Authored by Per Bylund via The Mises Institute,

The new kid on the economics block is something called modern monetary theory. The name is new, but the “theory” is not.

Proponents adamantly claim that it is both new and a theory of economics. To make it appear this way, they dress the ideas in unusual-sounding jargon and use rhetorical tricks. For example, instead of presenting actual arguments or responding to direct questions, they present a circular flow of deepities. To top it off, they, at least in my humble experience, usually lack fundamental economic literacy. This can make rebutting their nonsensical claims a challenge and, as a result, debates with this crowd typically go nowhere.

In order to figure out what exactly they are claiming—beyond the deepities—I decided to acquaint myself with the prominent proponents. I read “founder” Warren Mosler’s so-called white paper on MMT, but it’s not very helpful: there is little by way of theoretical explanation, other than redefining if not obscuring the meaning of common concepts in economics. Mosler also seems overly eager to move from explanation to instead argue for his preferred policies.

I hoped for (and got) more from listening to a TED Talk by Dr. Stephanie Kelton, an economist and professor at Stony Brook University who was the senior economic advisor to Bernie Sanders’ presidential campaign and author of The Deficit Myth (reviewed by Bob Murphy here). TED Talks are only fifteen minutes long, but it turned out to be a very painful experience.

It’s All about Spending

Judging from Kelton’s presentation, MMT boils down to a description of how the fiat currency system works under a central bank. Kelton explains:

MMT provides an accurate description of how a fiat currency like the US dollar or the British pound actually works. It reminds us that we are no longer on a gold standard, so finding the money to pay for the things we need is never an issue for countries like the US or the UK.

The implication of having a monetary monopoly is that the “[t]he federal government can never run out of money” (all quotes are from Kelton’s talk unless otherwise stated). This is obviously true, but only because Kelton (and MMT) does not distinguish between money in the real sense (the valued medium of exchange, i.e., purchasing power) and the currency issued by government and banks (the dollars or pounds, whether physical or digital). But that’s not always true. For example, the government of Venezuela was not running out of bolívars, but from this it did not follow that the currency would retain its purchasing power (as, obviously, it didn’t) or even retain its status as money (which it also didn’t). Venezuela is one recent example, but the claim is universal. (For more examples, see Zimbabwe/Zimbabwean dollar or the Weimar Republic/papiermark.)

So, in a strict sense, it is certainly true that the federal government “can afford to buy whatever is available or for sale in its own currency.” However, while proponents of MMT often emphasize and extrapolate from the word “afford” to make it appear as if there were no end to government spending, it is really “for sale in its own currency” that is key. This means there is indeed a limitation. Kelton realizes this but fails to mention it until the very end. Her point here is to delink government spending and taxation:

If you got a $1,400 check from the federal government earlier this year, or if your company received money to help cover payroll and other expenses, then you received some of the newly minted digital dollars that were created to support our economy. No taxpayers were involved in that process. It was all done using nothing more than a computer keyboard.

This too is not false; it only tells one side of the story. The point Kelton is making is that government need not worry about deficits, because they are paid in the government’s own currency. Yes, we have heard this before; it is nothing new. The problem is that it is based on a fundamental mistake: confusing the unit for its meaning to users or, if you will, thinking a currency is money. By talking about one, and the creation of more of it, yet referring to the other, thus assuming it remains largely unaffected, Kelton can state the following about deficits:

Here’s what I see. I see what’s happening on the other side of the government’s ledger. When the government spends more than it taxes away from us, it makes a financial contribution to some other part of the economy. Their red ink is our black ink.

Yes, you read it correctly: when government runs a deficit it is a contribution to society. Government creates new money for which it purchases infrastructure, teacher salaries, electric vehicles, etc. Thus, private businesses get the new money as revenue—they (presumably) earn a profit—while the government provides society with needed services. The result is, if we believe Kelton, more jobs and income for people while they get more services from government. We get something for nothing.

What about Price Inflation?

With deficits being a nonissue, the political problem is not to balance budgets. After all, according to MMT logic, a balanced budget would deprive society of the benefits that the deficits offer. Instead, policymakers have a moral duty to maximize the “contribution” to society as long as doing so does not have negative consequences for society. As Kelton puts it,

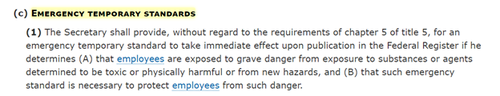

Congress should be focused on keeping inflation in check. That’s the real limit on spending, and it’s the thing to watch out for if you’re thinking of spending trillions on things like infrastructure, healthcare, and free college.

This is basically the same scheme as monetarists argue for, that the money supply should be increased to lubricate and support the growing economy—but not so much that it affects the price level. MMT takes this idea and greatly inflates it (pun intended) by adding that government deficits are not harmful—they are instead, if used wisely, a double benefit. As long as the price level remains largely unchanged (or, I presume, price inflation is kept at a “low” level, such as “only” 2 percent per annum), more can be squeezed out of the economy.

Government can and should do this to the extent possible, but the deficits also offer a means for reform, if not restructuring of whole economy, that should not be wasted.

[E]very deficit is good for someone. The question is, for whom? And what are those deficits used to accomplish? It matters how the money is spent and who ends up with the resulting surplus.

Indeed, money is not neutral, so it benefits whoever happens to receive it. This is another MMT twist that they use to their advantage. The argument does not rely on increasing the money supply helicopter-money style, so they need not assume it has no effect on the structure of the economy. On the contrary, MMT argues that the money should be used by government on specific investments—typically infrastructure, healthcare, schools. Because the money is spent on those things, businesses will be incentivized to create supply that facilitates those investments. As a result, the economy is force nudged to do the “right” things. (We are at this point deep into normative territory, i.e., ideology; there is no semblance of positive theory left.)

What about the Economy?

So far, the MMT story does not seem to relate at all to the real economy. It is pure magic: more currency means more jobs, greater government services, a higher standard of living. Does this mean MMT simply ignores the fact that the actual economy is a matter of allocating scarce resources toward valuable ends? Not quite. It only greatly downplays this fact by ignoring much of the implications.

Kelton refers to the problem of Congress’s directing the “contribution” of deficits as resourcing. Here comes the real economy:

Congress should be asking, how will we resource it? To answer that question, think of people, factories, equipment, and raw materials like wood and iron. If we’re going to build high-speed rail, fix crumbling infrastructure, and green our economy, then we’ll need concrete, steel, and lumber; we’ll need construction workers, architects, and engineers; we’ll need companies that can fill thousands of orders for solar panels, EV charging stations, and electric school busses. If our economy has the productive capacity to quickly supply all of those things, then we can easily resource it. Or take healthcare or free college. Paying the bills to expand Medicare to include dental, vision, and hearing is easy. The challenge is making sure we have enough dentists, optometrists, and audiologists to treat everyone who needs care. And if you want to resource free college, then you need the faculty, the classrooms, the dormitories to teach and house more students. In a full employment economy, all of the resources you need are, well, fully employed. There is no spare capacity anywhere in the system.

So, finally, we get to the real issue and the reason why proponents of MMT believe they can get something for nothing: there are idle resources, assets that are not currently used in production processes. Because those resources are not productive, government’s deficit investments will incentivize those sitting on the resources, whether individuals or businesses (or government agencies?), to surrender them to the productive efforts so that society can make productive use of them.

But this poses several problems that those arguing for MMT seem unaware of. First, that idle resources are not actually just sitting there, but are idle for a reason. They are idle because this is what their owners consider to be their highest-valued use. It is a mistake to assume that an asset that is not right at this moment used in some production process is not part of a greater production plan. In fact, most production includes some degree of waiting, maturing, or search for the proper timing.

Consider a newly distilled whiskey that sits “idle” in a cask for a decade. This is not waste, but part of the production process of ten-year-old whiskey, which is a different good with much greater expected value to consumers. Production takes time, which means we cannot at any specific moment determine what would be the best use of resources. This includes resources that do not appear to be used at all but are in fact owned and therefore directed toward some end. Timing is an important aspect of production that proponents of MMT, in their urgency to maximize only the present, fail to realize. Much entrepreneurship fails not because there is no value in what they offer but because the timing is not right—they are either too early or too late.

It is also true that we want resources to be held in reserve for future uses. If we use everything to 100 percent in the present, there is no possibility of attempting new and more valuable productions. After all, government investments in infrastructure (or anything on the MMT wish list, for that matter) are not an effective way to generate innovations. Valuable innovations are created by entrepreneurs seeking new ways to satisfy consumers and thereby earn profits. MMT’s shifting of resources toward public works means we may not get the solutions to those grand challenges that we have no solutions for today. The quest to maximize the present, whether or not it turns out successful (and it likely will not), sacrifices both the near and distant future.

Joseph Schumpeter put this clearly in Capitalism, Socialism and Democracy (p. 83):

[W]e are dealing with a process whose every element takes considerable time in revealing its true features and ultimate effects, [so] there is no point in appraising the performance of that process ex visu of a given point of time; we must judge its performance over time, as it unfolds through decades or centuries. A system—any system, economic or other—that at every given point of time fully utilizes its possibilities to the best advantage may yet in the long run be inferior to a system that does so at no given point of time, because the latter’s failure to do so may be a condition for the level or speed of long run performance.

I doubt Schumpeter’s genius will sway any proponent of MMT, however. To them, nobody is alive beyond the immediate present.

It Is Not about the Economy, but about Glorious Government

Kelton’s argument comes down to believing that whatever government does is right. Yes, she argues that it is important that the deficits end up in the “right” hands, but simply notes that this is the real task for Congress. Okay, but what if politicians do not invest in the “right” things? Or what if those things are right for some but wrong for others? Kelton doesn’t say, but I suppose she would refer to some vague notion of public good or what society “needs.” But this question cannot be avoided, because it strikes at the core of MMT’s failure.

The whole argument, as Kelton presents it, asserts that government needs to get idle resources into production. Whatever the reason they currently appear idle to Kelton and others is of no concern: government, they assume, will put those resources to better use. True to form, proponents of MMT tend to focus on only idle resources, which makes a cleaner point. But they overlook that changing the incentives will also shift resources from already productive uses to those productions that are on the MMT wish list.

What they are really saying here is that entrepreneurs, investing their own property for the chance of earning profits, but at the risk of losing everything if consumers dislike their offering, overall do a worse job allocating productive resources than politicians investing deficits that need not be paid off. This is a very problematic assumption. Just noting the different incentives for entrepreneurs and politicians is enough to fundamentally question what MMT proposes.

Add to this that government’s track record in creating public goods that are of actual value to people and that do not waste resources is nothing short of dismal. Then add the public choice aspect to the whole thing, that politicians have their own interests and therefore may not pursue the public good even if they know it. The assumption that government will fix the economy and increase our standard of living beyond what entrepreneurs can do is unbearably naïve.

I do not think these problems matter much to proponents of MMT, however. Because it is not a theory of how the economy works and so does not concern itself with worldly things like production, innovation, entrepreneurship, scarcity (other than as potentially causing inflation), or time. It is a pseudoreligious conviction that anything is possible and that the one and only solution is always Glorious Government.