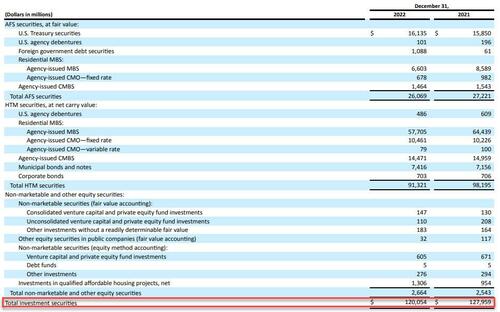

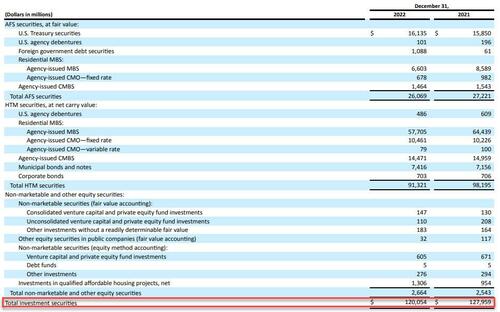

For those who slept through yesterday, here is what you missed and why the US banking system is suffering its worst crisis since 2020. Silicon Valley Bank, aka SIVB, a bank with $212 billion in assets of which $120 billion are securities (of which most or $57.7BN are Held to Maturity (HTM) Mortgage Backed Securities and another $10.5BN are CMO, while $26BN are Available for Sale, more on that later )…

… funded by over $173 billion in deposits (of which $151.5 billion are uninsured), has long been viewed as the bank at the heart of the US startup industry due to its singular focus on venture-capital firms. In many ways it echoes the issues we saw at Silvergate, which banked crypto firms almost exclusively.

SIVB stunned markets on Thursday after it announced a series of actions to improve its balance sheet flexibility and capital ratios as rates potentially remain higher-for-longer and private markets remain under pressure. Note: while many had speculated that the bank may be facing a liquidity crisis in a rapidly rising rate environment (most notably the WSJ in late 2022), it took the management team’s confirmation that liquidity has collapsed to spark a bank crisis and a depositor run. The bank said it sold $21 billion of its available for sale (AFS) securities to be reinvested into shorter-duration Treasuries, and publicly announced raising $2.25 bil of equity ($1.75 bil common and $0.5 bil pref) primarily to support its capital ratios given the $1.8 bil after-tax loss it expects to realize on the sale and also partly to help support its credit rating. We now know, courtesy of CNBC reporting, that this equity raise failed and the bank is instead is trying to sell itself to a bigger bank.

Why did SIVB do this? Well, according to Morgan Stanley’s Manan Gosalia, who as of yesterday was the only sellside analyst to have a Sell rating on the company with a $190 price target…

… the bank did not intend to spark a panic but instead “these actions enhance its balance sheet flexibility as rates move higher. By selling down its existing AFS portfolio, which had a duration of 3.6 years, and reinvesting the proceeds into short-term US Treasurys, SIVB is enhancing its liquidity position and NIM protection as rates continue to rise. The bank is also terming out its funding by adding $15 bil of longer-dated borrowings and hedging to protect against further increases in rates. All in, the bank estimates that it will flip to asset sensitive with each 25 bp increase in rates driving $50-60 mil of higher NII.“

In English? The bank had a lot of fixed-rate TSY (and other) exposure that was underwater and carrying an unrealized loss, and having decided that rates will keep rising, the bank decided to restructure its assets and flip its portfolio from a fixed-rate one (where rate hikes cause even more capital losses) to a short-term one (where they lead to modest NIM gains). Of course, the transition ended up costing the bank billions.

None of this is shocking, and yet the market was clearly surprised. Why?

For the answer we have to go all the way back to the immediate aftermath of the last financial crisis, when in early 2009 US regulators suspended Mark to Market, and instead of having banks hold debt securities on their books at price, they allowed them to split their asset holdings into two components: Available for Sale (or AfS), a bucket which would be marked to market and which could be sold to short up liquidity, and Held to Maturity (or HTM), a (far larger bucket) which allowed the banks to keep debt securities at cost.

This was created to avoid cross-selling contagion if one bank was forced to liquidate securities and infect other holders of the same security. In other words, it was purely a idiosyncratic feature, not one that was meant to offset macro conditions. And understandably so: in a time of raging deflation, and ZIRP and QE, when rates would seemingly never go up, virtually nobody even considered a scenario when it would be the Fed itself that would force rates higher to fight galloping inflation.

Sadly for SIVB, that’s where we are now, and the Fed’s rate hikes have manifested in two ways.

- First, rising rates afford depositors a completely risk-free way of parking your money at Treasuries without taking on company-specific deposit risk. This is a big issue for SIVB because as noted above it has $170BN in deposits.

- Second, rising rates force the bank to sweep ever bigger losses on its debt assets under the rug. And yes, while the bank can hide behind the “held at cost” basis afforded by Held to Maturity, the fact that the bank’s HTB book was of relatively moderate duration meant that even if it held to maturity, it would still suffer losses, which is why it proceeded with the previously discussed balance sheet restructuring.

The funny part, of course, is that we knew all of this!

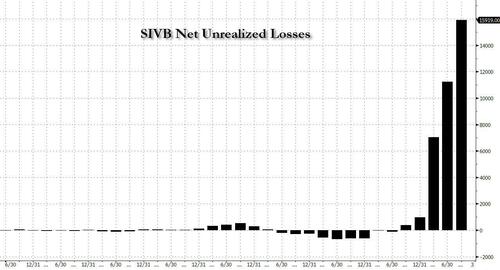

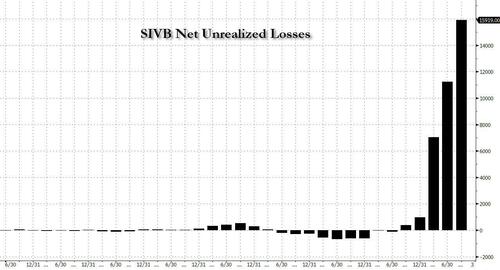

Yes, both SEC and FDIC regulators require banks to disclose not only the value of their HTM assets, but also the fair value of said assets, with the fair value being – as the name implies – the value of the HTM assets if they were to be sold today. The delta between the two is what is known as “net unrealized loss” and it is rapidly emerging as the most important indicator of bank health.

To be sure, until recently nobody cared about net unrealized losses on bank portfolios because, well, there simply weren’t any. But once the rate hikes started and debt prices – for anything from Treasurys, to MBS, to CRE – to started to tumble, the unrealized losses started to climb, and nowhere is this more visible than in Silicon Valley Bank’s own balance sheet, where from virtually no losses a year ago, the number climbed to $16 billion as of Q3.

Now this is a problem because at the same time, its total shareholder equity was $15.8 billion. This means that quietly, all of the bank’s book equity had been wiped out simply by the accumulated – but not marked – losses on SIVB’s HTM portfolio.

And here lies the rub: if it was only SIVB that has an “unrealized loss” problem then there would be no contagion, and the rest of the banking sector would be safe and sound. Unfortunately, as explained, the reason why SIVB’s HTM book blew up is because of surging rates, which is also why SIVB proceeded to liquidate its Available for Sale securities (at $26BN these are far less than the $91.3BN in HTM book). And it’s also why every other bank is now suffering under the pressure of massive “net unrealized losses.”

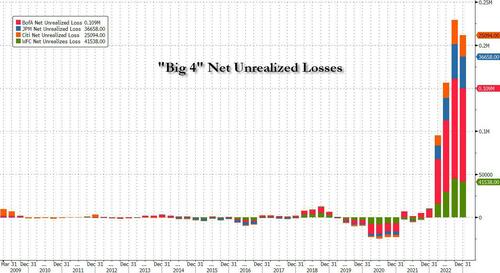

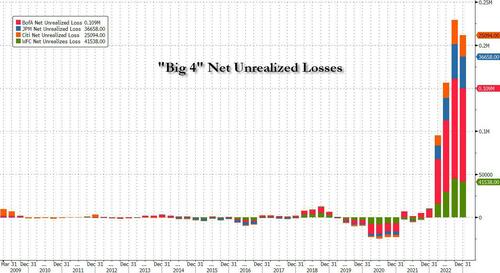

Presenting Exhibit A: net unrealized losses for the Big 4 banks.

Just like SVB, the unrealized loss issue emerged only in 2022 when rates exploded and prices of debt securities tumbled. What stands out here is that while all banks have substantial exposure – the total is $250BN as of Dec 31, 22 – Bank of America has the most exposure at just under $110 billion.

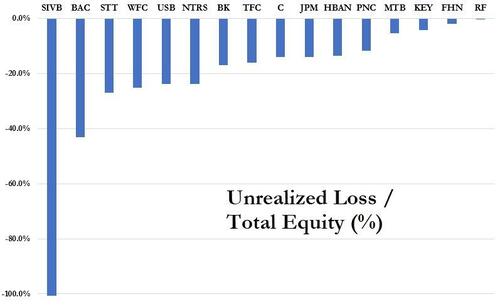

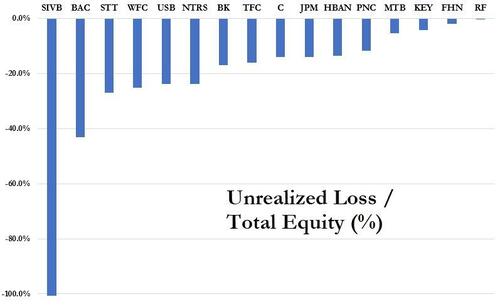

And another problem: these amounts may not sound like a lot, but when expressed in terms of book shareholder value for any given bank, they are staggering. The next chart shows what the net unrealized losses is when expressed as a function of total equity. Yes, SIVB is by far the worst with all of its book value wiped out by the unrealized loss, but other banks are hardly doing much better, to wit: Bank of America’s unrealized loss (i.e., the market-value gap between its HTB book and fair value) represents 43% of combined total equity; at State Street it is 27%; at Wells it is 25%, at US Bancorp it is 24% and so on…

Extending this analysis to all 15 of the 24 KBW index members, the “fair value” gaps were equivalent to 10% of their equity or more. And cumulatively for all 24 banks, the $300 billion difference between the bonds’ book value and market value represented 22% of their $1.39 trillion of combined total equity!

Still think there won’t be contagion?

To be sure, some do: take Morgan Stanley’s Manan Gosalia (who as noted above was the sole SIVB sell rating before yesterday’s implosion), who this morning said that “the funding pressures facing SIVB are highly idiosyncratic and should not be viewed as a read-across to other regional banks.” He continues:

SIVB primarily banks technology, life science, and healthcare companies and is an integral part of the VC ecosystem. Falling VC funding activity and elevated cash burn are idiosyncratic pressures for SIVB’s clients, driving a decline in total client funds and on-balance-sheet deposits for SIVB. That said, we have always believed that SIVB has more than enough liquidity to fund deposit outflows related to venture capital client cash burn. SIVB has $15B in cash, $25B in newly repositioned short-dated securities, $73B in off-balance-sheet sweep accounts and repo funds that can be brought on balance sheet, and $65B in borrowing capacity (FHLB and Repo). This totals to ~$180B in available liquidity, relative to $165B of on-balance-sheet deposits. Our Underweight rating on the stock reflects that some of these sources of liquidity (particularly sweep accounts and wholesale borrowings) are expensive in a higher-for-longer rate environment, and represent a drag to earnings until the VC funding environment improves.

There is more in the full note (which is a must read for anyone involved in this situation and is available to pro subs), but Gosalia’s thesis is that while “the stock reactions across the group show that investors are worried about liquidity across the banking space” he does not “believe there is a liquidity crunch facing the banking industry, and most banks in our coverage have ample access to liquidity. As we have said before, the headwind for the banking industry is that the cost of liquidity is high and rising, which we have been tracking with our bi-weekly deposit tracker. This is a headwind for net interest margins, revenue and EPS.” (again, more in the full note available to pro subs).

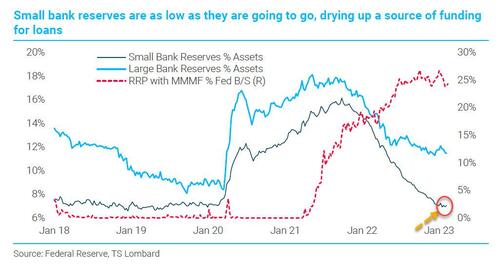

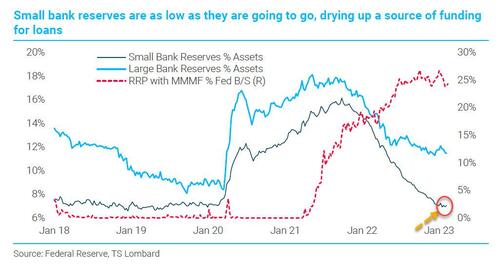

Perhaps he is right (one can’t forget that Manan is just a little conflicted, being employed by – well – a bank. But what we would counter with is that while he may well be right and contragion risk is modest for big banks, which thanks to the Fed’s massive post-covid QE are still drowning in reserves and have trillions in excess liquidity, the same can not be said for small banks. And the reason for that, as we explained in “Why Small Banks Are In Big Trouble: As Hedge Funds Pile Into The New “Big Short”, The Next ‘Credit Event’ Emerges“ is that not only do small banks have much more exposure to commercial real estate, and especially the office sector, but as TS Lombard showed, they are – unlike their bigger peers – now reserve constrained.

Which boils down to the following: if depositor confidence in the regional/small bank sector is now shot – and after both Silvergate and SIVB it very well may be – we will see a small (to medium if not larger) deposit run among the regionals which could prove devastating for these reserve-constrained banks which will need to scramble to raise capital a la SIVB in what eventually transforms into a death spiral for the sector, especially if depositors take one look at what is going on with regional bank prices – which have been in freefall in the past two days – and extrapolate what may come next – there’s a reason why banking is the ultimate confidence game.

There is one way to short-circuit this process and it, of course, involves the Fed which would need to step in the way it did in September 2019 when it was the big banks – namely JPMorgan – that were reserve-constrained, and forced the Fed to launch “Not QE” (but only after the US repo market suffered some historic rollercoaster moves). Ironically, even if the Fed does somehow whisper words of reassurance, the question is why would depositors park their money at “suddenly” risky banks when they can just buy a 6M T-Bill and get the same return with zero risk.

Yes, the Fed may have no choice but to cut rates if it wishes to save the (regional) banking system. But then again, the Fed is still stuck fighting runaway inflation, which means that Powell is now trapped, and as we tweeted previously, Powell is now trapped: More hikes: regional banks collapse; Less hikes: inflation target must be raised.

So will Powell let America’s small, regional banks risk failure as a result of his rate hikes (an outcome the likes of JPMorgan would find quite beneficial as it will make them even bigger), or will the Fed chair step in the way he did in 2019 even if it means gambling with runaway inflation? The right answer to that question could make some traders extremely rich.