U.S. index futures edged higher, along with European shares, after the sharpest two-day drop in almost a month, as investors digested Federal Reserve’s hawkish path and were jerked higher by a fleeting moment of Ukraine ceasefire hope when Emini futures initially spiked to session highs on the following Reuters headline:

- RUSSIAN FOREIGN MINISTER SAYS UKRAINE PRESENTED A NEW DRAFT AGREEMENT TO RUSSIA ON WEDNESDAY – IFX

… only to reverse the entire move two minutes later when the following headline hit:

- LAVROV: UKRAINE PROPOSALS ON CRIMEA, DONBAS UNACCEPTABLE: IFX

Mini hiccup aside, S&P futures were about 0.1% higher at 4,481 while Nasdaq futures gained 0.5% to 14,574, signaling an end to a selloff in the underlying index that erased $850 billion in market value over two days. Ten-year Treasury yields were flat around 2.61%, the dollar extended its rally to a sixth day, the longest streak in almost 10 months, and oil rebounded from yestereday’s IEA reserve release-driven plunge.

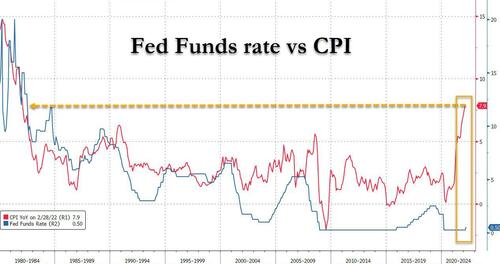

Markets are showing signs of recovery after a selloff brought on by hawkish Fed minutes in which the central bank laid out a long-awaited plan to shrink their balance sheet by about $95BN per month or more than $1 trillion a year while raising interest rates “expeditiously” to counter the hottest inflation in four decades.

“The FOMC minutes gave the clarity that every investors was looking for,” said Ipek Ozkardeskaya, senior analyst at Swissquote. “The US 2-10 year spread is back in the positive after having slipped below zero, but the recession threat is real, keeping the investor mood sour as the Fed pulls back support.”

“The Fed delivered what most market watchers were looking for, with details around the pace and composition of the balance sheet runoff,” said Janus Henderson global bond PM Jason England. Along with recent hawkish comments from Fed officials, the minutes showed “the Fed has pivoted from a gradual approach to tightening monetary policy to now moving more rapidly toward a neutral stance,” he said.

In premarket trading, HP shares were up 13% after Warren Buffett’s Berkshire Hathaway bought an 11% stake worth $4.2 billion in the laptop maker valued at more than $4.2 billion. SoFi shares declined 5.1% in premarket after the fintech firm gave new guidance as the U.S. government extended the pause on student-loan payments. Other notable premarket overs include:

- Levi Strauss & Co. (LEVI US) gains 5.5% in premarket trading after it said revenue during the most recent quarter increased 22% to $1.6 billion. Wells Fargo said comments about a strong first quarter and good momentum in March should help dispel investor concerns, at least in the near term.

- Wayfair (W US) falls 4.4% in premarket trading after Wells Fargo downgrades to underweight from equal weight in sector note turning more cautious on housing-impacted retailers.

- SoFi (SOFI US) drops 5.1% in premarket trading as Morgan Stanley cuts its 2022 Ebitda estimate by $42m to $100m after the fintech firm gave new guidance as the U.S. government extended the pause on student-loan payments.

- Sprinklr’s fourth- quarter results were a positive, though the most impressive point was the software company’s guidance, Barclays analysts led by Raimo Lenschow write in a note. The shares rose 4.7% in postmarket trading on Wednesday.

- Vapotherm (VAPO US) falls 23% in premarket trading after the respiratory-device company reported preliminary quarterly revenue that fell short of analysts’ estimates and withdrew its annual guidance.

In Europe, the Stoxx 600 added 0.7%, boosted by a rally in shares of Atlantia SpA, the billionaire Benettons’ highway and airport group. Atlantia added 10% in Italian trading after a non-binding bid from Global Infrastructure Partners and Brookfield Asset Management Inc. European healthcare and chemical stocks outperformed, while energy and miners declined. IBEX outperformed, adding 1.5%, FTSE 100 lags, dropping 0.1%. Health care, chemicals and travel are the strongest performing sectors. The energy sector was in the red, dragging the U.K.’s benchmark FTSE 100 down, as Shell’s $4-$5BN hit from its withdrawal from Russia weighed on oil producers. The statement from the London-based giant shows that, despite a surge in oil and gas prices, Russia’s invasion of Ukraine has upended the supermajors’ plans and left them scrambling to adapt to historic shifts in energy markets. Here are the most notable European premarket movers:

- Atlantia shares rise as much as 12%, extending yesterday’s gains, after a Bloomberg report that the motorway and airport company could become the target of a bidding war.

- Electrolux advances as much as 5.8% after announcing a positive non- recurring item of $70.5m in 1Q.

- Euronav shares gain as much as 12% on news of a potential stock-for-stock combination with Frontline to create a tanker company with a market capitalization of more than $4.2b.

- Daetwyler shares jump as much as 6% after it announced the acquisition of U.S. electrical connector seals company QSR, with Baader saying the deal may benefit earnings from day one.

- 888 shares surge as much as 31% after the gambling company announced a share placement to pay for its now-cheaper acquisition of William Hill’s international assets, with analysts reacting positively.

- Verbio shares surge to a record high after Hauck & Aufhauser lifts its PT on the biodiesel manufacturer by almost 33% ahead of what the broker expects to be “another outstanding quarter.”

- European basic resources and energy shares decline, lagging all other sectors, as commodity prices start to pull back, with Anglo American, Rio Tinto and Glencore all posting declines.

- PageGroup and other staffing companies fall after Jefferies lowers EPS estimates across the sector and takes a “more risk-off approach” in note, downgrading PageGroup in the process.

- Countryside shares sank as the home developer forecast a decline in profit after conducting a review of its business following a dispute with an activist investor.

- TI Fluid Systems falls as much as 12% after Jefferies downgraded the automotive parts maker to hold from buy, saying conditions faced by the company are among the most difficult in its coverage.

Earlier in the session, Asian stocks slid to a three-week low as traders feared a rapid rise in U.S. interest rates and aggressive scale-back of the Federal Reserve’s bond holdings could stymie growth and hurt earnings. The MSCI Asia Pacific Index lost as much as 1.4% on Thursday, with tech shares leading the losses in many countries, after minutes of the Fed’s March meeting showed plans to shrink its balance sheet by more than $1 trillion a year. The fall came after the Asian benchmark slumped 1.5% on Wednesday following similarly hawkish comments from Fed Governor Lael Brainard. Worries that hawkish policy tightening by the Fed may cool the world’s largest economy or even tip it into a recession are hitting equities broadly across Asia. Stocks in China also buckled, even as the state council renewed its pledge to use monetary policy tools at an “appropriate time” and consider other measures to boost consumption, according to the readout from a meeting of the State Council chaired by Premier Li Keqiang on Wednesday.

“The Fed is telling us that the party is over. It is saying it will take away the punch bowl,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. “This will have a serious impact on all risk assets.” Fujito saw tech shares with rich valuations as the most vulnerable, adding that investors will be trying to seek shelter in utilities and defensive stocks. The MSCI Asia Pacific Information Technology Index fell about 2%. Benchmarks in Japan and South Korea underperformed other Asian peers, while gauges in Australia and India posted smaller declines on Thursday. For April, the MSCI Asia is now down more than 2% on top of a slump of almost 7% last quarter — the most since the first three months of 2020 — amid concern about the war in Ukraine, higher rates and inflation.

Japanese equities fell by the most in almost four weeks, deepening declines in tandem with U.S. peers amid concerns over the Federal Reserve’s plans to tighten monetary policy. Electronics makers and service providers were the biggest drags the Topix, which dropped 1.6%, in its third day of decline. Tokyo Electron and Fast Retailing were the largest contributors to a 1.7% loss in the Nikkei 225. Minutes from the latest Federal Reserve meeting showed the U.S. central bank is prepared to raise rates sharply and reduce its balance sheet to cool the economy.

Indian stocks dropped with peers across Asia as the weekly expiry of derivative contracts weighed on the market. The S&P BSE Sensex slipped for a third session, dropping 1% to 59,034.95, its biggest fall since March 21. The NSE Nifty 50 Index slipped 0.9%. HDFC Bank retreated 2.2%, while Reliance Industries declined 1.8%. Seventeen of 30 shares on the Sensex traded lower. Fifteen of 19 sectoral sub-indexes compiled by BSE Ltd. declined, led by a gauge of oil & gas stocks. The Fed’s plan to prune its near $9 trillion balance sheet, which was swollen by pandemic-era bond purchases, points to more volatility in global markets. Locally, the nation’s central bank will likely raise its inflation outlook to reflect costlier oil while leaving borrowing costs steady in its policy decision on Friday. “U.S. Fed’s hawkish stance has raised concerns of steeper interest rate hikes going ahead,” Kotak Securities analyst Shrikant Chouhan said. He sees volatility in global crude oil prices leading to profit taking in Reliance Industries and other energy stocks.

The S&P/ASX 200 index fell 0.6% to close at 7,442.80, retreating alongside global peers after the Federal Reserve outlined plans to trim its balance sheet by more than $1 trillion a year while raising interest rates. Life360 was the biggest laggard as tech stocks dropped. Magellan Financial was the top performer after its funds under management update showed a slowdown in net outflows. In New Zealand, the S&P/NZX 50 index was little changed at 12,075.91

In FX, the Bloomberg dollar spot index is near flat, handing back earlier gains that saw it at a three-week high. RUB leads gains in EMFX.

In rates, the treasuries curve extends steepening counter-trend as front-end and belly yields retreat further from Wednesday’s YTD highs while long-end cheapens slightly. Yields richer by up to 3bp across front-end of the curve, steepening 2s10s by ~3bp with 10-year little changed near 2.60%; bunds and gilts keep pace. Bund, Treasury and gilt curves all bull steepen.

Meanwhile commodity markets continue to be whipsawed by disruptions sparked by Russia’s war in Ukraine and efforts to curb raw-material costs. WTI crude climbed toward $98 a barrel, paring a slump that was triggered by the International Energy Agency’s decision to deploy 60 million barrels from emergency stockpiles. WTI added 1.4% to trade near $98. Brent rises 1.5% to over $102. Most base metals trade in the red; LME nickel falls 2.3%, underperforming peers. Spot gold is little changed at $1,926/oz.

Raw materials could surge by as much 40% — taking them far into record territory — should investors boost their allocation to commodities at a time of rising inflation, according to JPMorgan.

In crypto, bitcoin is pressured and towards the low-end of a range that continues to drift from the USD 45k mark. Meta (FB) is exploring a virtual currency for the metaverse, according to the FT.

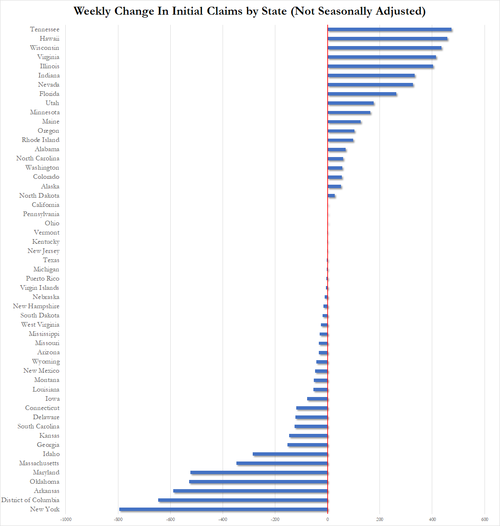

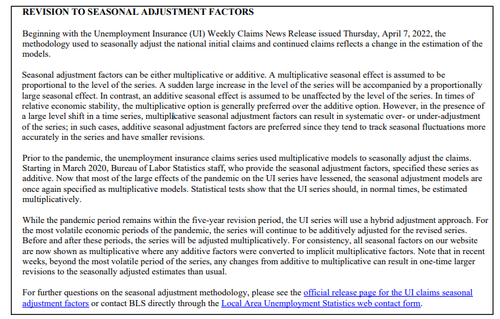

U.S. economic data slate includes initial jobless claims (8:30am) and February consumer credit (3pm). Fed speakers scheduled include Bullard (9am) and Bostic (2pm). U.S. session highlights include speech and Q&A by St. Louis Fed’s Bullard –who dissented from March FOMC decision in favor of a bigger rate increase — at 9am ET. Other central bank speakers include Bostic and Evans, as well as the BoE’s Pill. We’ll also get the minutes from the ECB’s March meeting, along with remarks from the Fed’s Bullard,

Market Snapshot

S&P 500 futures little changed at 4,476.75

MXAP down 1.4% to 176.33

MXAPJ down 1.4% to 584.33

Nikkei down 1.7% to 26,888.57

Topix down 1.6% to 1,892.90

Hang Seng Index down 1.2% to 21,808.98

Shanghai Composite down 1.4% to 3,236.70

Sensex down 0.7% to 59,191.33

Australia S&P/ASX 200 down 0.6% to 7,442.83

Kospi down 1.4% to 2,695.86

Brent Futures little changed at $101.14/bbl

Gold spot up 0.1% to $1,928.10

U.S. Dollar Index little changed at 99.69

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said she tested positive for Covid-19, adding that her symptoms are “reasonably mild” and that there won’t be any impact on the operations of her institution

- Surging U.S. real yields suggest bond traders believe the Federal Reserve can get a grip on inflation, but are likely to put further pressure on stocks and precious metals

- German Economy Minister Robert Habeck said the nation has already cut its reliance on Russian coal by at least half in the past month and won’t stand in the way of a European Union ban on imports of the fuel from the country

- In the days after the Ukraine war began, the ruble’s collapse was a potent symbol of Russia’s newfound financial isolation. Now, the ruble has surged all the way back to where it was before Putin invaded Ukraine

- Hungary kept its effective key interest rate unchanged at the highest level in the European Union after the forint plunged on the bloc’s announcement that it is triggering a process that may block the country’s aid funds

- China signaled it will step up monetary stimulus for the economy, acknowledging that domestic and global risks are now bigger than previously expected

- Bank of Japan board member Asahi Noguchi says it’s vital to continue with monetary easing as it will take some time before the possibility of shrinking stimulus comes into sight.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded lower throughout most of the session as the downbeat mood reverberated from Wall Street. ASX 200 was dragged lower by its tech sector following a similar sectoral performance in the West. Nikkei 225 was hit by losses across its energy, mining and manufacturing names. KOSPI conformed to the global losses whilst Samsung Electronics (-0.3%) failed to benefit from better-thanexpected prelim earnings. Hang Seng and Shanghai Comp were choppy and initially swung between gains and losses before stabilising in the red. Samsung Electronics (005930 KS) – Prelim Q1 (KRW) Revenue 77tln (exp. 75.7tln), Operating Profit 14.1tln (exp. 13.3tln), via Reuters

Top Asian News

- Suspected Chinese Hackers Collect Intel From India’s Grid

- SoftBank Tripled Share Buybacks to $1 Billion in March

- Thailand Mulls Easing Covid Test Rules for Overseas Visitors

- Japan to Release 15m Barrels From Oil Reserves: Kyodo

European bourses are firmer across the board and back in proximity to post-cash open levels after initial strength waned in choppy price action, Euro Stoxx 50 +0.7%. US futures have been relatively in-fitting with European peers, though the NQ, +0.5%, is the modest outperformer as yields take a breather from their recent surge. China’s Shanghai City is to cap the load factor of international flights by foreign airlines at 40% (prev. 75%), according to Reuters sources; effective from April 11th until month-end.

Top European News

- Turkey Transfers Khashoggi Case to Saudi Arabia to Improve Ties

- Shunned Oil Piling Up Off China as Virus Outbreak Worsens

- EU Full Ban on Russia Coal to Be Delayed Until Mid-August: Rtrs

- Yellen Says U.S. Would Use Sanctions If China Invaded Taiwan

FX:

- Greenback sets marginal new YTD best after hawkish FOMC minutes reveal tight call between 25 bp and 50 bp lift-off plus large cap balance sheet reduction, DXY up to 99.823, thus far.

- Albeit, the DXY has waned from best levels and turns flat ahead of the arrival of US participants as yields continue to pare

- Euro eyeing option expiries for support ahead of ECB minutes following loss of 1.0900 handle vs Dollar; EUR/USD down below Fib at 1.0895.

- Aussie unwinds more RBA inspired upside as trade surplus narrows on zero export balance; AUD/USD around 0.7475 vs circa 0.7661 only yesterday.

- Yen benefits from retreat in yields rather than BoJ rhetoric reaffirming ultra easy policy and merits of a weaker currency, USD/JPY capped below 124.00.

Commodities:

- Crude benchmarks consolidate near WTD lows after reserve release pressure; specifically, near lows of USD 95.43/bbl and USD 100.13/bbl for WTI and Brent.

- Updates elsewhere have been slim, and focused on China’s Shanghai City from a demand-side perspective amidst ongoing Ukraine-Russia developments; albeit, nothing fundamentally new in terms of negotiations.

- China is to strictly control new production capacity in the oil refining industry, according to the industry ministry

- Gas flows via Yamal-Europe pipeline resume westward, according to Gascade data.

- Spot gold/silver are contained and the yellow metal is once again capped by USD 1930/oz and LME Copper has failed to benefit from the equity pickup.

US Event Calendar

- 08:30: April Initial Jobless Claims, est. 200,000, prior 202,000; Continuing Claims, est. 1.3m, prior 1.31m

- 15:00: Feb. Consumer Credit, est. $18.1b, prior $6.84b

Central Bank Speakers

- 09:00: Fed’s Bullard Discusses the Economy and Monetary Policy

- 14:00: Fed’s Bostic and Evans Discuss Inclusive Employment

- 16:05: cancelled: Fed’s Williams Makes Closing Remarks

DB’s Henry Allen concludes the overnight wrap

We might be less than a week into Q2, but based on how markets are performing it’s shaping up to be very similar to Q1 thus far, with yesterday seeing another bond selloff and significant declines for global equities as markets gear up for the fastest monetary tightening we’ve seen in decades. Indeed, it seems to be progressively dawning on investors that this cycle of hikes is going to be very different to the one we saw from 2015, when even at its fastest in 2018, the Fed still only hiked rates by 100bps in a single year. As Jim has written, if we could erase the post-GFC cycle from people’s memory banks, there’s a case that markets would be pricing 300-400bps this year given where inflation is right now, not least given we saw hikes on that scale in the late-80s and from 1994 with inflation at much lower levels than it is at the minute.

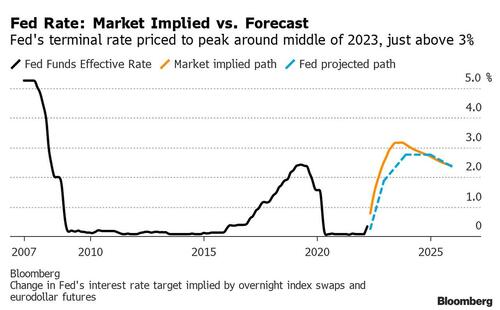

Given the rapid expected tightening (as well as the negative shock of Russia’s invasion of Ukraine), it’s worth noting that DB Research’s new World Outlook came out on Tuesday, (link here), where we downgraded our global growth forecasts and are now forecasting a US recession by the end of next year as our baseline. We also got a look into the Fed’s outlook yesterday with the release of the March FOMC minutes, where it looks like they would have hiked by 50bps in March were it not for the Russian invasion, and they are ready to entertain 50bps hikes going forward. The markets got the message, and upgraded the probability of a 50bp hike at the next meeting in early May to 85%.

The other big takeaway from the minutes were details around QT, which they signalled would start in May, in line with recent Fed speakers. The FOMC noted the balance sheet would rundown at a pace of $60bn Treasuries and $35bn MBS a month once QT hits terminal velocity, which should be by July if the minutes are to be believed. Markets digested the news, with Treasury yields more or less in line with their pre-minute levels into the close after declining modestly in the New York afternoon. With the pace of the runoff now set, the focus will turn to who buys the securities with the Fed stepping away and when the Fed has to stop QT.

Alongside the minutes, remarks from a number of officials yesterday helped to reiterate the point that policy will become tighter this year. Philadelphia Fed President Harker said that he expected “a series of deliberate, methodical hikes as the year continues”, whilst on the question of whether to move by 50bps, Richmond Fed President Barkin said that the FOMC “could certainly do that again if it is necessary to prevent inflation expectations from unanchoring”.

With all said and done, sovereign bond yields moved up to fresh highs on both sides of the Atlantic, with those on 10yr Treasuries up +5.1bps to 2.598%, which was its highest closing level since 2019, albeit some way beneath its intraday high of 2.656% shortly before noon in London, and this morning they have fallen a further -1.5bps to 2.583%. That increase yesterday was entirely driven by a rise in real yields, which rose +7.3bps to -0.24%, their highest level since March 2020, whilst a rally at the short end of the curve meant the 2s10s slope steepened for a 3rd day running, heading up to 12.2bps by the close. Those declines in shorter-dated yields came as futures actually took out a bit of Fed tightening from 2022, modestly reducing the expected number of additional hikes this year from 220bps in the previous session to 217bps by the close.

Over in Europe there were similar moves, with sovereign bond yields reaching fresh highs before paring back some of that increase towards the close. Yields on 10yr bunds (+3.3bps), OATs (+3.1bps) and BTPs (+3.8ps) all closed at multi-year records, although a key difference with US Treasuries were that the rise in European yields yesterday were driven by higher inflation expectations rather than real rates. In fact the 10yr German breakeven hit 2.81%, its highest in the data series that starts back in 2009, whilst the Italian 10yr breakeven hit 2.63%, its highest since 2008.

As on Tuesday, the selloff in bonds went hand in hand with further declines in equities, and by the close the S&P 500 (-0.97%) and Europe’s STOXX 600 (-1.53%) had both lost ground as well, with cyclical sectors leading the declines. Tech stocks in particular were an underperformer once again, and the NASDAQ (-2.22%) and the FANG+ index (-3.46%) both struggled again, bringing their declines over the last 2 sessions to -4.43% and -6.63% respectively. Amidst the equity declines, the VIX index of volatility rose +1.1pts yesterday to 22.1pts, taking it up to its highest level in 2 weeks.

Overnight in Asia, equities have very much followed that retreat on Wall Street as monetary tightening remained in focus. Among the main indices, the Nikkei (-2.00%) is leading the moves lower, whilst the Kospi (-1.42%), Hang Seng (-1.04%), Shanghai Composite (-0.99%), and the CSI (-0.78%) are also trading in negative territory. Separately, we heard from China’s State Council yesterday that they would use monetary policy at an “appropriate time”, as they acknowledged downward pressures on the economy. Looking forward, stock futures in the US are pointing to further declines today, with contracts on the S&P 500 (-0.37%) and Nasdaq 100 (-0.33%) both lower following those Fed minutes.

In terms of the latest on Ukraine, the EU continued to edge towards a fresh sanctions package, although that wasn’t finalised yesterday as had initially been suggested, with Reuters reporting that technical issues needed to be addressed like whether the ban on Russian coal would affect existing contracts. The report said that diplomats were optimistic about achieving a compromise today, so we could potentially see some news on that later, whilst in his speech to the European Parliament yesterday, European Council President Charles Michel also said that “I believe that measures on oil and even on gas will also be needed sooner or later.” Otherwise on sanctions, the US imposed further measures, including full blocking sanctions on Sberbank and Alfa Bank, along with a prohibition on new investment in Russia.

The various decisions came amidst a further decline in oil prices yesterday, with Brent crude down -5.22% to $101.07/bbl, its lowest closing level in 3 weeks. That was supported by confirmation that the International Energy Agency would release 60m barrels of crude, on top of the Biden Administration’s release from the Strategic Petroleum Reserve. Brent has recovered somewhat this morning however, up +1.85% to $102.94/bbl.

Turning to the French presidential election, we’re now just 3 days away from the first round on Sunday, and the polls have continued to tighten between President Macron and his main challenger Marine Le Pen. Yesterday’s polls for the second round runoff put Macron ahead of Le Pen by 54%-46% (Ipsos), 53-47% (Opinionway), and 52.5%-47.5% (Ifop), which are all much tighter than the 66%-34% margin in the 2017 election. French assets have continued to underperform against this backdrop, with the CAC 40 equity index (-2.21%) seeing a weaker performance than the broader STOXX 600 (-1.53%) for a 6th consecutive session.

On yesterday’s data, the Euro Area PPI reading for February came in at a year-on-year rate of +31.4% (vs. 31.6% expected), which is the fastest pace since the formation of the single currency. Separately, German factory orders contracted by a larger than expected -2.2% in February (vs. -0.3% expected).

To the day ahead now, and data releases include German industrial production and Euro Area retail sales for February, along with the weekly initial jobless claims from the US. Meanwhile from central banks, we’ll get the minutes from the ECB’s March meeting, along with remarks from the Fed’s Bullard, Bostic and Evans, as well as the BoE’s Pill.