The recent market weakness continued, and the S&P pulled further back from the 2800 “quadruple-top” overnight, as global stocks dropped for a third day following the latest disappointing PMI data out of China and an unexpected and abrupt collapse to the U.S.-North Korea summit added to investor fears of a rapidly slowing economy, and as the dollar slumped further, safe havens such as the Japanese yen and the Swiss franc, as well as gold, all gained.

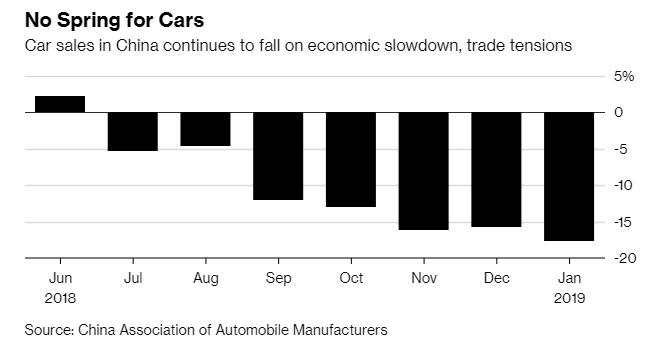

Just two weeks after announcing it had injected more credit into its economy than the GDP of Saudi Arabia, overnight China disappointed again when it reported its February manufacturing PMIs which tumbled deeper into contraction territory even as the Non-mfg PMI also missed expectations: the Mfg PMI dropped to 49.2, below the 49.5 expected as the index of new export orders tumbled to 45.2 from 46.9 – falling at their fastest pace since the global financial crisis – while the non-manufacturing PMI, which reflects activity in the construction and services sectors, also fell, to 54.3 compared with 54.7 in January.

Following the latest slow down in China, European miners led the drop in the Stoxx Europe 600 Index and copper declined amid fresh fears about the global economic slowdown, while Dow, Nasdaq and S&P 500 futures all fell, as the Citi Economic Surprise Index dropped to a fresh 18 month low.

Earlier, South Korean shares were the biggest losers in Asia after President Trump and Kim Jong Un departed the summit venue in Hanoi without a deal, even though expectations for a breakthrough were low. Trump and Kim Jong Un had constructive discussions on denuclearization, the White House said, but news of the summit’s early break-up triggered flight-to-quality bids in safe assets. Riskier assets took a hit, with stocks across the board lower in Europe after the start of trading. The pan-European STOXX 600 index fell more than half a percent.

That followed a retreat in Asian equities, which took a hit on a lack of progress on trade issues between China and the U.S. and data showing factory activity contracting to a three-year low in China. The Shanghai Composite Index fell 0.7 percent following the latest dour comments from U.S. Trade Rep Robert Lighthizer who told U.S. lawmakers on Wednesday that U.S. issues with China are “too serious” to be resolved with promises from Beijing to purchase more U.S. goods, and any deal between the two countries must include a way to ensure commitments are met. The USTR also later clarified in a statement that it was not abandoning the threat of increasing the tariffs to 25 percent from 10 percent.

“This is likely to be the sort of trade deal that comes through: enough of a deal, or delays of further taxes to enable equities to stay supported while still allowing enough room for U.S. President Trump to criticize China on the campaign trail next year,” said Paul Donovan, chief global economist at UBS Wealth Management. “In many ways this indefinite delay in the consequences are reminiscent of the deal agreed between Trump and one of the many EU Presidents Juncker last year.”

“One suspects trade headlines will continue to throw around sentiment for a while yet. The issues are complex, the trade-offs real, and opinions divided,” ANZ strategists said in a note.

As a result of another busy overnight session, the MSCI’s All-Country World Index was 0.2% lower on the day and down for a third day running. Treasuries climbed, most European bond slipped and the dollar held steady.

In overnight central bank news, Bank of Korea maintained its 7-day repo rate at 1.75% as expected, the decision was unanimous. The KRW immediately experienced marginal weakness as policymakers kept in mind the country’s declining exports, rising unemployment and the slowdown in Chinese growth. At the press conference, Governor Lee the central bank is to maintain accommodative rate policy although it is not time to consider easing policy rates.

In currency markets, the Swiss franc and yen led gains among G10 currencies as demand for havens climbed after President Donald Trump’s second summit with Kim Jong Un ended without an agreement, while the dollar index against a basket of six major currencies fell 0.1 percent at 96.041. The index had edged up 0.1 percent on Wednesday, pulling away from a three-week trough as Treasury yields rose ahead of the release of U.S. fourth-quarter GDP data later on Thursday. USD/JPY slid as much as 0.3% after Japan’s factory output posted the biggest decline in a year in January, while USD/CHF slipped 0.4%. Dollar-yen hit session- lows as leveraged funds in Tokyo exited intraday longs in defensive reaction to the Trump-Kim news, according to an Asia- based FX trader.

“Headlines on a shortened Trump-Kim summit lifted the yen as the uncertainty sparked a bit of risk-off moves,” said Jun Kato, chief market analyst at Shinkin Asset Management in Tokyo

The euro jumped 0.4% to $1.1412, a 4 week high, after slipping 0.15 percent on Wednesday. Sweden’s krona rallied by the most in two weeks against the euro and yields on Swedish benchmark bonds surged after stronger-than-forecast growth data.

Oil prices fell on Thursday amid weakening factory output in China and Japan and record U.S. crude output, although markets remained relatively well supported by supply cuts led by producer club OPEC. Brent (-0.8%) and WTI (-0.6%) prices are negative but trading within a very narrow USD 1/oz range as risk sentiment was hampered for the abovementioned reasons.

Expected data include jobless claims, annualized GDP and Chicago Business Barometer. CIBC, Autodesk, Dell Technologies, Marriott, and VMware are among companies due to report earnings.

Market Snapshot

- S&P 500 futures down 0.3% to 2,786.50

- STOXX Europe 600 down 0.4% to 371.22

- MXAP down 0.7% to 159.07

- MXAPJ down 0.6% to 522.82

- Nikkei down 0.8% to 21,385.16

- Topix down 0.8% to 1,607.66

- Hang Seng Index down 0.4% to 28,633.18

- Shanghai Composite down 0.4% to 2,940.95

- Sensex down 0.1% to 35,854.04

- Australia S&P/ASX 200 up 0.3% to 6,168.99

- Kospi down 1.8% to 2,195.44

- German 10Y yield rose 1.3 bps to 0.161%

- Euro up 0.2% to $1.1392

- Italian 10Y yield rose 7.9 bps to 2.425%

- Spanish 10Y yield rose 1.7 bps to 1.176%

- Brent futures down 0.9% to $65.80/bbl

- Gold spot up 0.4% to $1,324.87

- U.S. Dollar Index down 0.2% to 95.98

Top Overnight News

- The U.S. won’t accept a trade deal with China that merely commits the Chinese to buy more American goods, a scenario U.S. Trade Representative Robert Lighthizer dismissed as the “soybean solution,” in reference to promises to buy more American soybeans. “This administration is pressing for significant structural changes that would allow for a more level playing field,” Lighthizer said. “We need new rules.”

- Confidence among U.K. businesses plunged to a seven-year low this month and consumers remained pessimistic about the economic outlook as lawmakers failed to provide further clarity about the nation’s exit from the European Union

- In Wednesday’s Brexit debate, one of the Anti-European Conservatives seemed to have heeded May’s warning that continued obstinacy would jeopardize their entire project. “The choice is no longer perhaps between an imperfect deal and no deal, but between an imperfect deal and no Brexit,” Edward Leigh, a long-standing euroskeptic, told Parliament

- The first official gauge of China’s manufacturing sector in February showed activity contracting further, with a series of domestic holidays, the global slowdown and uncertainty from the trade war all likely playing a part

- Keeping interest rates below zero for too long may hinder the European Central Bank’s policy from trickling down to the economy, according to Francois Villeroy de Galhau. He said normalization of monetary policy is still “desirable” as the current slowdown is mainly due to temporary factors that should fade in the course of the year

- President Donald Trump said he’s in no rush for North Korea to give up its nuclear arms and tamped down expectations for his second summit with Kim Jong Un, saying that over the long term the talks would be a success

- The Bank of Japan made changes to the planned purchase ranges and buying frequencies for the key five-to-10-year segment under its monthly bond operations plan for March, when compared with February

- The Swiss economy returned to growth in the final three months of 2018, dodging the worst of the weakness that hit neighbors to the north and south

- Keeping interest rates below zero for too long may hinder the European Central Bank’s policy from trickling down to the economy, according to Bank of France governor Francois Villeroy de Galhau

- BNP Paribas SA won dismissal of a German lawsuit by a trader seeking 163 million euros ($186 million) for a “fat-finger” mistake in a 2015 transaction

Asian stocks were mixed following a similar lead from Wall Street wherein the Dow and S&P fell for a second consecutive day as investors digested key testimonies from US Trade Representative Lighthizer and Fed Chair Powell. The Dow was also weighed on by shares from UnitedHealth which closed lower by almost 5% whilst the S&P was pressured by the telecom and healthcare sectors. ASX 200 (+0.3%) was kept afloat by its pharma and energy names, while the Nikkei 225 (-0.9%) felt pressure from its heavyweight industrial and machinery sectors. Elsewhere, Shanghai Comp (-0.4%) and Hang Seng (-0.4%) initially traded choppy although the latter recovered from opening losses as pharma and finance stocks led the gains. Finally, South Korea’s KOSPI (-0.6%) slipped after index heavyweights Samsung Electronics (-1.8%) and SK Hynix (-4.2%) succumbed to the semiconductor weakness experienced stateside. BoJ Board Member Suzuki says it is important for the BoJ to maintain powerful monetary easing but there is no need to ease further, BoJ must be mindful of a sustainable framework as inflation may remain subdued for a prolonged period. Suzuki said the BoJ does not intend to raise rates now but will act swiftly through market operations if yield rise sharply, he added that overseas tail risk appear to be heightening.

Top Asian News

- CLO Market’s Japanese Whale Faces Increased Regulatory Scrutiny

- India Refuses to Negotiate Over Fate of Captured Pilot: Official

- BOJ Paves Way to Buy Less Bonds as Yields Drop to 2-Year Low

- Hong Kong Targets Thinly Traded Stock Headache in Strategy Plan

- It’s D-Day for Netanyahu as He Braces for Possible Indictment

Major European equities are currently flat after opening slightly lower [Euro Stoxx 50 U/C] as risk sentiment deteriorated following reports of no agreement being reached between US President Trump and North Korean leader Kim Jong-Un; with US President Trump stating they had some options but decided not to take them. The FTSE 100 (-0.7%) is underperforming its counterparts, weighed on by the pounds recent strength; additional downward pressure is exerted by Rolls Royce (-3.4%) at the bottom of the index in spite of strong earnings as the Co. have withdrawn from Boeing’s engine race. British American Tobacco (-2.5%) are in the red in-spite of good earnings; with some analysts attributing this to a lack of guidance for 2019. Sectors are also in the red with some marginal outperformance in telecom names. Other notable movers include, Zalando (+17.6%) who are leading the Stoxx 600 after their Q4 adj. EBIT came in above expectations; AB InBev (+5.1%) are also higher after a beat on their Q4 revenue. Towards the bottom of the Stoxx 600 are Adecco (-4.7%) after the Co. posted a Q4 net loss of EUR 112mln instead of the expected net profit of EUR 150mln.

Top European News

- Rolls-Royce Shares Drop as Series of Charges Weigh on Business

- AB InBev Report Allays Concern About Ties to Kraft Meltdown

- Scandal Contagion Spreads Past Danske in Bank Funding Rounds

- Sberbank Dividends May Miss Expectations on Denizbank Sale Delay

In FX, super strong Q4 GDP data from Sweden after the surprise contraction in the previous quarter has propelled the Krona through 10.5000 vs the Euro and further above recent lows, but the Franc is also a marked G10 outperformer following sub-forecast Swiss growth in the final 3 months of 2018 and a weaker than expected KoF survey, with Usd/Chf probing below the 100 DMA at 0.9960, while Eur/Chf has slipped under 1.1350. Indeed, the Franc is firmer across the board and clearly benefiting from its premier status as the safest currency destination amidst a storm, with risk sentiment still fragile due to ongoing tensions between India and Pakistan, and in wake of the Trump-Kim summit ending without a nuclear agreement. Back to Eur/Sek, nearest technical support level is seen at 10.4550.

- JPY/EUR – Also firmer into month end, and partly on the aforementioned risk-off or defensive positioning as the Jpy rebounds from 111.00 vs the Dollar yet again (heavy exporter supply touted at the big figure). Eur/Usd has now firmly breached the 1.14 level to the upside, for reference the current high is 1.1418, after surpassing both the 50 and 100 DMA’s, looking ahead is the February 5th high of 1.1441 and prior to this 1.1420. Of note moderate rebalancing sell signals for the Buck are said to be ‘strongest’ against the Euro.

- AUD/GBP/NZD/CAD – All flat to marginally weaker vs the Greenback, with the Aussie and Kiwi undermined by a 3rd consecutive sub-50.0 Chinese manufacturing PMI overnight after mixed independent impulses via a welcome beat in Australian Q4 Capex vs a deterioration in the NBNZ business outlook for the current month. Hence, Aud/Usd is holding up marginally better than Nzd/Usd within 0.7166-28 and 0.6854-35 respective ranges. Meanwhile, the Pound retains a relatively strong Brexit-related bid, albeit off best levels posted on Wednesday, with Cable pivoting 1.3300 vs its new 1.3351 ytd peak and perhaps wary about hefty option expiry interest at 1.3325 (1 bn). Elsewhere, the Loonie has stalled alongside oil prices and is back around the 1.3150 axis vs its US counterpart, as the DXY continues to skirt 96.000.

- EM – Unsurprisingly, the KRW has depreciated in disappointment over no breakthrough on a deal between the US and NK, to a low of almost 1125.00 vs the Usd at one stage.

In commodities, Brent (-0.8%) and WTI (-0.6%) prices are negative but trading within a very narrow USD 1/oz range as risk sentiment is hampered following no agreement being reached between the US and North Korea alongside Chinese Manufacturing PMI printing the third consecutive month of contraction. In terms of recent news flow Libya’s NOC spokesperson stated that there is no technical obstacle to restarting the El Sharara oilfield, but security remains the issue. Elsewhere, UBS highlight that the 8.6mln draw in US crude inventories does not necessarily signal the start of a trend, although the size of the draw indicates that the market is tightening. And just of note Brent futures expire later today. Gold (+0.5%) is firmer and approaching session highs, as the yellow metal is benefitting from the deteriorating risk sentiment after this mornings aforementioned US-North Korea updates. Elsewhere, copper prices were steady in-spite of the poor Chinese manufacturing PMI, with the negative impact of this balanced out by the ongoing supply concerns for the metal; as LME registered warehouse stocks are approaching their lowest level in 10 years.

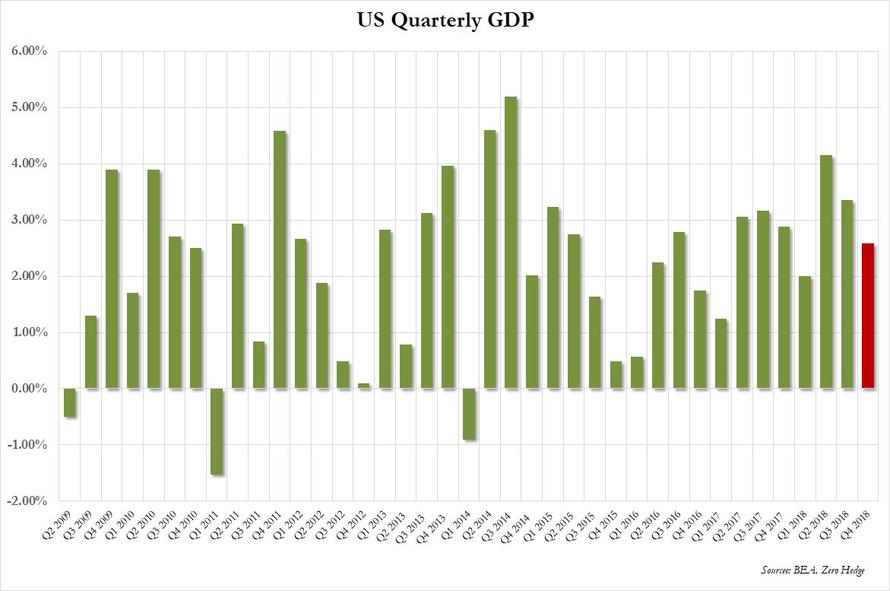

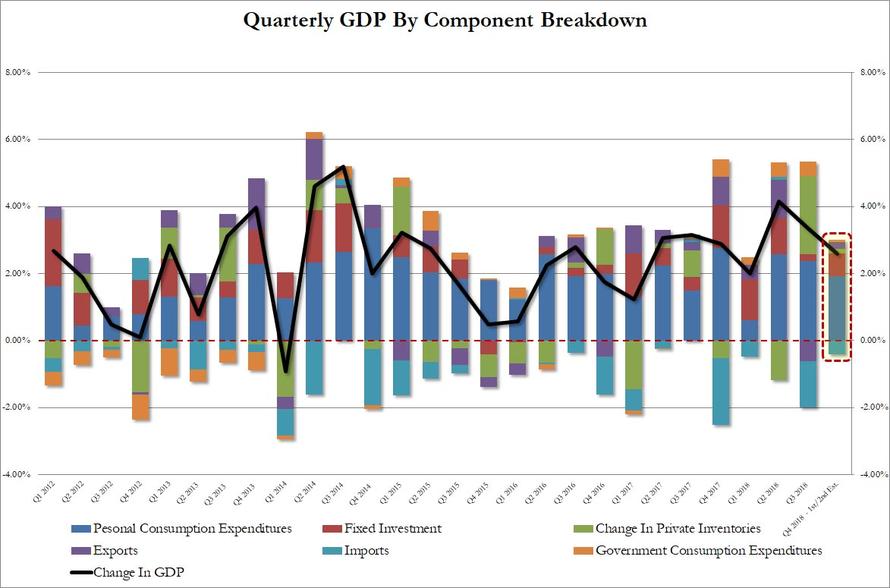

Looking at the day ahead, the main focus will be on the Q4 GDP reading which is expected to show a +2.2% reading which compares to +3.4% in Q3. In the details of that, core PCE is expected to print at +1.6%. The other data worth watching in the US is the latest weekly initial jobless claims reading and the February Chicago PMI and Kansas City Fed manufacturing survey readings which could give greater insight into the factory sector this month. Away from all that it’s another busy day for Fedspeak with Clarida (1pm GMT), Bostic (1.50pm GMT), Harker (4pm GMT) and Kaplan (6pm GMT) all slated to speak.

US Event Calendar

- 8:30am: BEA Releasing Initial 4Q GDP (Combining Initial/Second)

- 8:30am: Initial Jobless Claims, est. 220,000, prior 216,000; Continuing Claims, est. 1.74m, prior 1.73m

- 8:30am: GDP Annualized QoQ, est. 2.2%, prior 3.4%

- 8:30am: Personal Consumption, est. 2.95%, prior 3.5%

- 8:30am: Core PCE QoQ, est. 1.6%, prior 1.6%

- 9:45am: Chicago Purchasing Manager, est. 57.5, prior 56.7

- 11am: Kansas City Fed Manf. Activity, est. 6, prior 5

Central Banks

- 8am: Fed Vice Chair Clarida Speaks at NABE Conference in Washington

- 8:50am: Fed’s Bostic Speaks on the Economic and Housing Landscape

- 11am: Fed’s Harker Discusses Economic Outlook

- 1pm: Fed’s Kaplan to Speak in Q&A in San Antonio

- 7pm: Fed’s Mester Speaks on Women in Economics

- 8:15pm: Powell speaks on Economic Developments and Longer-Term Challenges

DB’s Jim Reid concludes the overnight wrap

Welcome to the last day of February. You’ll be surprised to learn that I’ve just won the carpet battle I discussed on Tuesday and we’re back to moving into our new place on time. As such after 7 months of renting a place with a 25 year old kitchen and a shower that takes 3 minutes to warm up and trickles out, we are going to hand in our two month notice today. With 3 babies/toddlers, a dog and a husband it will take us this long to fumigate the place. In fact I’m not sure why we even debated the quality of the carpets in the new house as they won’t last very long anyway!! So an exciting countdown nearly two years after first seeing our new place begins. The last day of the month is also the day we say goodbye to 20 degree temperatures as rain is expected with a cooler front. I’m making a market of 45-50 days until we next have a 20-handle temperature in London. Let’s trade!

The temperature rose in bond markets yesterday with the main talking point being to work out why bonds suddenly sold off from lunchtime in Europe and around the US open. Indeed 10y Treasuries finished +4.7bps higher last night (-1.4bps in Asia though) – weakening by the most in four weeks – after similar maturity Bunds had risen +3.0bps – the fifth weakest day since October 19th. In fact Bunds touched their highest level in 3 weeks and are up +5.6bps from last Friday’s intraday yield lows – or +61% if you wanted a more dramatic stat. There were also more multi-week highs for yields in France (+2.6bps) and the Netherlands (+3.0bps), while BTPs (+8.1bps) sold off by the most since February 1st. To be honest we’ve struggled to pinpoint the exact reason for the sell-off.

Gilts (+6.8bps) also underperformed and there was some suggestion that this led the wider move as Brexit news-flow gets incrementally more market positive. However there were other suggestions it was more technically driven by Treasuries hitting the bottom of a recent range, as well as a heavy day for US IG issuance. Further exacerbating the move was a the +2.59% rally in WTI crude prices after official data showed a 8.65 million barrel decline in US inventories. Additionally, US oil imports fell to a two-decade low and refinery utilisation rose.

As for markets overnight, sentiment is on the weaker side after China’s soft PMIs with the Shanghai Comp (-0.43%), Nikkei (-0.38%) and Kospi (-0.47%) all down while the Hang Seng (+0.26%) is up. Elsewhere, futures on the S&P 500 are down -0.12%. China’s February composite PMI came in at 52.4 (vs. 53.2 last month) with the manufacturing PMI continuing to remain in contractionary territory (at 49.2 vs. 49.5 expected; lowest since Feb 2016) – the third month in a row. Services PMI came in at 54.3 (vs. 54.5 expected). The new export orders component of the manufacturing PMI continued to contract with the reading at 45.2 (vs. 46.9 last month), the lowest since February 2009 and marking 9 months below 50 signaling continued weak global demand. The new order component edged up over 50 again (50.6) after spending two months below. By scale large enterprises showed improvement in their manufacturing PMI (at 51.5 vs. 51.3 last month) while medium (46.9 vs. 47.2 last month) and small enterprises (45.3 vs. 47.3 last month) continued their slump despite the PBoC’s continued push to provide easy credit access to SMEs amidst trade talks. In another sign of the global slowdown Japan’s preliminary January industrial output fell -3.7% mom (vs. -2.5% mom expected), marking three months of continued decline.

So equities on the weaker side in Asia which followed a slightly softer day in US and Europe. Equities initially dropped in unison with the higher rates move but subsequently clawed back somewhat, leaving the S&P marginally lower on the session at -0.06%. The DOW and NASDAQ finished -0.28% and +0.07%, respectively. This was after the STOXX 600 had finished -0.28%, as European markets had closed before the rebound took off. There was one bright spot on both sides of the Atlantic however, with bank stocks appreciating the higher rates and rallying +0.57% and +2.04% in the US and Europe. Part of the original softness in equities appeared to be driven by Lighthizer’s comments during his testimony about the US-China trade talks. The US Trade Representative said that “this administration is pressing for significant structural changes that would allow for a more level playing field” and that the issues between the two sides are “too serious to be resolved with promises of additional purchases”. He also added that “much still needs to be done” and that “there’s no agreement on anything until there’s agreement on everything”. This somewhat undermined previous comments from Secretary Mnuchin that a currency agreement had been finalised. We also seem to have a situation where Mr Trump has increasingly been playing good cop of late and siding more and more with Mnuchin, with Lighthizer firmly in the bad cop territory. It’s also worth noting that the ultra-hawk Peter Navarro seems to have been completely shut out of recent discussions. Ultimately it’s Mr Trump who is the most important but Lighthizer continues to talk hawkishly. There’s been increasingly chatter in the media of late about tensions between the two. Their recent public pronouncements perhaps hints at why that might be. Elsewhere, overnight Lighthizer has said on the USMCA that Trump wants him to get some kind of steel agreement if he can with Canada and Mexico, raising fresh concerns on the passage of USMCA. He further added that “If USMCA doesn’t pass, it would be a catastrophe across the country.” Earlier, Canada’s government had warned that they might not ratify the trade deal if the tariffs remain in place, a sentiment shared last week by Mexico’s envoy to the US, Martha Barcena.

Possibly also having an impact on risk yesterday was Cohen’s testimony. He stopped short of directly accusing the President of collusion with Russia, the subject of Special Counsel Mueller’s ongoing investigation, but did say that “I have my suspicions.” He did say that President Trump committed illegal acts, including alleged campaign finance violations and tax fraud, though Justice Department guidelines say that a sitting President cannot be indicted.

India and Pakistan-linked assets have remained relatively calm despite the escalating confrontation between the two nuclear-armed powers. CDS spreads on both countries remain near recent lows and their currencies remain stable. There are signs of de-escalation amidst contrasting claims from both sides, with no new strikes since yesterday morning. Overnight, the US has urged India and Pakistan to refrain from further military action.

On the theme of geopolitics, the second summit between President Trump and North Korea’s Kim Jong Un included the usual pleasantries however was short of anything particularly noteworthy to take away from. A more substantial announcement on talks between the two sides is expected at some point today so it’s worth keeping an eye on that, possibly at a scheduled press conference at 8:40am London time. Overnight, Trump has said that talks with Kim so far have been “very productive”and said “it’s all leaning toward a very big success”. In the meantime, Kim has said that “If I wasn’t working to do denuclearization I wouldn’t be here,” while Trump said before the start of today’s bilateral meeting that “speed’s not important” in denuclearization and he wants to do the right deal. Although as we go to print the press conference has seemingly been brought forward to 7am London time. So there’s intrigue as to why.

Here in Europe there was some interest in a Die Zeit story yesterday suggesting that high ranking members of the German Government were looking at “possible consequences” of Weidmann taking over the ECB Presidency job post the end of Draghi’s tenure. The story suggested that this was due to growing doubts that Manfred Weber would become the President of the European Commission, although it’s not the first time we’ve seen Weidmann’s name thrown in the ring for the ECB job. Expect these sorts of stories to only pick up over the next couple months.

Meanwhile, the good news is that there isn’t a huge amount of new Brexit news to highlight which makes for a nice change. The Evening Standard reported that senior ministers believed that the EU would insist on a Brexit delay of up to two years should PM May fail to secure a deal in the next few weeks. Interestingly the vote to extend Article 50 in two weeks – assuming May’s deal fails again – is amendable. DB’s Oli Harvey thinks this is very important as Parliament will be able to set the length of time the U.K. will request for such an extension. He believes this could scare the ERG group and make them more likely to vote for May’s deal for fear of a lengthy delay and ultimately the possibility of no Brexit. Labour’s amendment was defeated last night and they are now backing a second referendum as flagged earlier in the week.

On the data front, European money supply and credit data indicated a further slowdown. Credit growth slowed to +3.4% in January, while the M3 money supply grew +3.8% year-on-year, below expectations for +4.0%. Our economists’ preferred metric of the credit impulse dipped to -0.8pp of GDP, its weakest level since the summer of 2013, meaning that bank credit has shifted to become a modest headwind for growth, after several years in which it provided a tailwind. Perhaps most worryingly, there are signs of fragmentation within the euro area. The weakening is most visible in Italy and Spain, where lending to corporates has been zero or negative over the last six months, though lending to households has held up a bit better.

On the US data front, wholesale inventories were confirmed at 1.1% mom for December, beating expectations for a negative revision. Core goods orders were revised 0.3pp lower to -1.0% mom for December, which presents some further downside risks for fourth quarter capex estimates ahead of the GDP print later today. Pending home sales rose +4.6% mom, the biggest leap since 2010, which, combined with strong mortgage application data (+5.3% from +3.6%) shows further signs of the housing market bottoming out.

To the day ahead, where this morning in Germany we’ll get the January import price index reading, followed by February house price data in the UK. Later on the focus turns to the preliminary CPI readings for France, Germany and Italy. In the US the main focus will be on the Q4 GDP reading which are economists expect to show a +2.3% reading (in line with the market) which compares to +3.4% in Q3. In the details of that, core PCE is expected to print at +1.6%. The other data worth watching in the US is the latest weekly initial jobless claims reading and the February Chicago PMI and Kansas City Fed manufacturing survey readings which could give greater insight into the factory sector this month. Away from all that it’s another busy day for Fedspeak with Clarida (1pm GMT), Bostic (1.50pm GMT), Harker (4pm GMT) and Kaplan (6pm GMT) all slated to speak.

via ZeroHedge News https://ift.tt/2SvFnes Tyler Durden

In June, Secretary of Homeland Security Kirstjen Nielsen was heckled out of MXDC, an upscale Mexican eatery in the nation’s capital. In September, Sen. Ted Cruz (R–Texas) and his wife were hounded from Georgetown’s Fiola. In each instance, protesters associated with the group Smash Racism D.C. entered the restaurants and harangued their targets until they left.

In June, Secretary of Homeland Security Kirstjen Nielsen was heckled out of MXDC, an upscale Mexican eatery in the nation’s capital. In September, Sen. Ted Cruz (R–Texas) and his wife were hounded from Georgetown’s Fiola. In each instance, protesters associated with the group Smash Racism D.C. entered the restaurants and harangued their targets until they left.

Back in March 2018, President Donald Trump cited national security concerns to impose steel tariffs on our trading partners. At the time, trade experts warned that these duties (imposed under Section 232 of the Trade Expansion Act of 1962) would inevitably make the lives of American manufacturers more difficult. Trump’s 25 percent tariffs would significantly raise the price of imported steel used by American firms. Experts also predicted that manufacturers using domestic steel would pay a higher price. These predictions, writes Veronique de Rugy, have proved correct.

Back in March 2018, President Donald Trump cited national security concerns to impose steel tariffs on our trading partners. At the time, trade experts warned that these duties (imposed under Section 232 of the Trade Expansion Act of 1962) would inevitably make the lives of American manufacturers more difficult. Trump’s 25 percent tariffs would significantly raise the price of imported steel used by American firms. Experts also predicted that manufacturers using domestic steel would pay a higher price. These predictions, writes Veronique de Rugy, have proved correct.