Internal Study Finds 32% Of Teen Girls Say “Instagram Makes Me Feel Bad About My Body”

When it comes to the spreading “FOMO” and feelings of insecurity and jealousy among younger Americans – especially teenagers – Instagram is perhaps the worst offender in the entire social-media ecosystem.

And that assessment isn’t coming from a third party, but from Facebook’s own internal research (Facebook bought Instagram back in 2012) which was leaked to a team of WSJ reporters, who on Tuesday published the first of what they say will be a series of deep dives on Instagram and Facebook’s impact on teen mental health, the political discourse and human trafficking.

Facebook’s reasoning for releasing the information to the media is pretty clear. Its motivation was perhaps best articulated by an academic at San Diego State.

When told of Facebook’s internal research, Jean Twenge, a professor of psychology at San Diego State University who has published research finding that social media is harmful for some kids, said it was a potential turning point in the discussion about how social media affects teens.

“If you believe that R.J. Reynolds should have been more truthful about the link between smoking and lung cancer, then you should probably believe that Facebook should be more upfront about links to depression among teen girls,” she said.

The subtext here is pretty clear: Unlike the tobacco companies, Facebook is trying to get out in front of the growing mental-health backlash to Instagram and other social media platforms. Unfortunately (for the teens) this suggests that the company is trying to get out in front of the problem, not fix it.

Jen Selter, Instagram’s “queen of the butt selfie”

For the past three years, Facebook has been conducting internal research into how Instagram impacts the mental health of the teens and younger users who make up an important segment of the app’s user base. Their conclusion is this: for users who don’t struggle with anxiety and depression, the app is relatively benign. But for the roughly one-third of users who do report these issues, Instagram clearly exacerbated them.

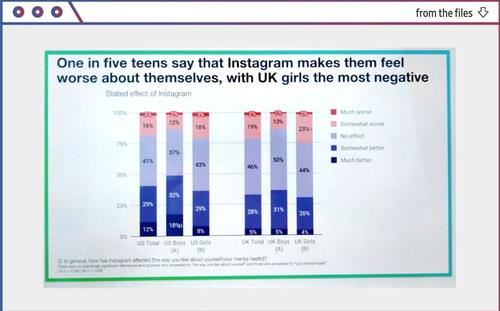

“Thirty-two percent of teen girls said that when they felt bad about their bodies, Instagram made them feel worse,” the researchers said in a March 2020 slide presentation posted to Facebook’s internal message board, reviewed by The Wall Street Journal. “Comparisons on Instagram can change how young women view and describe themselves.”

Another slide put it even more bluntly.

“We make body image issues worse for one in three teen girls,” said one slide from 2019, summarizing research about teen girls who experience the issues. “Teens blame Instagram for increases in the rate of anxiety and depression,” said another slide. “This reaction was unprompted and consistent across all groups.”

What’s more: Among teens who reported suicidal thoughts, 13% of British users and 6% of American users traced the desire to kill themselves to Instagram, one presentation showed.

At this point, some might question: why is Facebook even doing these studies considering that they’re almost guaranteed to go public? The answer is that Facebook has a lot on the line here, and so it needs to be in control of the public discourse every step of the way. One WSJ source claimed Facebook makes $100 billion in revenue a year thanks to Instagram’s popularity with the teenage demographic.

This research represents nothing less than a 180 from Facebook’s management, who curiously decided to comment on the record for the WSJ report. WSJ notes that CEO Mark Zuckerberg has insisted Instagram’s impact on teens as “positive”.

“The research that we’ve seen is that using social apps to connect with other people can have positive mental-health benefits,” CEO Mark Zuckerberg said at a congressional hearing in March 2021 when asked about children and mental health.

Instagram head Adam Mosseri has made similar statements. But speaking to WSJ before the story hit, he seems to have flip flopped.

In May, Instagram head Adam Mosseri told reporters that research he had seen suggests the app’s effects on teen well-being is likely “quite small.”

In a recent interview, Mr. Mosseri said: “In no way do I mean to diminish these issues.…Some of the issues mentioned in this story aren’t necessarily widespread, but their impact on people may be huge.”

Management’s new official line is that it was “late” to realizing the tremendous psychic damage Instagram has inflicted on a generation.

Now, what is Facebook planning to do about it?

Tyler Durden

Tue, 09/14/2021 – 17:05

via ZeroHedge News https://ift.tt/3EgUYaO Tyler Durden