buildings and building a replacement structure also adds to GDP, so it's an excellent source of "growth."

As Max-Neef points out, conventional economists have absolutely no understanding of poverty. If you need a sobering account of just how this abject willful ignorance works in the real world, I recommend reading The White Man's Burden: Why the West's Efforts to Aid the Rest Have Done So Much Ill and So Little Good.

Gail Tverberg (among others) has shown how the existing economic model no longer makes sense of the actual economy we inhabit: The Economy Is Like a Circus.

As for rising wealth/income inequality–there is a cure for that, but it's not in mainstream econ textbooks: The Only Thing, Historically, That's Curbed Inequality: Catastrophe Plagues, revolutions, massive wars, collapsed states—these are what reliably reduce economic disparities.(via Arshad A.)

2. Universal Basic Income. As noted in yesterday's essay, wages are no longer an adequate means of distributing the dwindling surplus of advanced economies. Wages as a share of GDP have been declining for decades, and only click up temporarily during massive speculative bubbles. Once these bubbles pop, which they inevitably do due to their instability and unsustainability, wage earners' share of GDP plummets to a new low.

The mainstream is enthusing about the "solution": Universal Basic Income (UBI). The solution to low pay and scarcity of middle-class paid work is to give everyone a basic income for doing nothing.

Delusional academics anticipate a flowering of creative talent akin to a new Renaissance as people are freed from work by robots and automation. But if we look at people already receiving the equivalent of "free money" UBI–disability– studies find recipients are simply watching more TV and YouTube videos and pursuing opioids, not writing poetry and composing concertos.

They are not volunteering in their community or engaging their communities in any positive fashion. What actually happens with UBI is recipients become isolated and miserable because UBI strips their lives of meaning, purpose and the need to contribute to a community.

The real purpose of UBI is to chain every household to the state, and drain all social relations between the isolated "consumer" and the state.

As tragic as the delusion of UBI is to individuals, it is unworkable financially because profits will fall as automation becomes commoditized, and the surplus available to distribute to every household will diminish.

I explain this at some length in my books Why Our Status Quo Failed and Is Beyond Reform and A Radically Beneficial World: Automation, Technology & Creating Jobs for All.

Much of what is passed off as "corporate profits" is accounting fraud and the monetization of what was once free. For example, all that customer labor: now that we pump our own gasoline, check and pack our own purchases, do our own banking–who's skimming the output of our labor? Yup, the corporations.

Commoditization of software and tools + the Internet = loss of monopoly. This is a problem, for the core function of the state-cartel version of capitalism we inhabit is the state enforces a cartel-monopoly structure to guarantee steady surpluses it can tax for its own expansion.

As automation is commoditized, profits plummet as competition can no longer be controlled by cartels or even the state–just as Marx laid out.

Combine declining productivity and declining surplus (profits) (both for deeply structural reasons) and there cannot be enough money to fund UBI. Weirdly, proponents of UBI never even perform a back of the envelope calculation of cost and the source of all this free money (tax revenues and/or borrowing from future generations). Perhaps they intuit that such an exercise would reveal the bankruptcy of their magical thinking.

As we shall see below, the system can't even support the entitlements it has already promised to hundreds of millions of people, never mind an additional universal entitlement.

(Note to UBI enthusiasts: there are limits on what robots and automation can and will do: they will only perform work that is highly profitable. Since most human work is not profitable (or even paid), the idea that robots and automation will free everyone from work is delusional fantasy. I explain all this in greater detail in A Radically Beneficial World.)

3. Medicare for all. I understand the desire for a single-payer healthcare system, and have published various proposals over the years for such a system.

The latest magical-thinking "solution" attracting widespread support (again, without any basis in actual numbers) is Medicare for all. The idea is: take a system (Medicare-Medicaid) that's already bankrupting the government and the nation and expand it from 70 million people to 320 million people.

Uh, right.

Shall we consult reality before embracing delusional "solutions"? Here's a chart of the rise of administrative costs in healthcare, public and private. Proponents of Medicare for All claim admin costs are lower in Medicare, but this conveniently overlooks the estimates that 40% of Medicare costs are paper-shuffling, needless or harmful tests, procedures, etc. and outright fraud.

We know a few things as fact. One is that the populations qualifying for Medicare and Medicaid (the elderly and low-income households) are expanding at a high and very predictable rate.

The other thing we know is that the Medicare-Medicaid costs are rising at a rate far above the growth rate of the economy that supports these programs (GDP), far above the growth rate of tax revenues and far above the growth rate of wages, which matters because payroll taxes fund Medicare.

It doesn't take much to extend these lines and conclude Medicare-Medicaid alone will bankrupt the federal government and the nation. The problem is these programs are bloated by fraud, defensive medicine, predatory pricing for medications, and every other costly ill of our healthcare system.

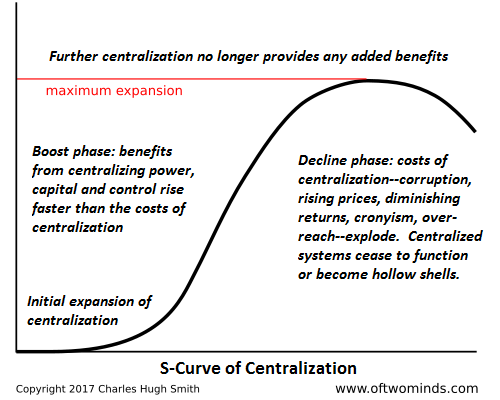

Like every other centrally funded/regulated sector, Medicare-Medicaid is optimized for maximizing private-sector profits and increasing regulatory costs. This is one manifestation of the diminishing returns on the entire centralized-control model:

We'd all like "solutions" that don't change anything, but when the system itself is the source of our problems, changing nothing guarantees collapse. As noted in the article linked above, various inequalities and asymmetries get resolved by collapse.

Clinging to magical-thinking fixes that change nothing on the fundamental level hastens collapse. In that sense, magical-thinking fixes are "solutions," but not the sort their proponents imagined.

* * *

If you found value in this content, please join Charles in seeking solutions by becoming a $1/month patron of my work via patreon.com. Check out both of Charles' new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print, $5.95 audiobook) For more, please visit the OTM essentials website.

via http://ift.tt/2oVkYEh Tyler Durden