Gold Or Rubles? A Pickle Worth Exploring

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Financial sanctions weighing on Russia are sending up red flags around the globe. The seizing of Russian foreign reserves and eliminating access to SWIFT is leading Russia and other countries to reassess the role of dollars in global trade. Today, there are likely quite a few central bankers and heads of Treasury asking themselves- Dollars, Gold, or Rubles?

This article explores the problem vexing Russia and her trade partners. We explore how sanctions and the threat of sanctions may force some countries to contemplate weaning off the world’s reserve currency.

Reserve Currency Status

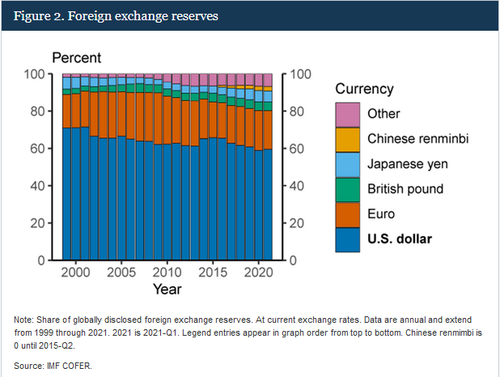

The rule of law, economic and military might, and the most liquid capital markets are the principal reasons the dollar is the preferred currency for most global trade, as shown below. Because of its status and global acceptance, the U.S. dollar is considered the world’s reserve currency. For more on the dollar’s status, please read our article Triffin Warned Us.

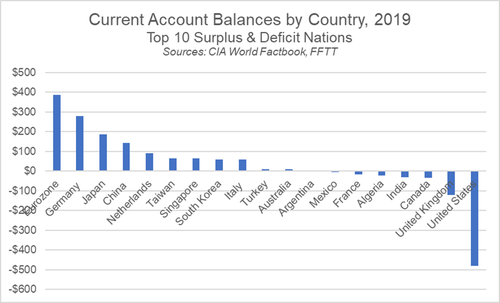

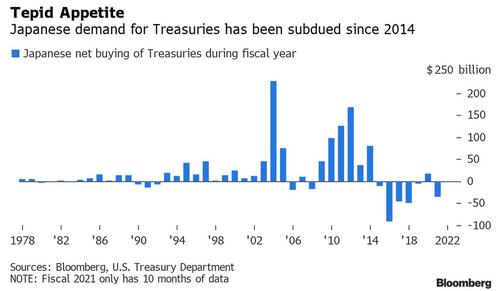

Despite Washington’s reckless monetary policy and burgeoning trade and fiscal deficits, the dollar remains the world’s reserve currency. The benefit to the U.S. is that countries with dollar reserves must invest in U.S. Treasury securities regardless of yields. As a result, about a third of U.S. Treasury bonds are held by foreign entities. Given the ability to run massive deficits and fund them easily, it should not be surprising that American politicians want to keep the dollar as the world’s reserve currency.

Some media and investment analysts cite America’s monetary and fiscal irresponsibility as reasons for the dollar’s death. Yet, with each crisis, financial, health, or geopolitical, the dollar appreciates against almost all currencies. Like it or not, there are no better options. Even our enemies transact in dollars and hold U.S. Treasury bonds as reserves. That may be slowly ending as Russia, and other countries are exploring.

“We are addicted to our reserve currency privilege, which is in fact not a privilege but a curse.”

– James Grant, Grant’s Interest Rate Observer.

Regardless of your view of whether it’s a curse or a privilege, politicians will fight to keep the reserve status and do everything, including war, to retain it. The “privilege” allows politicians to run unthinkable deficits and live above our means. It also keeps politicians and their parties in power. Anyone considering a speedy death of the dollar best brush up on political priorities.

Russia

One of the most biting sanctions against Russia is freezing her U.S. dollar reserves. Reserves are currency, bonds, bills, and other government securities held by a central bank.

Like freezing your banking account or stealing your wallet, the sanctions against Russia cripple their ability to conduct foreign trade.

Here is how President Putin thinks about the freezing of Russia’s reserves:

“The illegitimate freezing of some of the currency reserves of the Bank of Russia marks the end of the reliability of so-called first-class assets. In fact, the U.S. and E.U. have defaulted on their obligations to Russian. Now everybody knows that financial reserves can be stolen.”

The U.S. and Europe took control of Russia’s primary means of conducting trade. We can debate the pros and cons of the sanctions. Still, from an investment perspective, our time is best spent thinking about how Russia and other countries, enemies, and foes, might shield themselves from similar tactics in the future.

What Is Russia Doing?

Russia is a major exporter of agriculture, energy, and metals. They are heavily reliant on imports like computers, machinery, vehicles, and pharmaceuticals.

Russia has a colossal trade problem on its hands. In addition to many countries boycotting trade with them, their foes are likely not willing to accept rubles as payment for goods.

Why? For starters, there is no rule of law in Russia. Add to that a flawed and corrupt banking system and illiquid securities markets. Further, Russia most recently defaulted on its debt in 1998 and could easily do so again.

As if that weren’t enough to dissuade you from holding rubles, the ruble’s value, as shown below, is highly volatile. Maintaining purchasing power is a vital trait of a dependable currency.

Countries, such as India, are not able or willing to uphold sanctions and must have Russian imports. Despite sanctions, global trade between India and Russia will not end. Instead, countries like India are seeking a “workaround.”

Russia recently demanded that “unfriendly countries” pay for natural gas in rubles. Before the conflict, about 97% of Russian energy giant Gazprom’s foreign sales were in dollars and euros. Now it appears gold and rubles will play a role.

Can Gold Replace Dollars and Rubles?

Given that trade with Russia will not cease despite sanctions let’s consider how transactions might occur.

Most often, global trade transaction payments occur over money wires. They are the fastest and most secure way of transacting. Having lost access to SWIFT and not able to access its dollar reserves, Russia is seeking alternative payment methods. (SWIFT is a network of banks and financial institutions sending and receiving electronic funds transfers.)

Russia would like to pay for foreign goods with rubles and receive gold or rubles for their goods. However, we doubt their trade counterparts have a desire to accept rubles for the reasons we note. Given that using dollars and euros is now exceedingly difficult, and no one wants rubles, the only feasible currency alternative is gold.

Gold, however, presents a different set of headaches due to the transportation and storage requirements to keep it safe.

That said, gold can be held as a reserve currency and converted to any currency the seller of goods prefers. For example, if Pakistan wants Russian goods, they can convert their rupees to gold and gold to rubles to complete the transaction.

Russia and other countries can retain their gold within their respective borders and not fall prey to seizure as is occurring with its dollars.

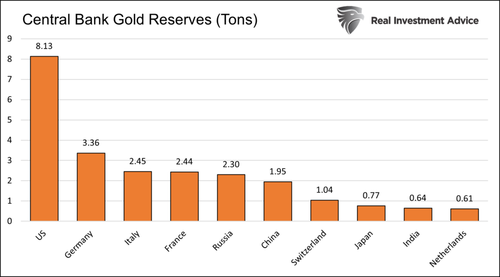

While currencies are now longer fully backed by gold, many countries hold substantial gold stocks. The graph below, with data from the World Gold Council, shows the top ten central bank holdings of gold.

Gold, Rubles, or Bitcoin?

We must presume other countries are thinking about the safety of their reserves. Shouldn’t the threat of seizure of dollar reserves worry countries like India, Iran, or Saudi Arabia? Their ability to trade rests on the whims and politics of the U.S. and Europe?

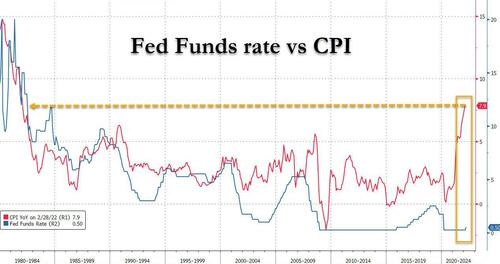

Bitcoin presents an option to gold reserves and traditional currencies. However, with Bitcoin come other problems.

First and foremost, it appears bitcoin might be subject to seizure. Per law firm DLA Piper: On February 8, 2022, the United States Department of Justice (DOJ) announced a landmark seizure of 94,000 Bitcoin valued at over US$3.6 billion, the DOJ’s largest seizure of cryptocurrency ever and the largest single financial seizure in the department’s history.

Second, cryptocurrency prices or exchanges rates to other currencies are extreme. As we show in the SimpleVisor graph below, the price of Bitcoin has been cut in half twice in the last year. It has also doubled. Lastly, Bitcoin does not pay interest. That may not be a problem in the current low-interest-rate environment, but it will be in a higher rate situation.

Summary

We are not suggesting the dollar loses reserve status. But we do want you to consider that some countries now have more incentive to seek an alternative payments source to the dollar. Gold is not the only solution but a currency that has worked for millennia and is helping Russia today.

Will enemies of the U.S. stop using dollars? Highly doubtful. Will they possibly add gold to their reserves? Most likely.

Gold has been used in trade for over 5000 years, and we suspect its popularity will increase going forward.

We leave you with a recent headline from the IMF:

IMF WARNS RUSSIA SANCTIONS THREATEN TO CHIP AWAY AT DOLLAR DOMINANCE

Tyler Durden

Wed, 04/06/2022 – 13:20

via ZeroHedge News https://ift.tt/xSqzRFa Tyler Durden