Authored by Matthew Piepenburg via GoldSwitzerland.com,

Below we look at the dark corner in which the Fed has placed themselves and investors: A one-way path toward tanking markets or crippling inflation.

Alas: Pick your poison.

For us, the antidote is as good as gold.

More Inflation Signs

Stocks continue to gyrate nervously as the Fed continues to behave like a cornered animal trying to downplay inflation risks while paradoxically supporting a mega “everything bubble” with pro-inflationary tools.

April’s “official” CPI inflation number climbed by 4.2%, the fastest climb since 2008 and 2X the Fed’s mandate.

The Fed is claiming that’s because because COVID’s 2020 deflationary trends made such relative inflationary increases “expected,” “temporary,” and soon to be “contained.”

We’ve heard those words before…

Meanwhile, US producer prices surged by 6.2% for the same month, the highest move since 2010, as core inflation, which excludes energy and food, saw its highest move since 1981.

As for energy and food, we’ve already made it painfully clear that prices on everything from ethanol to canola and corn, or from milk, chicken wings and lean pork to beef and coffee are skyrocketing by high double digits.

Thus, in case you think inflation is still up for debate, the facts once again tell us it’s already here.

And as for inflation in the risk asset markets, that’s now as obvious as any bubble narrative.

The Bubble Narrative: Rates Matter

As for asset bubbles, they are the result of simple cause and effect.

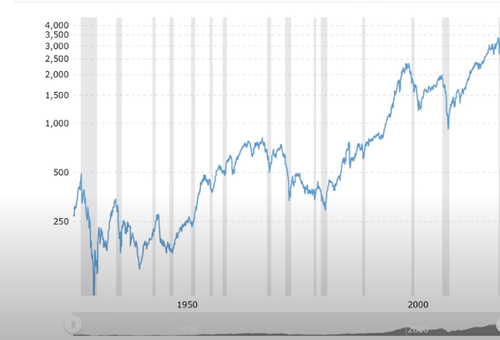

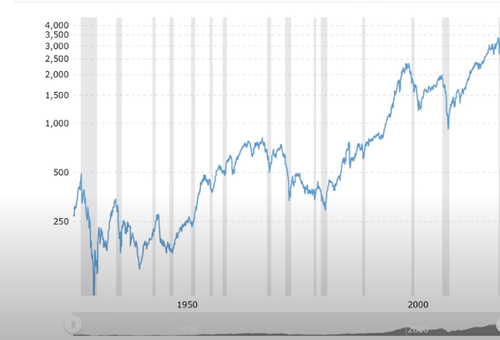

If you want to know why stocks are inflated to levels that would make any bull or bear’s nose bleed, the following rate chart tells you why.

History and math confirm that debt drives all bubbles, and when debt is cheap—bubbles expand fatally. Period.

The following interest rate picture, which tracks the cost of debt, says a thousand words as to the power, as well as danger, of cheap debt fueled by the Fed’s artificial rate suppression.

In short: Rates matter.

As the 1980’s rate spike above confirms, interest rates in the U.S. were once as high as 19% when debt levels were low.

But now try to imagine current sovereign, real estate or corporate debt-issuers having to re-pay debt at such rates.

Would the Fed even toe-dip in that direction intentionally to fight the inflation discussed above?

They can’t, the couldn’t and they won’t.

Rising rates would mean instant party-over for the bond market, and no less so for the stock market. Thus, if you’re at all worried about an intentional “Volker moment” or intentional rate hikes: Don’t be.

The Fed simply can’t allow rates to rise in any meaningful way.

Frankly, even at 5%, rates would send global markets and economies to the insolvency basement. Period.

What this chart also reveals is that for every recession (gray vertical lines above), the Fed has been able to reduce rates to re-“stimulate” markets, which is their only real motive, despite libraries of Fed-speak to the contrary about their alleged role in supporting the real “economy.”

As I’ve said before, the Fed’s mistress is the market, not the economy.

The Fed’s deliberate pattern of market support, and hence distortion, is now beyond debate and boils down to this:

1) “Stimulate” markets with low rates to bubble point;

2) when things feel good, try to raise rates gently, and

3) when those market bubbles inevitably pop, recover/create them again with more rate cuts.

In short, rate cuts save dying markets.

Running Out of Bullets

But here’s the rub: What happens when there are no rates left to cut?

Well, that’s where the Fed (and other central banks) are today—out of bullets.

The graph above, moving from left to right, makes this clear rather than hypothetical or theoretical—there are no rates left to cut, and thus what “worked” in the past simply won’t work tomorrow.

In the early 1980’s, for example, the Fed’s rates dropped from 19% to 8%; in 1989, they cut rates from 10% to 3%; and during the dot.com bubble of the early 2000’s, they dropped rates from 6% to 1%.

See the pattern? With each “accommodative” rate cut, more bubbles followed, which led to more bubbles popping, which meant more rates cuts to “accommodate” markets.

In 2008, of course, the Fed responded to the Great Financial Crisis with, you guessed it–another 5% rate cut—all of which helped “recover” markets (from real estate to tech stocks) on the back of cheap debt.

Unfortunately, however, as we look to the far right of the above chart, we again see that there are no rates left to cut.

Powell, of course, knows this too.

He may be a double-speaker, but he isn’t stupid. That’s why he tried so hard in 2018 to raise rates and “taper” so that he’d have something to “cut” when the markets nosedived again.

Of course, trying to raise rates in a national and global backdrop of historically unprecedented sovereign and corporate debt didn’t pan out so well for Powell and his beloved markets—as we saw in the subsequent market puking of late 2018 or the repo crisis of 2019.

Net conclusion?

Simple: The Fed can’t go “hawkish” and raise rates without sending markets –and economies–to their knees; by extension, they now have nothing left to “cut” when the current everything bubble implodes.

And that, as we’ve said so many times, is a real problem.

Solution Worse than the Problem

As for a solution, what’s so tragic is that the only option before the Fed is an even bigger problem—current and inevitably more inflation.

That is, if the Fed wants to keep markets (and their job security) breathing, they no longer have the foregoing template of “rate-hike-followed-by-rate-cutting” at their disposal, which means they now have no choice but to dovishly keep rates near the zero-bound indefinitely.

But the only way to keep rates “controlled” and nailed to the floor of time is to purchase otherwise unwanted bonds to keep their prices elevated and hence yields and rates repressed.

Such bond “accommodation,” of course, costs money, and as we already know, the only “money” the Fed has to spend is the kind they create out of thin air– the very kind of money (and policy) which leads to the kind of inflation discussed above—namely, the brutal kind.

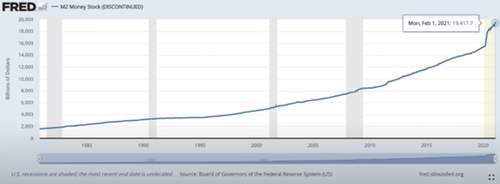

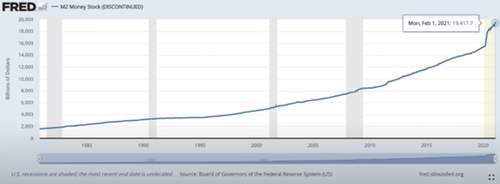

As for that fake money, the evidence of the Fed’s desperate (and only) direction is now obvious, as the following M2 money supply makes equally clear.

As we’ve discussed elsewhere, the Fed is so embarrassed by this “printing solution” that they’ve stopped weekly reporting of M2 data, and frankly, since March, have even stopped monthly reporting of the same.

That, of course, is both telling as well as disgraceful… The Fed literally has something to hide, and that never bodes well, does it?

Central Banks—Caught Between Their Own Inflationary Rock and or Market-Killing Hard Place

Thus, the Fed can continue to use printed currencies to pay for yield curve control (YCC) in order to repress rates and hence keep markets from totally imploding.

That requires trillions, not billions, to maintain.

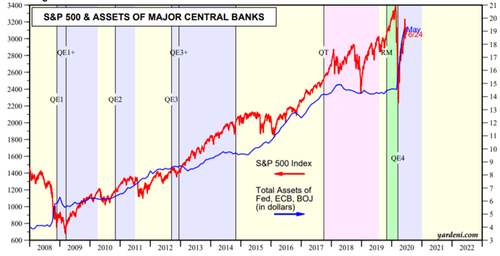

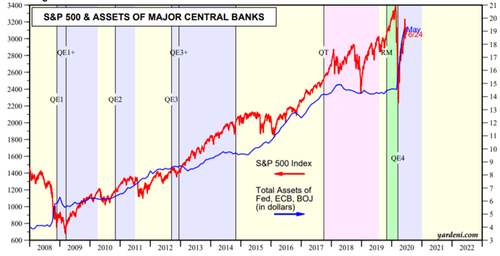

The correlation to central bank balance sheet (i.e., money supply) expansion and rising markets is now beyond dispute.

But in order to continue this open charade of printing money to “accommodate” risk asset bubbles from bonds to beach front homes, the inflationary effects (above) of such fake money (and desperate) monetary policy are now getting impossible to ignore, despite openly laughable excuses, CPI data and calming projections from snake-oil merchants like Powell.

Whenever the markets get wobbly, the Fed prints money (think March 2020) and whenever the Fed thinks markets are “strong” (think June 2020) and it’s safe to taper (i.e., print less), the markets sink and thus the Fed has to crank out the money printers again (think July 2020).

In short—do you see the correlation and pattern? Do you see how the Fed’s market sausage is made? More importantly, do you now see the Fed’s self-made conundrum?

That is, they have to choose between 1) allowing markets to die (by hawkishly tapering the money supply needed to control rates) or 2) allowing for Main-Street-crippling inflation to increase (by dovishly accommodating the markets with unlimited fiat money).

Given that the Fed bows to the markets not the people, which choice do you think they’ll make?

In other words, expect more money printing and more yield curve control—and hence more money creation, more inflation, and by extension more fiat currency debasement.

Once you accept the Fed’s true nature and true market priorities—then making behavioral (and hence policy) projections on the Fed is as easy projecting the actions of gambling addicts or used car salesmen.

What’s Ahead for Markets? Taper Tantrum or a Generous Uncle Fed?

As of this writing, markets are panicking up and down, from exchanges in the US and Europe to Australia and Japan.

Why? Because regardless of what Powell, the CPI scale or other financial puppets say, forward-looking markets are witnessing and expecting more inflation (from money printing to supply-chain shocks).

At the same time, those same markets are hanging on Powell’s every word, which is just further proof that today’s modern and horrifically un-natural markets are entirely Fed-driven as opposed to settings of age-old (and now extinct) capitalistic principals like, say, natural supply and demand or legitimate price discovery.

Folks let’s just say it: The Fed is the market.

As of now, there is a real fear that Powell will hint at tapering (i.e., less printing), which will send the spoiled Wall Street nephews of their rich uncle Fed into yet another “taper tantrum.”

Meanwhile, as markets wait nervously for another Fed carrot or stick (dove or hawk, rate repression or rate hike), they can’t help but ignore the S&P’s 43 PE ratio (the historic average is 17-20), which screams of over-valuation but could in fact lead to even higher stock prices (bubbles) so long as the Fed doesn’t taper its money printing and rate repression.

But even if Powell found his “hawkish” manhood, conscience or common sense and offered Wall Street a rate-hike stick rather than YCC carrot, any future tapering of rate and money supply “accommodation” would send markets tanking, just tanking.

So, what will it be: Carrot or stick? Dove or Hawk? Market implosion or hyper-inflation?

In the interim, stocks are facing a myriad of other slings and arrows.

Dividend yields on the S&P have fallen to 1.5%, which is less than the return on even artificially repressed 10-year Treasuries (at 1.66%).

Will investors leave stocks for the “safety” of bonds, creating an outflow-driven price decline in stocks?

At the same time, stimulus checks are drying up, as are projected unemployment benefit extensions.

If this support slows, consumer demand and hence corporate earnings will feel the pinch—and so will stock prices. This explains why the smart money is leaving the casino.

Traditional Thinking Is Dangerous

Regardless of how long it takes for either a tanking market (Hawkish Fed) or Main-Street crushing inflation (Dovish Fed) to become fully evident, the bobble-head media and consensus-think financial industrial complex will tell you to stay the course.

Why?

Because they only get paid by investors staying the course, even if that course means steaming straight into an iceberg of debt and increasingly worthless fiat money.

But as for staying the course in the backdrop of the largest debt expansion in history, as well as an equally unprecedented bubble environment in stocks, bonds, real estate and cryptos, it might be worth considering a little bit of math and history to shape your thinking and curb your enthusiasm.

Markets, currently sustained by debt bluff, hot air, and fake money, are poised for an “uh-oh” moment far more painful than anything seen in the Great Depression.

Yet in case you are thinking of riding such a course out (as most risk-parity advisors suggest), take a moment to think about how long and painful that ride can and will be.

Consider the great crash of 1929 and the years that followed:

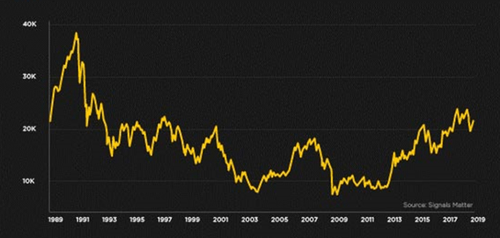

As the facts confirm, the S&P crashed from its near-500 peaks in 1929. It did not recover those prior highs until 1956, some 27 years later.

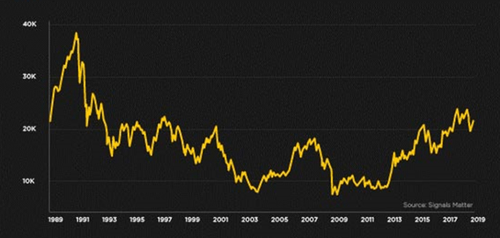

Gazing across the Pacific toward another historical moment of familiar “uh-oh,” we have the oh-so-embarrassing example of the Nikkei’s infamous 1989 crash.

Well, some 30 years later, that market has yet to recover its prior highs.

By the way, even if you can and are willing to risk waiting that long to “recover” prior price highs, keep in mind that the inflation to hit you during that period will eat away at more than 50% of your purchasing power.

Thus, if you believe markets are priced for perfection today and for the coming decades, stay the course, ride the wave, pay your broker and ignore the data-rocks below the surface.

To each his/her own.

But even the market itself is globally showing signs of “sell,” as the inflationary consequences of outright fraudulent central bank policies are becoming impossible to ignore.

If, as expected, the Fed “allows” inflation, or worse, if inflation continues to run way past the Fed’s hubris and comical control, no amount of yield curve repression can stop interest rates from rising with inflation, and if interest rates increase by even 3%, the debt party we’ve been enjoying in the markets since 2009 turns into a nightmarish hangover.

Again, see the conundrum?

Carrot or stick, the only future our central banks can hand us is one of rubble, not vegetables or wood.

The last remaining unknown is how long double-speakers like Powell and his ilk can continue this carrot and stick chess match (or market vs. inflation tug-of-war) as our financial, economic and currency “Rome” is burning.

As we’ve said, it’s a fool’s errand to time or forecast the damning yet undeniably powerful effects of unlimited money creation, but it remains a prudent investor’s obligation to prepare for their inevitable consequences.

More money supply to keep rates monetized simply means more currency debasement and rising inflation.

Gold, of course, has no where to go but up in the years ahead for the very simple reason that currencies now have nowhere to go but down.