Today’s AM fix was USD 1,241.75, EUR 913.11 and GBP 760.45 per ounce.

Yesterday’s AM fix was USD 1,250.75, EUR 923.88 and GBP 773.69 per ounce.

Gold fell $4.10 or 0.33% yesterday, closing at $1,236.33/oz. Silver slid $0.17 or 0.86% closing at $19.68/oz. Platinum fell $19.20, or 1.4%, to $1,352.70 an ounce and palladium fell $2.50, or 0.4%, to $715.95 an ounce.

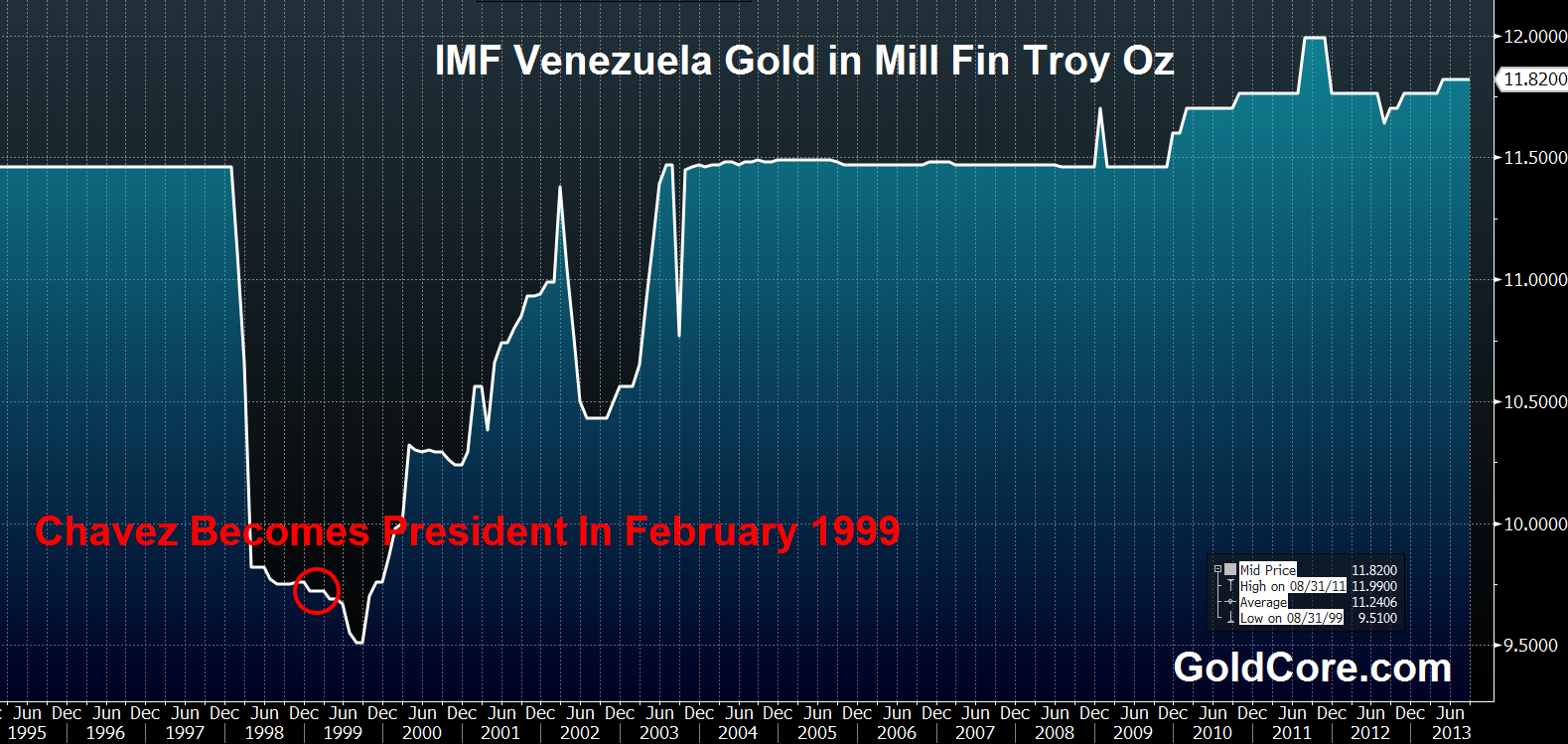

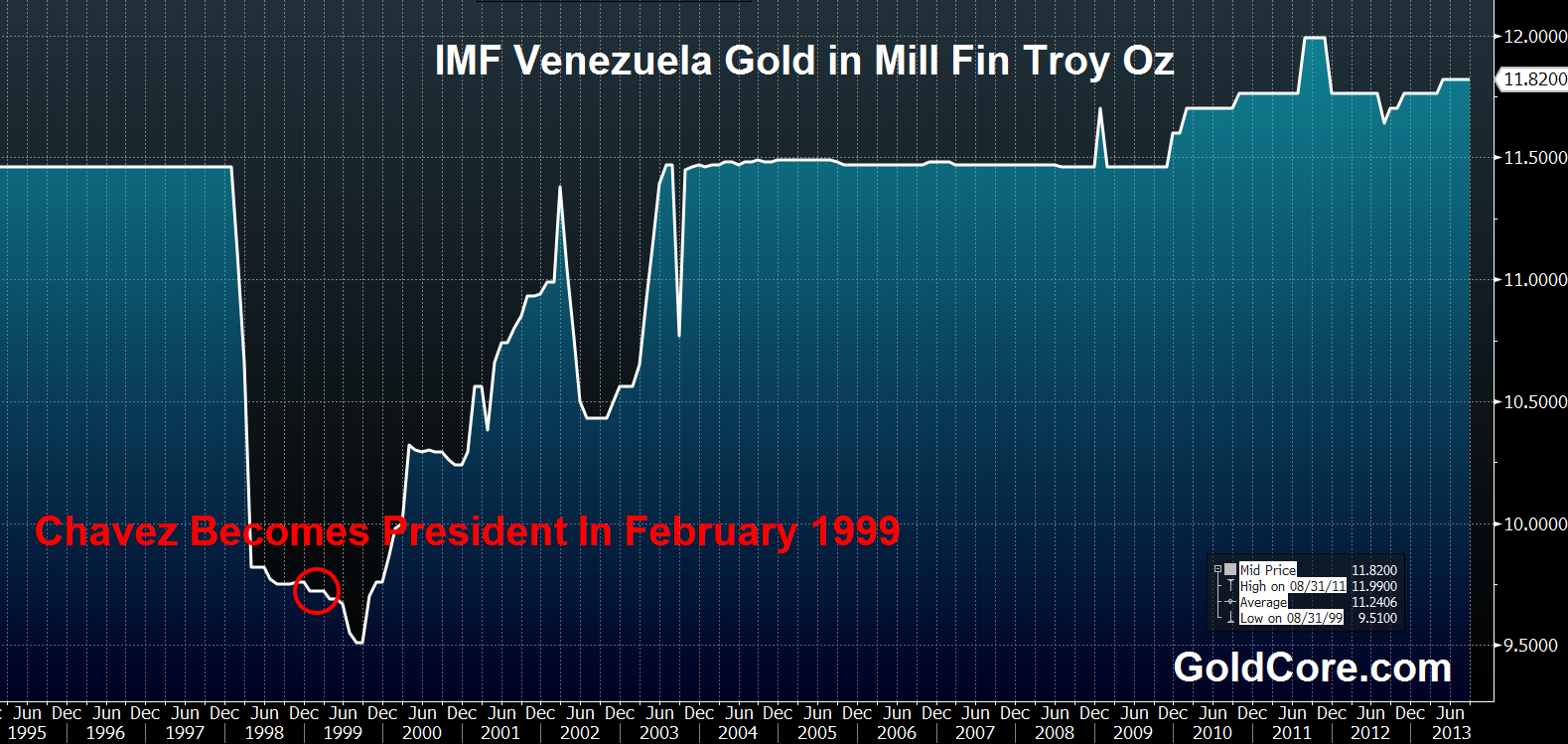

Venezuela Gold Reserves In Million Fine Troy Ounces (1995 to Today)

Gold is higher today as huge demand from China is believed to be supporting prices.

China has seen a notable pick up in demand this week due to lower prices. Traded volumes of 99.99 percent purity gold on the Shanghai Gold Exchange hit 18.3 tonnes overnight, their highest since October 8, according to Reuters data.

China’s net gold bullion imports from Hong Kong climbed to their second highest on record in October as the country bought more than 100 tonnes of gold for a sixth straight month to meet unprecedented demand.

VENEZUELA HAS DENIED that it is considering a proposal from Goldman Sachs Group Inc. that would allow the government to mortgage its gold reserves to Goldman.

A Venezuelan central bank official, requesting anonymity in keeping with bank policy, said that she had no information about the proposal. The nation’s finance ministry declined to comment according to Bloomberg.

The denial came after media reports of a peculiar gold deal being hatched by Goldman Sachs. The deal is meant to provide Venezuela with $1.68 billion in cash, providing they post $1.85 billion of Venezuela’s gold reserves, documents obtained by Bloomberg News show.

$1.85 billion is equal to some 47 tonnes of gold at today’s prices. Venezuela has nearly 366 tonnes of gold.

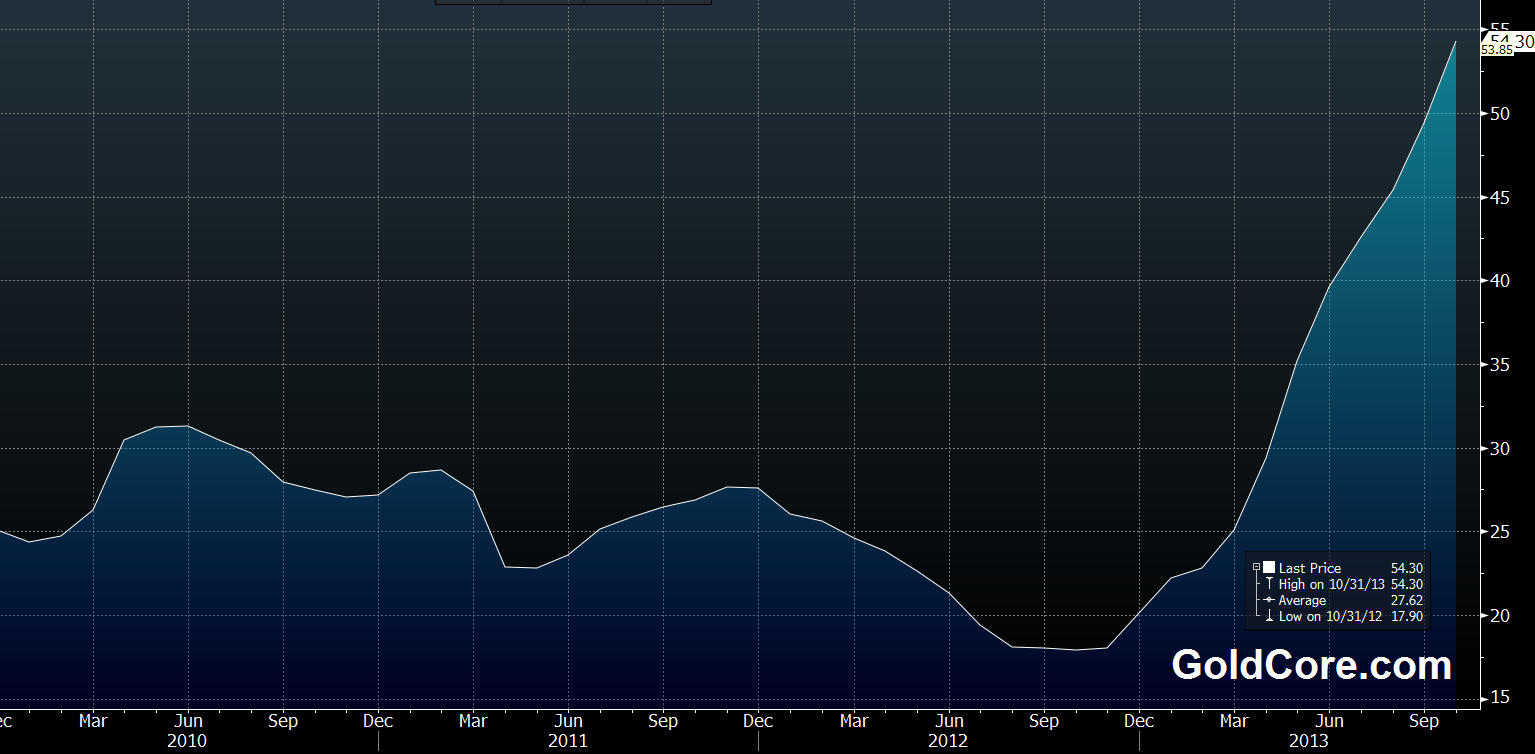

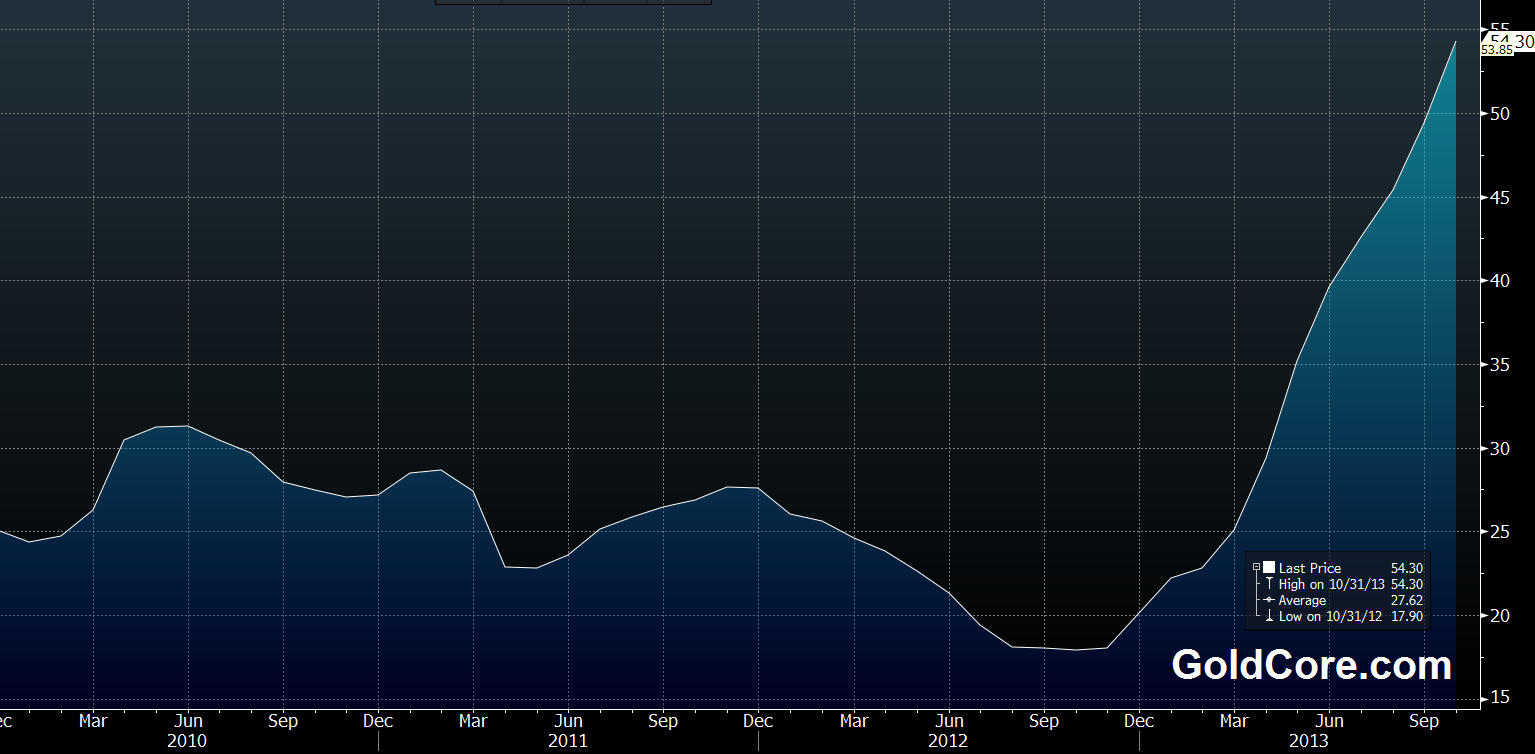

Venezuela’s economy is struggling with low economic growth and inflation surging to near hyperinflation levels at over 54%.

Venezuela National Consumer Price Index (CPI) YoY%

At the very least stagflation appears to be taking hold in Venezuela as its economy expanded by just 1.1% in the third quarter, less than half the pace that analysts forecast.

Imports plunged 18%, the central bank said Nov. 26 and its bonds have been sold in recent months resulting in much higher interest rates on its debt.

Yields on the country’s $4 billion of bonds due 2027 have jumped 4.15 percentage points this year to 13.48%, almost three times the average increase in emerging markets.

Venezuela’s foreign reserves sank to a nine-year low of $20.7 billion this month, limiting the supply of dollars in a country that imports about 75 % of the goods it consumes. Some analysts say that the shortage is also exacerbating inflation that reached 54.3% last month, the fastest in the world.

Two weeks ago, government oil producer Petroleos de Venezuela SA sold $4.5 billion of debt to fund currency auctions and food imports from Colombia in the first sale by a state-owned entity since May 2012.

“When I’m hearing that they might sell gold to raise cash, that strikes me as pure desperation,” Robert Abad, who helps oversee $53 billion in emerging-market debt at Western Asset Management Co., said in a telephone interview from Pasadena, California. “How bad can it get until I as a foreign investor have to start worrying about payment capacity?”

Goldman Sachs’s total-return swap would bear interest of 7.5% plus the three-month London interbank offered rate, for $818 million in estimated financing costs over seven years, the documents show.

Michael DuVally, a spokesman at New York-based Goldman Sachs, declined to comment on the proposal. Analysts questioned if the deal made sense and one analyst said that “a seven-year deal does not make any sense, much less at a 7.5% spread when there is collateral involved.”

Goldman’s proposal re Venezuela’s gold is interesting as it comes at a time when Goldman have been extremely vocal about its negative outlook for gold and has predicted loudly that gold is a “slam dunk” sell today and in 2014. Goldman’s crystal ball gazing and price predictions have not been particularly accurate in recent years and many investors have lost money by following their gold price predictions.

“Dictatorship Of The Dollar”

About 70% of Venezuela’s foreign reserves are in gold. Former President Hugo Chavez, who died of cancer in March, secured Venezuela’s patrimony by repatriating its gold reserves from the Bank of England. The move was believed to be an effort to move away from what he called the “dictatorship of the dollar.”

From 1999, Chavez’s first year in office, through 2012, Venezuela bought 75.3 metric tons of gold, according to data on the International Monetary Fund’s website. Those purchases cost $1 billion based on average annual gold prices and would be valued at $3.03 billion at today’s price of $1,251.96 an ounce, meaning the additions would have made $2.03 billion. The country also sold 13.1 tons of bullion during that period, the IMF data show.

“It’s The Economic Reserve For Our Kids”

Venezuela’s gold reserves total 367.6 tons, making it the 14th largest holding by country, according to the World Gold Council. Gold accounts for 70% of the nation’s foreign reserves, compared with 7.6% for Argentina and less than 1% for Brazil.

“It’s our gold,” Chavez, a self-proclaimed socialist who nationalized hundreds of companies and imposed curbs on currency trading, said on state television in November 2011.

“It’s the economic reserve for our kids. It’s growing and it’s going to keep growing, both gold and economic reserves.”

Venezuela’s currency board, known as Cadivi, sells greenbacks at the official exchange rate of 6.3 bolivars per dollar. The government, which devalued the bolivar by 32% in February, has failed to stem the currency’s slide on the black market, where companies and people not authorized to use the official rate pay about 60 bolivars per dollar.

Average prices of Venezuelan crude exports, responsible for 95 percent of the nation’s foreign-currency earnings, fell to a 16-month low this month and ended last week at $93.98 a barrel.

Each $1 dollar decline in a barrel of oil costs Venezuela about $700 million per year, according to estimates from PDVSA, as the state-owned company is known.

President Nicolas Maduro, Chavez’s handpicked successor, seized electronics retailer Daka and warned other businesses to cut prices to “fair” levels earlier this month to tame the highest inflation in 16 years.

“Basic-goods deficits are starting to affect even the poor population”

“We are very negative on the country’s debt,” Marco Aurelio de Sa, the head of fixed-income trading at Credit Agricole SA’s Miami brokerage unit, said in a telephone interview. “Basic-goods deficits are starting to affect even the poor population, and when things get to this point, this type of populist government loses support. You have to analyze the fixed-income market through the political spectrum.”

Francisco Rodriguez, chief Andean economist at Bank of America, said that the decline in imports is helping boost Venezuela’s current-account surplus, bolstering the nation’s ability to service debt.

The government said Nov. 26 that the current-account surplus rose by $1.8 billion from a year earlier to $4.1 billion.

National Gold Reserves

“The country’s ongoing external adjustment is leading to a stabilization of its capacity to service external debt obligations,” Rodriguez sai

d in a report published the same day.

Goldman is suggesting that the proposal is meant to allow Venezuela to keep its national gold reserves, with the nation posting gold bullion or cash to a margin account if the price falls and Goldman posting dollars if it rises, the documents show.

Gold in U.S. Dollars – 5 Year

President Maduro is likely to be reluctant to engage in sales of Venezuela’s gold. He may not want to reverse the strong pro-gold stance of this mentor Chavez and he may realise the importance of gold reserves in protecting countries from systemic and currency collapse.

Venezuela may also be reluctant to do such a deal after seeing the appalling state that Greece and indeed the EU has been left in. This is partly due to Goldman’s ‘creative’ financial wizardry which helped disguise Greece’s debt allowing it to join the European Monetary Union. This action contributed to Greece’s economic collapse.

An important question is what exactly is Goldman’s motivation for the peculiar gold deal? Does it wish to have access to Venezuela’s gold reserves? There are many other innovative ways that Goldman could help Venezuela with its current economic travails that do not involve gold. Were Venezuela to default on the bonds would Goldman become the beneficial owner of Venezuela’s gold reserves?

Venezuela is suffering from inflation at 54%. Given the risks posed to the U.S. dollar and other paper currencies due to currency debasement today, rather than pawning its gold reserves in some debt deal with Goldman, Venezuela would be better served adding to its gold reserves at this time as gold will protect the country from a systemic crisis or currency collapse.

Click Gold News For This Week’s Breaking Gold And Silver News

Click Gold and Silver Commentary For This Week’s Leading Gold, Silver Opinion

Like Our YouTube Page For The Latest Insights, Documentaries and Interviews

Like Our Facebook Page For Interesting Insights, Blogs, Prizes and Special Offers

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/BznRXCl749c/story01.htm GoldCore

![]()

Ramez Naam shares an excerpt from his novel,

Ramez Naam shares an excerpt from his novel,