A few hours ago, the “historic” and “most important ever” (just like ever payrolls report) Chinese plenum concluded. And like everything out of China, it was big on promises and scant on details. Among the numerous assurances of reform, the plenum promised: to deepen reform of the medical system and in the education sector, to speed up free trade zone development, to clear barrier in markets, to deepen national defense and military reform, to reform the income distribution system, reiterated the main role of public ownership and said there would be reform of government-market relations. And all of this would yield results by 2020. Essentially, words so hollow one can’t help but doubt this was merely the latest smokescreen to justify the perpetuation of the status quo, investment-based economy which as the BBG Brief chart below shows, instead of becoming more consumption driven which is what China has been feverishly attempting to achieve, has instead become ever more reliant on consumption.

Perhaps the most notable (and we use the term loosely) result from the plenum, was a shift in language, when the Communist Party acknowledged the market’s “decisive” role in allocating resources, as opposed to just “basic” according to a communique issued after its key session about reform. Xinhua has more:

China will deepen its economic reform to ensure that the market will play a “decisive” role in allocating resources, according to the communique after the Third Plenary Session of the 18th CPC Central Committee, which closed here Tuesday.

The market had been often defined as a “basic” role in allocating resources since the country decided to build a socialist market economy in 1992.

While following its basic economic system and improving it, the country will work to improve the modern market system, macro-regulatory system and an open economy, the document said.

To let the market decide the allocation of resources, the primary task is to build an open and unified market with orderly competition, according to the document. Land in cities and the countryside, which can be used for construction, will be pooled in one market, it said.

Under a modern market system, businesses should be allowed to operate independently and compete fairly while consumers should be free to choose and spend. Also, merchandise can be traded freely and equally, the document said.

In the document, the CPC pledged to clear barriers in the market and improve the efficiency and fairness in the allocation of resources. It will also create fair, open and transparent market rules and improve the market price mechanism.

So does this mean that China is now officially more capitalist than the US, whose market has devolved to having a very basic, centrally-planned, and manipulated role of preserving the wealth effect, and the illusion that the US economy is now cratering with each passing day?

Alas, no. This is merely more jawboning to give the impression that China is serious about market reform. Why? Because with the various local stock markets having not increased their depth in the past 5 years, all the excess liquidity ends up in the housing sector and makes housing inflation a huge issue for the CPC. What China would prefer is to have its stock market act like that of the US, and provide the liquidity buffer that absorbs all those trillions in annual liquidity injections by central banks. Good luck with that.

As for everything else, Reuters explains why the Plenum was nothing but another dud on China’s path to non-reform.

The party did not issue any bold reform plans for the country’s state-owned enterprises (SOEs), saying that while both state firms and the private sector were important and it would encourage private enterprise, the dominance of the “public sector” in the economy would be maintained.

While the statement was short on details, it is expected to kick off specific measures by state agencies over the coming years to reduce the role of the state in the economy.

Historically, such third plenary sessions of a newly installed Central Committee have acted as a springboard for key economic reforms, and this one will also serve as a first test of the new leadership’s commitment to reform.

Among the issues singled out for reform, the party said it would work to deepen fiscal and tax reform, establish a unified land market in cities and the countryside, set up a sustainable social security system, and give farmers more property rights – all seen as necessary for putting the world’s second-largest economy on a more sustainable footing.

President Xi Jinping and Premier Li Keqiang must unleash new growth drivers as the economy, after three decades of breakneck expansion, begins to sputter, burdened by industrial overcapacity, piles of debt and eroding competitiveness.

Out of a long list of areas that the meeting was expected to tackle, most analysts have singled out a push towards a greater role of markets in the financial sector and reforms to public finances as those most likely to get immediate attention.

As part of that, Beijing is expected to push forward with capital account convertibility, and the 2020 target date for making significant strides on reform could set off expectations that the government will be looking to achieve breakthroughs on freeing up the closely managed yuan by then.

Few China watchers had expected Xi and Li to take on powerful state monopolies, judging that the political costs of doing so were just too high. Many economists argue that other reforms will have only limited success if the big state-owned firms’ stranglehold on key markets and financing is not tackled.

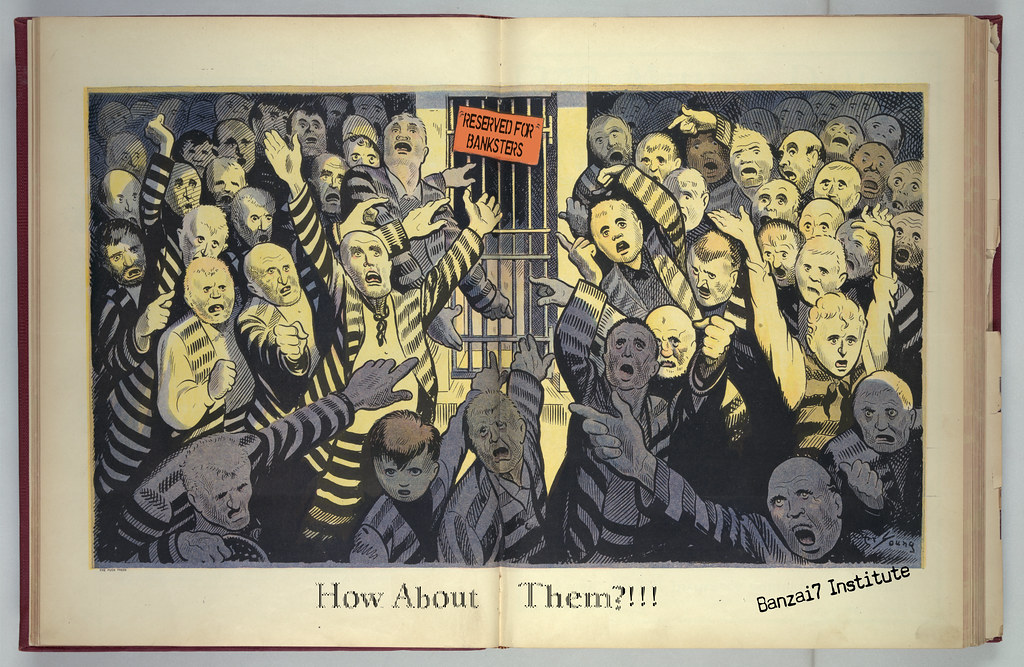

Bottom line: as former Fed bond market manipulated Andrew Huszar admitted, no government will ever engage in difficult, voluntary reforms (which by definition will infuriate the population), until they have no choice but to do so. Which means only after central banks lose control of risk assets, and Mr. Chairmen around the world are no longer able “to get to work” and make the politicians’ lives easier. Until then, it is just smoke and mirrors.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/-NCwqa9YIkU/story01.htm Tyler Durden

![]()

Suicides are

Suicides are

As President Obama’s

As President Obama’s If it’s not clear

If it’s not clear