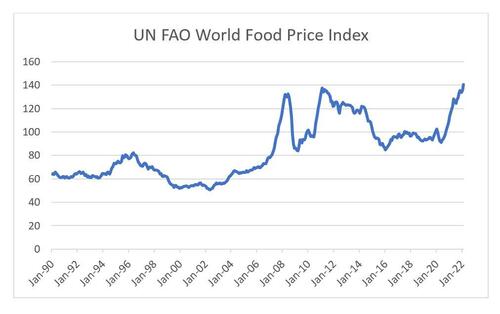

If one pretends hard enough that the Ukraine war isn’t sending already record high commodity prices even higher, do commodity prices really rise? Unfortunately for much of the western world, the answer is yes, and not just oil and gasoline, but diesel. electricity, coal and even jet fuel.

At a time when Europe is desperately trying to come up with some brilliant scheme to wean itself away from Russian energy supplies (spoiler alert: there is none), French supermarkets have joined a national effort to curb the country’s electricity consumption, as cold weather and nuclear reactor outages pushed domestic power prices to a 13-year high.

The country’s largest retailer, Carrefour, said it was cutting power consumption Monday morning, heeding calls from France’s grid operator RTE to households and industries to reduce usage in order to tackle a surge in demand coupled with nuclear outages and colder weather. Carrefour told Bloomberg that it is using methods like “reducing heating in offices, and dimming lighting in the group’s 400 stores across the country.” Adding insult to injury, in a stunning twist, one which nobody can blame on Putin (but they can sure blame on Greta), Bloomberg writes that as many as 25 of state-run utility Electricite de France SA’s 56 nuclear reactors are offline, just as overnight temperatures in most of the country are set to fall below freezing.

With a collapse in electricity production, power deliveries between 8 a.m. and 9 a.m. Paris time surged to as much as 2,987.89 euros ($3,286) per megawatt-hour, while the average price for the entire day settled at 551.43 euros on the Epex Spot SE’s day-ahead auction, the most since a record set in October 2009. It was also high enough to trigger an increase of the maximum upper price limit on power exchanges across Europe.

To be sure, France has an alternative to draconian power conservation: freezing. Households turned up electrical heating amid freezing temperatures across the country on Sunday night, which was the coldest for that period of the year since 1947, according to Meteo France. A return to warmer weather is expected Tuesday, with close to average temperatures seen, at least until the next cold snap.

Meanwhile, as French power prices were trading limit up, the commodity crucible also hit the US where while oil was trading around $100 thanks to Biden’s desperate political gamble to dump a third of the US SPR ahead of the midterms in hopes of keeping gas prices low, U.S. coal prices topped $100 a ton for the first time in 13 years.

While prices for coal from Central Appalachia surged 9% to $106.15 a ton last week, the highest since late 2008, prices in the Illinois Basin rose to $109.55, topping $100 for the first time in records dating to 2005. The surge matches increases around the world as the Ukraine war prompts users to seek alternatives to Russian coal, which accounted for almost 18% of global exports in 2020. That’s exacerbating a surge in demand that began last year as a global economic recovery from pandemic drove up electricity consumption.

Prices in Central Appalachia and the Illinois basin are rising more than in other U.S. coal-producing regions because they have easier access to international markets. U.S. exports climbed 23% last year and are expected to increase another 3.3% this year as miners take advantage of record international prices.

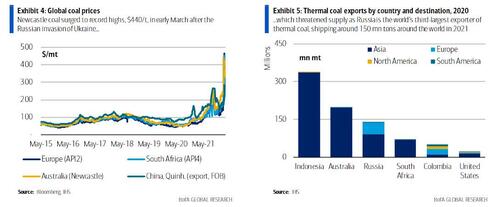

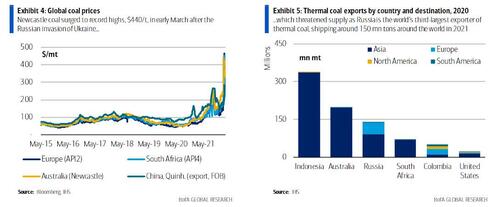

In its recent discussion of the record surge in coal prices, Bank of America writes that Newcastle coal prices surged to record highs, $440/t, in early March as chaos swept through global commodity markets in the wake of the Russian invasion of Ukraine. While Russia is the world’s largest exporter of natural gas, it is also the world’s third-largest exporter of thermal coal, trailing only Indonesia and Australia. Last year Russia accounted for roughly 15% of the seaborne thermal coal market and shipped nearly 150 mn tons of thermal coal around the globe and made up roughly half of Europe’s coal imports. The disruption of Russian coal supply is just the latest in a wave of supply issues that have hounded the market since early last year.

And yet, despite record prices last year, major thermal coal suppliers struggled to boost output due to a litany of issues including weather events, rail disruptions, Covid outbreaks, and equipment shortages. Then, for most of January, Indonesia, the world’s largest coal exporter, banned coal exports to combat low domestic stockpiles, sending Newcastle prices to over $220/t and leaving the seaborne market with little room to maneuver. Then, Russia invaded Ukraine at the end of February, which threatened further disruption to global coal supplies, launching Newcastle prices to well over $400/t before retreating some in recent weeks. Adding further flames to the coal fire, record-high European natural gas prices have incentivized near maximum coal generation in Europe. Despite the rally, thermal coal remains one of the cheapest MMBtu’s on the planet, with a gas equivalent cost of around $15/MMBtu, significantly cheaper than crude at $25/MMBtu or global natural gas near $35/MMBtu.

Adding to the supply issues, Russia accounted for over 25% of the world’s high calorific value (CV) coal exports, which has driven high CV coal to record premiums over low quality coal. While an increase in Indonesian exports could help offset the lost tonnage from Russia, it won’t make up for the quality difference. With supply issues abounding, the market will have to balance through demand destruction. India, one of the world’s largest importers, has historically been a very price-sensitive buyer, and BofA expects imports to eventually decline this year to the lowest level since 2013.

“The energy fallout from Russia’s invasion of Ukraine could last for a while,” Michelle Bloodworth, CEO of coal-power trade group America’s Power, told Bloomberg in an interview. “Coal is going to be needed for the foreseeable future.”

Which is odd considering the past 4 years were spent by the environmentalists and their teenage god to wean the world away from coal. Almost as if all of that was one giant spectacle, and meanwhile reliance on coal only grew!

But wait, the absurdity gets better: while U.S. power producers have reportedly been quote unquote shifting away from coal, consumption actually jumped last year – as in before the Ukraine war- as prices also increased for natural gas.

The bottom line is that American consumers, already facing the highest inflation in four decades and paying higher utility bills, as food prices are surging and housing costs are up, are about to pay up even more and Biden will be scrambling to find even more creative ways to blame it all on Putin (which almost explains why the US appears so perplexingly interested in perpetuating the Ukraine war).

The hilarious conclusion to this tragic story, however, comes from Bloomberg which notes that the rebound in coal comes as a United Nations-backed panel of climate scientists warned Monday that the world may be on track to warm at a pace that would painfully remake societies and life on the planet. In other words, the Ukraine war crisis is already being put to use by the same crony capitalists who will now be pushing very hard to greenlight the $150 trillion in spending (and QE) needed to usher in the “green” agenda (as described in “Here is The Hidden $150 Trillion Agenda Behind The “Crusade” Against Climate Change“). All they need is a strong enough deflationary crisis that transitions the current inflation-fighting posture to a world permitting nearly $5 trillion in annual QE. We are confident they will find it.