HANK’S RESTAURANT

(Arlo Guthrie–Alice’s Restaurant)

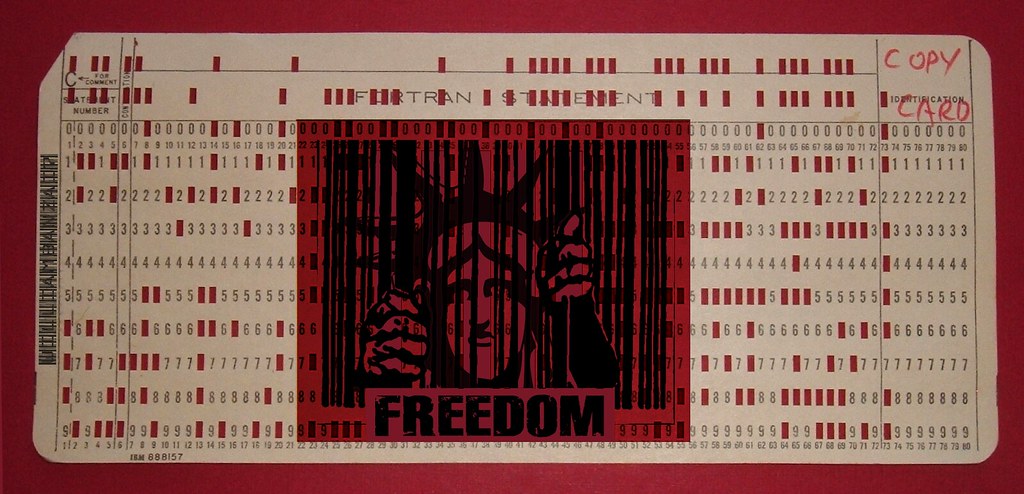

Adapted by WilliamBanzai7

This song is called Hank’s Restaurant,

and it’s about Hank,

and the restaurant,

but Hank’s Restaurant is not the name of the restaurant,

that’s just the name of the song,

and that’s why I called the song Hank’s Restaurant.

You can take anything you want from Hank’s Bailout Restaurant

You can take anything you want from Hank’s Bailout Restaurant

Walk right in it’s around the back

Just a half a mile from the Federal Reserve Bank

You can take anything you want from Hank’s Bailout Restaurant

Now it all started Hanksgiving Day 2008

when my friend Fabulous Fab and I went up to visit Hank at the restaurant,

but Hank doesn’t like sittin in there,

he likes sittin near a fella named Blankfein in Goldman Sachs’ Wall Street office,

in a big glass tower.

And being in a tower like that,

they got a lot of room downstairs.

Havin’ all that room,

they decided that they didn’t have to take out their subprime garbage for a long time.

We got up there,

we found all the toxic subprime garbage in there,

and we decided it’d be a friendly gesture for us to take the garbage down to the Federal Reserve shitty deal dump, Maiden Lane.

So my friend and I took the $700 billion tons of subprime garbage,

put it in the back of a red Humvee stretch limo, including CDSs and CDOs and other implements of financial

mass destruction and headed on toward the Maiden Lane shitty deal dump.

Well we got there and there was a big sign and a chain across across the dump saying,

“By order of Emperor Benron–No Dumping on Hanksgiving.”

And we had never heard of a shitty deal dump closed on Hanksgiving before,

and with tears in our eyes we drove off into the sunset looking for another place to put the toxic asset garbage.

We didn’t find one.

Until we came to a side road,

and off the side of the side road there was another financial black hole hole and at the bottom of the hole there was

a big pile of Wall Street garbage, offering circulars, stress tests, analyst reports, mortgage notes and such.

And we decided that one big pile is better than two little piles,

and rather than bring that one up we decided to throw our’s down.

That’s what we did, and drove back to the restaurant,

had a Thanksgiving dinner that couldn’t be beat,

went to sleep and didn’t get up until the next morning,

when we got a phone call from Porn Commissioner Cox.

He said, “Kid, we found your name on an Abacus offering circular at the bottom of a half a ton of shitty deals,

and just wanted to know if you had any information about it.”

And I said, “Yes, sir, Mr. Porn Commissioner,

I cannot tell a lie, I put that Abacus offering circular under that garbage.”

After speaking to Porn Commissioner Cox for about fourty-five minutes on the telephone we finally arrived at

the truth of the matter and said that we had to go down and pick up the subprime garbage,

and also had to go down and speak to him at the Porn Commission’s NY Regional office.

So we got in the red Humvee Limo with the CDOs and CDSs and implements of financial mass destruction and

headed on toward the Porn office upstairs at Score’s.

Now friends, there was only one or two things that the Commissioner coulda done at the Porn office,

and the first was he could have shown us some hot porn tubes of Mary Schapiro doin the deed,

which wasn’t very likely, and we didn’t expect it,

and the other thing was he could have bawled us out and told us never to be seen driving toxic asset backed

garbage around the vicinity of Wall Street again,

which is what we expected,

but when we got to the Porn Commission’s office there was a third possibility that we hadn’t even counted upon,

and we was both immediately arrested.

Handcuffed.

And I said Mr. Porn Commissioner sir, I don’t think I can pick up the toxic garbage with these handcuffs on.

He said, “Shut up, kid. Get in the back of the car.”

And that’s what we did, sat in the back of the c

ar and drove to the quote Scene of the Crime unquote.

I want tell you about Wall Street, where this happened here, they got three Federal regulators, the SEC, the

CFTC and the FBI, but when we got to the Scene of the Crime there was all kinds of Black Ops people running

around,

this being the biggest financial crime of the last five consecutive Wall Street trading days,

and everybody wanted to get in the newspaper story about it.

And the TSA, they was using up all kinds of equipment that they had hanging around the anti-traveler unit.

They was taking plaster tire tracks, finger prints, dog smelling prints, and they took twenty seven eight-by-ten

glossy back scatter scans with circles and arrows and a paragraph on the back of each one explaining what each

one was to be used as evidence against us.

Took scans of the approach, the getaway, the northwest corner the southwest corner and that’s not to

mention the aerial drone photography.

After the ordeal, we went back to the jail.

Porn Commissioner Cox said he was going to put us in the cell. Said,

“Kid, I’m going to put you in the cell, I want your wallet and your belt.”

And I said, “I can understand you wanting my wallet so I don’t have any money to spend in the cell,

but what do you want my belt for?”

And he said, “Kid, we don’t want any hangings.”

I said, “did you really think I was going to hang myself for financial intermediation?”

Porn commissioner Cox said he was making sure,

and friends the Porn Commissioner was,

cause he took out the toilet seat so I couldn’t hit myself over the head and drown,

and he took out the toilet paper so I couldn’t bend the bars roll out the – roll the toilet paper out the window,

slide down the roll and have an escape.

The PornCommissioner was making sure,

and it was about four or five hours later that Hank (remember Hank? It’s a song about Hank),

came by and with a few nasty words to Porn Commissioner Cox on the side,

Bailed us out using Federal taxpayer money,

and we went back to the restaurant,

had a another Hanksgiving dinner that couldn’t be beat!!

You can take anything you want, from Hank’s Bailout Restaurant

You can take anything you want, from Hank’s Bailout Restaurant

Walk right in it’s around the back

Just a half a mile from the Federal Reserve Bank

You can take anything you want, from Hank’s Bailout Restaurant

WB7: This is my favorite Thanksgiving song. It is also the only one I know.

Arlo Authrie, if you don’t know him, is the son of Woody Guthrie, a famous folk singer who was no friend of Wall Street.

I originally did this version of Alice’s Restaurant in September 2008. This is my updated version, which is really an excuse for me to play this song for you and to once again say…

HAPPY HANKSGIVING ALL!!

WB7

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/gR6IidDKzRg/story01.htm williambanzai7

The New York City Council is

The New York City Council is

“opinion” that “economic growth,

“opinion” that “economic growth,