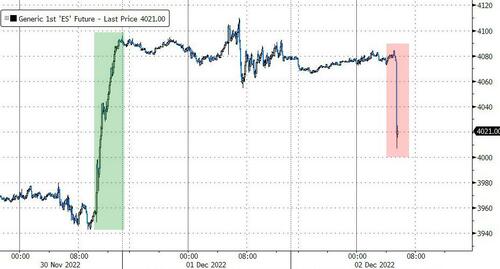

US stock futures were muted, trading in a narrow 5 point range and unchanged for the second day in a row after a blistering post-Powell rally, as investors awaited the latest jobs report for clues around the strength of the domestic economy (with consensus expecting a +200K print, it will be the weakest monthly gain since Dec 2020) as well as its impact on the outlook for rate hikes. Contracts on the Nasdaq 100 and the S&P 500 were little changed 745 a.m. ET. The underlying indexes were also subdued Thursday after a sharp rally that was fueled by signals from Federal Reserve Chair Jerome Powell that the central bank could slow the pace of rate hikes at this month’s meeting.

Among notable movers in premarket trading, Marvell Technology dropped after the US chipmaker issued a tepid sales forecast for the fourth quarter. Zscaler Inc. also slumped after the cloud security company gave a forecast for calculated billings that fell slightly short of the average analyst estimate at the midpoint. Here are all the notable premarket movers:

- Marvell Technology shares drop 7% in premarket trading after the US chipmaker issued a tepid sales forecast for the fourth quarter. Analysts note that weakness stemmed from the company’s data-center business, as well as a broad softening in demand from China. This indicates that the decline in demand for chips continues to spread outside of the computer and smartphone industries, they said.

- Opendoor shares fall as much as 2.2% in premarket trading, after the real estate platform provider’s CEO Eric Wu stepped down to become president of its marketplace business to be replaced as CEO by Carrie Wheeler. Analysts said that the CEO change came as a surprise and raised questions around its timing amid a tough backdrop for the real estate market.

- Zscaler shares are down 9% in premarket, after the cloud security company gave a forecast for calculated billings that fell slightly short of the average analyst estimate at the midpoint. Analysts noted that revenue and billings growth decelerated as macro headwinds intensified.

- Asana shares slumped as much as 17% in premarket, after the software firm’s revenue forecast for the fourth quarter disappointed, with analysts cautious on the stock given its greater exposure to job losses in the technology industry, which could put pressure on future growth.

- Veeva shares drop 4.2% in postmarket trading after the company’s adjusted EPS and billings guidance for the fourth quarter missed Street estimate.

- Smartsheet’s strong quarterly results beat across the board and set the work-management software firm up well to deliver durable growth into next year, analysts say. Shares in the firm were up more than 9% in after-hours trading.

- Samsara rose 20% postmarket after the software company boosted its year revenue outlook. The company also posted 3Q sales that topped expectations and delivered a narrower-than-expected loss

US stocks have rallied since mid-October, with the S&P 500 posting its first two-month gain since August 2021, on bets that inflation has peaked. The blue-chip Dow is back in a technical bull market, but market strategists have warned equities could see further declines in the first half of next year amid the specter of a recession. Data from Bank of America, citing EPFR Global, showed US stock funds had their biggest outflows since April in the week through Nov. 30. US large cap funds had the largest redemptions at $14.5 billion. Among sectors, utilities and health care attracted inflows, while $600 million exited financials.

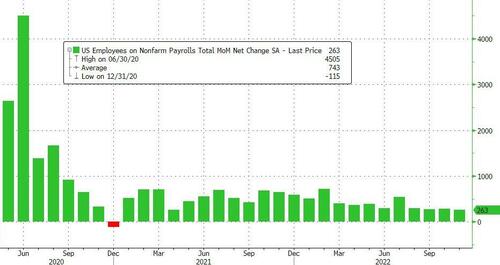

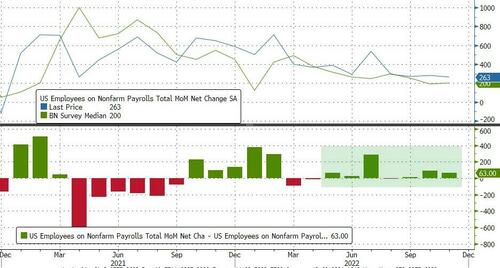

All eyes today are on the November non-farm payrolls report, with economists expecting it to show signs that labor demand is ebbing. Still, they say a bigger slowdown is needed to bring that more in line with labor supply in order to contain the wage growth that’s helped fuel inflation. We have posted a full preview here, but the median estimate for November jobs report’s employment change is 200k; crowd-sourced whisper number is 187k. Nonfarm payrolls change has exceeded the median estimate for seven months running; 2-year yield’s YTD high 4.799% was reached on Nov. 4 following October jobs report.

In terms of the market’s reaction to the headline jobs print, this is what Goldman expects:

- >261k (aka higher than last print) S&P down at least 2%

- 175k – 261k S&P down 1 – 2%

- 125k – 175k S&P up 50bps – 1%

- 0 – 125k S&P up 1 – 2% <0 S&P down 1 – 2% on R word fears

Many economists reckon Friday’s employment report may fall short of the turning point Fed officials are seeking in their battle to beat back inflation. The median projection in a Bloomberg survey calls for payrolls to rise 200,000 in November, cooling only slightly from the previous month. Other market watchers point to signs that steep rate hikes will tip more economies into a downturn.

“Nervous Fed-watchers will be hoping that the non-farms number comes in somewhat below consensus to strengthen the case for a moderation of aggressive rate hikes so far,” said Richard Hunter, head of markets at Interactive Investor. “On the other hand, a stronger-than-expected reading, while positive for the economy, would be damaging for that case in another example of good news being bad news for investors.”

“Consensus is that recession is coming but equities cannot bottom before it starts, inflation won’t fall quickly so central banks can’t blink, China reopening will be a messy process, and Europe remains tricky,” Barclays Plc strategist Emmanuel Cau wrote in a note.

And speaking of that, recession concerns have become more pronounced after data on Thursday showed November factory activity sliding in a range of countries, with American manufacturing contracting for the first time since May 2020. Recent company reports also hint at mounting pressure on company earnings, and companies, ranging from Amazon.com to Ford Motor Co., have announced thousands of job cuts.

In Europe, the Stoxx 50 is little changed before the release of US payroll data. Here are the top European movers:

- Credit Suisse shares rise as much as 6.9%, halting a 13-day losing streak, as Chairman Axel Lehmann said the bank has mostly stemmed the huge outflow of client assets.

- AJ Bell jumps as much as 12% to its highest level in a year after Jefferies upgraded its rating to buy from hold, praising the strategy of the firm’s trading platform.

- Goldman Sachs upgrades both AB Foods and H&M to neutral. AB Foods shares rise as much as 4.3%, touching the highest since August, while H&M gains as much as 3.1%.

- Separately, Morgan Stanley sees a “perfect storm” ahead for apparel retail as revenue and cost pressures collide, in a note putting an overweight rating on AB Foods, equal-weights on Next and Inditex and underweight on H&M.

- Trigano hits the highest level since April, rising as much as 3.6% in a third straight day of gains since the French caravan maker announced results on Tuesday evening.

- Sanofi is the worst performer across France’s SBF 120 index on Friday, losing as much as 2.5%, after the French pharmaceutical group confirmed that any offer it would make for Horizon Therapeutics would be solely in cash.

- PolyPeptide falls as much as 37%, the most since July, after the Swiss peptides maker issued its second profit warning of 2022. The update casts a “very negative shadow” on the company’s strategic alignment and management, ZKB says, downgrading the stock to underperform from market perform.

- Kerry Group falls as much as 3.8% in Dublin, heading for a seventh daily drop, after Citi downgraded to neutral from buy, expecting the food company to face volume headwinds in 2023 as customers reduce inventory levels.

- DOF shares drop as much as 53% in Oslo, the most since 2016, after the firm said it will petition for reconstruction proceedings with Hordaland district court.

Earlier in the session, Asia stocks fell, trimming their weekly gain, as investors sold off some positions ahead of a key jobs report in the US. The MSCI Asia Pacific Index declined as much as 0.9%, with most sectors in the red, led by energy and utility stocks. Benchmarks in Japan and South Korea were among the worst performers as investors await more signs of China’s reopening and economic policy at an upcoming meeting of the country’s top leaders. Chinese stocks edged lower. Read: China Watchers See Shift to Growth at Politburo Meeting (1) All eyes will also be on the payrolls and employment data due in the US Friday.

“The US job report will be the key risk event today,” said Jun Rong Yeap, market strategist at IG Asia in a note. “Current expectations are pointing to job gains of 200,000, which is a step closer to pre-Covid levels.” The Asian measure is poised to advance more than 2% this week, set for its fifth weekly gain. Bullish indicators are growing, with the index testing its 200-day moving average for the first time since September 2021, as global funds dip back into the region. Foreign funds pumped about $15.7 billion into emerging Asia shares outside China last month, the biggest inflows in two years, Bloomberg-compiled data shows.

Japanese stocks dropped as investors weighed data showing US manufacturing contracted in November for the first time since May 2020 and as the yen strengthened against the dollar. The Topix fell 1.6% to close at 1,953.98, while the Nikkei declined 1.6% to 27,777.90. The Japanese currency slightly extended against the greenback, up nearly 3% on the week. Daiichi Sankyo Co. contributed the most to the Topix decline, decreasing 4.2%. Out of 2,164 stocks in the index, 201 rose and 1,919 fell, while 44 were unchanged. The yen has been gaining strength against the dollar and investors are cautious ahead of the monthly US employment report, creating a double-whammy for stocks, said Ercan Serdar Armutcu, head of electronic trading at Mita Securities.

Australian stocks snapped a 3-day rally: the S&P/ASX 200 index fell 0.7% to close at 7,301.50, taking a breather after three consecutive days of advances. Banks and some commodity stocks dragged the benchmark most. Still, the index posted a weekly advance of 0.6%, ending a second week in the green. In New Zealand, the S&P/NZX 50 index fell 0.1% to 11,641.85.

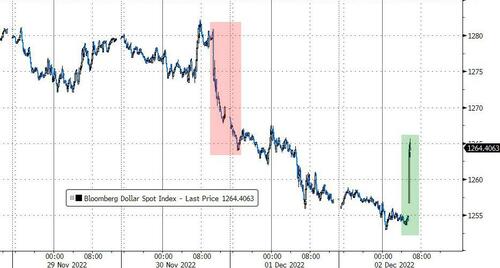

In FX, the Bloomberg Dollar Spot Index gave up an early Asia session gain as the greenback traded mixed versus its Group-of-10 peers.

- The euro rose to touch $1.0545, the highest level since June, and its volatility skew shifted higher as leveraged desks unwind long-term bearish bets.

- The yen led G-10 gains. The Japanese currency briefly strengthened beyond 134 per dollar and is set for its longest rising streak since April 2021. BOJ’s new board member Naoki Tamura said “it would be appropriate to conduct a review at the right time, including the monetary policy framework and inflation target”.

- Australian and New Zealand bonds rally as a drop in stocks boosts demand for haven assets and ahead of the key US employment report later Friday. Scandinavian currencies were the worst G-10 performers

In rates, treasuries twist-steepened, with the 2-year yield falling around 4bps and the 30-year yield rising by about 2bps; the 2- to 5-year yields declined to lowest levels in several weeks; 2s10s approaches Wednesday’s high. Front-end yields are richer by 2bp-3bp curve, 10-year cheaper by ~1bp at 3.51%, steepening 2s10s by ~3bp; bunds outperform by 4bp, gilts by 6bp in the 10-year sector. Bunds outperform in bull-steepening price action. Bund and gilt curves bull steepen. Peripheral spreads widen to Germany with 10y BTP/Bund narrowing 1.1bps to 187.2bps. Dollar issuance slate empty so far, while no issuers announced bond sales on Thursday; December is expected to be slow for issuance with just $20b expected vs November tally of $102b

In commodities, oil headed for its biggest weekly gain in almost two months, benefiting from looser Chinese curbs, calls by the Biden administration to halt sales from US strategic reserves and an OPEC producers’ group decision to cut crude supply by the most since 2020. Crude futures were steady. WTI trades within Thursday’s range at near $81.22. Most base metals trade in the green. WTI and Brent futures are subdued in early European hours as market participants await the next catalyst, and with the clock ticking down to the US jobs report. The G7 price cap coalition official said they are ‘very very close’ to an agreement on a USD 60/bbl price cap for Russian oil exports and there is some flexibility in determining the market price of Russian crude for the price cap. The official said oil markets seem pretty comfortable with a cap mechanism and noted uncertainty on how Russia will react to a USD 60/bbl cap but added that Russia has no good options, according to Reuters. Spot gold is flat in pre-NFP trade and probes the USD 1,800/oz mark with the 200 DMA today at USD 1,795/oz. Base metal futures are similarly flat/mixed with 3M copper off session highs of around USD 8,418/t and closer to session lows.

To the day ahead now, and the main highlight will be the US jobs report for November. Otherwise, we’ll get data on French industrial production and Euro Area PPI for October. Elsewhere, central bank speakers include ECB Vice President de Guindos, the ECB’s Villeroy and Nagel, along with the Fed’s Barkin and Evans.

Market Snapshot

- S&P 500 futures down 0.1% to 4,076.75

- STOXX Europe 600 down 0.1% to 443.62

- MXAP down 0.5% to 158.53

- MXAPJ down 0.6% to 513.09

- Nikkei down 1.6% to 27,777.90

- Topix down 1.6% to 1,953.98

- Hang Seng Index down 0.3% to 18,675.35

- Shanghai Composite down 0.3% to 3,156.14

- Sensex down 0.7% to 62,851.92

- Australia S&P/ASX 200 down 0.7% to 7,301.46

- Kospi down 1.8% to 2,434.33

- German 10Y yield down 1.2% to 1.79%

- Euro little changed at $1.0520

- Brent Futures little changed at $86.82/bbl

- Gold spot down 0.1% to $1,801.49

- U.S. Dollar Index down 0.13% to 104.59

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said inflation expectations need to remain anchored and that the public needs to know price gains will be brought back to target

- The global economy may be headed for a new era of volatile inflation, making it even more crucial to anchor expectations for where prices are headed, central bank governors warned Friday

- There’s been a “significant” improvement in relations between the European Union and UK, and a landing zone in their Brexit negotiations is possible in the next few weeks, Ireland’s foreign minister said, even though there has been “no major breakthroughs” over the Northern Ireland Protocol

- Italy will meet all its second semester objectives for the Next Generation EU program by the end of this year, Economy and Finance Minister Giancarlo Giorgetti said

- Option traders are growing less concerned about potential dollar strength as the drivers of the US currency’s world-beating rally fade away

- A rush by Japan’s life insurers to protect themselves against a stronger yen may have the paradoxical effect of accelerating gains in the currency

- Central banks are facing their first test in a new world of more variable inflation that they must pass in order to re-establish confidence in the community, Reserve Bank of Australia Governor Philip Lowe said

- South African President Cyril Ramaphosa’s allies closed ranks behind him as the governing party’s top leaders prepared to discuss his fate over an independent panel’s findings that there may be grounds for his impeachment. The rand rallied and government bond yields fell

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were subdued following the uninspired lead from the US where the major indices took a breather from the Powell-induced rally and finished relatively flat amid soft data releases and ahead of the looming NFP jobs report. ASX 200 was pressured as weakness in real estate, energy and the top-weighted financials sector overshadowed the resilience in defensives. Nikkei 225 underperformed and fell back below the 28,000 level, while there were notable comments from BoJ’s Tamura who called for a review of the BoJ’s ultra-easy monetary policy framework. Hang Seng and Shanghai Comp were indecisive but with downside stemmed following the recent slight easing of China’s COVID rules.

Top Asian News

- China’s top leaders will likely signal a more reasonable approach to COVID controls at the upcoming meeting of the CPC’s Politburo which usually takes place in early December, according to economists cited by Bloomberg.

- China’s Beijing City to allow passengers without a 48-hour COVID nucleic acid negative certificate to take buses and subways from Monday; busses and subways cannot reject people with no COVID test results, according to Bloomberg.

- PBoC Governor Yi said the forecast for China’s inflation in 2023 is in a moderate range, while he noted the current focus is on growth and that monetary policy has been pretty accommodative.

- Chinese Finance Minister Liu Kun said they will keep the economy within a reasonable range and strive to realise better results, while Liu added that China’s economy will keep growing at a reasonable speed with stable employment and prices, according to Reuters.

- China’s top four banks intend to issue offshore loans for domestic developers overseas debt repayments, via Reuters citing sources.

Equities in Europe are mostly mildly softer with the ranges particularly narrow ahead of the US jobs report; US futures in-fitting. DXY is under pressure with peers modestly firmer and JPY outpacing given yield differentials and Tamura’s remarks. Bunds are modest bid but failed to breach 143.00 with USTs essentially unchanged pre-NFP. Crude benchmarks similarly contained awaiting oil cap/OPEC+ developments. Beijing City is to ease its COVID travel restrictions from Monday while reports indicate the Politburo could signal a more reasonable approach. Looking ahead, highlights include US & Canadian Jobs Reports, Speakers from ECB’s de Guindos, Fed’s Barkin & Evans.

Top European News

- ECB President Lagarde said monetary policy is complicated by three uncertainties including the global economy and CPI outlook, while she added that all policies need to act in concert for sustainable growth.

- US President Biden and French President Macron made major progress in talks on how to alleviate the impact of the Inflation Reduction Act on Europe in which the US could use executive orders to give European allies the same level of exemptions on local content as countries with a free-trade deal, according to a source at the French Finance Ministry

- EU Commissioner Breton withdrew from EU-US Trade and Technology Council discussions and believed that talks will not provide enough space to EU concerns, according to Politico.

Fixed Income

- Modest overnight Bund pressure proved shortlived and appeared more of a pause for breath rather than a concerted pullback.

- Instead, the German benchmark has tested but failed to breach 143.00 while USTs are essentially unchanged in 10tick parameters pre-NFP.

- NFP aside, newsflow has been limited and of insufficient magnitude thus far to impact the above price action.

Commodities

- WTI and Brent futures are subdued in early European hours as market participants await the next catalyst, and with the clock ticking down to the US jobs report.

- Spot gold is flat in pre-NFP trade and probes the USD 1,800/oz mark with the 200 DMA today at USD 1,795/oz.

- Base metal futures are similarly flat/mixed with 3M copper off session highs of around USD 8,418/t and closer to session lows.

- G7 price cap coalition official said they are ‘very very close’ to an agreement on a USD 60/bbl price cap for Russian oil exports and there is some flexibility in determining the market price of Russian crude for the price cap. The official said oil markets seem pretty comfortable with a cap mechanism and noted uncertainty on how Russia will react to a USD 60/bbl cap but added that Russia has no good options, according to Reuters.

- Just one of these three ministries/ministers handling the oil price cap is yet to okay it, according to WSJ’s Norman’s sources.

- Turkish media says a fire broke out in the port of Samsun due to the explosion of an oil depot, according to Al Arabiya.

- India will continue to buy oil from wherever possible, including Russia, according to a source cited by Reuters; adds that India will continue to get oil, even beyond January 19th.

FX

- DXY sees another session of early European weakness for the broader Dollar and index as the JPY continues to strengthen.

- JPY is again the marked outperformer with gains fuelled by further narrowing yield differentials post-Powell, and with BoJ’s board member Tamura yesterday striking somewhat of a hawkish tone; USD/JPY down to 133.64 at worst.

- NZD, AUD, CHF, EUR, GBP are all modestly firmer against the USD and to varying degrees, whilst the CAD lags ahead of the Canadian jobs report.

- PBoC set USD/CNY mid-point at 7.0542 vs exp. 7.0563 (prev. 7.1225)

- Chairman of South Africa’s ANC has denied that President Ramaphosa has considered resigning.

Geopolitics

- Military analysts claimed that satellite images suggested Russia is planning an ‘imminent’ large-scale missile strike on Ukraine, according to Sky News Australia.

- Belarusian border guards shot down a Ukrainian march that conducted reconnaissance and photographing operations over the border areas with Ukraine, according to Al Jazeera.

- US imposed additional North Korea-related sanctions on three individuals and Japan imposed additional sanctions on 3 entities and 1 individual from North Korea, while South Korea imposed sanctions on 8 individuals and 7 agencies over North Korea’s weapons programme, according to Reuters.

US Event Calendar

- 08:30: Nov. Change in Nonfarm Payrolls, est. 200,000, prior 261,000

- Change in Private Payrolls, est. 185,000, prior 233,000

- Change in Manufact. Payrolls, est. 18,000, prior 32,000

- Unemployment Rate, est. 3.7%, prior 3.7%

- Underemployment Rate, prior 6.8%

- Labor Force Participation Rate, est. 62.3%, prior 62.2%

- Nov. Average Weekly Hours All Emplo, est. 34.5, prior 34.5

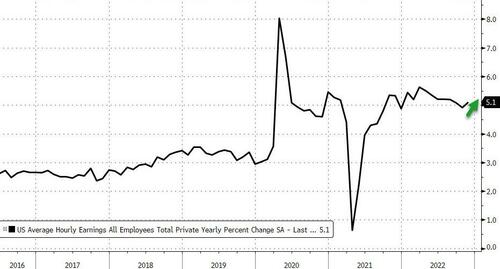

- Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- Average Hourly Earnings YoY, est. 4.6%, prior 4.7%

Central Bank Speakers

- 09:15: Fed’s Barkin Speaks in Richmond

- 10:15: Fed’s Evans Speaks at Event on Financial Regulation

- 14:00: Fed’s Evans Gives Welcome Remarks at Economic Symposium

DB’s Jim Reid concludes the overnight wrap

After the massive surge on Wednesday following Fed Chair Powell’s speech, the rally in risk assets stalled out yesterday thanks to weak US data that sparked growing concern about the state of the economy. There were lots of releases to digest, but in many ways the most notable was the ISM manufacturing print, which fell into contractionary territory for the first time since May 2020, coming in beneath expectations at 49.0, and crucially beneath the 50-mark that separates expansion from contraction. The sub-components didn’t look too promising either, with the employment reading at 48.4, and new orders down to 47.2.

Of course, we should add the usual caveats this is just one data release, but it fits into a declining trend for the ISM over the last year, and only added to fears about a potential recession. In addition, it comes on the back of some other pretty negative data over recent days. For instance, last week’s flash PMIs for November were also in contractionary territory, and Wednesday’s Chicago PMI release came in at levels that have historically been consistent with recessions.

This gloomy backdrop meant that investors once again put increasing emphasis on a dovish pivot from the Fed. Indeed, terminal rate pricing fell back to 4.86%, which is the lowest it’s been in a couple of weeks and is noticeably beneath the 5% levels before Powell’s Wednesday speech. In turn, this led to a further rally in Treasuries, with the 10yr yield coming down by a sizeable -10.1bps on the day to 3.50%, which is its lowest level in a couple of months, although we’ve had a slight +3.4bps pullback this morning. Bear in mind that the 10yr Treasury yield hit an intraday peak of 4.34% in late-October, so we’re now down by around -80bps from those levels. Furthermore, the decline yesterday was driven by real yields, with the 10yr real yield down -10.7bps on the day to 1.14%.

Those hopes for a dovish pivot from investors were given added support by the latest PCE inflation data for October, which is the measure the Fed officially target. That showed the month-on-month numbers coming in beneath expectations, with headline PCE up +0.3% (vs. +0.4% expected), and core PCE up +0.2% (vs. +0.3% expected). There were also signs that inflationary pressures were waning in the ISM release, since the prices paid indicator fell to 43.0 (vs. 45.9 expected), marking the lowest level for that reading since May 2020.

Whilst this environment proved a great backdrop for Treasuries, equities had a tougher time yesterday, with the S&P 500 (-0.09%) ending the session modestly lower as investors considered the tough outlook. Banks (-1.77%) were one of the worst-performing sectors as bond yields continued their decline, but tech was a relative outperformer and the FANG+ index (+0.55%) of megacap tech stocks even hit a 2-month high. Over in Europe the major indices advanced for the most part, but that was more a reflection of them catching up to the previous day’s rally following Powell’s speech. That saw the STOXX 600 (+0.89%) hit its highest level in nearly 5 months, with the index now on track for a 7th consecutive weekly advance.

As investors mull over the prospects for a dovish Fed pivot, attention today will turn to the US jobs report, which is out at 13:30 London time. Our US economists expect that growth in nonfarm payrolls will have slowed to +200k in November, which is in line with consensus and would mark the weakest number since December 2020. That should still be enough to lower the unemployment rate by a tenth to 3.6%, but clearly a downside surprise would only add to the jitters in markets given the negative survey data for November that we’ve already had.

Speaking of the Fed, yesterday we heard from a few officials, including New York President Williams, who said “I still think we have a ways to go” on raising rates. He added that he felt “we need to get the federal funds rate above the inflation rate”, and the two still remain some way apart even with the recent series of 75bp hikes. Remember as well that today is the last opportunity for FOMC officials to comment before their blackout period begins ahead of the next meeting, so these comments are some of the last clues we’ll get ahead of the next decision and the December dot plot. Elsewhere, we also heard that the new Chicago Fed President would be Austan Goolsbee, a former chair of the Council of Economic Advisers under President Obama. Goolsbee will have a vote on the FOMC in 2023, and has previously said on October 31 that a peak fed funds rate around 5% “kind of makes sense to me.”

Back in Europe, sovereign bonds rallied alongside US Treasuries as investors caught up with Chair Powell’s speech and priced in a more dovish outcome for the ECB as well. For instance, the hike priced in for this month’s meeting fell to 54.1bps, which is the lowest since mid-September as investors became increasingly sceptical that the ECB will continue to hike at a 75bps pace. That triggered a big rally across the continent, with yields on 10yr bunds (-11.7bps), OATs (-14.0bps) and BTPs (-17.6bps) all moving lower on the day. In the meantime, the continued weakness for the US Dollar meant that the Euro surpassed the $1.05 mark in trading for the first time since June, yesterday, where it remains this morning.

Overnight in Asia, equity markets have continued that trend lower from the US, with the Nikkei (-1.72%), the KOSPI (-1.45%), the Hang Seng (-0.60%), the CSI 300 (-0.49%) and the Shanghai Composite (-0.24%) all trading lower. The moves came in spite of further signs of waning inflationary pressures, with South Korean CPI falling to +5.0% in November (vs. +5.2% expected). That’s been echoed by US futures, with those on the S&P 500 (-0.19%) and the NASDAQ 100 (-0.33%) both in negative territory ahead of today’s jobs report.

Finally, with all the data releases yesterday, there were plenty of numbers that got relatively less attention than usual, but still told an interesting story. First, the Nationwide house price index in the UK saw a monthly drop of -1.4% in November, which is the steepest decline since early 2009 if you exclude the pandemic months of April and May 2020. Second, the Euro Area unemployment rate fell to a record low of 6.5% in October (vs. 6.6% expected). And back in the US, the weekly initial jobless claims came in at 225k in the week ending November 26 (vs. 235k expected).

To the day ahead now, and the main highlight will be the US jobs report for November. Otherwise, we’ll get data on French industrial production and Euro Area PPI for October. Elsewhere, central bank speakers include ECB Vice President de Guindos, the ECB’s Villeroy and Nagel, along with the Fed’s Barkin and Evans.

One of the earliest Reason stories I remember reading, “Love Canal: The Truth Seeps Out,” was from the February 1981 issue. If you grew up in the 1970s like I did, fear of birth defects caused by corporate villainy was never more than a TV Movie of the Week away. “Love Canal,” a toxic neighborhood somehow built on top of a chemical dump in Niagara Falls, fueled such anxieties that it became a national outrage in 1978 due to local activism. Of course a chemical company had secretly poisoned pregnant women, created monster babies, and jacked up cancer rates for the out-of-work folks living in a Rust Belt hellhole!

One of the earliest Reason stories I remember reading, “Love Canal: The Truth Seeps Out,” was from the February 1981 issue. If you grew up in the 1970s like I did, fear of birth defects caused by corporate villainy was never more than a TV Movie of the Week away. “Love Canal,” a toxic neighborhood somehow built on top of a chemical dump in Niagara Falls, fueled such anxieties that it became a national outrage in 1978 due to local activism. Of course a chemical company had secretly poisoned pregnant women, created monster babies, and jacked up cancer rates for the out-of-work folks living in a Rust Belt hellhole!

Freedom’s Furies. A new book by Timothy Sandefur looks at the intellectual and political forces that shaped the thinking of Ayn Rand, Isabel Paterson, and Rose Wilder Lane and how these three women in turn shaped the U.S. liberty movement. Earlier this week, I participated in a panel discussion of the book at the Cato Institute, alongside Sandefur, Cato’s Paul Meany and Kat Murti, and longtime Libertarian Party activist Carla Howell. You can watch the discussion

Freedom’s Furies. A new book by Timothy Sandefur looks at the intellectual and political forces that shaped the thinking of Ayn Rand, Isabel Paterson, and Rose Wilder Lane and how these three women in turn shaped the U.S. liberty movement. Earlier this week, I participated in a panel discussion of the book at the Cato Institute, alongside Sandefur, Cato’s Paul Meany and Kat Murti, and longtime Libertarian Party activist Carla Howell. You can watch the discussion

(@basedspinach)

(@basedspinach)