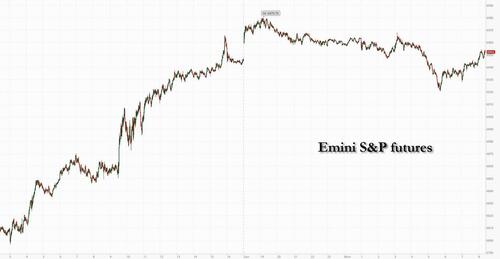

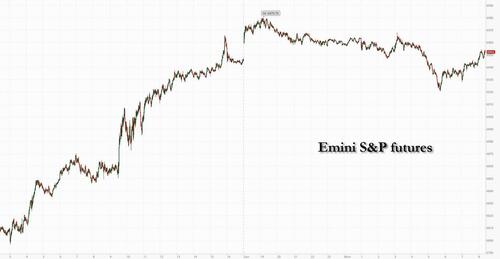

S&P futures are unchanged, erasing all overnight losses, extending last week’s choppy price action focused on AI repercussions; Nasdaq 100 futures underperform slightly ahead of an important week that has both the January jobs and CPI report on deck (at least the firehose of earnings is slowing down). As of 8:15am ET, S&P futures are unchanged, and Nasdaq futures dip 0.2% with tech the biggest laggard as Semis come back under pressure and Mag7 names are all weaker. The yield on 10-year Treasuries rose three basis points to 4.24% after BBG reported that China tells state and local banks to limit/reduce Treasury exposure (does not affect Federal holdings) which according to JPM may raise risk of a “Sell America” trade esp with Japan / APAC poised to rip in the near-term. The dollar dipped 0.3%, supporting gold and silver. Bitcoin slipped below $69,000. Commodities are big with precious metals and gasoline the upside standouts. Today’s macro data focus is on the NY Fed’s inflation expectations release.

In premarket trading, Mag 7 stocks are mixed (Microsoft +0.6%, Amazon +0.03%, Meta -0.1%, Tesla -0.1%, Alphabet -0.3%, Apple -0.1%, Nvidia -0.9%)

- Cleveland-Cliffs (CLF) falls 3% after fourth-quarter adjusted Ebitda from the steel company missed the average analyst estimate.

- Eli Lilly (LLY) rises 1% after agreeing to buy US biotech Orna Therapeutics Inc. for up to $2.4 billion in cash.

- Hims & Hers Health (HIMS) tumbles 20% after the telehealth company said it will stop selling its recently launched copycat version of the new Wegovy weight-loss pill.

- Kroger Co. (KR) is up 5% as the supermarket chain named Greg Foran as its chief executive officer. Foran led Walmart US for six years

- Kyndryl Holdings (KD) sinks 40% after the information-technology services company spun off from IBM reported adjusted earnings per share for the third quarter that missed the average analyst estimate.

- Li Auto’s ADRs (LI) fall 3% after JPMorgan downgraded the stock to underweight on a view that new EV models from five other carmakers are likely to pressure the Chinese auto firm’s sales this year.

- Monday.com (MNDY) slumps 14% after the software company forecast revenue for the first quarter; the guidance missed the average analyst estimate.

- SoFi Technologies (SOFI) gains 3% as Citizens upgrades the online personal finance company to market outperform.

- Tegna Inc. (TGNA) rises 9% after President Donald Trump backed television broadcaster Nexstar Media Group’s proposed $3.5 billion acquisition of the company.

In corporate news, Nvidia-backed Firmus Technologies secured a $10-billion loan from a group including Blackstone-led funds to boost its data center rollout.

Stock futures are jittery after last week’s nosebleeding volatility while Treasuries fell after Chinese regulators urged banks to limit their holdings. It’s a big week for eco data, with delayed January releases for payrolls on Wednesday and CPI due Friday. Stocks will remain choppy, according to Goldman Sachs’ trading desk, with systematic strategies expected to be net sellers. A renewed decline could trigger about $33 billion of selling this week, they said, although that will likely be more than offset by a huge short squeeze after last week saw record short selling of single stocks.

“These moves also make people say, ‘Let me be a little bit more cautious than I had been” and wait for a better opportunity,” said Keith Lerner, chief investment officer at Truist Advisory Services.

The AI debate continues, with Deutsche Bank strategists noting significant rotation out of tech, while Morgan Stanley’s Mike Wilson sees opportunity in enablers and adopters. Tech stocks had been caught up in a rout due to worries over the billions of dollars being spent on AI. The release of a new automation tool from Anthropic PBC added to the pressure, as investors ditched stocks seen as vulnerable to AI disruption.

“Expect swings to continue until we have clearer visibility on the AI monetization, as well as the Fed’s rate path,” said Desmond Tjiang, chief investment officer for equities and multi-asset investment at BEA Union Investment.

The employment report this week is predicted to show payrolls rose 69k in January, which would be the best in four months. The report will also include an annual revision to the jobs count, which is expected to reveal a notable markdown to payrolls growth in the year through March 2025. CPI may be lukewarm due to prices of cars and medical commodities offsetting a spike in other core goods.

While the US is winning the AI race, “its markets are footing the bill,” write Bloomberg Intelligence strategists Gillian Wolff and Michael Casper. After recent volatility, US tech valuation premiums have narrowed to around 23% versus China and Taiwan tech. After a challenging week for stocks, with rising performance dispersion and single-stock volatility, global equity markets look primed for short-term consolidation, according to strategists at Citi.

In geopolitics, Iran’s President described US nuclear talks as a “step forward.” Bessent cited Chinese traders as a reason behind last week’s wild swings in the gold market. Japanese equities surged to fresh record highs on Monday after PM Sanae Takaichi’s party achieved a landslide victory.

Apollo, Becton Dickinson and Waters are among companies scheduled to report before the market open. Apollo’s AUM are likely to expand 25%, the most since 1Q 2021, helped by continued inflows growth. Earnings from Arch Capital and ON Semi are due later in the day.

The Stoxx 600 is up 0.2% as European stocks rise on Monday, lifted by Novo Nordisk A/S shares after a US competitor scrapped a copycat Wegovy weight-loss pill. Travel and leisure as well as banking shares outperform, while the personal care and retail sectors lag. Here are some of the biggest movers on Monday:

- InPost shares jump as much as 14% after Advent, FedEx, A&R and PPF announced plans for a €15.60 share buyout.

- Novo Nordisk shares surge as much as 8.6%, reversing some of last week’s plunge, after Hims & Hers Health Inc. pulled a copycat version of the new Wegovy weight-loss pill.

- STMicro shares rise as much as 7% after Amazon deepened its ties with the Franco-Italian chipmaker to secure semiconductor technologies for its data centers.

- Plus500 shares rise as much as 7.1% to a record high as the trading platform says its performance in FY26 is likely to be better than the market expects.

- UniCredit shares gain as much as 6.5% after the Italian lender reported fourth-quarter net income that beat estimates, and said it plans to return about €50b to investors in next five years.

- Coor Service Management shares rise as much as 14% in Stockholm, the steepest gain since December 2015, after newspaper Dagens Industri reports that six new owners have simultaneously built up almost identical holdings in the Swedish company.

- DSM-Firmenich shares fall as much as 5.7% after the firm agreed to sell its animal nutrition and health business to CVC Capital Partners at a lower valuation than some analysts expected.

- NatWest shares fall as much as 5.6% as the UK lender says no further buybacks are likely before 1H 2027 results after it agrees to buy wealth manager Evelyn Partners for an enterprise value of £2.7 billion.

- Greggs shares drop as much as 6% after Jefferies downgraded the bakery chain to hold, noting that the uptake of weight-loss drugs was a headwind to the earnings outlook.

- Ayvens shares fall as much as 3.7% after Oddo BHF cuts the French vehicle rental firm to neutral from outperform over a reset of used car sales results.

- Eramet shares fell as much as 6.3% after the Financial Times reported that the French company suspended CFO Abel Martins-Alexandre last week, days after the board announced it had terminated the mandate of CEO Paulo Castellari.

Earier in the session, Asian stocks gained, as Japanese stocks rallied to a record and South Korea led a wider surge in technology shares.

The MSCI Asia Pacific Index rose as much as 2.5% to a fresh high, with Japanese stocks leading gains after Prime Minister Sanae Takaichi’s ruling party achieved the biggest post-war victory for a single party in a general election. Korean stocks also surged by more than 4% following report that Samsung Electronics will start mass production of HBM4 chips after the Lunar New Year holiday. Stocks also traded higher in Taiwan, China and Hong Kong. The renewed optimism comes as a relief after Asia’s benchmark index posted its first weekly loss in seven. Meanwhile in Japan, Takaichi’s win is expected to benefit sectors including AI, semiconductors and defense on her expansionary fiscal policies. The yen strengthened away from levels seen as a danger zone for intervention. In Thailand, stocks surged as much as 4% to the highest levels since December 2024 after an election win by the ruling party paved the way for more policy clarity. Stocks also gained in India, Indonesia and Malaysia.

The ruling Liberal Democratic Party’s “historic victory gives Prime Minister Takaichi a stable majority, reducing coalition constraints and enabling decisive action on fiscal stimulus, AI, semiconductors, energy security, and strategic reforms,” said Marc Jocum, senior investment strategist at Global X Management. “Markets now have a clear fiscal policy runway through 2028 until the next election.”

In FX, the yen is gaining against the greenback in the wake of Japanese PM Sanae Takaichi’s election victory. Expect this kneejerk reversal, which may have had some help from local authorities to unwind soon. The Bloomberg Dollar Spot index is down 0.2%. While the pound has picked up, it remains near the bottom of the G-10 pile amid a UK political risk premium. This is also being seen in other UK assets with gilts down 35 ticks versus losses of 13 ticks for bunds.

In rates, treasuries are mixed, tracking a curve-steepening gilt selloff following the resignation of a second senior aide to Prime Minister Keir Starmer.US long-end yields are 2bp-3bp higher on the day with shorter maturities little changed, widening 2s10s and 5s30s spreads by about 2bp, triggered by a Bloomberg report noting that China directed banks to limit holdings of US Treasuries. The bond market is also trying to figure out what a Warsh-led Fed will mean, particularly his call for a new accord with the Treasury Department. UK long-end tenors are about 3bp cheaper on the day, steepening its 2s10s curve by 3bp. The delayed January jobs report is ahead on Wednesday and quarterly new-issue auctions start Tuesday. Treasury coupon auctions resume Tuesday with 3-year notes, followed by 10- and 30-year new issues, totaling $125 billion.

“There is no credible alternative as a global reserve asset at present,” said Geoff Yu, senior macro strategist at BNY. “Our holdings data indicates 72% of global sovereign bond allocations are in US Treasuries, with the euro zone at 11%. There is no comparison.”

Meanwhile, the Treasury is due to offer a combined $125 billion in three-, five- and 10-year debt.

“At least two cuts this year, maybe three cuts. Given the easing that we’ve already seen, I think the US economy probably will accelerate this year,” Paul Jackson, global market strategist at Invesco, told Bloomberg TV.

In commodities, precious metals are higher but off best levels with gold and silver showing respective gains of 0.9% and 2.7%. WTI crude futures have picked up throughout the European session, gaining 0.3%. Bitcoin is down 2.5% with selling picking up after slipping below the $70,000 level.

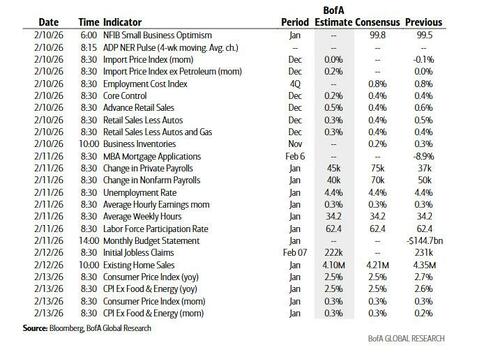

US economic calendar includes January New York Fed 1-year inflation expectations at 11am. Ahead this week are December retail sales and January employment and CPI.Fed speaker slate includes Waller (1:30pm), Miran (2:30pm, 5pm) and Bostic (3:15pm)

Market Snapshot

- S&P 500 mini -0.1%,

- Nasdaq 100 mini -0.2%,

- Russell 2000 mini -0.1%

- Stoxx Europe 600 little changed,

- DAX little changed, CAC 40 -0.1%

- 10-year Treasury yield +3 basis points at 4.24%

- VIX +0.8 points at 18.52

- Bloomberg Dollar Index -0.1% at 1189.33

- euro +0.3% at $1.1856

- WTI crude little changed at $63.56/barrel

Top Overnight News

- Democrats won’t pass the remaining DHS funding unless their demands to reform ICE are met, House Minority Leader Hakeem Jeffries told CNN. BBG

- Kevin Warsh’s call for a new Fed-Treasury accord has stirred debate in the $30 trillion bond market, raising concerns over central bank independence and potential market volatility. BBG

- Chinese regulators have advised financial institutions to rein in their holdings of US Treasuries, citing concerns over concentration risks and market volatility. BBG

- Japanese stocks swept to all-time peaks while super-long bonds quickly reversed early weakness in an apparent vote of confidence in Prime Minister Sanae Takaichi’s “responsible, proactive” fiscal policy. BBG

- Treasury Secretary Scott Bessent cited Chinese traders as a reason behind last week’s wild swings in the gold market. He said “They’re having to tighten margin requirements. So gold looks to me kind of like a classical, speculative blowoff.” Bessent expects the Federal Reserve to move cautiously in any effort to trim its balance sheet, and to take at least a year to decide what to do. RTRS

- Thailand’s ruling party clinched a surprise election win over the pro-democracy People’s Party. PM Anutin Charnvirakul’s victory marks the first this century for a party aligned with the royalist establishment. Thai stocks and currency rose. BBG

- UK PM Keir Starmer is battling to save his premiership after the dramatic resignation on Sunday of his most trusted aide Morgan McSweeney, as Labour MPs and officials warn that his job is still in grave peril. FT

- The ECB’s Gediminas Simkus said there’s an equal chance that policymakers’ next move will be to raise or lower borrowing costs. BBG

- Big Tech’s AI push and data center building being financed by some of the world’s biggest companies in the AI boom is becoming one of the most momentous capital efforts in US history (as a percentage of GDP). It’s bigger than the railroad expansion of the 1850s, the Apollo space program that put astronauts on the moon in the 1960s and the decadeslong build-out of the U.S. interstate highway system that ended in the 1970s. WSJ

- Trump posted “Record Stock Market, and National Security, driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term. REMEMBER, TRUMP WAS RIGHT ABOUT EVERYTHING! I hope the United States Supreme Court is watching”.

Trade/Tariffs

- Indian imports of Russian oil could nearly halve following the White House order, Bloomberg reported citing sources. Within the order, it stated that India has committed to stop directly or indirectly importing Russian oil or import tariffs will be raised.

- South Korea’s legislature approves creation of special US investment committee.

- Australia has imposed 10% tariffs on China’s steel ceiling frames, following an investigation by the nation’s Anti-Dumping Commission, according to Bloomberg.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week higher after last Friday’s rally on Wall St, where the DJIA topped the 50k level for the first time, while the Nikkei 225 also hit a fresh record high after PM Takaichi’s landslide election victory and supermajority. ASX 200 rallied with all sectors in the green and the advances being led by broad strength in tech, real estate, miners, materials and resources. Nikkei 225 rose to fresh record highs above the 57,000 level after the Japanese PM Takaichi’s LDP won a supermajority in the lower house election, which would allow it to override the upper house in legislation, while the decisive win paves the way for the government to proc eed with further stimulus and a sales tax cut. Hang Seng and Shanghai Comp conformed to the widespread upbeat mood across the region, while it was also reported late last week that China’s Cabinet studied measures to promote effective investment and pledged to boost support for private investment.

Top Asian News

- Japan’s PM Takaichi said that she has received strong mandate for her policies, following the election. Confirms a swift restart of of parliamentary session. Discussions on refundable tax credit will commence. Will not resort to debt to fund the suspension of food sales tax. Will summit bill to establish national information and committee on foreign investment in the next parliament. Want to pursue a coalition expansion with the DPP if they are keen to do so. Want to lay out interim finding at cross-party meeting on food sales tax suspension by around summer this year. Closely watching market moves, including FX.

- Japanese PM Takaichi said the potential of our alliance with the US is limitless and she is sincerely grateful to US President Trump for his warm words.

- US President Trump congratulates Japanese PM Takaichi and her coalition on a landslide election victory.

- Japanese Finance Minister Katayama said will not comment on FX levels, but noted that recent yen moves are somewhat rapid and one-sided.

- Hong Kong court sentences media tycoon Jimmy Lai to 20 years in jail.

- Japan’s top currency diplomat Mimura said closely watching FX moves with a high urgency.

European bourses (STOXX 600 +0.2%) are firmer across the board, as strength across APAC equities filters through into Europe. European sectors hold a positive bias. Travel & Leisure leads, followed closely by Healthcare and Banks whilst Optimised Personal Care and Retail lags. Healthcare is buoyed by gains in Novo Nordisk (+8.3%), which benefits after Hims & Hers said it will stop selling a copycat version of Novo Nordisk’s Wegovy weight-loss pill two days after launch.

Top European News

- Norwegian GDP Growth Rate YoY (Q4) Y/Y 2.2% (Prev. 2.1%).

- Norwegian PPI YoY (Jan) Y/Y -7.8% (Prev. -11.4%).

- Norwegian GDP Growth Mainland QoQ (Q4) Q/Q 0.4% vs. Exp. 0.4% (Prev. 0.1%).

- Norwegian GDP Growth Rate QoQ (Q4) Q/Q -0.3% (Prev. 1.1%).

FX

- DXY is on the backfoot and trades at the bottom end of a 97.33-97.76 range; further pressure could see a test of last week’s trough at 97.00. Much of the pressure this morning can be associated with JPY strength (post-election, discussed below) and following a Bloomberg report which noted that China is urging banks to curb US Treasuries exposure amid market risk – whilst this piece pertains to USTs, it renews fears of a “sell America” theme. US data is lacking for the remainder of the day, so focus will be on Fed speak via Waller, Miran and Bostic. Note: Waller is to discuss “digital assets”, markets know what they expect from arch-dove Miran, and Bostic is set to retire. The docket picks up later in the week, where markets will await US NFP (Wed) and then CPI (Fri); as a reminder, recent jobs metrics have been pointing towards a weakening of the labour market.

- JPY is amongst the outperformers this morning. USD/JPY initially gapped higher at the open (157.47), edged lower a few moments later, before reversing back to highs of 157.65. Since, the JPY has been strengthening vs the USD, potentially on a) high expectations of an LDP victory, b) higher JGB yields, c) jaw-boning via Finance Minister Katayama, d) political stability, e) odds of a BoJ hike in April rising to circa. 60% (prev. 54%). For the latter, analysts at Barclays believe that LDP’s landslide victory may allow the BoJ to proceed with normalisation “somewhat” faster. As such, the bank brought forward its expectations of a 25bps hike to April (prev. saw July), and increased its terminal forecast to 1.5% (prev. 1.25%). This morning, PM Takaichi has provided commentary, has reiterated her vows of fiscal stability, noting that she “will not resort to debt to fund the suspension of food sales tax” – another factor which is likely helping the strength in the JPY this morning. [More details can be found on the Newsquawk headline feed at 07:40GMT/02:40ET]

- G10s are broadly stronger against the USD, with JPY, AUD, EUR, and CHF all firmer by around 0.5%. GBP is the laggard this morning, as domestic political woes remain for the PM. On Sunday, Chief of Staff McSweeney resigned from his role following the Mandelson scandal. Irrespective of this, risks remain, as members of the Cabinet are potentially set to call for the PM to resign, and if he doesn’t, they will possibly step down themselves.

Fixed Income

- JGBs gapped lower by 30 ticks from 131.42 to 131.12 at the open, and then continued to trundle lower to a 131.10 trough; there was then a brief bounce overnight, before gradually declining back to the APAC low. Action today can be characterised by concern around potential increased spending and fiscal instability fears, but overall, the response to Takaichi’s LDP securing a super majority has been within recent levels – see the 07:40GMT post for more details and next steps.

- USTs are lower, given the above initially. More recently, pressure is a function of a Bloomberg report that China has urged banks to diversify exposure to US Treasuries amid heightened market risk, guidance that reportedly does not apply to state holdings. A report that pushed USTs to a 111-26 low. Fed speak ahead, though the individuals scheduled are, on face value, not particularly interesting. Reminder, the week ahead has NFP on Wednesday and CPI on Friday.

- Bunds followed the above. Interestingly, while they were initially hit by the Bloomberg report, the benchmark bounced off a 128.03 trough in short order. As the report is, potentially, a net-positive for EGBs long-term, as Chinese banks have to reposition their holdings.

- Gilts hit on the ongoing Mandelson/McSweeney fallout. In brief, while McSweeney has resigned, the pressure around Starmer hasn’t abated. Action that saw Gilts gap lower by 42 ticks before slipping another two to a 90.21 base. Since, the benchmark has rebounded by around 30 ticks, but remains in the red by some 10 ticks. The Spectator highlights that some ministers are concerned that Starmer could stand down at any moment. More likely, we could see Cabinet Ministers, privately initially and then possibly publicly, call for the PM to resign, and then they themselves may resign from Starmer’s cabinet if he does not comply.

- China is reportedly urging banks to curb US Treasuries exposure amid market risk, Bloomberg reported citing sources; guidance does not apply to China’s state holdings of US Treasuries.

Commodities

- WTI and Brent gapped lower but then traded with an upward bias as the morning progressed, to currently trade flat; Brent now trading around USD 68.20/bbl, with a recent bid higher led reports that Qatar is pushing the start of its LNG expansion to the end of 2026. US-Iran meetings last week lacked a material outcome, with the pair agreeing to further talks. For the next meeting, the Trump administration has told Iran to arrive with meaningful substance, following the “good meeting” on Friday.

- Precious metals have continued Friday’s rebound, with spot gold regaining the USD 5k/oz handle. Over the weekend, the PBoC announced its 15th straight month of gold buying, which reinforces the key structural driver of major central bank buying of the gold bullion. The dollar has also weakened at the start of the European session, weighed on by the Bloomberg report that China is urging banks to limit USTs exposure. Silver has gradually bid higher as European trade continues, returning back above USD 80/oz and briefly topping above USD 82/oz.

- 3M LME Copper gapped higher but trades muted in a USD 13.02k-13.14k/t band, heading into the Chinese New Year celebrations.

- US Energy Secretary Wright intends to visit Venezuela soon to discuss the future of PDVSA, Politico reported; focussed on improving the management of the Co. Expects Venezuela to hold elections in 18-24 months.

- Vitol Group forecasts peak oil demand to be pushed back to the mid-2030s, with peak demand reaching around 112mln bpd.

- New Zealand energy minister said has shortlisted proposals related to building a first LNG import plant and facility could be operational by 2027 or early 2028.

- Qatar reportedly pushes the start of its LNG expansion to the end of 2026.

Central Banks

- ECB’s Kocher said that inflation expectations are fully anchored and FX movements are factored in; Europe must prepare for a greater financial safe haven role. Policy is appropriate and it would require a change in the environment to change current policy stance.

- ECB’s Simkus said there’s a 50/50 chance that their next move is a hike or cut; rates are at neutral level with growth near potential. Economic environment is fragile.

Geopolitics: Ukraine

- Indian imports of Russian oil could nearly halve following the White House order, Bloomberg reported citing sources. Within the order, it stated that India has committed to stop directly or indirectly importing Russian oil or import tariffs will be raised.

- Russia’s FSB said an attempted assassination of General Alexeyev was ordered by Ukraine with Poland’s participation, according to Interfax.

- US reportedly aims for a March peace deal in Ukraine, followed by quick elections, according to reported.

Geopolitics: Middle East

- Iran’s advisor to Supreme Leader is to visit Oman on Tuesday, Tasnim reported.

- Iranian Parliament Speaker said they discussed defence and security in a secret session.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 69k, whilst Ethereum remains just above the USD 2k mark.

US Event Calendar

DB’s Jim Reid concludes the overnight wrap