These Are The Four Main Risks In The Upcoming Q3 Earnings Season

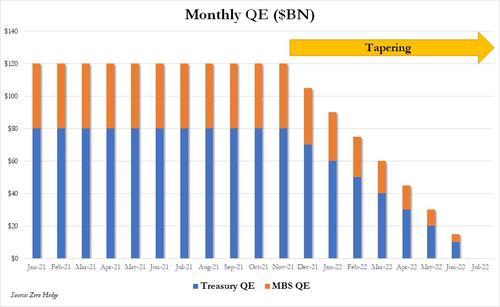

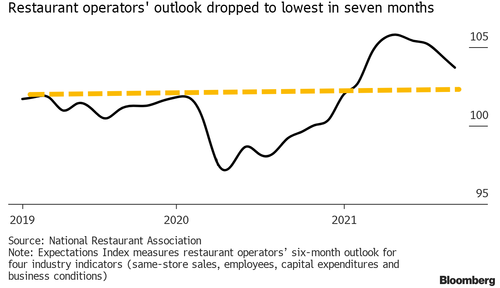

One of the major challenges facing the bull case, in addition to numerous previously discussed factors such as the Fed’s imminent tightening (save us the semantics, and just read Morgan Stanley on “Tapering is Tightening“), rapidly shrinking margins, rising interest rates and stagflation fears, China’s real estate slowdown, the global energy crisis, snarled supply chains, a potential US debt default, and the first failure of dip buying to push the S&P back to its rising trendline, is that after several quarters of record corporate earnings, equity valuations are increasingly coming under scrutiny and, as Goldman’s David Kostin writes in his latest Weekly Kickstart note, “investor focus will increasingly assess whether earnings growth can continue to lead the market higher.”

3Q earnings season kicks off when the largest Banks report during the week of Oct. 11th, 47% of S&P 500 market capitalization will report during the week of October 25th and 86% will report by November 6th.

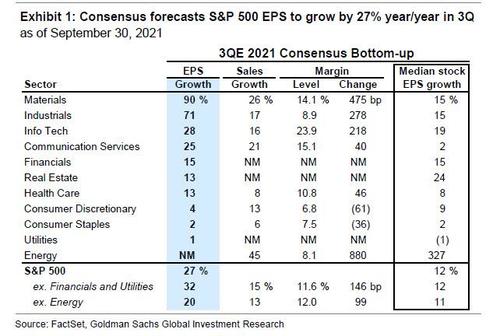

Consensus expects S&P 500 EPS growth of +27% year/year in 3Q, a sharp deceleration from the 2Q growth rate of +88%, even if EPS growth for the median stock is forecast to slow more modestly, from +38% to +12%. Bottom-up estimates imply a roughly equal contribution to EPS growth from sales and margin expansion. Excluding Financials and Utilities, S&P 500 sales are expected to rise 15% yr/yr and net profit margins are forecast to equal 11.6% (+146 bp yr/yr). However, this would bring 3Q margins below the realized level of net profit margins from 1H 2021 (12.2%). All 11 sectors are expected to report positive EPS growth in 3Q, led by Energy (from negative to positive EPS), Materials (+90%) and Industrials (+71%).

And while a generally optimistic Goldman, which recently upped its S&P price target to 4,700 believes there is upside to consensus estimates (as a reminder, the share of companies beating EPS by more than a standard deviation averaged 71%, a record high, and the average EPS beat equaled 21%, well above the long-term average of 6%), the bank does warn that the frequency and magnitude of EPS beats will moderate from 1H 2021 – as economic and earnings growth are decelerating and base comparables have become more challenging – and warns that there are four key risks to watch: (1) Supply chains, (2) oil, (3) labor costs, and (4) China growth.

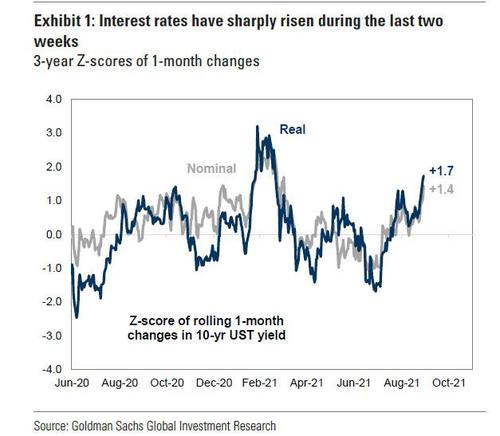

We delve deeper into these four earnings season themes below, but first we note that arguably the biggest challenge for stocks – especially high growth, ultra-high duration tech names, namely the rapid recent rise in rates which have led to a contraction in tech name valuations (the FAAMG sector is about 7% below its all time high). As Goldman recently warned (again) S&P 500 returns “have typically been below-average when rates rise by 1 standard deviation in a month and negative when rates rise by 2 standard deviations. The recent move in nominal rates was a 1.5 standard deviation event on a monthly basis, but reached the 2 standard deviation threshold on a 10-day basis.“

So going back to Goldman’s key risk factors we start with…

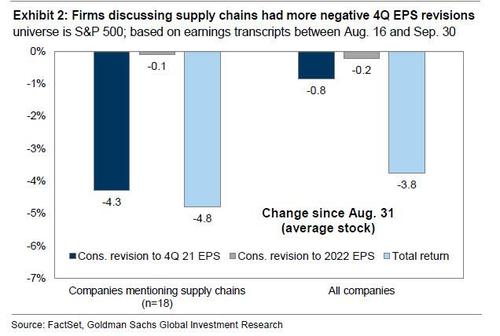

1. Supply chains.The ISM Suppliers Deliveries Index averaged 74 during the past six months (>50 indicates slower deliveries), the highest level since 1974. Of the 26 S&P 500 firms that reported results since the start of September, 18 mentioned supply chains on their earnings calls, primarily within Consumer and Industrial sectors. The average consensus revision to 4Q 2021 EPS for these firms has equaled -4%.

Goldman economists estimate that strong goods demand accounts for two-thirds of global manufacturing delays. Ironically, Goldman then writes that the strong demand backdrop and expectations that disruptions will ease is likely one reason that 2022 EPS estimates for these firms have been roughly unchanged. This is completely wrong as even the CEO of Mersk said that global demand has to ease so that supply can catch up and supply-chains can normalize; absent this we will remain in an indefinite state of stagflation. Where Goldman does get it right is that the largest firms have highlighted mechanisms including price hikes, cost controls, leveraging scale,and switching suppliers to mitigate the impact of supply chain disruptions, which however means sharply higher prices for a much longer length of time than the “transitory” argument suggests. As such, Goldman warns that “a key risk is that supply chain normalization takes longer than expected and that unmet demand today is not fully recouped in later quarters. Services industries such as Financials and Software have less EPS risk than goods-producing industries such as Industrials.”

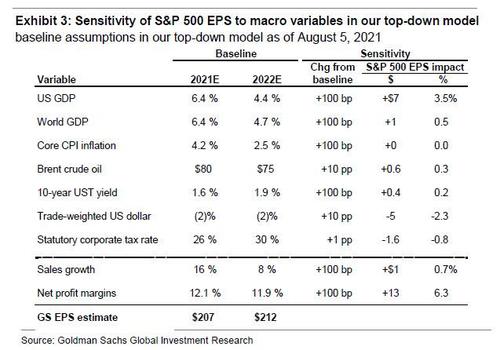

2.Oil. Brent oil prices have risen by 51% YTD and Goldman’s commodities team recently hiked its year-end forecast to $90/bbl, above their previous forecast of $80. However, contrary to expectations that these will be rapidly passed on to consumers leading to sharp gains for energy companies, Kostin says that “based on our top-down earnings model, oil prices have a roughly neutral impact on aggregate S&P 500 EPS” and calculates that every 10% increase in Brent prices boosts S&P500 EPS by just 0.3%. Furthermore, while higher oil prices are a tailwind to Energy EPS they are also a headwind to most non-Energy sectors that rely on oil as an input or are sensitive to consumer spending (higher gas prices act as yet another tax on the US consumer). Also, it is worth noting that the boost from Energy to index EPS is likely smaller today, as it represents just 4% of S&P 500 2021E EPS.

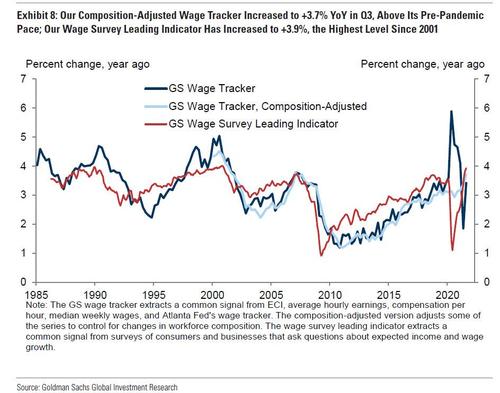

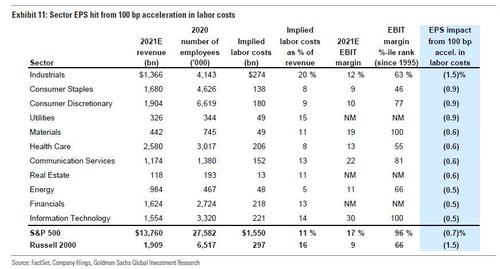

3. Labor costs. Ongoing commentary from corporations shows an acute focus on rising wages and the lack of labor supply. Goldman’s adjusted Wage Tracker sits at the highest level since 2007.

Here, however, Kostin is again quick to defuse fears that labor costs will hit margins, calculating the these represent only 13% of the median S&P 500 stock’s revenues, and historical correlations show that the large-cap index is relatively insulated from wage pressures.

Furthermore, as noted last month, Goldman’s analysis suggests a 100 bp acceleration in wage growth would reduce S&P 500 EPSby just 0.7%, all else equal.

Small-caps and the Industrials and Consumer sectors are most vulnerable to rising wages due to their high labor costs and low profit margins.

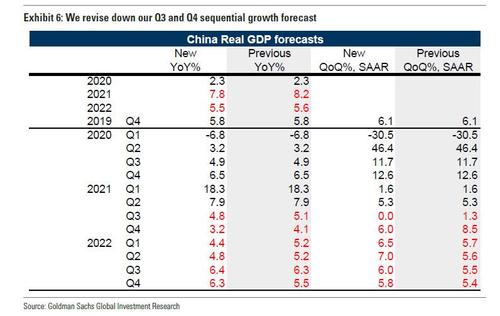

4. China growth. Goldman’s China Economics team recently lowered their Q3 growth forecasts to 0% (QoQ) amid sharp cuts to production in a range of high energy intensity industries and the property market slowdown.

And while the indirect impact on supply chains is likely a greater EPS risk than the direct effect from reduced end demand in China, Kostin says that in aggregate, the S&P 500 generates just 2% of its sales explicitly from Greater China. Indeed, the S&P 500 derives 72% of its sales in the US and US GDP growth is the most important driver of EPS, however some very high growth sectors such as semis (43% of sales in China), tech Hardware(11%), and stocks with the highest sales to China are more exposed.

The good news – according to the traditionally cheerful Goldman – is that downside risk from these four factors appears relatively contained in aggregate today, but certain stocks face more risks than others. Indeed, several early reporters beat on 3Q EPS but offered weak guidance (MKC, MU, NKE). Consistent with recent quarters, and as we predicted recently, guidance will be a clearer differentiator of stock price reactions than 3Q results during the season. As Kostin – correctly – cautions, earnings revisions typically carry a particularly strong signal for stock returns in the current backdrop of decelerating economic growth, underscoring the importance of identifying the “winners” and “losers” around these key macro risks. Readers should monitor management commentary to assess the implications of these macro factors on the S&P 500 earnings outlook.

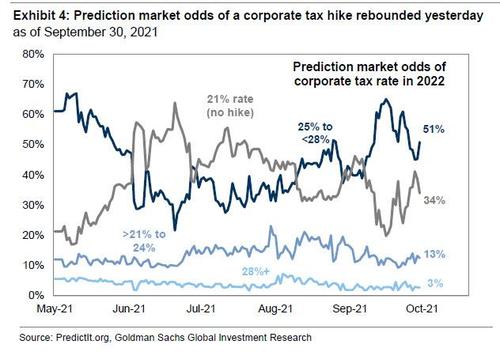

Finally, in addition to these four themes, Biden’s corporate tax hikes remain a broad-based, imminent risk to the 2022 EPS outlook. As Goldman warned previously, a change in the corporate tax code would have a direct impact on nearly all S&P 500 companies. The bank’s baseline assumption for a 25% statutory corporate tax rate and an increase in the foreign income tax rate would represent a 5% hit to 2022 S&P 500 EPS. However, thanks to growing bickering between progressive and centrist Democrats, uncertainty about whether tax reform will actually become law is high, as the House delayed a vote on the bipartisan infrastructure bill. Prediction market odds of an increase in the corporate tax currently stand at 66%.

Tyler Durden

Sun, 10/03/2021 – 20:15

via ZeroHedge News https://ift.tt/3l7WYe4 Tyler Durden