After several extremely volatile days, US equity futures are ending the week in the green (for now) with European equities snapping two days of declines sparked by the Federal Reserve’s plan for aggressive monetary-policy tightening, and Asian stocks trading higher. S&P 500 and Nasdaq 100 futures trimmed earlier gains to trade 0.3% higher as traders weighed the latest developments about the war in Ukraine. Contracts on U.S. stock benchmarks trim earlier gains as traders weigh developments about the war in Ukraine.Nasdaq 100 futures flat; S&P 500 futures +0.1%; Dow Jones futures +0.2%. The dollar rose for a 7th consecutive week and US Treasuries sold off across the curve; gold and bitcoin were flat. Oil was steady after three days of losses stoked by plans to release millions of barrels of crude from strategic reserves and China’s demand-sapping virus outbreak.

Markets had a subdued session yesterday after sinking more than 4% in the previous two days as hawkish signals from the Federal Reserve sent Treasury yields surging. Among notable premarket moves, Robinhood slid 3% after Goldman Sachs, not too long ago the lead underwriter on the company’s IPO, cut their rating on the stock to sell, saying softening retail engagement levels and profitability concerns will likely limit any outperformance. Some other notable premarket movers:

- Alcoa (AA US) is 1.2% lower as Credit Suisse analyst Curt Woodworth trims his recommendation to neutral as he views LME aluminum prices near peak levels.

- Quidel (QDEL US) gained in extended trading Thursday after it posted preliminary revenue for the first quarter that beat the average analyst estimate.

- CrowdStrike (CRWD US) advanced 4.1%. Analysts responded positively after management set a framework to reach $5 billion in annual recurring revenue (ARR) by 2026, during the cybersecurity company’s investor briefing.

- WD-40 (WDFC US) is poised to gain after producing a “solid” beat in the second quarter, Jefferies said, adding that an increased market share and new product launches would support volume growth of 3% in 2022.

- Kura Sushi (KRUS US) shares rose in postmarket trading after the restaurant chain reported a year-over-year jump in quarterly sales.

- ACM Research (ACMR US) edged lower in extended trading Thursday after saying in a release its first quarter revenue would be “significantly below” expectations, but reiterated full-year revenue guidance for 2022.

U.S. stocks are on course to snap a three-week winning streak with investors shedding risk assets following indications from the Fed of a faster-than-expected pace of tightening in monetary policy. Concerns are also growing about the impact of high inflation and slowing economic growth on corporate earnings. The two-year Treasury yield rose five basis points and the 10-year yield climbed one point, reversing some of the curve steepening seen in the wake of the Fed minutes Wednesday, which outlined plans to pare the central bank’s balance sheet by more than $1 trillion a year alongside interest-rate hikes.

Global equities are nursing losses for the week as markets grapple with the Fed’s campaign against elevated price pressures, Russia’s grinding war in Ukraine and China’s Covid travails. The lockdown in Shanghai — which recorded more than 21,000 new daily virus cases — has become one of President Xi Jinping’s biggest challenges. Expectations are growing that China will take steps to support its economy.

“Stocks have had a little bit of a harder time this week digesting the fact that interest rates are going to be higher” amid a major shift in expectations around monetary policy, Anthony Saglimbene, global market strategist at Ameriprise Financial Inc., said on Bloomberg Television.

Still, U.S. equities saw a second straight week of inflows at $1.5 billion, with large-cap and growth stocks outperforming small-cap and value sectors, according to Bank of America strategists. Marija Veitmane, a senior strategist at State Street Global Markets, also said stocks still appeared to be the safest option.

“Cash gives you nothing with 7% inflation, bonds just had one of the worse quarters in history, and then if you look at stocks, we still have decent earnings outlook, and to me the biggest attraction is really strong balance sheets,” she said on Bloomberg TV.

In the latest news out of Ukraine, dozens were killed Friday morning as Russian troops allegedly bombed civilians waiting at a train station to be evacuated from the Donetsk region. Meanwhile, U.S. officials warned that the war may last for weeks, months or even years, as Kyiv’s foreign minister pleaded for urgent military assistance. Here are the latest Ukraine war developments:

- Ukraine intends to establish up to 10 humanitarian corridors on Friday, those leaving Mariupol will need to use private vehicles.

- Ukrainian advisor Podolyak says negotiations with Russia continue online constantly, but the mood changed after Bucha events, via Reuters.

- Kremlin says it does not understand EU concerns about European countries paying for Russian gas in RUB, adds Commission President von der Leyen probably needs more information. On planned EU ban of Russian coal, says coal is in high demand. Special operation in Ukraine could be completed in the foreseeable future, given aims are being achieved and work is being carried out by peace negotiators and the military.

- EU ready to release EUR 500mln for arms to Ukraine, according to AFP citing EU chief.

- Russia says it has destroyed a training centre for foreign mercenaries within Ukraine, was located north of Odesa, via Tass.

- Japan’s Industry Ministry plans to reduce Russian coal imports gradually while looking for alternative suppliers, according to Reuters.

- Ukraine PM says they have large stocks of grain, cereals and vegetable oil. Are able to provide themselves with food; this year’s harvest will be 20% less YY.

- Ukraine gas grid warns that Russian actions could impact gas flows to Europe, via Reuters.

On Thursday, St Louis Fed president James Bullard said he prefers boosting the policy rate to 3%-3.25% in the second half of 2022. Chicago Fed President Charles Evans and his Atlanta counterpart Raphael Bostic said they favor raising rates to neutral while monitoring the economy’s performance. The steepening in the Treasury yield curve contrasts with the flattening and inversions that have vexed markets this year. The two-year rate topped the 10-year last week for the first time since 2019, a possible warning of recession.

“We’re seeing a tactical re-steepening right now but the curve is going to continue to flatten,” Kelsey Berro, fixed income portfolio manager at JPMorgan Asset Management, said on Bloomberg Television. “That’s because the Fed has told us, we’d like to get to neutral expeditiously. On top of that, they may need to tighten beyond neutral. Front-end yields can still go higher.”

In Europe, Euro Stoxx 50 rallies over 1.8% before stalling while the Stoxx 600 index climbed 1.2% but drifted off best levels as investors took advantage of beaten-down stock valuations with energy, banks and autos the strongest-performing sectors. Banks outperformed as Banco BPM SpA surged after Credit Agricole SA bought a 9.2% stake in the Italian lender. An Asia-Pacific share index eked out a small increase. Here are some of the biggest European movers today:

- Scout24 shares rise as much as 17%, the most intraday since December 2018, after a report that Hellman & Friedman, EQT and Permira have discussed taking the firm private.

- Banco BPM shares rise as much as 17% after Credit Agricole bought a 9.2% stake in the Italian lender, with Bank of America saying the deal is a reminder that real value should be based on fundamentals.

- Sodexo shares jump as much as 7.4%, their biggest single-day gain in a month, after RBC Capital Markets upgrades the French caterer to outperform from sector perform.

- K+S gains as much as 10% after JPMorgan double-upgraded the shares to overweight from underweight, seeing a very positive environment for fertilizers amid supply disruptions and high energy prices.

- Atlantia shares rise as much as 4.5% following a report in a Italian newspaper that the Benetton family and Blackstone may start their takeover offer for Atlantia at more than EU22 per share.

- Saab rise as much as 5% as SEB upgrades the shares to buy from hold on the Swedish defense firm’s sales potential in the coming decade in the wake of Russia’s invasion of Ukraine.

- Moncler shares rise as much as 4.2% after Barclays upgrades the Italian luxury company to overweight, citing an “attractive” defensive profile in the current environment.

- Genmab fall as much as 10%, the most since September 2020, after saying a tribunal decided in favor of Janssen Biotech over two issues surrounding the cancer drug daratumumab (Darzalex).

Ahead of this weekend’s French election, Macron’s lead is shrinking: the current President led his rivals in the April 10 election with 26.2% support, down from 27.2% a day earlier, according to a polling average calculated by Bloomberg on April 8. Macron was 3.5 percentage points ahead of second-placed Marine Le Pen, down from 4.1 points.

Asian stocks edged higher on Friday, poised to snap three days of declines as traders assessed the prospect of policy easing by Beijing. The MSCI Asia Pacific Index erased early losses of as much as 0.4% to climb 0.2%. Chinese property and infrastructure-related stocks surged on hopes for fiscal as well as monetary easing as the government seeks to prop up growth. For the week, the Asian benchmark was down 2% as investors turned cautious on risk assets after latest comments from the Federal Reserve suggested aggressive tightening lies ahead. Tech shares were hit hard in particular, with the MSCI Asia-Pacific Information Technology Index losing 4% this week, on track for its worst performance since end-January.

“There appears to be speculation that monetary easing by the PBOC might be imminent,” said Kazutaka Kubo, senior economist at Okasan Securities. There are also expectations that once lockdowns are over, the economy could be supported by pent-up demand, he added. Chinese authorities have repeatedly vowed to support the economy and markets in thet past few weeks, as rising Covid-19 infections and lockdowns darken the outlook for growth. The pledges have spurred bets that some form of monetary easing may come soon. Movements in most national benchmarks in the region were modest on Friday, gaining less than 1%. Stocks in the Philippines and Indonesia outperformed, while Singapore shares fell.

Indian stocks gained after the Reserve Bank of India kept borrowing costs at a record low, even as it raised its inflation forecast on the back of rising commodity prices. The central bank also announced the start of policy normalization as the pandemic’s impact fades. The S&P BSE Sensex climbed 0.7% to 59,447.18 in Mumbai to complete a second week of gains, while the NSE Nifty 50 Index rose 0.8%. Gauges of small- and mid-sized companies gained 1% and 0.9%, respectively. The Reserve Bank of India’s monetary policy panel held the benchmark rate at 4%, in line with predictions of all 36 economists surveyed by Bloomberg. RBI Governor Shaktikanta Das said the central bank will start focusing on withdrawal of banking liquidity accommodation to target inflation but such a move would be “multi-year” and carried out without disrupting the markets.

“Equity markets will like the RBI’s continued focus on growth and its commitment to an accommodative stance,” said Abhay Agarwal, a fund manager at Mumbai-based Piper Serica Advisors Pvt. The RBI’s commentary means adequate flow of liquidity will continue and immediate beneficiaries will be consumers who are borrowing to purchase real estate and autos, he added. All but one of 19 sectoral sub-indexes compiled by BSE Ltd. advanced, led by a gauge of power companies. Reliance Industries Ltd. was a key gainer on the Sensex, which saw 22 of its 30 components advance. The RBI has comforted markets by refraining from being aggressive, unlike its global peers, and by ensuring that the liquidity withdrawal will be gradual, Yesha Shah, head of equity research at Samco Securities wrote in a note. “On the growth front, one can assume that the central bank expects private investment to ramp up now that capacity utilization has improved further,” she said, adding the policy lays the framework for a possible rate increase in coming reviews.

Australian stocks advanced – the S&P/ASX 200 index rose 0.5% to close at 7,478.00 – supported by materials and industrial stocks. GrainCorp shares surged to a record high, after the firm upgraded its FY22 earnings guidance as high levels of rain in Australia lay a path for a bumper crop. Platinum Asset plunged to an all-time low after the company reported net outflows of A$222 million in March. In New Zealand, the S&P/NZX 50 index was little changed at 12,066.27.

In rates, Treasuries fell across the curve, with the front-end of the Treasuries curve pressured lower, flattening 2s10s spread by ~5bp as 2-year yields trade more than 7bp cheaper on the day at ~2.54%. S&P 500 futures near top of Thursday’s range, following bigger advance for European stocks after three straight declines. Yields across long-end of the curve are little changed on the day, as flattening extends out to 5s30s spread which is tighter by ~4bp; 10-year yields around 2.683%, cheaper by 2.5bp vs Thursday close; bunds and gilts outperform by 1bp-2bp in the sector. Bunds reversed opening gains, adding to a three-day run of declines; French debt underperformed bunds ahead of presidential elections beginning Sunday. The German curve bull-flattens, richening 2bps across the back end. Peripheral spreads widen to core with Italy underperforming.

In FX, Bloomberg dollar index advanced a seventh consecutive day and neared the strongest level since July 2020 as the greenback advanced against all of its Group-of-10 peers apart from the Norwegian krone. The euro pared losses after touching a one-month low against the dollar in early London trading. The pound fell to the lowest in more than three weeks as bets for aggressive policy tightening by the Federal Reserve boost the dollar. Gilts rose across the curve as U.S. Treasury yields stabilized following the recent selloff. The Australian and New Zealand dollars were the worst-performing G-10 currencies; Australia’s yield curve steepened following a similar move in Treasuries on Thursday. Most Japanese government bonds rose, thanks to support from the central bank’s regular purchase operations. The yen briefly reversed early an Asia session loss after an ex-BOJ official said there’s likelihood of a policy shift as soon as this summer.

Bitcoin is contained and unable to derive traction either way from the broader risk tone. Strike payment platform launches Shopify (SHOP) integration, which allows merchants to accept Bitcoin (BTC), according to Bloomberg.

In commodities, crude futures trade within Thursday’s range; WTI holds above $96, Brent stalls near $102. Spot gold holds steady near $1,930/oz. Most base metals trade well: LME zinc and lead outperforming, tin lags.

To the day ahead now. Central bank speakers include the ECB’s de Cos, Centeno, Panetta, Stournaras, Makhlouf and Herodotou. Italian retail sales for February and Canadian employment for March round out this week’s data.

Market Snapshot

- S&P 500 futures up 0.5% to 4,517.00

- STOXX Europe 600 up 1.4% to 461.27

- MXAP up 0.2% to 176.33

- MXAPJ up 0.3% to 584.66

- Nikkei up 0.4% to 26,985.80

- Topix up 0.2% to 1,896.79

- Hang Seng Index up 0.3% to 21,872.01

- Shanghai Composite up 0.5% to 3,251.85

- Sensex up 0.9% to 59,558.63

- Australia S&P/ASX 200 up 0.5% to 7,477.99

- Kospi up 0.2% to 2,700.39

- Brent Futures up 1.2% to $101.76/bbl

- Gold spot down 0.0% to $1,931.38

- U.S. Dollar Index up 0.14% to 99.89

- German 10Y yield little changed at 0.68%

- Euro down 0.1% to $1.0865

Top Overnight News from Bloomberg

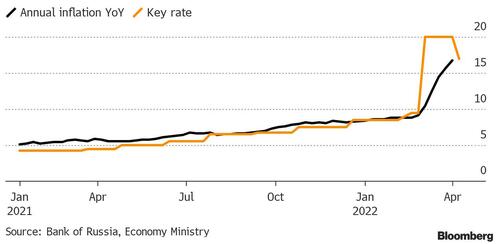

- The Bank of Russia delivered a surprise cut in its key interest rate Friday, reversing some of the steep increase it made after the invasion of Ukraine as the ruble recovered. The central bank lowered the rate to 17% from 20% and said further cuts could be made at upcoming meetings if conditions permit

- EU countries agreed to ban coal imports from Russia, the first time the bloc’s sanctions have targeted Moscow’s crucial energy revenues. Japan is also looking to curb imports, in what could be a shift in policy from one of the world’s largest energy buyers

- The EU is aiming to lock in progress on trade and technology disputes with the U.S. during President Joe Biden’s first term amid concerns that any gains could otherwise be easily reversed

- The relationship between Australia’s equities and currency has become the closest in a decade as commodity prices surge. The 180-day correlation between the country’s stock benchmark and the Australian dollar has climbed to the highest level since late 2011, according to data compiled by Bloomberg. The strengthened ties come as rallies in materials from oil to iron ore have boosted both the nation’s equities and the Aussie

- The ECB will look past threats to economic growth from the war in Ukraine, ending asset purchases in the summer and setting the stage for a first interest-rate increase in more than a decade in December, according to a survey of economists

- Junk bond sales across Europe are experiencing their longest drought in more than 10 years, as the Russian invasion of Ukraine and the prospect of rising interest rates neuter risk appetite

A more detailed look at global markets courtesy of Newsquawk:

Asia-Pacific stocks were choppy and eventually conformed to a mixed picture; some weakness was seen shortly after the Chinese cash open. ASX 200 bucked the trend and was propped up by its energy and gold names. Nikkei 225 was choppy and moved in tandem with action in USD/JPY whilst the KOSPI was weighed on by its chip and telecoms sectors. Hang Seng remained pressured by losses across its large constituents – Alibaba and JD.com. Shanghai Comp swung between gains and losses but overall remained supported by reports from China’s Securities Journal which noted of a potential PBoC RRR in Q2.

Top Asian News

- Hong Kong Tycoons Heed China, Endorse John Lee to lead City

- Chinese Tech Stocks Fall as Tencent Shuts Game Streaming Site

- Abu Dhabi’s IHC Invests $2 Billion in Billionaire Adani’s Empire

- ADDX Rolls Out Private Market Services for Wealth Managers

European bourses are firmer across the board, Euro Stoxx 50 +1.5%, bouncing in a morning of quiet newsflow with the broader tone modestly risk-on. Albeit, benchmarks are still negative on the week and some way from earlier WTD peaks; unsurprisingly, sectors are all in the green with defensive-bias names lagging. Stateside, futures are similarly in the green, ES +0.2%, though magnitudes are more contained ahead of a limited US schedule to round off the week.

Top European News

- U.S. Sanctions Russian Miner Producing 30% of World’s Diamonds

- Atlantia Gains After Reports of Offer Price Above EU22/Share

- Generali CEO Says He Won’t Change Plan Challenged by Investors

- Baader Downgrades Six Chemical Firms, Citing Ukraine War

In FX:

- DXY touches 100.000 as US Treasury yields continue to soar and curve steepen, but unable to break barrier.

- Kiwi underperforms awaiting NZIER Q1 survey, while Aussie holds up better after hawkish warning in RBA FSR; NZD/USD around 0.6950, AUD/USD nearer 0.7460.

- Yen sub-124.00 as Japanese export supply is absorbed, Euro supported by bids circa 1.0850 and Sterling treading water above 1.3000.

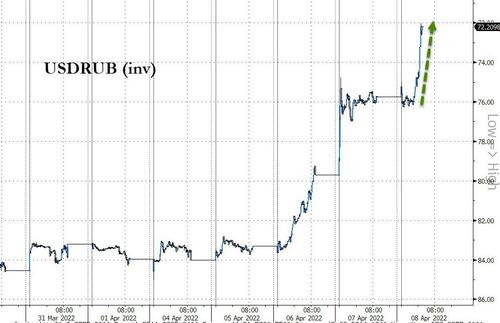

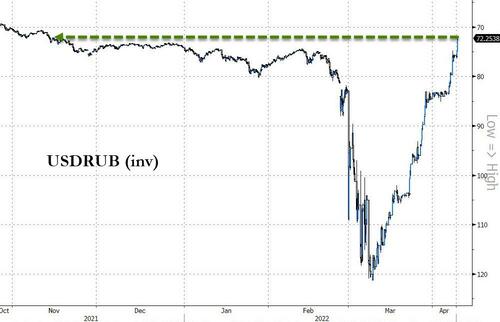

- Rouble relatively resilient in the face of 300 bp CBR rate reduction as it remains above pre-conflict highs.

Fixed income:

- Choppy trade in bonds approaching the end of another very bearish week.

- Bunds and Gilts nurse losses mostly above par around 157.00 and 120.00 handles vs fresh cycle lows of 156.40 and 119.83.

- US Treasuries most seeing red, but curve less steep in correction after hawkish FOMC minutes and Fed commentary, via Brainard and Bullard especially

Central Banks:

- RBA Financial Stability Review: important that borrowers are prepared for an increase interest rates; global asset markets are vulnerable to larger-than-expected rate increases, via Reuters.

- RBI leave rates unchanged as expected, retains “accommodative” stance as expected; will focus on withdrawing accommodation going forward. RBI is to restore LAF corridor to 50bps and floor to be constituted by SDF, according to Reuters.

- CBRT April survey sees Turkish End-Year CPI at 46.44% (prev. 40.47%)

- CNB Minutes (March): Dedek and Michl voted in the minority for stable rates. Board assessed risks and uncertainties of winter forecast as being markedly inflationary, particularly in short-term

- CBR cuts its Key Rate to 17.00% (prev. 20.00%) as of April 11th; holds open the prospect of further key rate reduction at its upcoming meetings.

In commodities, WTI and Brent are bolstered amid broader sentiment, though crude/geopolitical specific developments have been limited In-fitting with equities, the benchmarks are negative on the week and some way shy of best levels as such. New York will suspend the state gas tax from June 1st to December 31st, according to Reuters. Barclays raises oil forecasts by USD 7-8/bb assuming no material disruption in Russian supplies beyond Q2 2022, according to Reuters. Spot gold is marginally firmer, but, remains drawn to USD 1930/oz after marginally eclipsing the level overnight; base metals bid in-line with sentiment.

US Event Calendar

- 10:00: Feb. Wholesale Trade Sales MoM, est. 0.8%, prior 4.0%

- 10:00: Feb. Wholesale Inventories MoM, est. 2.1%, prior 2.1%

DB’s Henry Allen concludes the overnight wrap

Yesterday’s ECB minutes reinforced what we learned from the March FOMC minutes and soon-to-be Vice Chair Brainard earlier this week – there are no doves in fox holes – by casting doubt on the likelihood of inflation returning to target this year. We also heard from St. Louis Fed President Bullard, the hawk leading the charge, who called for a fed funds rates above 3% this year. That would beckon a faster pace of hikes along with more aggregate tightening. Regional Presidents Bostic and Evans, non-voters each, meanwhile, want to get rates to neutral. The tighter path of global policy continued to drive sovereign yields higher and equity indices lower.

Market-implied ECB policy rates by the end of the year increased +6.0bps to +62.3bps, the highest level this cycle. Sovereign yields rose to multi-year highs of their own, with those on 10yr bund (+3.4bps), OATs (+4.4bps) and BTPs (+3.5bps) moving higher, with 10yr breakevens falling in Germany (-1.9bps) and France (-0.7bps) for the first time in five days, while Italian breakevens were essentially flat (+0.2bps).

Meanwhile, fed funds futures by end-2022 staged a slight retreat, falling -1.2bps to 2.50%, albeit +10bps higher than a week ago. While the probability of a +50bp hike in May remained steady at 85.4%. 2yr yields fell in line, declining -1.2bps, while 10yr Treasuries gained +6.0bps, leaving the curve at +19.2bps. If you’re up on the yield curve discourse, you’ll know the Fed discounts the signal coming from 2s10s, instead preferring shorter-dated measures of the yield curve, which wound up flattening yesterday.

Yesterday’s yield curve steepening should not be viewed in a vacuum. The 2s10s curve has taken a 58.3bp round trip over the last two weeks, falling from +23.1bps two weeks ago, to -8.0bps last Friday, to +19.2bps at yesterday’s close. The fundamental outlook hasn’t changed dramatically over that time span. Instead, this likely reflects the elevated rates volatility environment we currently sit in. This, all before QT has even begun. Real Treasury yields continue to march higher in the back end, with 10yr real yields gaining +5.3bps to -0.19%, their highest level since March 2020, having gained +25.1bps this week alone, and +91.3bps YTD.

Despite higher rates and more restrictive language, the S&P 500 ended the day +0.43% higher, after losing -2.21% the previous two sessions. The S&P 500 is now -5.58% YTD following the massive repricing of Fed expectations, while the Bloomberg Financial Conditions index is just a hair tighter than the post-2010 average. Monetary policy may need to adjust tighter yet to engineer the demand slowdown commensurate with a return of inflation to target.

European equities were modestly lower, with the STOXX 600 slipping -0.21% and the DAX down -0.52%. The CAC (-0.57%) underperformed the STOXX 600 for the seventh consecutive session, on the back of growing Presidential election jitters. Polls between President Macron and his closest rival, Marine Le Pen, tightened. In particular, one poll (caveat emptor) from Atlas actually put Le Pen marginally ahead of Macron in a head-to-head runoff for the first time, by 50.5%-49.5%. The news immediately saw the French 10yr spread over bund yields widen in response, ending the day at 54.2bps, its widest since March 2020.

While one poll a race does not make, it’s worth noting the broader poll narrowing over the last month. That has seen Macron’s lead in the first round over Le Pen go from 30%-17% a month ago (according to Politico’s average), to just 27%-22% now. In the second round, polls are likewise pointing to a tight contest, with Macron ahead of Le Pen by 52-48% (Ifop) and 53%-47% (Ipsos). For those looking for more details on the presidential race, DB’s Marc de-Muizon put out a guide yesterday (link here), where he looks at the current state of play in the election, the main aspects of both Macron and Le Pen’s programmes, as well as some potential challenges for both candidates.

Back to the US, in a rare show of bi-partisanship, the Senate voted 100-0 to discontinue normal trade relations with Russia and Belarus and to ban Russian oil imports. Brent crude prices fell below $100/bbl for the first time since mid-March intraday, ultimately falling -0.48% to close at $100.58/bbl. The EU also moved to include a Russian coal embargo in its fifth round of sanctions. The opprobrium was global, with the UN General Assembly voting to suspend Russia from the Human Rights Council following its human rights violations, the first such suspension since Libya in 2011. On the ground, the Kremlin admitted to enduring heavy troop losses, and while the locus of the war still seems set to shift eastward, Ukrainian commanders have their guard up for a renewed assault on Kyiv.

Elsewhere, Judge Ketanji Brown Jackson was confirmed to the Supreme Court. It’s expected the Senate will now turn to approving President Biden’s nominations for the Fed Board of Governors later this month, which will still have one empty seat following Sarah Bloom Raskin withdrawing her nomination.

Asian equity markets this morning aren’t matching Wall Street’s resilience from yesterday. The Hang Seng (-0.57%) is leading the moves lower with the Nikkei (-0.08%), Kospi (-0.10%), Shanghai Composite (-0.06%) and CSI (-0.10%) all slightly on the wrong foot. Along with tighter global monetary policy, China’s Covid outbreak is worsening and dragging on sentiment. US stock futures are unperturbed, with S&P 500 and Nasdaq futures virtually unchanged. Meanwhile, the aforementioned rates volatility continues to rear its head, with the curve snapping back flatter as we go to press, with 2yr Treasuries +4.2bps higher and the 10yr a bit softer at -0.5bps. Oil prices are extending their decline this morning with Brent futures (-0.74%) sliding below $100/bbl.

On the data side, Japan’s current account swung back to surplus in February to +¥1.6 trillion, following a -¥1.2 trillion deficit in January – the second-biggest deficit on record. The main release yesterday came from the US weekly initial jobless claims, which fell to their lowest level since 1968, with just 166k initial claims in the week through April 2 (vs. 200k expected). In addition, the previous week was revised down to 171k from 202k, which left the smoother 4-week moving average at 170k, the lowest ever in the entire data series going back to 1967. Euro Area retail sales grew by +0.3% in February (vs. +0.5% expected), and German industrial production grew by +0.2% that same month, in line with expectations.

To the day ahead now. Central bank speakers include the ECB’s de Cos, Centeno, Panetta, Stournaras, Makhlouf and Herodotou. Italian retail sales for February and Canadian employment for March round out this week’s data.