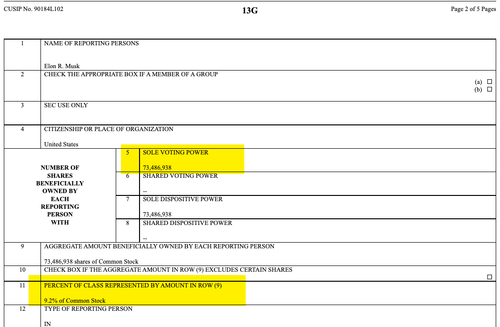

US futures rose along with stocks in Europe and Asia, as corporate news took some of the focus off developments in the Ukraine war, where peace talks are expected to resume on Monday. Nasdaq 100 futures led gains among other gauges, climbing as much as 0.4% with S&P futures up 0.2%, while equities also rose in Europe. Twitter soared as much as 29% in premarket trading after Elon Musk took a 9.2% passive stake in the company. Tesla shares also rose after the automaker posted record first-quarter deliveries despite supply chain and logistical constraints, taking other electric-vehicle stocks higher as well.

Chinese stocks listed in Hong Kong climbed over 4% after Beijing sought to modify a rule that restricts offshore-listed firms from sharing sensitive financial data with foreign regulators. That may allow the U.S. to gain full access to audits, reducing the risk of Chinese firms losing Wall Street listings. Starbucks Corp. fell after the coffee chain’s chief executive officer suspended its share buyback program on his first day back on the job. Among other notable premarket movers, electric-vehicle stocks in the U.S. gain in premarket trading along Tesla. Rivian (RIVN US) +1.6%, Nikola (NKLA US) +1%.

- Starbucks (SBUX US) shares fell 1.6% in premarket trading after the coffee chain’s CEO Howard Schultz suspended its share buyback program on his first day back on the job.

- Chinese stocks listed in the U.S. rallied on Beijing’s plans to modify restrictions on the data that overseas-listed companies are allowed to share with foreign regulators, easing concerns that these companies could be kicked off American exchanges. Alibaba Group (BABA US) +5%, JD.com (JD US) +5.9%, Pinduoduo (PDD US) +8.5%.

- Mullen Automotive (MULN US) shares climb 2.8% in premarket after it named John Taylor to the role of senior vice-president of Global Manufacturing and Strategic Planning.

- NIO (NIO US) jumps 6.8% in premarket as it was upgraded to buy from neutral at UBS following drop in shares of about 44% over the past year, and with potential for sales acceleration on new model launches planned for 2022.

- SPI Energy (SPI US) jumped 32% in extended trading Friday after the renewable energy company projected revenue between $200 million and $220 million for 2022.

“It would not be surprising to see yields rise further from here and it is very hard to know where they will land,” Angela Ashton, founder and director of investment consulting firm Evergreen Consultants, wrote in a note. “Markets are volatile and there is every chance they will overshoot.”

In geopolitical news, negotiators from Russia and Ukraine may resume video talks Monday, though the European Union said it will hold Russian authorities responsible for alleged atrocities committed in northern Ukrainian towns, saying that the bloc will “as a matter of urgency” work on additional sanctions against Moscow.

Developments around Ukraine are weighing “on today’s appetite for riskier assets like stocks and underly the current uncertain and volatile state of those markets,” said Pierre Veyret, a technical analyst at ActivTrades. Meanwhile, Morgan Stanley Chief U.S. Equity Strategist Michael Wilson, one of Wall Street’s most vocal bears, said the recent rebound in equity markets will prove short-lived as the economy is heading for a sharp slowdown.

The Treasury yield curve is flashing more warnings that economic growth will slow as the Fed raises rates to tame inflation stoked in part by commodities. The two-year U.S. yield has exceeded the 30-year for the first time since 2007, joining inversions on other parts of the curve. The Fed minutes later this week will shape views on the odds of a half percentage-point rate increase in May and provide key details on how the central bank will shrink its balance sheet.

New York Fed President John Williams said Saturday a “sequence of steps” can get rates back to more normal levels. Mary Daly, president of the San Francisco Fed, said in an interview published Sunday that rising inflation and a tight labor market strengthen the case for a half-point May hike.

The Stoxx Europe 600 index fluctuated and turned higher after a soggy start. Consumer discretionary, healthcare and autos led the advance, with Delivery Hero SE jumping as much as 14% after saying it expected the entire company to hit a measure of profitability next year for the first time. The healthcare sector outperformed as Roche Holding AG climbed after the U.S. Food and Drug Administration granted a priority review for its Covid-19 drug Roactemra. Here are some of the biggest European movers today:

- Delivery Hero rises as much as 14%, leading food delivery peers higher, after announcing debt financing of EU1.4 billion, easing concerns over a first batch of convertible bond repayments, also saying it expects to turn a profit on an adjusted Ebitda basis in 2023.

- Persimmon and other U.K. homebuilder shares rise following a report in trade publication that the government has dropped its demand for companies to contribute to a cladding remediation fund.

- Bayer shares gain as much as 3.4% following positive results for its thrombosis prevention drug Asundexian. This prompts Barclays to raise the stock to overweight from equal-weight.

- Logitech rises as much as 4% after it is raised to buy from neutral at Goldman Sachs on an attractive valuation and solid secular trends for the computer-equipment company.

- Ted Baker jumps as much as 15% after announcing it has received an improved proposal from private equity group Sycamore, and other unsolicited third-party bid interest.

- Novartis rises after announcing a new corporate structure to save “at least” $1 billion in SG&A expenses by 2024. ZKB says the new structure increases confidence about Novartis’s margins.

- Allegro shares sink as much as 7.7% after EBay announced plans for a new opening in the Polish market, aiming to be one of the top-3 e- commerce platforms in the country in coming years.

- Maersk falls as much as 7.2% amid concerns about a decline in freight demand and macro factors, particularly supply chain issues that have been driving up freight rates, analysts say.

Asian stocks initially traded mixed but later rose, supported by a jump in Chinese tech shares as the risk of getting delisted from the U.S. eased, and as Indian lenders surged upon a major financial sector merger. The MSCI Asia-Pacific Index rose as much as 1%, boosted by internet giants Tencent and Alibaba. The Hang Seng Tech Index gained the most in over two weeks after China sought to scrap a key hurdle in its spat with the U.S. over audits. Hang Seng outperformed and was bolstered at the open by Chinese dual-listed stocks, with the tech sector the main beneficiary of the weekend Audit news, whilst gains compounded after HK Chief Executive Lam said she will not seek a second term. China on Saturday proposed revising confidentiality rules involving offshore listings, removing a legal hurdle to cooperation on audit oversight while putting the onus on Chinese companies to protect state secrets, via Reuters. Mainland China was closed due to a domestic holiday. Investors welcomed Beijing’s action as it could help avert the threat of U.S. regulators removing Chinese stocks from American exchanges, and herald a more stable relationship between the two economies. That outweighed concerns about a lockdown in Shanghai and rising expectations of a larger U.S. rate hike next month.

“The risk of Chinese ADRs getting delisted seems to have fallen even though it is of course too early to declare ‘all clear,’” said Kota Hirayama, emerging-market economist at SMBC Nikko Securities. “Perhaps Chinese authorities are taking an appeasing stance with an eye on how the West has reacted to Russia’s invasion of Ukraine.” Trading in the region was slow overall with mainland China and Taiwan closed for holidays. Indonesian stocks hit a record high, while Japanese stocks eked out small gains as the Tokyo Stock Exchange’s biggest revamp in over 60 years took effect. Traders in Asia were also reacting to U.S. jobs data released late last week, which showed the country added close to half a million jobs in March, cementing expectations of a half-percentage point rate hike by the U.S. Federal Reserve early next month

Japanese equities closed the day higher after swinging between gains and losses earlier in the day amid light trading, as the Tokyo Stock Exchange implemented its biggest revamp in over 60 years. The bourse’s overhaul took effect today, replacing the former segments with the new Prime, Standard and Growth sections. The benchmark index Topix will remain in place, but see its components adjusted in stages over several years. “There shouldn’t be that much of a big impact on the operational side with the TSE market revamp, but companies that want to stay in the Prime section or companies that are aiming to enter it may put more focus on governance which is going to be positive for the markets,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Research. Telecoms and drugmakers were the biggest boosts to the Topix, which rose 0.5%. SoftBank Group was the largest contributor to a 0.3% gain in the Nikkei 225. The yen fell 0.2% against the dollar, extending its 0.7% loss on Friday. Total daily TSE trading value was 2.7 trillion yen ($22.2b yen), the lowest since Dec. 30. Trading around the region was muted with market holidays in China and Taiwan.

In FX, the Bloomberg Dollar Spot Index was little changed, hovering after a two-day advance and the greenback traded mixed versus its Group-of-10 peers, with commodity currencies leading gains. The pound gained against the dollar as traders looked ahead to speeches by Bank of England officials for further clues on the outlook for monetary policy. BOE Governor Andrew Bailey, Deputy Governor Jon Cunliffe, as well as Chief Economist Huw Pill are all due to speak at separate events Monday. Traders have trimmed bets on the scale of future rate hikes after the central bank softened its guidance in the wake of Russia’s invasion of Ukraine. The yen traded in narrow ranges with no fresh catalysts. Australia’s dollar advanced for a second day amid speculation the Reserve Bank may turn hawkish and as rising equities support demand for growth-linked currencies. Bonds declined after robust U.S. jobs data on Friday caused the U.S. yield curve to bear flatten. While RBA is expected to leave the cash rate at 0.1% on Tuesday, a number of economists have either brought forward their forecasts for the first rate hike to June or are highlighting risks from Governor Philip Lowe turning hawkish, a Bloomberg survey shows.

In rates, Cash USTs are relatively. Treasuries curve steepens with long-end yields cheaper by ~3bp on the day despite gains for bunds and gilts rally during European morning. U.S. 10-year yields around 2.40%, cheaper by ~2bp on the day, lagging bunds and gilts by 6bp and 7bp in the sector; with 2- year richer by ~2bp on the day at 2.43%, 2s10s is steeper by more than ~3bp though still inverted. A heavy IG credit issuance slate is expected this week and, beginning Tuesday, talks by several Fed officials. Japanese government bonds were mixed, with futures and maturities up to 10-years rising on support from the Bank of Japan, while the curve continued to steepen as super-long sectors are outside of the yield-curve control policy and prone to overseas moves. Bunds, gilts climbed, erasing opening declines on haven demand amid escalating geopolitical tensions after the EU says Russia is responsible for atrocities in Ukraine.

Fixed income is mixed. German curve bull-steepens slightly, belly outperforms, richening 4-5bps. Peripheral spreads widen to core. Gilts bull-flatten, richening 6bps across the back end. Cash USTs are relatively quiet. In FX,

In commodities, crude futures give back modest gains. WTI drifts lower, stalling after a brief breach of $100. Brent dips back toward a $103-handle. Base metals are mixed; LME tin falls 1.2% while LME zinc gains 1.9%. Spot gold reverses Asia’s losses to trade near $1,926/oz.

Looking at today’s calendar, we get US February factory orders, Germany February trade balance, Canada February building permits Central bank speakers include the BoE’s Bailey and Cunliffe.

Market Snapshot

- S&P 500 futures little changed at 4,539.50

- STOXX Europe 600 up 0.1% to 458.89

- MXAP up 1.0% to 181.56

- MXAPJ up 1.1% to 598.67

- Nikkei up 0.3% to 27,736.47

- Topix up 0.5% to 1,953.63

- Hang Seng Index up 2.1% to 22,502.31

- Shanghai Composite up 0.9% to 3,282.72

- Sensex up 2.1% to 60,498.35

- Australia S&P/ASX 200 up 0.3% to 7,513.73

- Kospi up 0.7% to 2,757.90

- German 10Y yield little changed at 0.50%

- Euro little changed at $1.1036

- Brent Futures up 0.5% to $104.86/bbl

- Gold spot up 0.3% to $1,930.90

- U.S. Dollar Index little changed at 98.62

Top Overnight News from Bloomberg

- Japan showed investors last week just how tenacious it would be in keeping interest rates locked near zero in the world’s third- biggest economy despite skyrocketing inflation across the globe and the risk of weakening the yen to damaging levels

- Turkish inflation is galloping toward a fresh 20-year high, leaving the lira increasingly vulnerable by depriving the currency of a buffer against market selloffs

- The EU condemned Russia for atrocities by its military in several Ukrainian towns, saying that the bloc will work “as a matter of urgency” on additional sanctions against Moscow

- Hungarian Prime Minister Viktor Orban scored a crushing election victory to clinch a fourth consecutive term, overcoming criticism about democratic backsliding, his lukewarm support for war-ravaged Ukraine and close ties with Russian President Vladimir Putin

- French electricity prices for Monday surged to near a ceiling of 3,000 euros as a cold snap coincided with outages for almost half of the nation’s nuclear reactors

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks initially traded mixed but later turned mostly higher. ASX 200 saw early outperformance as mining names surged, with rising EV sales also boosting some Russia-related metals. Nikkei 225 traded flat with a downside bias throughout the session. Hang Seng outperformed and was bolstered at the open by Chinese dual-listed stocks, with the tech sector the main beneficiary of the weekend Audit news, whilst gains compounded after HK Chief Executive Lam said she will not seek a second term. China on Saturday proposed revising confidentiality rules involving offshore listings, removing a legal hurdle to cooperation on audit oversight while putting the onus on Chinese companies to protect state secrets, via Reuters. Mainland China was closed due to a domestic holiday.

Top Asian News

- Chinese Tech Stocks Jump as U.S. Delisting Concerns Ease

- Sri Lanka Central Bank Chief Resigns as Crisis Worsens

- Ex-Japan Forex Chief Sees Kuroda Standing Firm Despite Weak Yen

- Pakistan’s President to Appoint Caretaker PM After Consultation

European bourses are mixed, Euro Stoxx 50 +0.2%, failing to derive firm direction after initial opening gains faded in limited newsflow. Sectors, are mixed as well with Roche and Bayer lifting Health Care and the former aiding the SMI while Banking names lag modestly. Stateside, are similarly indifferent with a thin docket ahead.US futures Spanish PM Sanchez says they are to spend EUR 11bn on the semi-conductor and micro-chip industry, via Reuters

Top European News

- Spain Plans to Invest $12.4 Billion in Chips, Semiconductors

- Bunds, Gilts Lead Bond Gains Amid Haven Buying After EU Comment

- Russian Stocks Fluctuate as Traders Mull Talks, Sanctions

- European Gas Swings With EU Mulling New Sanctions Against Russia

In FX, greenback grinds higher amidst more Fed officials flagging half point hikes post-US jobs data and pre- factory orders, DXY forms 98.500+ base. Aussie outperforms ahead of AIG construction index, final PMIs and RBA policy meeting that might see rate guidance turn more plausible than patient; AUD/USD pivots 0.7500 and AUD/NZDsolid on the 1.0800 handle. Euro underperforms as EGB yields retreat, Russia/Ukraine angst persists and option expiry interest exerts downside pressure, EUR/USD drifts down from 1.1050+ towards 1.1000 and 1bln rolling off between the round number and 1.1010. Forint underpinned following resounding win by Hungarian PM Orban, but Lira undermined by further increases in Turkish CPI and PPI. S&P said Turkey long-term LC rating lowered to ‘B+’ from ‘BB-‘; FC rating affirmed at ‘B+’; outlook remains negative.

In commodities, WTI and are choppy within a relatively contained USD 2.0/bbl range, as we await updates on the Russia-Brent Ukraine talks set to resume on Monday. Currently, the benchmarks are holding within USD 98.00-100.70/bbl and USD 102.90-105.80/bbl parameters respectively. Reports on Saturday suggested Gazprom has stopped deliveries of Russian gas to Germany via the Yamal-Europe pipeline. It was then reported Gazprom has booked to pump gas through the Polish section of the Yamal-Europe pipeline on Sunday night to Monday, according to Interfax. Goldman Sachs upgrades its 2023 oil price forecast to USD 115/bbl (prev. 110/bbl); still forecast end-year oil at USD 125/bbl. “A UN-brokered two-month ceasefire in Yemen was broadly holding on its first full day with oil shipments reaching the port of Hodeida”, according to The Guardian. The Russian Energy Ministry has delayed the publication of March oil output numbers amid technical issues, according to reports. Azerbaijan plans to supply 9.5bcm of gas to Italy, according to Interfax. Indian State has cancelled bids by Adani Enterprises to supply imported coal as prices that were quoted were too high, according to a government official cited by Reuters. Spot are firmer, deriving modest impetus from the deterioration in sentiment seen around thegold/silver European cash open, metals towards top-end of respective ranges.

US Event Calendar

- 10:00: Feb. Factory Orders, est. -0.6%, prior 1.4%

- 10:00: Feb. Factory Orders Ex Trans, est. 0.3%, prior 1.0%

- 10:00: Feb. Durable Goods Orders, est. -2.2%, prior -2.2%; -Less Transportation, est. -0.6%, prior -0.6%

- 10:00: Feb. Cap Goods Orders Nondef Ex Air, prior -0.3%;

- 10:00: Feb. Cap Goods Ship Nondef Ex Air, prior 0.5%

DB concludes the overnight wrap

We also published our Q1 performance review on Friday, covering what was a lackluster month for most asset classes given the war and the tightening policy outlook. You can find that here.

In Ukraine, Russia’s retreat from the north, including Kyiv, and pivot to concentrate their war effort on the east drove some optimism across markets. However, the big story over the weekend were the atrocities left in the wake of the retreating Russian forces, which prompted renewed calls for sanctions from the EU and US. The bloc remained split on the question of whether Russia’s energy sector should be targeted, but the momentum was building toward it. Lithuania and Poland announced they would stop importing Russian energy, despite diplomats noting EU sanctions were strongest when they were coordinated. Germany demurred, though some leaders were at least countenancing energy sanctions, with Defense Minister Lambrecht telling an interviewer the EU should discuss such measures.

Elsewhere, there were positive negotiation developments. Secretary of State Blinken gave the US imprimatur for President Zelensky to offer the removal of western sanctions in exchange for peace, which was an uncertain prospect. It remains too early to tell whether negotiations have turned a new leaf given the reported war crimes and intense fighting in the east. On the latter point, port city Odessa endured rocket attacks over the weekend.

To start the week, the Nikkei (+0.06%) is flat with the Hang Seng (+1.24%) and Kopsi (+0.37%) strengthening. Chinese tech shares listed in Hong Kong soared following China’s decision to allow US authorities better audit access to Chinese firms and thus avoid delisting from US exchanges. Markets in mainland China are closed to start the week for holiday. US futures point to a lower open, with S&P 500 (-0.14%) and Nasdaq (-0.26%) futures retreating.

Oil prices are extending last week’s drop in early trading, with Brent futures -0.41% at $103.96/bbl and WTI futures (-0.25%) staying below $100/bbl. Along with the increase in US oil supply, demand could take a hit as the Covid outbreak in China has intensified, driving more severe lockdowns, including in Shanghai. Reports of emerging sub-variants to Omicron in China will also bear watching in the coming days and weeks. Elsewhere, 2yr Treasury yields (+2.44bps) increased to three-year highs of 2.48%. Try as it might to steepen, the 2s10s curve remains -6.9bps inverted this morning.

On the curve, the 2s10s Treasury yield curve ended last week -8.0bps inverted. There has been plenty ink spiled on the recessionary risk signal embedded within the yield curve. Meanwhile, the narrative is that healthy sector balance sheets, including a stockpile of excess consumer savings, will foam the runway of any slowdown. At the same time, financial conditions have now eased to pre-invasion levels despite the implied market pricing of 2022 Fed hikes hitting their highest level. One wonders if strong balance sheets have made consumers less exposed to credit conditions, attenuating the link between higher policy rates and slowing demand. Indeed, Fed data show household financial obligations as a percent of income are at multi-decade lows while FHFA data show less than 1% of outstanding American mortgages are adjustable rate, often the biggest credit exposure for households, well-below levels during the last hiking cycle let alone the peak of the housing crisis and subsequent recovery. Instead of foaming the runway, might it be that strong balance sheets will force the Fed to hack through more underbrush to reach the clearing (to mix my metaphors) via higher terminal rates? Of course, this picture could turn quickly as Covid-era mortgage and student loan forbearance programs come to an end. Further, tightening credit conditions are but one mechanism slowing demand; wealth effects as higher rates hit home prices and equity portfolios and demand destruction if real wages lag will contribute, while the Fed still holds out hope that supply side expansion will also help bring inflation back to target.

How the Fed are thinking about these questions will be expounded in the March FOMC meeting minutes released this week. Liftoff was the main event at the March meeting, and the minutes should reveal how policymakers are considering the sizing and pace of future rate hikes, especially as St. Louis Fed President Bullard dissented in favor of a +50bp hike in March. The minutes should also have more detail about the rundown of the Fed’s balance sheet, as I covered with our Chief US economist in a piece last Friday (see here). The Fed has signalled QT could begin as soon as May but didn’t clarify QT’s parameters. After a year of careful, cautious balance sheet communication (it appears QT won’t get the ‘talking about talking about’ treatment that taper received), the omission was notable, so the minutes should contain useful information.

The ECB will also release the account of their March monetary policy meeting, where investors can look for more clues about how the central bank is balancing the risks from the war and from higher inflation when setting the course for monetary policy. ECB policy pricing through 2022 has also recovered from its depths at the invasion’s outset, with +54bps of tightening priced in to start the week.

Rounding out central banks, the RBA has its meeting tomorrow, BoE Governor Bailey speaks today, Fed Vice Chair nominee Brainard speaks tomorrow, while a number of other speakers from the Fed, ECB, BoE, and BoJ will hit the tapes.

It is a lighter week for global data releases, with US ISM services, China PMIs, Eurozone PPI, and Japan consumer confidence figures among the highlights. Earnings are light as well, but Sberbank and Lukoil releases will provide insight about the impact of the war on Russian companies. On politics, the first round of the French Presidential elections are coming up Sunday.

A quick wrap on the week that was. As mentioned, Russia’s retreat from northern theaters and the yield curve inversion were the main focus along with the US’s historic release of Strategic Petroleum Reserves that sent brent crude oil futures -13.18% (-2.89% Friday) lower.

Sovereign bonds traded with notable volatility, with ten-year Bund and Treasury yields falling -3.2bps (+0.7bps Friday) and -9.1bps (+4.4bps Friday), respectively. This came as policy rates continued to price additional tightening, driving 2yr Treasury yields +18.7bps (+12.2bps Friday) higher, sending the 2s10s yield curve to -8.0bps after flirting with inversion since early in the week. 2yr Bund yields increased +6.7bps (+0.6bps Friday), even moving above zero intraweek.

Equity markets were much more subdued by comparison, with the VIX falling -1.19 ppts (-0.93ppts Friday) and below 20 for the first time in almost 2 months. The S&P 500 managed to just eek out a weekly gain at +0.06% (+0.34% Friday), while news of Russian retreat was a bigger boost to European stocks, with STOXX 600 gaining +1.06% (+0.54% Friday).

Friday brought the US employment situation report; nonfarm payrolls increased by +431k in March. The slightly-below-expectations reading was offset by a revision to the previous month’s figures. The unemployment rate ticked down to a post-pandemic low of +3.6%. Meanwhile core PCE inflation increased to a fresh four-decade high of +5.4% in the US. Eurozone CPI surprised well to the upside month-over-month, gaining +2.5% versus expectations of +1.8%, while core CPI increased to +3.0% on a year-over-year basis.

Finally, US ISM manufacturing at 57.1, was slightly below expectations and the prior month print, while the prices paid component surprised higher at 87.1.