Markets Spooked By Report China Doubts Trade Deal Is Ever Possible

S&P futures reversed overnight gains, and European stocks slumped on Thursday after a Bloomberg report that China doubts the possibility of a long-term trade deal with President Donald Trump. And one day after they all slumped following the Fed’s latest rate cut which pushed stocks to all time highs, safe haven assets including bonds, gold and the yen all advanced.

US index futures all reversed sharply, wiping out most of the post-FOMC gains, and Europe’s Stoxx 600 turned lower, with basic resources, energy and autos leading European indices into the red after Bloomberg reported Chinese officials have warned they won’t budge on the thorniest trade issues and remain concerned about “Trump’s impulsive nature and the risk he may back out of even the limited deal both sides say they want to sign in the coming weeks”, a report which frankly said nothing new, but seemed almost a hit piece designed to kill any upward algo momentum.

Amusingly, just an hour earlier, Reuters reported that Beijing could remove extra tariffs imposed since last year on U.S. farm products to ease the way for importers to buy up to $50 billion worth, rather than direct them to buy specific amounts, the head of a government-backed trade association said, in what appeared to be dueling narratives between Reuters and Bloomberg. Also prior to the Bloomberg report, China’s MOFCOM said trade negotiations are progressing well and that the teams maintain close communication, while the sides will proceed according to previous plan and lead US and China negotiators are to hold a phone call on Friday

Of course, all it takes is one optimistic tweet from Trump to reverse the dour early mood.

Earlier, world stocks edged to their highest in 20 months on Thursday after the Federal Reserve cut rates even as it signaled it would hold back from further reductions, sending bond yields and the dollar down, while solid earnings results from Facebook and Apple helped boost tech stocks.

Asian stocks outside Japan had earlier forged ahead on the cuts, following Wall Street’s advance to fresh record highs, climbing 0.3% to touch their highest since Jul. 30. Asian stocks advanced, led by communications firms, after the Federal Reserve cut interest rates for the third time this year and the dollar weakened. Fed officials signaled a pause in further rate cuts unless the economic outlook changes materially. Hong Kong led gains in the region, while Indonesia retreated. Japan’s Topix edged up 0.1%, supported by Sony and SoftBank Group, after the Bank of Japan strengthened the wording on its policy pledge, flagging the possibility that interest rates could go lower. The Shanghai Composite Index fell 0.4%, with Industrial & Commercial Bank of China and PetroChina among the biggest drags.

Early on Thursday, China’s National Bureau of Statistics reported that in October, China’s manufacturing PMI slumped deeper into contraction, dropping from 49.8 to 49.3, not only below the 49.8 consensus estimate, but also below the lowest sellside estimate (the range was 49.5-50.5). Worse, the Non-manufacturing PMI, which many had ignored for months because it was so deeply into expansionary territory, tumbled sharply, and after its biggest drop in almost a year, dipped to 52.8 from 53.6, and is now just shy of the lowest print since the financial crisis.

Emerging stocks rose 0.2% to their highest in three months, and were on course for a second straight month of healthy gains. India’s Sensex climbed 0.7%, as Infosys and State Bank of India offered strong support. Yes Bank soared as much as 39% after saying it got a $1.2 billion binding offer from a global investor for its share sale.

On Wednesday, Fed Chair Jerome Powell gave an upbeat assessment of the U.S. economy and geopolitical risks from Washington’s trade war with China to Brexit had eased. Yet many investors held on to expectations that further rate cuts could come should the U.S. economy turn sour next year, and on Thursday money moved to riskier assets.

“Markets are discounting some more easing, but not very aggressively at this stage,” said Klaus Baader, chief global economist at Societe Generale. “We think the U.S. is going slide into recession, and that is likely some time around the middle of 2020. If the economy slides into recession, we think the Fed will continue to cut interest rates aggressively – even though this isn’t mainstream thinking.”

The Fed dropped a previous reference in its policy statement that it “will act as appropriate” to sustain the economic expansion – language that was considered a sign for future cuts. Even so, market players said they thought the Fed could act should geopolitical risks flare up.

After the Fed cuts, the S&P 500 index closed at another record high on Wednesday, though some in the market voiced concern that central banks across the world lack room to respond to any economic downturn. “I’d be worried that there isn’t enough in the tool box,” said Neil Wilson, chief market analyst at Markets.com. “The Fed is in a better state than most, but I’m not sure what Europe and Japan can do.”

Just a few hours after the Fed cut, the Bank of Japan kept policy steady on Thursday, but introduced new forward guidance – a pledge central banks make on future policy – that commits more strongly to perpetuating ultra-low interest rates. The BoJ noted that this is to pay close attention to chance momentum for hitting price target will be lost although it added there has been no further increase in chance of momentum for hitting price target will be lost but must continue to pay attention to the possibility. Furthermore, BoJ stated Japan’s economy is likely to grow below potential temporarily but will likely continue expanding as a trend, while it noted that risks are skewed to the downside for the economy and it lowered all growth and inflation forecasts in its Outlook Report.

In geopolitics, North Korea has reportedly fired two projectiles, according to the South Korean Military and the Japanese Coast Guard note that the missile appers to have landed outside of their EEZ. The projectiles flew 370km with a maximum altitude 90km before sinking into the sea.

The dollar slipped against a basket of six major currencies slipped 0.4% to 97.29, its lowest in a week, after rising a day earlier. The Bloomberg Dollar Spot Index was set to lose 1.9% this month – its worst performance in 21 months – and fell a fourth day after Fed Chairman Powell said the bar to raising interest rates remained high. The greenback stayed lower on news of China’s skepticism to reach a longer-term trade deal with the U.S. while Treasuries advanced. The yen saw the biggest gains against the dollar on haven demand as risk sentiment soured; the Swiss franc also climbed. The pound rose a second day as the Dec. 12 election campaign began.

In rates, as investors switched to a risk-off mood, the yield on 10-year U.S. bonds fell four basis points to 1.74%. Euro zone bond yields also fell: German government bond yields, seen as a benchmark, were set for their biggest fall this month.

In commodity markets, oil prices rose as investors banked on further economic stimulus by China after weak PMI data. Brent crude futures were last up 0.6%, or 39 cents, at $60.99 a barrel.

To the day ahead, focus will be on the September PCE report along with personal income and spending readings. The Q3 ECI, latest jobless claims data and Chicago PMI are also due. Elsewhere, the ECB’s Guindos is due to speak while earnings releases include Royal Dutch Shell, Sanofi, BNP Paribas and Kraft Heinz.

Top Overnight News from Bloomberg:

- Chinese officials are casting doubts about reaching a comprehensive long-term trade deal with the U.S. even as the two sides get close to signing a “phase one” agreement. In private conversations, Chinese officials have warned they won’t budge on the thorniest issues, according to people familiar with the matter. They remain concerned Trump could back out of even a limited deal

- In a press conference after the Fed cut interest rates for the third time in 2019, Federal Reserve Chairman Jerome Powell repeatedly said that the stance of policy was now “appropriate” to keep the economy growing moderately, the jobs market strong and inflation near the central bank’s 2% goal. Bond market signals doubt Fed has shut door on further rate cuts

- Jeremy Corbyn will blast what he calls the U.K.’s “corrupt system” as he kick-starts Labour’s campaign to overthrow Prime Minister Boris Johnson’s Conservatives in the Dec. 12 general election. The opposition Labour Party leader will deliver his first speech of the campaign with an attack on billionaires. He’ll also reiterate Labour’s plans to nationalize rail, mail and water companies

- A gauge of the outlook for China’s manufacturing sector dropped to the lowest level since February, underlining the weakness of an economy buffeted by weak domestic demand, shrinking profits, and the trade war with the U.S.

- Japanese industrial output rebounded more than expected in September from a drop the previous month, though factory production still fell over the third quarter

- Reserve Bank of Australia board member Ian Harper said his nation’s economy does “not need” a stronger currency — but worries that’s exactly what it could end up with if the U.S. Federal Reserve keeps easing

- President Donald Trump’s plan to ink the first installment of a trade accord with Xi Jinping next month was thrown into question Wednesday after Chile canceled an upcoming summit where the two leaders had planned to meet

- House Democrats hold a historic vote on Thursday to affirm an impeachment inquiry of President Trump that also will starkly illustrate the country’s political divisions

- Pound traders eyeing December’s snap U.K. election are more worried about Brexit champion Nigel Farage than the socialist agenda of Labour leader Jeremy Corbyn. Faced with a vote as much about Brexit as the contenders, making it more difficult to predict, Goldman Sachs Group Inc. and BlueBay Asset Management have backed away from bets on pound strength

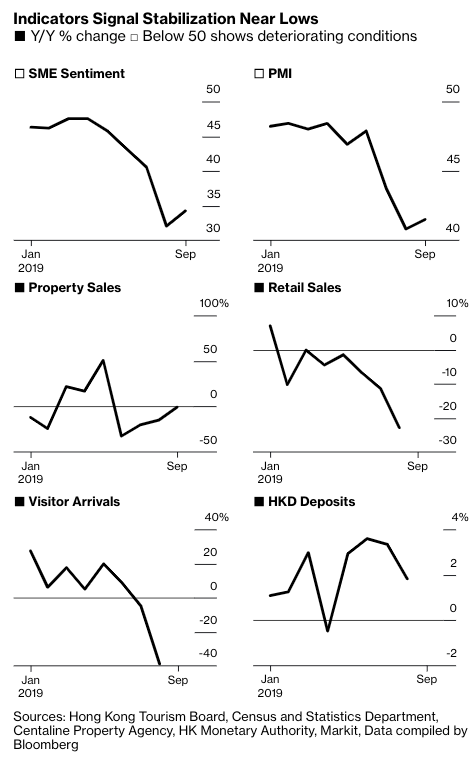

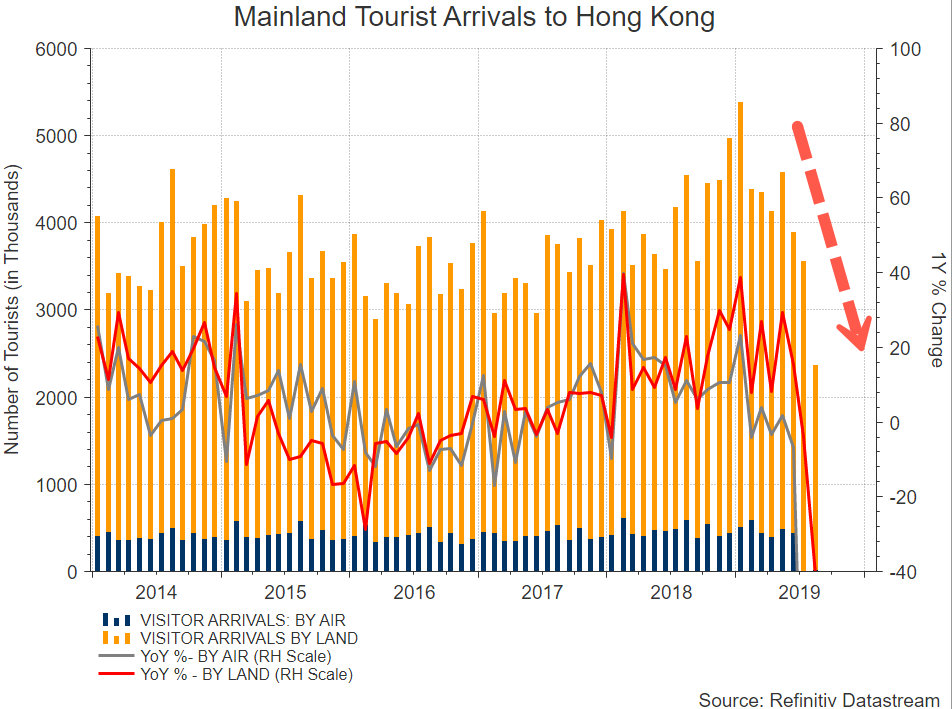

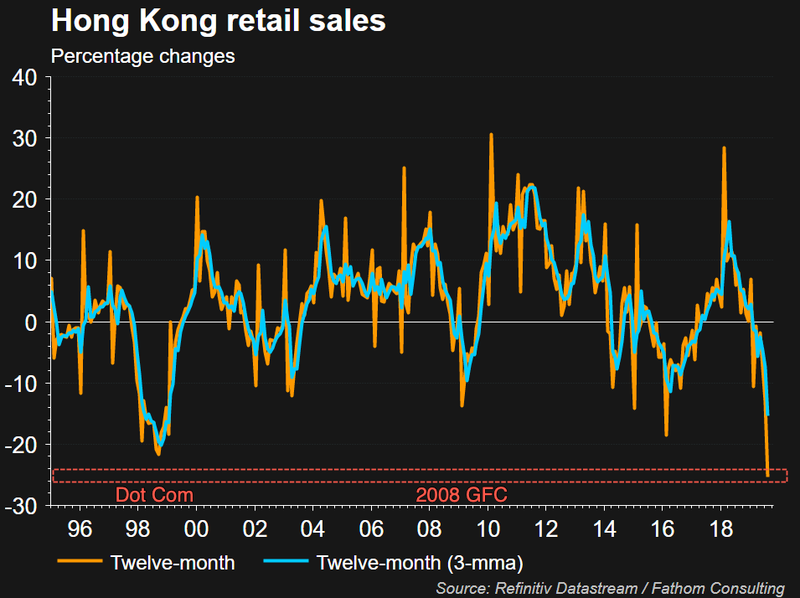

- Hong Kong’s economy contracted sharply in the third quarter as it entered a recession, exceeding economists’ worst estimates of the damage from nearly five months of protests. Third-quarter gross domestic product retreated 3.2% from the previous three months, after a 0.4% contraction in the second quarter. That’s the worst slump since 2009

Asian equity markets traded mostly positive after the mild post-FOMC tailwinds, with participants also reflecting on a slew of blue-chip earnings and disappointing Chinese PMI data. ASX 200 (-0.4%) was among the few laggards, pressured by underperformance in its largest weighted financials sector after Big 4 lender ANZ Bank reported flat profits amid challenging conditions, while Nikkei 225 (+0.4%) just about kept afloat amid a mixed currency and with a deluge of earnings including Sony which raised its FY net forecasts. Elsewhere, KOSPI (+0.2%) was boosted by index heavyweight Samsung Electronics which surpassed its profit guidance and Apple suppliers in Taiwan saw mixed fortunes despite a strong Q4 result from the US tech giant which beat on top and bottom lines, as well as iPhone revenue but missed on iPad and Mac sales. Hang Seng (+0.9%) outperformed overnight after the HKMA lowered rates in lockstep with the Fed and Shanghai Comp. (-0.4%) was less decisive after another PBoC liquidity drain, weaker than expected Chinese Manufacturing and Non-Manufacturing PMI data, as well as some uncertainty after Chile cancelled the APEC summit next month. Finally, 10yr JGBs rallied from the open ahead of the BoJ announcement after source reports suggested that the BoJ is considering modifying its forward guidance to more clearly signal the chance of a future rate cut, although JGB prices pulled back aggressively following the BoJ announcement which was met with disappointment given that the bank’s new guidance for “short and long-term rates to stay at current or lower levels as long as needed“ didn’t provide anything ground-breaking, as the bank have previously reiterated the possibility for further negative rates.

Top Asian News:

- BOJ Deploys Words Instead of New Policy Action to Fight Slowdown

- Alibaba Is Said to Eye November Window for $10 Billion Listing

- Taiwan Bucks Asia Slowdown With Fastest GDP Growth in 5 Quarters

- Record Singapore Deposits May Show Hong Kong Funds Shift

Major European Bourses (Euro Stoxx 50 -0.6%) are mostly lower, after reports that China is doubtful about the possibility of a long-term trade deal with US President Trump and unwilling to budge regarding key structural issues; news which triggered a bout of risk off sentiment. Underperformance is being seen in the FTSE 100 (-1.07%) – weighed on by index heavy weight Royal Dutch Shell (-3.6%) after it reported disappointing earnings, in which the Co. noted risks to the completion of its share repurchase programme (Note: Shell A and B shares account for 11% of the FTSE 100). Meanwhile, the FTSE MIB (-0.1%) fares slightly better, with decent gains in Fiat Chrysler (+8.7%) on the terms of its merger with Peugeot (-12.3%) and with each to own 50% share in the merged entity. Prior to the US/China trade headlines, global equities had been holding on to yesterday’s post FOMC gains; in which the Fed cut rates by 25bps but indicated it would likely be on hold going forward. The sectors meanwhile are relatively defensive; Utilities (+0.7%), Health Care (-0.3%) and Consumer Staples (+0.1%) outperform while Energy (-2.4%) is the laggard on Shell. Prior to the risk off move, Tech (-0.7%) had been leading the pack higher, following strong earnings from strong earnings from Apple and Facebook (4.8% and 1.8% higher respectively in premarket trade). In terms of other individual movers; decent earnings saw Sanofi (-0.2%) bid at the open, albeit the Co. reversed gains amid the aforementioned US-China trade news. Conversely, weaker than expected earnings from Air France (-3.8%), Lloyds (-2.7%), BT (+0.5%) and Swiss RE (-1.9%) saw their respective shares under pressure.

Top European News:

- BNP Paribas Fixed-Income Trading Outperforms European Rivals

- Pound Investors’ Biggest Fear on Snap U.K. Election Isn’t Corbyn

- British Airways Owner Posts Earnings Drop After Pilot Strike

- Shell Warns of Weak Economic Outlook Despite Bumper Profit

In FX, the Greenback remains under pressure in the FOMC aftermath as some month end rebalancing models are negative in contrast to neutral signals flagged earlier in October, while the latest comments from China on the US trade front have been net bearish for the Buck with Beijing apparently raising doubts about the prospect of a long term accord given a reluctance to make major structural reforms and demands that Washington removes all tariffs before moving forward to Phase 2 talks. The DXY is holding just off 97.216 lows compared to 97.449 at one stage and considerably higher in knee-jerk Fed rate cut and shift to pause mode trade.

- JPY/CHF/GBP/EUR – Risk-off sentiment prompted by the aforementioned Chinese concerns and conditions regarding trade negotiations with the US and more NK missile tests has (naturally) boosted the likes of the Yen and Franc (while Gold has also benefited and reclaimed Usd1500+/oz status), with Usd/Jpy retreating sharply through the 21 DMA (108.59), 108.50 and now testing 108.25 that would expose hefty option expiries between 108.00-10 (2.5 bn) if breached. Meanwhile, Usd/Chf is hovering close to the base of a 0.9895-60 range and Sterling is muscling in, albeit with bullish UK election momentum also underpinning the Pound amidst reports that the Brexit party may pull candidates and boost Tory votes in the process. Cable is holding near 1.2950, while Eur/Gbp is having another look at support ahead of 0.8600 even though the single currency is outpacing the Dollar with Eur/Usd firm within a 1.1150.75 band.

- NZD/AUD/CAD – Somewhat contrasting fortunes down under, as the Kiwi clings to 0.6400 vs its US counterpart and stays above 1.0800 against the Aussie despite the latest China-US headlines and downbeat Chinese PMIs overnight with the aid of Westpac rolling its RBNZ ease forecast to February 2020 from next month and an improvement in the NBNZ business outlook. Conversely, Aud/Usd is losing grip of 0.6900 and Usd/Cad remains elevated between 1.3148-78 parameters following yesterday’s cautious BoC outlook and eyeing Canadian data in the form of GDP, PPI and AWE.

- EM – A steeper retreat from recent peaks by the Rand as the risk aversion noted above merely adds to weakness stoked by SA’s MTBS and investor angst that Eskom aid is not as comprehensive as anticipated or hoped. Usd/Zar has been above 5.1800, but now paring back a tad.

In commodities, crude markets have eroded earlier gains after US/China trade related risk off saw this morning’s tentative gains quickly given back. WTI Dec’ 19 futures topped out around USD 55.60/bbl and Brent Jan’ 20 at USD 60.80/bbl, before a souring of sentiment saw the contracts fall as low as USD 54.85/bbl and USD 60.05/bbl respectively. In terms of crude specific news; the 590mln bpd Keystone pipeline, which carries crude oil from Alberta, Canada to refineries in the US, was shut yesterday after a spill, with little clarity on how long the disruption will last. Separate reports alleged that TC Energy has declared a ‘force majeure’ on the pipeline. “These developments will not be welcome news for Canadian producers” notes ING “with it likely to weigh on the WCS-WTI differential”. Meanwhile, source reports last night that US plans to allow Russian, Chinese and European companies to continue non-proliferation work with Iran by renewing sanctions waivers, although the news appears to have done little to change the dial. In terms of Metals; Gold is bid on 1) a weaker buck post-FOMC, 2) weak overnight Chinese PMI data 3) jitters regarding North Korean missile tests and, most recently, 4) negative US/China trade headlines. Meanwhile Copper prices saw renewed pressure amid the overall risk sentiment coupled with the dismal China data, with the red metal now below earlier reported resistance at USD 2.660/lbs to make fresh weekly lows.

US Event Calendar

- 8:30am: PCE Deflator YoY, est. 1.4%, prior 1.4%; 8:30am: PCE Deflator MoM, est. 0.0%, prior 0.0%

- 8:30am: Personal Income, est. 0.3%, prior 0.4%

- 8:30am: Personal Spending, est. 0.3%, prior 0.1%

- 8:30am: Real Personal Spending, est. 0.2%, prior 0.1%

- 8:30am: Employment Cost Index, est. 0.7%, prior 0.6%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 212,000; Continuing Claims, est. 1.68m, prior 1.68m

- 9:45am: MNI Chicago PMI, est. 48, prior 47.1

DB’s Jim Reid concludes the overnight wrap

Welcome to Hallowe’en – a day that was pretty meaningless to me until I had my first child. Since then each year I’ve come home on this day to pumpkins, witches hats, broomsticks and old bedsheets with eye holes cut out. I’m a bit nervous about tonight as trick or treaters at my house might get a nasty shock as we are half way through the process of getting a new set of gates at the top of our drive. We are at the stage where we have a massive drainage trench exposed but with no surrounding lights. So any attempt to come seeking sweets at our house tonight might end up being swallowed up by a three foot ditch.

The trick for markets last night was that the Fed offered very little to those hoping for more cuts with the treat being that the bar to hiking rates seemed to also get higher. So this was a Fed that seemingly wants to hold steady here for a long period of time. Whether the data lets them is another matter but both bonds and equities rallied once this message got across in the press conference, especially the one regarding the hurdle to future hikes.

They did cut 25bps as expected but the tone of the conference has meant that our US economists have adjusted their Fed call. They continue to expect another rate cut in December, even though the probability of this has been reduced by yesterday’s FOMC. Their outlook for the US economy anticipates a further weakening of the data, particularly related to the labour market. In addition, significant event risks remain related to trade policy and geopolitics before the December meeting. They have removed the rate cut they expected in January 2020 though. This cut was in part predicated on the Fed credibly committing to a shift to an inflation makeup strategy at that meeting. Chair Powell, however, sent a clear signal that the outcome of the Fed’s policy review is likely to be announced around the middle of next year. At that point, with growth having rebounded and inflation near target, they expect the Committee to compromise by committing to this change in inflation target by promising to keep rates lower for longer. They have therefore removed the rate hike they had built into late-2021. See their note here for more.

So whether you believe the Fed or whether you believe our economists the key take home that the market took away last night was that the Fed aren’t going to be very active over the next few years. I suspect that this view is wishful thinking but that’s the narrative for now.

The reaction in Treasuries was for 10y yields to fall -6.7bps, 4bps of which occurred after Powell answered a question about how far they were away from rate hikes. At the short end 2y yields fell -4.4bps, but 6bps from the peak in the press conference. Those moves meant the 2s10s curve flattened a couple of bps. Meanwhile the S&P closed +0.44% having been slightly lower for the first part of the press conference. US equity futures are broadly flat this morning even with earnings beats out of Apple and Facebook post the closing bell last night. They were up +1.94% and +4.46% respectively in after hours trading. Apple also projected fiscal first-quarter revenue that beat analysts’ estimates

Jumping to Asia now where following the Fed, the BoJ kept its policy settings unchanged but strengthened forward guidance. The BOJ now says that it expects short- and long-term interest rates to remain at current or lower levels as long as it is necessary to pay attention to the possibility of losing price momentum. They dropped a time frame of keeping rates extremely low until at least around spring 2020. On the review of prices that the BoJ had called for at its September meeting, the central bank said the possibility of losing momentum toward its price target had not increased any further, though it was necessary to keep closely watching the situation. Meanwhile, the BOJ revised down its CPI forecasts for 2019, 2020 and 2021 to +0.7% (vs. +1.0% previously), +1.1% (vs. +1.3%) and +1.5% (vs. +1.6%). GDP forecasts were also revised down too. Yields on 10y JGBs are down -1.4bps to -0.144%.

Also out this morning were the October PMIs in China where manufacturing PMI printed at 49.3 (vs. 49.8 expected), the lowest reading since February while the non-manufacturing PMI came in at 52.8 (vs. 53.6 expected) thereby bringing the composite PMI to 52.0 (vs. 53.1 last month). In details, the sub index of new export orders fell by -1.2pts from last month to 47.0 while the new orders sub index dipped back into contractionary territory (49.6 vs. 50.5 last month). Elsewhere, Japan’s preliminary September industrial production printed at +1.4% mom (vs. +0.4% mom expected).

Markets in Asia are largely trading higher with the Nikkei (+0.35% ), Hang Seng (+1.05% ), CSI (+0.10% ) and Kospi (+0.81%) all up. The Kospi’s performance is also being helped by the earnings beat from Samsung electronics (up +1.19%) as the company posted better-than-expected earnings and projected a gradual recovery in the memory chip market in 2020 as fifth-generation wireless technology rolls out globally. Elsewhere the US dollar index is down -0.31% and yields on 10y USTs are up +1.3bps.

In other news, Xinhua reported overnight that the top negotiators from the US and China will have a phone call tomorrow while China’s commerce ministry said that China – US trade negotiations are progressing well.

On Brexit the first national opinion poll that has come out since the election seemed a formality. Canvasing Tuesday and Wednesday the Survation results showed an 8 pc lead for the Conservatives – the same as two weeks ago for this agency. There was news last night that the Brexit Party might only contest around 20 seats and allow the Conservative Party free reign elsewhere. They had previously said they would contest all 650. We’re expected to know their plan by the end of the week. If true this would take some of tail risk out of the election and reduce the no-deal risk. Sterling has edged back above $1.292 this morning but much of that has been due to a weaker dollar after the FOMC.

Unsurprisingly there wasn’t much going on in markets prior to the Fed decision yesterday – the biggest news being the decision by Chile to cancel the APEC summit. President Trump had previously flagged this as the location for a likely signing of the preliminary trade accord with Xi but the cancelled summit presumably shouldn’t be a hurdle for that assuming they can find a new location. Indeed a spokesman for the White House said that the time frame for a deal is still the same despite the cancellation. Away from that, the slate of earnings that were released were a bit more mixed. The DOW got a lift from Johnson & Johnson while GE shares also jumped after painting a more optimistic cash flow picture for the rest of this year. Molson Coors, Yum Brands and CH Brands were among those to disappoint.

Coming back to the Fed, the committee also had the benefit of some slightly stronger than expected Q3 GDP data just prior to their decision yesterday. Indeed the +1.9% annualized reading bettered expectations for +1.6% and was down only one-tenth from Q2 as a result. Consumption was a driver (+2.9% vs. +2.6% expected) while the quarterly figure is also not far from the Fed’s second half forecast built into their September SEP projections. The one disappointing aspect of the report was capex, while elsewhere core PCE was in line at +2.2%.

Also out yesterday and as a precursor to tomorrow’s payrolls was the October ADP employment change print. The 125k reading bettered expectations for 110k however it did come about in the context of 42k of downward revisions to the September data. It’s worth noting that there was no mention of the GM strike in the press release which had been flagged as a factor potentially negatively impacting payrolls tomorrow.

The data in Europe included a +0.1% mom CPI reading in Germany which was slightly ahead of expectations for no change, and left the annual rate at +0.9% yoy. Away from that Q3 GDP was better than expected in France (+0.3% qoq vs. +0.2% expected) while the unemployment rate held steady at 5.0% in Germany. Finally confidence indicators were broadly weaker than expected for the Euro Area in October with the exception of the business climate indicator. For completeness European equity markets were little changed yesterday.

In other news, the Bank of Canada held rates steady at 1.75% yesterday however the message was interpreted as fairly dovish including references like “the resilience of Canada’s economy will be increasingly tested as trade conflicts and uncertainty persist”, as well lowering projections for 2020 and 2021. The Canadian Dollar immediately weakened following the statement release and closed down -0.55% while 10y yields were down -15.1bps.

To the day ahead, which this morning includes September retail sales data in Germany, preliminary October CPI in France and Italy, and the advance Q3 GDP reading for the Euro Area. In the US the focus will be on the September PCE report along with personal income and spending readings. The Q3 ECI, latest jobless claims data and Chicago PMI are also due. Elsewhere, the ECB’s Guindos is due to speak while earnings releases include Royal Dutch Shell, Sanofi, BNP Paribas and Kraft Heinz.

Tyler Durden

Thu, 10/31/2019 – 08:13

via ZeroHedge News https://ift.tt/34dhbn6 Tyler Durden