Seized Russian Yachts Create Serious Headaches For Marinas As Unpaid Bills Pile Up

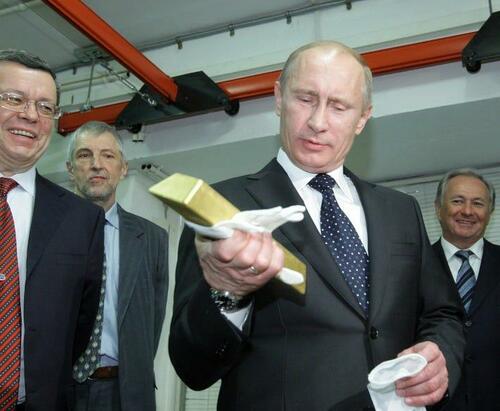

Russian billionaire Roman Abramovich has managed to keep his $1 billion yacht fleet out of the hands of European authorities – although it appears they’re finally closing in.

But while the Western press loves to celebrate the seizure of yachts and other luxury properties belonging (or allegedly belonging) to oligarchs, the opaque ownership structure raises many questions and is even creating problems for some European businesses, including marinas that don’t know who to bill.

Reuters raised one notable example on Monday, when it reported that La Ciotat Shipyards, nestled in a quiet corner of the French Riviera, has continued producing bills for mooring fees and other expenses tied to the massive superyacht Amore Vero (“True Love” in Italian) after it was seized by French authorities on suspicion of belonging to Russian oligarch Igor Sechin, the head of Russian oil giant Rosneft (the yacht was seized last month just days after Sechin was added to the sanctions list).

Customs agents seized the 86-metre (282-ft) vessel as its crew prepared to sail out of harbour on the night of March 2, two days after the European Union added Igor Sechin, the head of Russian state oil company Rosneft, to its sanctions list for the war in Ukraine.

However, now that the yacht is technically in government custody, the marina doesn’t know to whom it should send the (increasingly sizable) bills. Ironically, Sechin has issued a statement denying that he ultimately owns the yacht.

France’s finance ministry says the yacht belongs to a company controlled by Sechin – one of Russian President Vladimir Putin’s oldest allies. The ministry declined to name the firm.

But Sechin – in a statement sent to Reuters by Rosneft – denied this.

Finance Minister Bruno Le Maire said France had officially seized the Amore Vero – a measure that officials said gives the state custody over the yacht and leaves costs with the owner.

The confusion is causing quite the headache for La Ciotat.

But authorities have not notified third parties of the vessel’s status, leaving it unclear who is responsible for its upkeep, said two companies involved in servicing the yacht. As bills pile up, an executive at La Ciotat Shipyards said the company was unsure how to get paid.

“We’re continuing to invoice,” said Alice Boisseau, communications officer for La Ciotat Shipyards. Asked who would foot the bill, she said: “We don’t know.”

Boisseau declined to answer further questions. France’s customs agency declined to comment on why it had not informed the shipyards of the yacht’s status.

Of course, France and Italy aren’t the only EU member states to seize yachts purportedly belonging to sanctioned oligarchs. On Monday, a $95 million yacht belonging to Russian billionaire Viktor Vekselberg was confiscated in Spain at Washington’s urging (although Vekselberg isn’t facing sanctions in the EU, he is facing them in the US, where he has also been accused of bank fraud). But since the ownership structure is so opaque, authorities had to rely on two unidentified employees of a company providing services to the vessel (named Tango) to ‘confirm’ its true ownership.

That seizure was coordinated through the Justice Department’s Task Force KleptoCapture and was the first of its kind, though Attorney General Merrick Garland said “it will not be the last”.

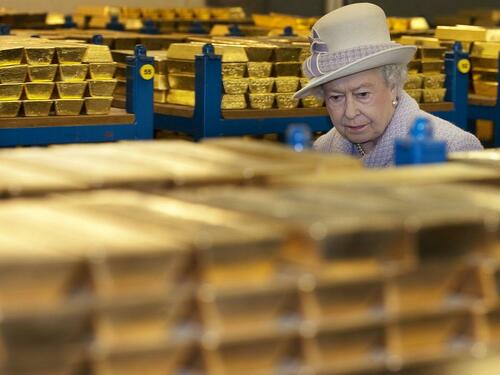

According to Bloomberg, more than a dozen yachts or superyachts have been seized over the past five weeks.

The largest and most valuable of these is the detained superyacht Dilbar, a 156-meter (512-foot) motor yacht owned by Alisher Usmanov, who has been sanctioned by the US, UK and EU. That yacht alone is worth between $587 million and $625 million.

Source: Bloomberg

In total, the detained superyachts of sanctioned Russian tycoons are worth $2.25 billion.

But the problem for local marinas (and ultimately, the law enforcement agencies responsible for seizing the yachts) is that the yachts require extensive maintenance even when docked in order to keep them seaworthy. Forego the maintenance, and the yachts will soon deteriorate, destroying their value and making it impossible (or extremely difficult) to re-sell them at auction (if that is actually what authorities plan to do).

In the meantime, governments need to think long and hard about how they will reimburse marinas for this maintenance.

Tyler Durden

Tue, 04/05/2022 – 07:00

via ZeroHedge News https://ift.tt/70eMubW Tyler Durden