Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Financialization results when leverage and information asymmetry replace innovation and productive investment as the source of wealth creation.

Emmanuel Saez and Thomas Piketty are leading lights in the exploration of rising wealth inequality. Both are academic economists who have devoted considerable time and effort to assembling data that deepens our understanding of the issues.

For example, Saez's recent essay Striking it Richer: The Evolution of Top Incomes in the United States, provides an in-depth look at the widening gulf between the top 1% and the bottom 90% from 2009 to 2012.

Here is a chart of the top 10% share of income, based on their research: (the note in red marking the beginning of financialization in 1982 is my own)

What is the primary driver of this era's widening wealth inequality? Thomas Piketty's new book Capital in the Twenty-First Century provides an answer: financialization. While definitions vary, mine is:

Financialization is the mass commodification of debt and debt-based financial instruments collaterized by previously low-risk assets, a pyramiding of risk and speculative gains that is only possible in a massive expansion of low-cost credit and leverage.

Another way to describe the same dynamics is: financialization results when leverage and information asymmetry replace innovation and productive investment as the source of wealth creation.

When the profits from financializing collateral and leveraging those bets to the hilt far exceed generating wealth by creating products and services, the economy is soon hollowed out as the perverse incentives of financialization start driving every business decision and strategy.

Author David Cay Johnston recently wrote an insightful review of Piketty's book,Trickle-Up economics:

Coming out of the Great Recession in 2009, inequality increased dramatically, the opposite of what happened when the Great Depression ended nearly eight decades earlier. Why?

The short answer: When investment returns exceed economic growth, the rich get richer, increasing inequality.

When an economy grows at 1 percent annually but investment returns are 5 percent, the already wealthy need to reinvest only a fifth of their gains for their fortunes to grow at the same rate as the overall economy. The rest can be spent on a sumptuous lifestyle.

Since by definition the very rich do not need to consume 80 percent of their incomes — the portion by which investment returns exceed the growth of the economy in Piketty’s model — they can reinvest most of their annual gains in the market. Over time this accumulating capital will snowball.

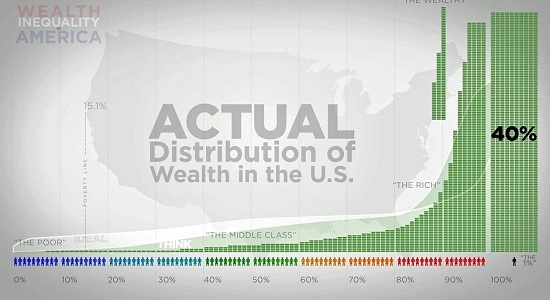

The official American income numbers, crunched by Piketty and his sometime colleague Emmanuel Saez, show that in the 21st century wealth and income increases are almost all taking place among the tiniest sliver of the wealthiest and highest-earning.

The top 1 percent of Americans raked in 95 cents out of every dollar of increased income from 2009, when the Great Recession officially ended, through 2012. Almost a third of the entire national increase went to just 16,000 households, the top 1 percent of the top 1 percent, Piketty and Saez’s analysis of IRS data shows.

The income changes for the vast majority are just as revealing. The bottom 90 percent saw their average incomes rise 8.8 percent in 1934 over the prior year, while in 2012 the same statistical group had to get by on 15.7 percent less than in 2009.

Piketty shows that whether capital is taxed or not, inequality will grow under current policies because savings from current wages and salaries cannot grow as much as returns to existing riches.

The process of accumulating “becomes more rapid and inegalitarian as the return on capital rises and the [overall economic] growth rate falls,” Piketty writes.

It's important to note that capital is not monolithic, nor is all capital qualitatively equal. Capital that is invested in rigged financier games funded by the Federal Reserve (for example, carry trades and high-frequency trading) is entirely different from capital that is placed at risk in a start-up company.

Capital invested in building a house is quite different from capital invested in pyramiding the mortgage into mortgage-backed securities (MBS) and exotic financial instruments based on the MBS.

Productively invested capital is at risk and generates additional production of goods and services. Financialized capital skims profits from leveraging debt: nothing of any real-world value is produced, it's just a giant skimming operation based on information asymmetry (or outright fraud and misrepresentation) and leverage.

Fed-funded financialization creates a perverse set of incentives: talent and capital flow to unproductive skimming operations because that's what generates the outsized profits, effectively starving the real economy of talent and capital.

The Fed makes essentially limitless funds available to banks and financiers at near-zero interest rates. Try borrowing $100,000 from the Fed at 0.1% interest; you can't. That privilege is reserved for financial predators and parasites.

Financier skimming operations stripmine productive assets and labor. With the Fed providing free money to financiers and no limits on debt, leverage, information asymmetry and sleight-of-hand accounting, the only result possible is widening wealth inequality.

You want to fix wealth inequality? Abolish the Fed, eliminate the too-big-to-fail banks, tax speculative profits from high-frequency trading and other skimming operations at 90% and lower the corporate tax rate on productively invested capital to 5%. The only way to reduce wealth inequality is to change the incentives and disincentives to favor productive investments and innovation rather than financialization.

via Zero Hedge http://ift.tt/OSkObi Tyler Durden