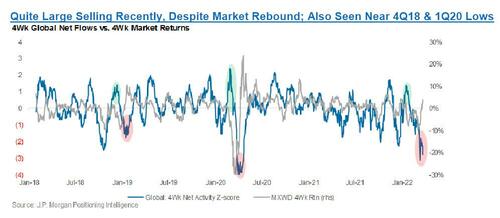

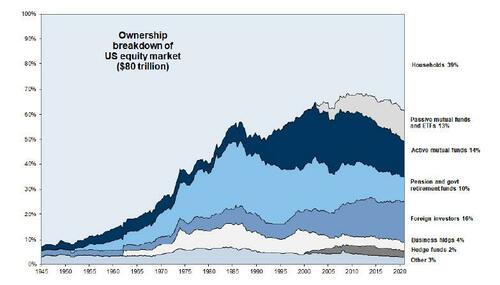

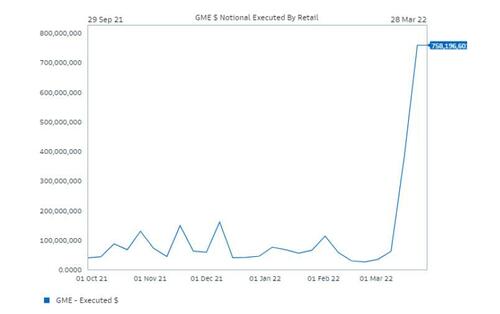

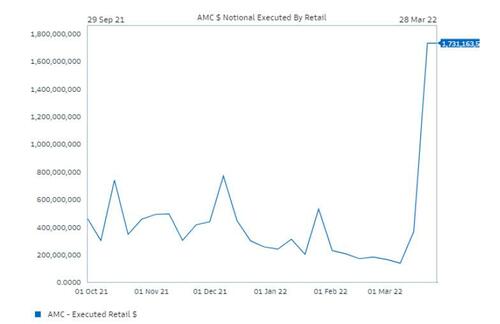

With one half of Wall Street – such as the degenerate permabulls at JPM – desperate to see the record distribution extend and retail investors continue to buy everything that liquidating hedge funds have to sell, and urging anyone who still listens to them to ignore such recession signs as yield curve inversion, while the other half of Wall Street is dazed and confused and unable to decide whether to buy here (along with most other hedge funds) or to bet it all on green (along with most degenerated retail traders) and pray for another short squeeze, few dare to invoke the worst case: namely, that the March bear market rally is over and that a recession is imminent.

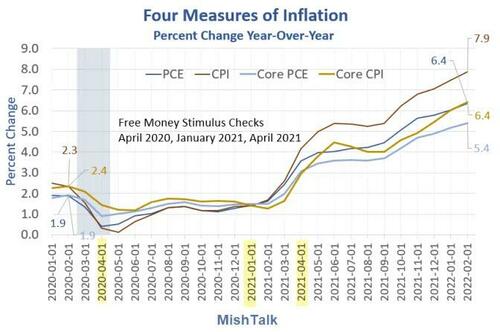

However, Morgan Stanley’s chief US equity strategist Mike Wilson, who has been feuding with BofA’s Michael Wilson for biggest reformed bear (unlike the likes of Albert Edwards who were always bearish), has no such problems and in his latest Weekly Warm-up note writes that “after one of the roughest quarters in history for stocks and bonds collectively, the markets better reflects the “Fire” part of our narrative; but now it’s about the “Ice,” and that’s decidedly worse for stocks relative to bonds.” And so, as the market comes to the realization of just how bad it will still get, Wilson declares that “the bear market rally is now over” as markets grasp the realization that the US economy is heading for a sharp slowdown driven by i) payback in demand from last year’s fiscal stimulus, ii) demand destruction from high prices, iii) food and energy price spikes from the war that serve as a tax, and iv) inventory builds that have now caught up to demand. And as this increasingly brutal macroeconomic backdrop eats away at corporate profits, it will be increasingly harder for investors to ignore, and stock prices will be hammered next.

Some more background.

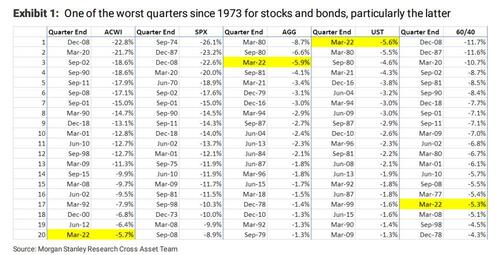

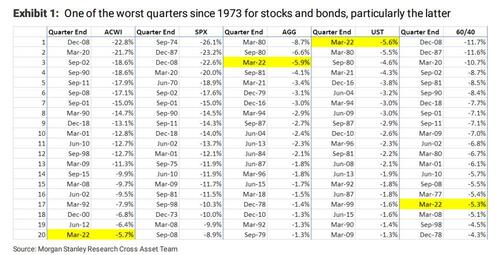

First, looking back at the just concluded quandary of a quarter, Wilson writes that given how bad first quarter returns were for both stocks and bonds, “most investors (both asset owners and manager) were probably happy to see it end.” Furthermore, the bear market rally in the second half of March – which as we explained on several occasions was not due to fundamentals but to technicals and positioning – made it considerably better for stocks than it was looking just a few weeks ago. In the end, Wilson notes, “bond returns ranked much worse than stocks from a historical perspective, with Treasuries posting their worst quarter in 50 years.”

Yet while for many the turmoil of Q1 was a surprise, it was not surprise to Wilson who writes that “the tough 1Q was very much in line with our view coming into 2022 – i.e. we didn’t see many fat pitches given the Fed’s (and other central banks’) resolve to fight the surge in inflation in the face of slowing growth (Tightening Fed and Slowing Growth = Defense).” Indeed, whether it was for technical or fundamental reasons, bond and stock markets ignored this risk into year end 2021 and instead they required an additional prompt, which the Fed – which as a reminder is hoping to crash stocks according to Zoltan Pozsar – gladly supplied with the minutes of its December meeting on January 5th. From that moment, both stocks and bonds made a sharp U-turn and never really looked back for the entire first month of the year.

In short, headline indices in stocks and bonds finally adjusted to the “Fire” part of Wilson’s narrative, i.e., the sharply higher rate reality, a risk that started to price under the surface in early November when Powell was renominated. And so, with inflation (finally) on everyone’s mind in 1Q more than any other risk, it made sense that bonds would be worse than equities. It also makes sense that stocks most vulnerable to higher rates did even worse than the more diversified S&P 500 index – i.e. the Nasdaq performance was considerably worse than both the S&P 500 and Russell 2000, a very rare occurrence over the past few years. And, this is after a major rally in the past two weeks that was led by the Nasdaq.

Wilson’s takeaway was that markets were preoccupied with the Fed’s sharp pivot more than anything else and it played out in asset prices, appropriately.

… but now comes the slowdown

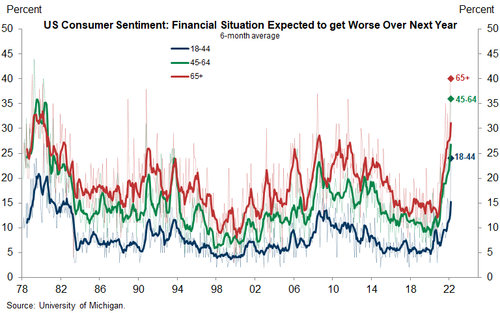

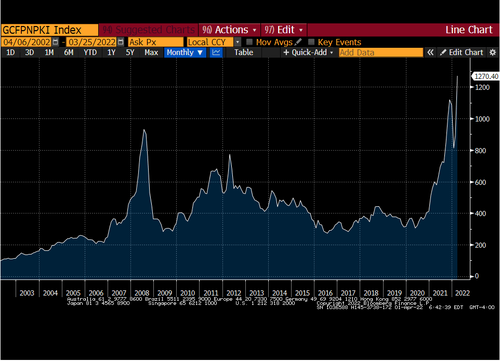

It’s not just the fire and ice narrative: the other major driver of markets in Q1 was the war in Ukraine. While tensions had been building since late last year, it’s fair to say markets had ignored this risk as much as the Fed’s pivot. The only difference is that the Fed’s pivot was well telegraphed while Russia’s invasion was far from a sure thing and more of an unknown known to most, including Wilson. Such an event did materially factor into the risks for 1Q by accentuating the Fire and Ice – i.e., it made inflation worse while dampening growth prospects simultaneously. It has also rattled confidence for both businesses and consumers, especially in Europe. And since this was not in Morgan Stanley’s already bearish calculus when the bank made its forecasts for 2022, it now finds itself “incrementally more negative on growth trends than we were at the end of last year.”

Wilson lays out what this incremental bearishness means in practical terms:

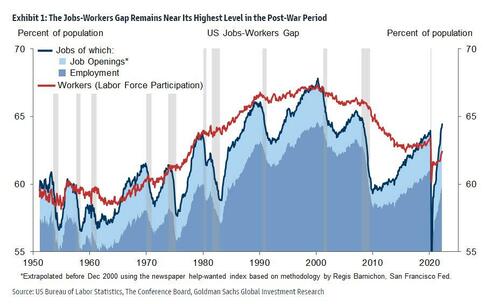

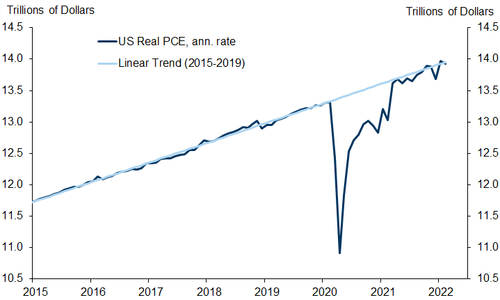

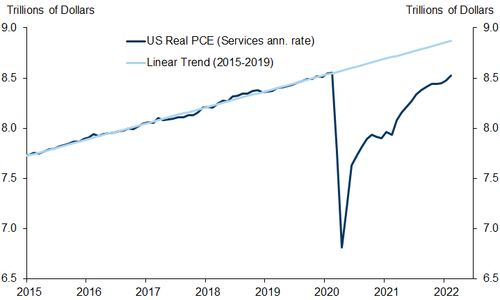

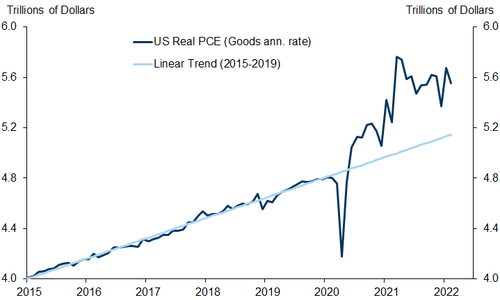

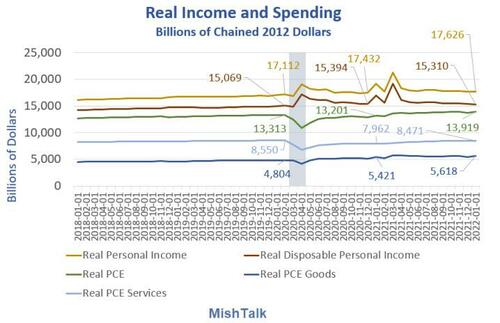

Last fall we pushed out the timing of the Ice part of our narrative to 1H22 when we realized the economy still had plenty of strength left for companies to deliver on earnings growth. But, now investors face multiple headwinds to growth that will be harder to ignore – i) payback in demand from last year’s fiscal stimulus, ii) demand destruction from high prices, iii) food and energy price spikes from the war that serve as a tax, and iv) inventory builds that have now caught up to demand. While the first three headwinds are somewhat appreciated, we think the last one is not.

Specifically, and in keeping with last week’s FreightWaves “recession is imminent” note that crushed the freight sector, Morgan Stanley had been highlighting the risk for supply to overwhelm demand in many goods this year while most have viewed the recent build in inventory as mainly a positive that will help tame inflation. Here, Wilson would warn investors to be careful what you wish for: “Inflation has been an elixir for profits for most of this recovery. Until now, companies have had little problem passing along higher costs, hence why we have inflation. However, as supply catches up to demand, pricing power will likely dissipate and discounting could return in many areas of consumer goods that typically are price takers.”

Separately, Wilson expects to also see cancellations of orders that were doubled up due to the shortages. It’s why the bearish strategist warns that “semiconductor stocks and other areas of the market that have very fragmented supply chains look to be the most vulnerable.” Which brings us to the punchline of Wilson’s latest note:

The bear market rally is over

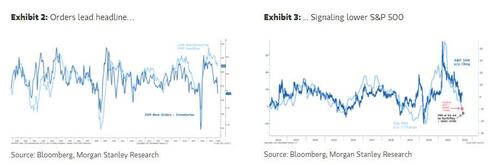

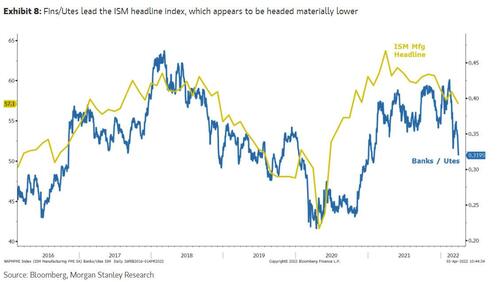

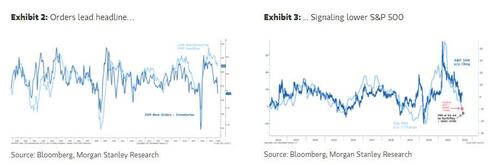

On that score, the strategist writes that “Friday’s ISM release showed a sharp deterioration in the orders component, and relative to inventories, it looks even worse, with the inventory component of the index now below orders for the first time since the recovery began.” Think of this as a book to bill for the broader manufacturing economy. Based on the Ice and over-ordering thesis, this is precisely the worst case outcome that Wilson had been expecting… and now it is here.

As shown previously, this differential between the orders and inventories components leads the headline index (Exhibit 2). Importantly for investors, it suggests the S&P 500 has another rough month(s) ahead (Exhibit 3). Bottom line, the rally in stocks over the past few weeks has been remarkable, but in our view it has all the characteristics of a bear market rally, and we view month/quarter end as the perfect spot for it to come to an end.

How to trade the end of the bear market rally?

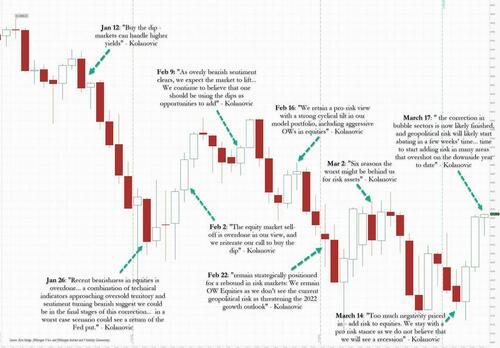

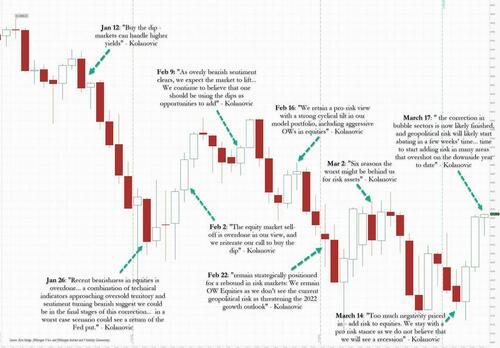

While we know of quite a few banks and strategists who will go apeshit at Wilson’s dismal assessment, most of all Marko Kolanovic who has literally said to buy the dip every single week in 2022…

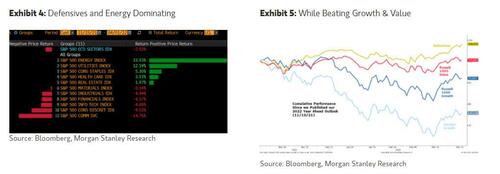

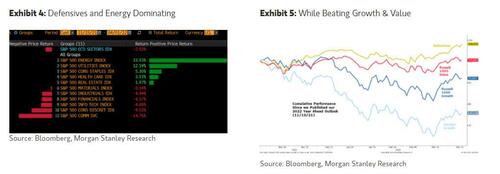

… Wilson goes one step further and rubs it into the faces of all those sellsides who expected the S&P to close above 5,000 (and are now desperately dragging their forecasts lower) and writes that based on his Fire and Ice narrative and all of the building evidence to support it, he has been defensively positioned in his strategy recommendations since he published his year ahead outlook back in mid November: “while not a straight line, this positioning has worked well and has dominated a growth or cyclicals bias (Exhibit 4 and Exhibit 5). Our big miss was being equal weight Energy although in our Fresh Money Buy list we have effectively been overweight with our 10% position in Exxon as a “defensively” oriented energy stock. Bottom line, defensive positioning has been the right move.”

This defensive domination may surprise Wilson’s readers given the large weighting of Energy within cyclicals and the fact that rates have moved up so much in the past several months. As he explains, “typically defensives act poorly in a rising rate environment as they serve as a bond proxy in many ways. However, bond proxies are doing well, especially over the past week when Real Estate and Utilities were the best-performing sectors. It’s also worth noting that on the back of Friday’s strong labor market report, 30-year bonds rallied 2 points from the intra-day lows.”

While some of this may be due to the ugly ISM report noted above, Wilson’s sense is that the markets are starting to price in our Ice scenario right on cue. And, in this context, the strategist thinks that 30-year Treasuries offer an excellent hedge against the growth scare he expects now that the Fed is fully priced: “Last week’s price action seems to support such a view and we’re sticking to it with our reiteration of defensive stocks as the place to be. We remain overweight Utilities, REITs and Healthcare.”

Conversely, Wilson is also underweight Consumer Discretionary and cyclical Tech while keeping equal weights in everything else and focusing on stock picking; MS is also recommending Defensives over both cyclicals and growth.

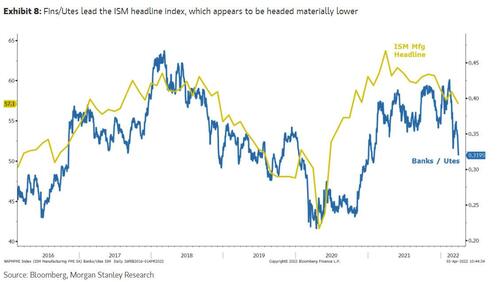

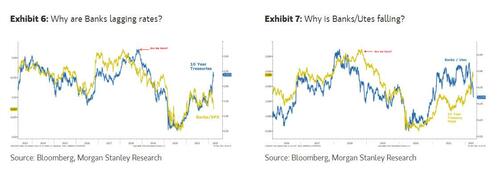

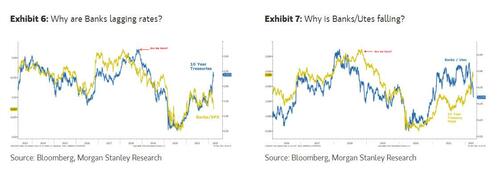

Finally, following Wilson’s last week downgrade of Banks, he thinks that the pair of Utilities over Banks looks particularly attractive. With Banks positively correlated to back end rates, “this is another example of the internals of the market saying we close to a top.”

Last but not least, the inversion of the yield curve – which was not mentioned yet – is clearly supportive of this relative value trade as it signals late cycle, a time when Utilities dominate early cycle groups like Banks. The pair is also highly correlated to the ISM manufacturing index, which is headed much lower.