Submitted by Jim Quinn of The Burning Platform blog,

“Human history seems logical in afterthought but a mystery in forethought. In every prior Fourth Turning, the catalyst was foreseeable but the climax was not.” – The Fourth Turning – Strauss & Howe – 1997

We are five years into the Crisis that will not resolve itself until sometime in the 2020’s. No one can predict the specific events that will fundamentally change history over the next decade, but the catalysts of debt, civic decay and global disorder were evident sixteen years ago when Strauss and Howe wrote their prophetic generational history. The volcanic eruption occurred in 2008 when the worldwide financial system blew and the molten lava continues to spew forth and flow along the Federal Reserve created channels, protecting the corrupt establishment while incinerating senior citizens, the working middle class and Millennials. Deep within the volcano the pressure is building again as the mood of the country darkens. It will blow again and the economic, social, political and military distress will catalyze into a catastrophic emergency that will tear the fabric of the country asunder. The existing social order will be swept away and replaced by a new paradigm which could be better or far worse.

“Imagine some national (and probably global) volcanic eruption, initially flowing along channels of distress that were created during the Unraveling era and further widened by the catalyst. Trying to foresee where the eruption will go once it bursts free of the channels is like trying to predict the exact fault line of an earthquake. All you know in advance is something about the molten ingredients of the climax, which could include the following:

- Economic distress, with public debt in default, entitlement trust funds in bankruptcy, mounting poverty and unemployment, trade wars, collapsing financial markets, and hyperinflation (or deflation).

- Social distress, with violence fueled by class, race, nativism, or religion and abetted by armed gangs, underground militias, and mercenaries hired by walled communities.

- Political distress, with institutional collapse, open tax revolts, one-party hegemony, major constitutional change, secessionism, authoritarianism, and altered national borders.

- Military distress, with war against terrorists or foreign regimes equipped with weapons of mass destruction.”

The Fourth Turning – Strauss & Howe – 1997

Linear thinkers are incapable or unwilling to understand that history is cyclical, primarily driven by national mood changes and the interaction of generations entering different stages in their 80 year life cycle. We’ve seen this story before, but those who lived through the last Fourth Turning have mostly died out, and our techno-narcissistic populace has absolutely no interest in understanding history beyond last night’s episode of Duck Dynasty. The mood of the country during a Turning is often captured in literature and/or film produced during that period.

The last Fourth Turning encompassed the period from the Great Crash in 1929 through the Great Depression and World War II, ending in 1946 with a new world order. Four novels written during this Crisis captured the dystopian nature of the time, reflecting the fear, pain, anger, brutality, and courageousness of the common man during that perilous period. Huxley’s Brave New World (1932), Steinbeck’s Grapes of Wrath (1939), Orwell’s 1984 (written during WWII), and Tolkien’s Lord of the Rings Trilogy (written from 1937 through 1949) are masterpieces of literature which captured the aura of the times in which they were penned. Only one of the novels was brought to film during the Crisis, with John Ford’s brilliant Grapes of Wrath screen adaptation capturing the suffering and desperation of common folk during the Great Depression.

Most of what passes for literature and film these days is nothing more than glorified commercials or corporate created twaddle designed for narcissistic, mindless, teenage girls. Many will dismiss Suzanne Collins’ Hunger Games trilogy and the film adaptations as nothing more than run of the mill teenager nonsense. They are making a huge mistake. Decades from now, if we make the right choices during this Fourth Turning, The Hunger Games will be viewed as the novels and films that captured the darkening, rebellious mood of the Crisis. It is not a coincidence the first novel was published in September 2008. The worldwide financial meltdown initiated by the Wall Street financial elite and their paid for cronies in the nation’s capital, occurred in September 2008 and marked the commencement of this Fourth Turning. Collin

s has brilliantly created a dystopian nightmare that combines the shallowness and superficiality of our reality TV culture with our never ending wars of choice and rise of our surveillance state, while blending the decadence and debauchery of the declining Roman Empire. She also unwittingly places her characters in their proper generational roles during a Fourth Turning Crisis.

Collins was a military brat who was fortunate enough to have a father that taught her the truth about historical events, not the propaganda taught in our public schools today.

“He was career Air Force, a military specialist, a historian, and a doctor of political science. When I was a kid, he was gone for a year in Viet Nam. It was very important to him that we understood about certain aspects of life. So, it wasn’t enough to visit a battlefield, we needed to know why the battle occurred, how it played out, and the consequences. Fortunately, he had a gift for presenting history as a fascinating story. He also seemed to have a good sense of exactly how much a child could handle, which is quite a bit.”

She learned lessons about war, poverty, oppression, and the brutality and corruption of the ruling classes. Her knowledge of history, the visual images of reality shows and the Iraq War displayed on TV created the idea for her Hunger Games trilogy.

“I was channel surfing between reality TV programming and actual war coverage when Katniss’ story came to me. One night I’m sitting there flipping around and on one channel there’s a group of young people competing for, I don’t know, money maybe? And on the next, there’s a group of young people fighting an actual war. And I was tired, and the lines began to blur in this very unsettling way, and I thought of this story.”

The central storyline of The Hunger Games is there are twelve districts subservient to the Capitol in the totalitarian nation of Panem. The country consists of the affluent Capitol, located in the Rocky Mountains, and twelve desperately poor districts ruled by the Capitol. The Capitol is lavishly opulent and technologically advanced, but the twelve districts are in varying states of poverty. As punishment for a past rebellion against the Capitol wherein twelve of the districts were defeated and the thirteenth purportedly destroyed, one boy and one girl from each of the twelve districts, between the ages of twelve and eighteen, are selected by lottery to compete in the “Hunger Games” on an annual basis.

The Games are a televised spectacle, with the participants, called “tributes”, being forced to fight to the death in a treacherous outdoor arena. It’s a combination of American Idol, Survivor, and Middle Eastern warfare. The victorious tribute and his or her home district are then remunerated with extra food and supplies. The objective of the Hunger Games is to provide superficial reality TV entertainment for the vacuous small-minded masses in the Capitol and serve as a constant reminder to the Districts of the Capitol’s supremacy and supposed omnipotence. The Capitol ruling with an iron fist over its 13 Districts is clearly founded upon the British Empire running roughshod over the 13 American colonies and harvesting resources and taxes to maintain their wealth, power and control. Collins utilizes her knowledge of ancient Greek and Roman history and merging it with our degraded shallow TV culture to meld a dystopian nightmare of brutality, child murder, voyeuristic sadism, and a fragile, rotting empire.

“A significant influence would have to be the Greek myth of Theseus and the Minotaur. The myth tells how in punishment for past deeds, Athens periodically had to send seven youths and seven maidens to Crete, where they were thrown in the Labyrinth and devoured by the monstrous Minotaur. Even as a kid, I could appreciate how ruthless this was. Crete was sending a very clear message: “Mess with us and we’ll do something worse than kill you. We’ll kill your children.” And the thing is, it was allowed; the parents sat by powerless to stop it. Theseus, who was the son of the king, volunteered to go. I guess in her own way, Katniss is a futuristic Theseus.

In keeping with the classical roots, I send my tributes into an updated version of the Roman gladiator games, which entails a ruthless government forcing people to fight to the death as popular entertainment. The world of Panem, particularly the Capitol, is loaded with Roman references. Panem itself comes from the expression “Panem et Circenses” which translates into ‘Bread and Circuses’.” – Suzanne Collins

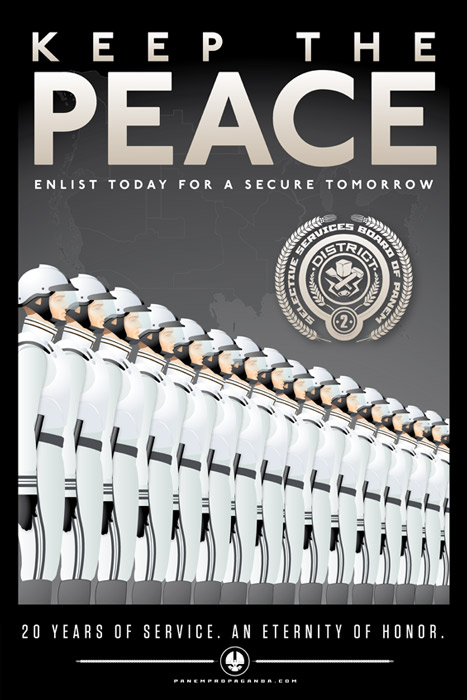

Any similarities between propaganda posters in Panem and propaganda in America are purely coincidental, I’m sure.

“At least once every human should have to run for his life, to teach him that milk does not come from supermarkets, that safety does not come from policemen, that ‘news’ is not something that happens to other people. He might learn how his ancestors lived and that he himself is no different–in the crunch his life depends on his agility, alertness, and personal resourcefulness.” – Robert Heinlein

The Reaping of Wealth

“War, terrible war. Widows, orphans, a motherless child. This was the uprising that rocked our land. Thirteen districts rebelled against the country that fed them, loved them, protected them. Brother turned on brother until nothing remained. And then came the peace, hard fought, sorely won. A people rose up from the ashes and a new era was born. But freedom has a cost. When the traitors were defeated, we swore as a nation we would never know this treason again. And so it was decreed, that each year, the various districts of Panem would offer up in tribute, one young man and woman, to fight to the death in a pageant of honor, courage and sacrifice. The lone victor, bathed in riches, would serve as a reminder of our generosity and our forgiveness. This is how we remember our past. This is how we safeguard our future.” – President Snow – Hunger Games

A major theme in the novels is the tremendous wealth inequality between the Capitol and most of the districts. District 12, the home of Katniss Eve

rdeen the protagonist, is the most desperately poor. District 12 is located in the Appalachian region of the former USA. They are tasked with providing the Capitol resources obtained from dangerous mines. The population lives a bleak existence in poverty and squalor, with starvation always looming like an apparition of death. The districts are essentially slave plantations to be pillaged for whatever the dictatorial Capitol demands. The districts exist to harvest resources, such as fish, coal, lumber, crops, and gems, all sent to fulfill their quotas. Many districts, such as 12 and 11, don’t have enough coal to power their own district or enough food to feed their citizens. Districts 1, 2 and 4 are closer and more allied with the Capitol, resulting in them receiving more support, better food, consumer goods, and military protection. The wealth inequality between the ruling class and the working class in the districts is the primary cause of discontent and increasing rebelliousness.

The parallels with our corporate fascist surveillance state are unmistakable. The wealth and power in our country is concentrated in the hands of ruling elite who primarily reside in the nation’s capital of Washington D.C. and the financial capital of New York City. The top 1% control 42% of the nation’s financial wealth, while the bottom 80% control less than 5% of the financial wealth.

Table 1: Income, net worth, and financial worth in the U.S. by percentile, in 2010 dollars

|

Wealth or income class |

Mean household income |

Mean household net worth |

Mean household financial (non-home) wealth |

|

Top 1 percent |

$1,318,200 |

$16,439,400 |

$15,171,600 |

|

Top 20 percent |

$226,200 |

$2,061,600 |

$1,719,800 |

|

60th-80th percentile |

$72,000 |

$216,900 |

$100,700 |

|

40th-60th percentile |

$41,700 |

$61,000 |

$12,200 |

|

Bottom 40 percent |

$17,300 |

-$10,600 |

-$14,800 |

From Wolff (2012); only mean figures are available, not medians. Note that income and wealth are separate measures; so, for example, the top 1% of income-earners is not exactly the same group of people as the top 1% of wealth-holders, although there is considerable overlap.

The concentration of wealth in the hands of the few if achieved through superior work ethic and/or intellectual advantage would not cause discontent among the masses. Henry Ford, Steve Jobs and Bill Gates were admired for creating businesses and employing people. They earned their wealth. Today, it has become clear to all critical thinking people that a small cabal of super-rich men constituting an invisible ruling class have captured our financial and political system. They are the .1% who run the Wall Street banks, control the Federal Reserve, buy off the politicians of both parties, and pay lobbyists to write the laws and tax regulations. They use their ill-gotten wealth to maintain the status quo and further pillage the wealth of the working class through financial market manipulation, man-made inflation and outright theft. As 47 million Americans depend upon food stamps and other welfare programs to get by and real unemployment exceeds 20%, the wealth inequality in the nation has reached levels only seen in 1929, prior to the Great Crash outset of the last Fourth Turning. The mounting anger and discontent among the former working middle class is palatable. Those at the top of the food chain have rigged the system and get richer by the day. They bribe the lower classes with welfare benefits, taken from the working middle class, in an effort to stave off riots in the streets.

Rentier capitalism, the economic practice of parasitic monopolization of access to physical, financial, and intellectual property, has replaced free market capitalism, with the rentier class generating billions of illicit financialization profits while contributing nothing to society. We’ve become a modern day Panem, an imperialistic state thriving on the slave labor of other countries and inflicting our bastardized form of democracy at the point of Tomahawk missiles. In order to survive, Katniss defiantly and illegally hunts outside the District 12 fence perimeter and the famished citizens openly defy the law with their black market trading at the Hob. Desperate times lead to desperate measures.

When people despair, laws designed to maintain the status quo are deemed inconsequential by the peasants. You can see this happening in our society today. Welfare fraud among the lower classes is rampant. Bartering and working under the table for cash to avoid the crushing tax burden is growing. The rise of bitcoin as an alternative currency and the growing popularity of having possession of physical gold and silver is a reaction to the banker/politician fiat currency debt scheme to impoverish the masses. When the people see the bankers (Jamie Dimon) and former politicians (Jon Corzine) breaking laws with impunity, they feel no obligation to obey laws designed to keep them under the thumb of the ruling class. The fallacy of all men being created equal, with the American dream achievable for everyone, is still propagated by the government media propaganda mouthpieces. You’d have to be asleep to believe it.

In reality the ultra-rich have captured the system and have stacked the deck in their favor. This theme is captured in the Hunger Games during the reaping process, which is supposed to be random, with rich and poor equally likely to get chosen. In reality, the poor are much more likely than the rich to be reaped as tributes. In exchange for extra rations of food and oil necessary to keep from starving or freezing to death, called tesserae, those children eligible for the Hunger Games can enter their names into the reaping additional times. Most children of poor families have to take tesserae to survive, so the children of poor families have more entries in the reaping than children of wealthy families who need no tesserae. The odds are never in their favor. The current version of the Hunger Games for our youth is loading them up with government peddled student loan debt, with no jobs available when they graduate, leaving them enslaved in unpayable debt.

The rich who do become tributes from the more prosperous districts have an additional advantage, because they are often trained to take part in the Games and volunteer to do so. They are bigger, stronger, well fed and groomed to win. The poor tributes face certain death. The fact is you can only push people so far before they fight back. The arrogance and hubris of the rich governing class leads them to disregard the misery of the lowly peasants, while they intensify their pillaging and burning of the countryside. Eventually a spark ignites a revolutionary spirit and unleashes a torrent of violence and retribution. History is ripe with instances of the downtrodden masses rising up and throwing off the yoke of authoritarian despots. Fourth Turnings are when the existing social order is swept away in an avalanche of violence and bloodshed.

Bread, Circuses & Reality TV

“What must it be like, I wonder, to live in a world where food appears at the press of a button? How would I spend the hours I now commit to combing the woods for sustenance if it were so easy to come by? What do they do all day, these people in the Capitol, besides decorating their bodies and waiting around for a new shipment of tributes to roll in and die for their entertainment?” – Katniss Everdeen – Hunger Games

The name of the nation – Panem, derives from the Latin phrase panem et circenses, which translates into ‘bread and circuses’. The idiom is meant to describe entertainment used to distract public attention from the corruption and vices of the governing class. By the government providing basic food and ample entertainment, the citizens voluntarily sacrifice liberties and rights for safety, security, and sustenance. The debauched occupants of the Capitol are the wealthiest and most decadent of all Panem, and the city’s affluence is fueled by the compulsory labor of the districts. The degenerates of the Capitol are known for their “creative” outfits, outrageous hair and ridiculous sense of fashion, even to the extent of dying the color of their own skin, or having whiskers implanted. Food and amusement are major drivers of the Hunger Games plot. The impoverished citizens, particularly in Districts 12 and 11 are on the verge of starvation, while the Capitol has food in abundance and throws lavish parties with extravagant and copious quantities of cuisine.

The superficial decadent upper class in the Capitol embraced overindulgence to such an extreme they purposely drank a concoction which would force them to throw up, so they could consume more. The analogy to the Roman vomitoriums during the depraved final days of their declining empire is distinct. Today in America, 47 million lower class Americans are reliant upon food stamps to be fed, while the majority are left to ingest processed poison packaged as food by mega-corporations and relentlessly marketed on television to a dumbed down populace. The ultra-rich dine on caviar and champagne in their penthouse suites, mansions in the Hamptons, or make reservations at restaurants not available to the 99.9%.

Appearances are extremely important in the post-apocalyptic pretentious world of the Hunger Games. Style and ostentatious fashion are everything to the affluent citizens of the plutocratic Capitol. It is natural to tattoo and dye their bodies’ in bright colors, as well as undergo plastic surgery to improve their looks. Some people of the Capitol have gems implanted in their skin, as well as talons. Capitol residents regularly wear wigs in a multitude of shocking colors. The degradation of our society can be seen in the worship of Hollywood created stars and pop singers freaks like Lady Gaga. The filthy rich deform their bodies with plastic surgery to change their natural appearance. By mutilating their bodies with surgery and tattoos, the media glorified fashionistas set the tone for a cultural decay. The lower classes can’t afford expensive plastic surgery, so they cover themselves in hideous tattoos in a pathetic attempt at individuality, when they are just conforming like lemmings to what they are told is trendy. The vain and narcissistic are too ignorant to realize their worship of celebrity and purchase of the latest fashions in clothes and jewelry are the sheep-like behavior of conformists.

The voyeuristic exploitation of children is taken to an extreme in The Hunger Games with their terror, suffering and slaughter televised for the enjoyment of a blood thirsty public. Murder as mass entertainment in a reality TV game show format illustrates a truly depraved culture. The American TV culture turns news, tragedy, childhood and war into morbid reality TV entertainment. The news, as reported by the corporate legacy media, is nothing more than propaganda generated by the establishment to support their continued control over the financial and governmental levers. It is designed to distract, misinform and obscure the truth. What the news cameras show is not reality and facades are more consequential than the truth – a Wag the Dog world. Virtually half of prime time TV is a staged voyeuristic display of moronic triviality, requiring no thought and providing a form of passive sedation for low IQ imbeciles. The sexual exploitation of children in shows such as Toddlers & Tiaras and Honey Boo Boo is considered normal in a thoroughly abnormal society. Television is nothing but show business and we are amusing ourselves to death, as revealed by Neil Postman.

“When a population becomes distracted by trivia, when cultural life is redefined as a perpetual round of entertainments, when serious public conversation becomes a form of baby-talk, when, in short, a people become an audience, and their public business a vaudeville act, then a nation finds itself at risk; culture-death is a clear possibility.” – Neil Postman – Amusing Ourselves to Death

The Hunger Games are televised and discussed incessantly in Panem’s media, just as the pointless Iraq War and faux War on Terror are ceaselessly analyzed, evaluated and hyped by talking heads with bleached teeth, like the smarmy Caesar Flickerman in the Hunger Games movie. The Roman gladiatorial games and the televised “Shock & Awe” of obliterating the city of Baghdad with thousands of cruise missiles are both forms of barbaric entertainment, with the poor sacrificed on the altar of entertainment. The ruling class have successfully dehumanized our culture and turned real people into commodities to be manipulated, used and even killed for profit. Their value becomes determined by how much entertainment they provide, and as such they lose their identities as people. Reality television is a form of objectification. The world has become a stage for our Contoll

ers, their stage managers on Madison Avenue and the mainstream media.

“Television is our culture’s principal mode of knowing about itself. Therefore — and this is the critical point — how television stages the world becomes the model for how the world is properly to be staged. It is not merely that on the television screen entertainment is the metaphor for all discourse. It is that off the screen the same metaphor prevails.” ? Neil Postman – Amusing Ourselves to Death

We’ve spent the last five decades learning to love our oppression, adoring our technology, glorying in our distaste for reading books, and wilfully embracing our ignorance. Huxley’s vision of a population, passively sleep walking through lives of self- absorption, triviality, drug induced gratification, materialism and irrelevance has come to pass. Only in the last two decades has Orwell’s darker vision of oppression, fear, surveillance, hate and intimidation begun to be implemented by the ruling class. We’ve become a people controlled by pleasure and pain, utilized in varying degrees by those in power. Stay tuned for our modern day Hunger Games after this commercial for your very own Duck Dynasty Chia Pet.

In Part 2 of this article – May the Odds Ever Be in Your Favor – Hope & Defiance, I’ll address how Edward Snowden is our mockingjay who has ignited a fire that will lead to revolution and the next phase of this Fourth Turning.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/_7SRsEgR4S8/story01.htm Tyler Durden

Tonight at 9 pm Eastern, your favorite

Tonight at 9 pm Eastern, your favorite

The Federal Bureau of Investigation held an

The Federal Bureau of Investigation held an