Submitted by Charles Hugh-Smith via OfTwoMinds blog,

Sorry, pal, you're evil. Self-righteous indignation counts for nothing in the strict accounting of real progressivism.

Dear Self-Proclaimed "Progressive": I love you, man, but it has become necessary to intervene in your self-destruction. Your ideological blinders and apologies for the Establishment's Neocon-Neoliberal Empire are not just destroying your credibility, they're destroying the nation and everywhere the Empire intervenes.

While you squandered your political capital defending zero-cost causes like "safe spaces on college campuses," the Empire was busy killing, maiming and making refugees of women and children in Syria. President Obama and his Neocon crew (former Secretary Hillary Clinton included) aren't fools; they rely on drones and proxy armies to do their dirty work.

Neoliberalism is the Establishment's core ideology, and by supporting Bill Clinton and Barack Obama, you furthered, defended and rationalized the Empire's neoliberal expansion and exploitation. Neoliberalism's Big Lie is transforming everything into a market makes everyone richer.

The dirty little secret of Neoliberalism is that the markets it creates are rigged in favor of Elitist cronies. If you can set aside your "progressive" blinders for a moment (Bill and Barack could do no wrong for 16 long years of neoliberal exploitation), you might learn that the Presidents and party you supported ushered in the era of neoliberal pillage as public-private partnerships, Philanthro-Capitalism, and rigged markets that enriched the elitist Establishment you defend at the expense of the bottom 95% non-elites.

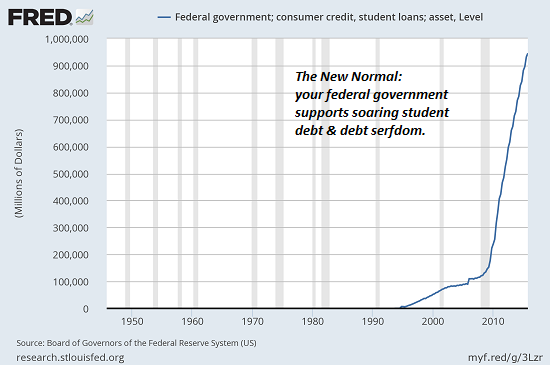

You defended "higher education," which was simply a code word for stripmining the bottom 95% via student loans to pay outrageous salaries for under-assistant deans of student affairs and fund lavish expansion projects.

You embraced the Corporate Media's absurd "fake news" witch-hunt, when the biggest purveyors of fake news/Imperial Propaganda are the "liberal" media you unhesitatingly believe with all your heart because it reinforces your sense of moral superiority. Never mind that the mainstream "liberal" media is owned by corporations that are in bed with the Establishment and the Empire.

You were silent when your "progressive" president engaged in a global Murder, Inc., and your former secretary of state bragged "we came, we saw, he died." Your sputtering excuses for Imperial over-reach, extra-judicial murder and the destruction and displacement of entire populations is a travesty of a mockery of a sham of real Progressivism.

Wake up, Self-Proclaimed "Progressives": you're apologists for an Evil Empire. Your devotion to the Democratic Establishment that has mastered the art of bleating politically correct speech acts while destroying entire nations renders you the classic useful idiots, on par with those who defended Stalinism and the Soviet Gulag because "it was the right thing to do."

While you devote your energy to "resisting" Trump in completely empty gestures, you did nothing to resist the imprisonment of tens of thousands of young men of all ethnicities in America's War on Drugs Gulag.

While you championed your fake-Progressive presidents and party, wealth and wage inequality soared. Did you not mind because you and your household benefited from neoliberal skimming and scamming?

How many of your self-proclaimed "progressive" peers are in the 5% who came to do good and stayed to do well?

You have the luxury of supporting ObamaCare because somebody else is paying the bills. It may be a corporation, the state, a government agency, a university, a foundation or the taxpayer, but your support of neoliberal skims and scams doesn't cost you anything.

You are a hypocrite because you only engage in causes that don't cost you anything. Prove to us that you've been questioned or arrested by the F.B.I. for political action against the Empire, and you will have earned credibility. If you don't have any skin in real resistance, then your support of politically correct speech acts is cost-free and therefore meaningless.

I am sorry to be the one to tell you, but your unquestioning support of a neoliberal- neocon president, party and candidate makes you as evil as the empire you support, via your silence, rationalizations and absurdly empty gestures in favor of cost-free political correctness.

You have surrendered principled action in favor of a self-righteous belief that indignation makes you better then everyone else. Sorry, pal, you're evil. Self-righteous indignation counts for nothing in the strict accounting of real progressivism.

Your claim to moral superiority based on indignation makes you the moral equivalent of the "conservative" married preacher who is sleeping with the church secretary and skimming church funds. His claim to moral superiority is based on indignation, too.

By supporting a corrupt, self-serving elitist Empire of privilege and power, you are an enemy, witting or unwitting, of truth, justice, self-determination and liberty.

If you want to become a real Progressive, it has to cost you. You will have to abandon the Establishment you belong to, the party you support and the cheap veneer of self-congratulatory fake-progressivism you project.

You will have to throw yourself on the gears of the stripmining, protecting-the-privileged autocratic war machine you have supported by your silence and your rationalizations. To quote Mario Savio's famous extemporaneous speech during Berkeley's Free Speech Movement:

"There's a time when the operation of the machine becomes so odious, makes you so sick at heart that you can't take part! You can't even passively take part! And you've got to put your bodies upon the gears and upon the wheels, upon the levers, upon all the apparatus — and you've got to make it stop! And you've got to indicate to the people who run it, to the people who own it — that unless you're free the machine will be prevented from working at all!"

Memo to Self-Proclaimed "Progressives": "safe places" on campus don't count.

The truth is, you are an embarrassment to real progressives. You should be ashamed of your empty claims to the high moral ground. If you are incapable of feeling ashamed for your self-congratulatory self-righteousness, then you are truly lost.

Look, I know you want to "do the right thing." You want to encourage and support truth, justice, self-determination and liberty. To follow your better instincts, you're going to have to admit that you've been conned, and that you've been a loyal passive puppet of an Evil Empire.

The "right thing to do" is to recognize the Neocon-Neoliberal Empire as the enemy of truth, justice, self-determination and liberty and withdraw your consent. If you still don't get it, maybe these essays will help:

Moral panic over fake news hides the real enemy – the digital giants

America was a 'stan' long before Trump Paul Krugman et al conveniently forget that corruption, cronyism and contempt for the rule of law long predated Trump.

Authoritarian Neoliberalism and the Myth of Free Markets

We need to pull together, not self-divide into ever more fractious camps. The oldest and most successful Imperial strategy is divide and conquer. Don't fall for it.

via http://ift.tt/2iAmw0l Tyler Durden

President Obama once promised to “turn the page on the imperial presidency” and lead the most transparent administration of all time, yet he leaves the White House with the executive branch more empowered to wage war and act in secret than ever before.