El-Erian Warns Of “Collateral Damage & Unintended Consequences” Of JPM’s Sponsored Buyout Of FRC

Authored by Mohamed El-Erian, op-ed via Bloomberg,

Lots will be written on the rise and fall of First Republic Bank. Its customer service was legendary in the banking system, as was its list of rich clients with ample deposits and a healthy appetite for issuing jumbo mortgages to highly creditworthy borrowers. Yet it went from being admired to being seized by regulators and sold to another bank.

Another California bank failure for Mary Daly’s @sffed which is more concerned about DEI, colorful flags, virtue signaling and climate change than, you know, actually supervising insolvent banks

— zerohedge (@zerohedge) May 1, 2023

What emerged on Monday morning was far from perfect, despite weeks of discussions and posturing. What we have are US government institutions caught up in the policy implications of a “second best” world — that is, the repeated inability to come up with an optimal solution. What’s emerged will come with collateral damage and unintended consequences.

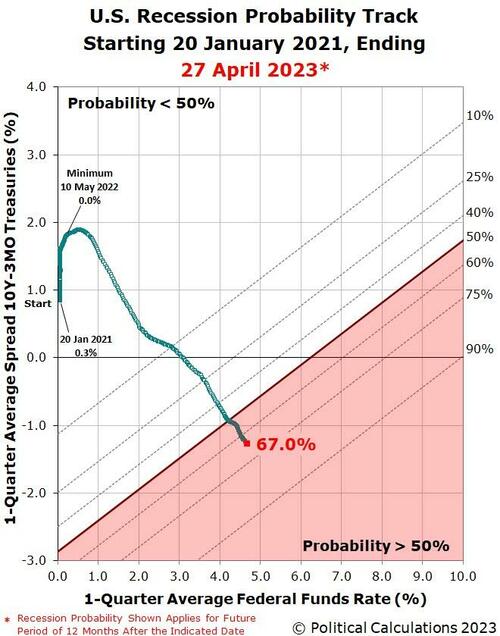

First Republic found itself in a similar situation to Silicon Valley Bank, which was shut down by regulators in March. Its failure to manage an interest rate mismatch on its balance sheet ultimately crippled it as deposits flew out the door in response to the earlier bank failures. Its vulnerability was amplified by the Federal Reserve’s initial mischaracterization of inflation as transitory, the failure to take timely measures, and the inevitably highly concentrated set of hikes that followed.

The inevitable assessments of First Republic’s failure are also likely to point to significant lapses in bank supervision and regulation — the type of failures that were detailed last Friday in a report by the Fed that, refreshingly and encouragingly, saw the central bank finally take ownership of a mistake and seek to learn from it. Unlike other major central banks, it had repeatedly failed to do so when it comes to monetary policy.

First Republic became increasingly fragile as the contraction in deposits worsened funding costs, deepened a capital hole, and plummeted its stock price by around 95%. That was the bad news. The good news was that, at least on paper, there was a constructive alignment of incentives among the main actors in the bank resolution process.

Having already lost three institutions, the banking system as a whole desperately needed an orderly resolution for First Republic that minimized the risk of further disruptions.

This was not just the case for regional and community banks where the risks of flighty deposits and duration mismatches were under a bright spotlight. It was also the case for the 11 larger banks as they had injected tens of billions of deposits into First Republic in an earlier attempt to stabilize the situation.

It was also the case for regulators, especially the Federal Deposit Insurance Corp. and the Fed. The FDIC wanted to avoid being on the hook for financial losses and having to dispose of yet another bank’s assets and liabilities; and the Fed did not want to trigger yet again the “systemic risk” clause to allow for an extension of deposit insurance to theoretically uninsured deposits. The Fed was also keen to keep the door open for the policy “separation principle” that has interest rate policy aimed at inflation reduction and other tools used for financial stability.

Despite this alignment, it took weeks for a solution to emerge. And when it did, it involved unfavorable spillovers, as well as having one of the nation’s biggest and most dominant bank – JPMorgan – becoming even more so. With this comes the further evolution of the largest financial institutions from major sources of systemic risk to stabilizers of the system itself. Moreover, and also departing from the previous conventional wisdom, the bigger and more diversified banks are now being considered “safer” than the narrow banks which have either no or a very limited range of capital market activities that have traditionally been viewed as a source of financial stability risk.

The solution that emerged early Monday morning deals with the immediate threat of a disorderly failure of First Republic and, therefore, does not fuel the already uncomfortable risk of possible additional disruptions to other regional and community banks.

Yet the potential collateral damage and the unintended consequences are far from immaterial.

Four stand out in particular.

-

First, the US now has a more concentrated banking system, with what was once viewed not so long ago as “too big to fail”/”too big to manage” banks becoming larger.

-

Second, there is even greater doubt about the nature of the de facto deposit insurance system in place.

-

Third, the compositional risk within the banking system of less credit extending into the economy will continue, potentially aggravating the headwinds to high and inclusive growth.

-

Finally, the total cost of First Republic’s resolution remains to be assessed, including how the burden be shared among the public and private sectors and, with that, the extent of the “bailout” for the 11 banks that had large deposits with First Republic.

The US economy continues to suffer from too many years of easy money, and the subsequent mishandling of the rate hiking cycle and lapses in supervision and regulation. With that comes the ever-present risk of collateral damage and unintended consequences given that first best policy responses are no longer available.

Tyler Durden

Mon, 05/01/2023 – 08:45

via ZeroHedge News https://ift.tt/UahDwJ5 Tyler Durden