Authored by Lance Roberts via RealInvestmentAdvice.com,

Warren Buffett defended stock buybacks in Berkshire Hathaway’s annual letter, pushing back on those railing against the practice he believes benefits all shareholders.

“When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

The media latched on to this quote with both hands, apparently not taking the time to read what Warren Buffett actually wrote in his annual letter. (Emphasis mine.)

“The math isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices.

Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

Gains from value-accretive repurchases, it should be emphasized, benefit all owners – in every respect.”

Mr. Buffett is correct that if repurchases are done at a “value-accretive” price, they can benefit all shareholders by increasing the size of their ownership in the company. Unlike the mainstream narrative, this is NOT a “return of capital to shareholders,” but just the opposite of a shareholder dilution.

Unfortunately, while the mainstream media quickly jumped on those opposed to share repurchases, their lack of reading what Mr. Buffett stated is critically important to what is happening in the financial markets today.

A Basic Example

I have discussed the problems with stock buybacks previously. But let’s start with a simple example of what happens with stock buybacks.

“Share repurchases in and of themselves are not necessarily a bad thing, it is just the least best use of cash. Instead of using cash to expand production, increase sales, acquire competitors, or buy into new products or services, the cash is used to reduce the outstanding share count and artificially inflate earnings per share. Here is a simple example:”

-

Company A earns $1 / share, with 10 / shares outstanding.

-

Earnings Per Share (EPS) = $0.10/share.

-

Company A uses all of its cash to buy back 5 shares.

-

Next year, Company A earns $0.20/share ($1 / 5 shares)

-

Stock price rises because EPS jumped by 100%.

-

However, since the company used all of its cash to buy back the shares, it had nothing left to grow its business.

-

The following year Company A still earns $1/share, and EPS remains at $0.20/share.

-

Stock price falls because of 0% growth over the year.

“This is a bit of an extreme example but shows the point that share repurchases have a limited, one-time effect, on the company. This is why once a company engages in share repurchases they are inevitably trapped into continuing to repurchase shares to keep asset prices elevated. This diverts ever-increasing amounts of cash from productive investments and takes away from longer term profit and growth.”

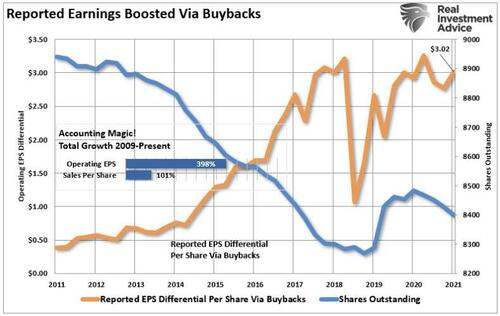

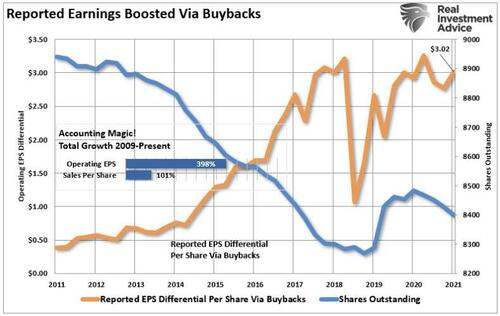

As shown in the chart below, the share count of public corporations has dropped sharply over the last decade as companies rush to shore up bottom-line earnings to beat Wall Street estimates against a backdrop of a slowly growing economy and sales.

(The chart below shows the differential added per share via stock backs. It also shows the cumulative growth in EPS and Revenue/Share since 2011) You will notice that while operating earnings per share have surged, actual sales remains very weak.

As Mr. Buffett states, buybacks done on a value-accretive basis benefit shareholders. However, that has not happened since the turn of the century.

Mostly Not Value-Accretive

“Over the past five years, according to S&P Dow Jones Indices, big U.S. companies have spent $3.9 trillion repurchasing their own stock.

Buybacks are neither bad nor good. They are simply a tool. Just as you can use a hammer either to build a house or knock one down, buybacks are useful in the right corporate hands and dangerous in the wrong ones.“ – Jason Zweig, WSJ

Jason is correct. Notably, the media overlooked another aspect of Buffett’s comment on share buybacks in their rush to support them. While Mr. Buffett was speaking about his repurchases of Berkshire Hathaway stock, he also noted that many managers do not report earnings properly.

“Finally, an important warning: Even the operating earnings figure we favor can easily be manipulated by managers who wish to do so. Such tampering is often considered sophisticated by CEOs, directors and their advisors.

Reporters and analysts embrace its existence as well. Beating ‘expectations’ is heralded as a managerial triumph. That activity is disgusting. It requires no talent to manipulate numbers: Only a deep desire to deceive is required. ‘Bold, imaginative accounting,’ as a CEO once described his deception to me, has become one of the shames of capitalism.“

This manipulation of earnings through accounting gimmicks and buybacks is a topic I discussed previously on how companies stretch to “beat estimates.”

“The tricks are well-known: A difficult quarter can be made easier by releasing reserves set aside for a rainy day or recognizing revenues before sales are made, while a good quarter is often the time to hide a big ‘restructuring charge’ that would otherwise stand out like a sore thumb.

What is more surprising though is CFOs’ belief that these practices leave a significant mark on companies’ reported profits and losses. When asked about the magnitude of the earnings misrepresentation, the study’s respondents said it was around 10% of earnings per share.“ – WSJ

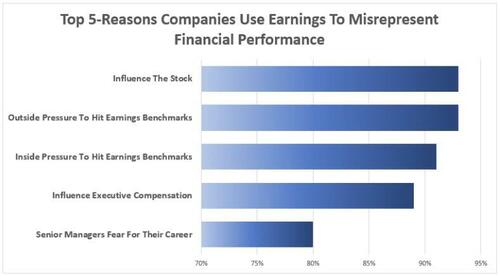

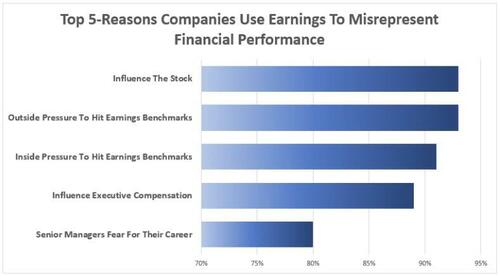

Unsurprisingly, 93% of those surveyed pointed to “influence on stock price” and “outside pressure” as the reason for manipulating earnings figures.

However, the question is whether these buybacks were value-accretive to shareholders.

“A new study, “Share Repurchases on Trial,” by accounting and finance professors Nicholas Guest of Cornell University, S.P. Kothari of the Massachusetts Institute of Technology and Parth Venkat of the University of Alabama, analyzes the stock returns of thousands of companies from 1988-2020, comparing those that repurchased shares against firms that didn’t, adjusting for their size and other factors. In the year of a repurchase, companies that did large or frequent buybacks had slightly lower—not higher—returns. Over longer periods, their returns were indistinguishable.” – Jason Zweig

Clearly, if there is no real benefit to higher returns, then the buybacks were not value-accretive to shareholders. Which then fosters the question, why do they continue to do it?

Who Really Benefits

Share buybacks only return money to those individuals who sell their stock. This is an open market transaction, so if Apple (AAPL) buys back some of its outstanding stock, the only people who receive any capital are those who sold their shares.

So, who are the ones mostly selling their shares?

It’s the insiders, of course, as changes in wage structures since the turn of the century became heavily dependent on stock-based compensation. Insiders often sell shares “given” to them as part of their overall compensation structure to convert them into actual wealth. As the Financial Times previously penned:

“Corporate executives give several reasons for stock buybacks but none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay and in the short-term buybacks drive up stock prices.”

A report on a study by the Securities & Exchange Commission found the same:

- SEC research found that many corporate executives sell significant amounts of their own shares after their companies announce stock buybacks, Yahoo Finance reports.

What is clear is that the misuse and abuse of share buybacks to manipulate earnings and reward insiders has become problematic.

Stock Buybacks Do Help Keep The Market Afloat

As John Authers pointed out:

“For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.”

In other words, between the Federal Reserve injecting massive liquidity into the financial markets and corporations buying back their shares, there have been no other real buyers in the market.

“U.S. stocks have received support from a key source during 2023’s shaky market environment: companies repurchasing their own shares.

Stock buybacks by companies in the S&P 500 are projected to top $1 trillion in 2023 for the first time in a calendar year, according to S&P Dow Jones Indices. Authorizations for repurchases are picking up pace: As of Feb. 17, they totaled more than $220 billion, a record for that point in the year, according to a Goldman Sachs analysis of S&P 500 and Russell 3000 companies.” – Jannah Miao, WSJ

The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The returns for the S&P 500 breaks down as follows:

-

6.1% from multiple expansions (21% at Peak),

-

57.3% from earnings (31.4% at Peak),

-

9.1% from dividends (7.1% at Peak), and

-

27% from share buybacks (40.5% at Peak)

While Mr. Buffett is correct that share buybacks benefit shareholders at value-accretive prices, that has not been the case for most corporate actions.

Instead, money that could have been spent for future growth was wasted only benefiting senior executives paid based on fallacious earnings-per-share.

While Mr. Buffett supports the practice of share buybacks, there is a significant difference between what he is doing for Berkshire’s stakeholders and what is happening in the rest of the market.

Of course, that is probably why the SEC had banned stock buybacks until 1990, as they were a form of stock market manipulation.