Another day, another overnight drop pushing US equity futures, European and Asian markets all broadly lower. Bond yields are also lower, while the Bloomberg Dollar Index is modestly weaker and pulling back from a six-month high as dovish comments from Federal Reserve officials revived speculation that the central bank may keep interest rates at current levels; still it is set to close a record 8th consecutive week of gains.

At 7:30am ET, S&P futures and Nasdaq 100 futures are both down 0.2%. Asian stocks fell, heading for their first weekly loss in three, as rising US-China tensions over a new technology war, while European stocks are on course to extend their losing streak to eight consecutive sessions – the longest run of declines since 2016. Commodities are mixed with Nat Gas leading gains as Chevron’s Australian LNG workers begin striking while base metals lag on continued China fears. Today the macro focus will be the Manheim Used Vehicle Value Index at 9am ET; we will also receive Wholesale Inventories revision and Consumer Credit. China is set to release their CPI and PPI tonight at 9.30pm ET.

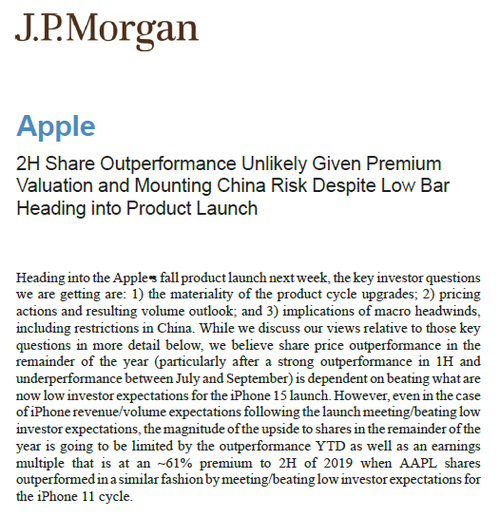

Pre-market, megacap tech are mostly lower, with Apple shares down 0.1% as mounting risks related to iPhone restrictions in China and a premium valuation make it unlikely for Apple shares to outperform in 2H, JPMorgan said in a Friday note, cutting its price target from $235 to $230 (full note available to pro subscribers in the usual place).

Some other notable premarket movers:

- DocuSign gained 3.0% after the e-signature company reported second-quarter results that beat expectations and raised its full-year forecast for revenue and billings. Analysts said the results were better than expected, and highlighted strong billings.

- First Solar rose 2.2%, as analysts raise their price targets following the solar tech company’s capital markets day.

The biggest narrative of the week has been the dramatic moves in currencies and the widening gulf in economic growth prospects between the US and the rest of the world. The Bloomberg Dollar Spot Index is still on track for an eighth consecutive week of gains, which would be the longest run of increases in data going back to 2005.

“The dollar upside we have seen recently has surprised our expectations,” Laura Cooper, senior investment strategist at BlackRock International, said in an interview on Bloomberg Television. “We question the sustainability of that, largely as we look forward to the Fed, we think it is going to signal a hawkish pause.”

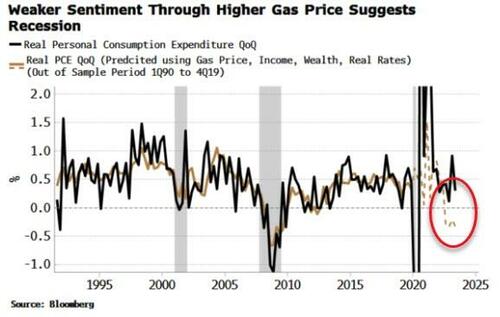

New York Fed chief Williams said policy is having the desired effects of bringing demand and supply more into balance and easing inflation, adding that the Fed has “done a lot” by raising interest rates significantly. At the same time, officials must calibrate policy if needed to ensure they’re bringing inflation sustainably down to their 2% goal. Upward pressure on inflation however is about to jump, with Brent back near $91 and European benchmark gas prices surging as much as 11% after LNG workers at key Chevron sites in Australia began partial strikes on Friday after talks failed to reach an agreement.

Here is a recap of what some other Fed officials said overnight:

- Fed’s Goolsbee (voter) said it is possible to get on the ‘golden path’ and that monetary policy is working, while he added that overall inflation is above where they want it and there are risks. Goolsbee also stated that they are very rapidly approaching the time when the argument is not about how high should rates go, but rather how long rates have to stay high and collectively, the Fed forecast is that rates will have to stay up for a relatively extended period, according to a Marketplace interview.

- Fed’s Logan (voter) said it could be appropriate to skip an interest rate increase in September and skipping does not imply stopping rate hikes, while she noted that there is work left to do to get to sufficiently restrictive policy and is not yet convinced that they have extinguished excess inflation.

- Fed’s Bostic (non-voter) said there is still work to do to get inflation back to 2%, while he added the US economy is still working through pandemic dynamics and consumer strength has kept economic pain at bay.

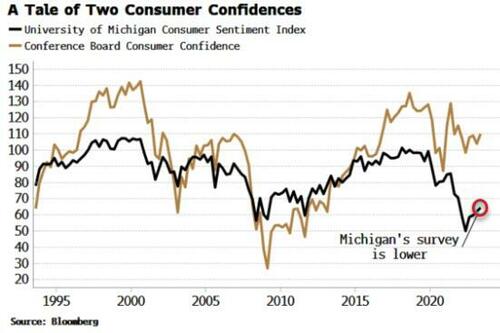

Meanwhile, stock markets have been hit on the first week of the seasonally week month of September by a decoupling data hinting at a deepening economic downturn in Europe and China offset by continued bizarro strength in the US (at least when it comes to easily manipulated sentiment surveys like the ISM). The mood is especially pessimistic toward European markets, which saw a 26th straight week of investment outflows, according to a note from Bank of America Corp.

And speaking of European stocks, they are on course to extend their losing streak to eight consecutive sessions – the longest run of declines since 2016. Investors remain cautious heading into the weekend as the US announces an official probe into Huawei’s new smartphone. The Stoxx 600 is down 0.6%, led by declines in the construction, chemical and industrial sectors. Here are sopme of the most notable European movers:

- Computacenter jumps as much as 8.5%, the most since Jan. 30, after the IT reseller reported first-half results that beat market expectations. JPMorgan analysts highlighted demand resilience and market share gains, while Jefferies lifted its earnings estimates for the year.

- D’Ieteren gains as much as 7.8%, the most in a year, after the Belgian automobile distributor raised its forecast for adjusted pretax profit for the full year. KBC Securities praised the firm’s very strong set of results and said it’s more than likely to exceed the new target.

- Next gains as much as 2.4% after SocGen upgrades the retailer to buy from hold, citing the company’s tilt toward online as a positive.

- Wartsila falls as much as 6.1%, the most since March, after Barclays initiated coverage of the Finnish marine and energy equipment maker, seeing around 20% downside to current 2024 estimates, calling the stock “materially overvalued.”

- ConvaTec drops as much as 5.6%, before paring the drop, after news that Novo Holdings’ representative on Convatec’s board will step down.

- Energean drops as much as 5.8%, before paring the decline, after Panmure Gordon slashed its PT for the British exploration and production company, citing reduced production and high debt levels.

- Saipem shares gains as much as 2.7% in Milan trading after the engineering company won two new contracts for offshore activities in Côte d’Ivoire and Italy worth a total of €850m.

Asian stocks fell, heading for their first weekly loss in three, as rising US-China tensions over technology and concern that the Fed may keep interest rates higher for longer weighed on risk appetite. The MSCI Asia Pacific Index slid as much as 0.5%. Tokyo Electron and TSMC were the biggest drags on the gauge while trading in Hong Kong was delayed amid the heaviest rainstorm to hit the city since records began in 1884. The CSI 300 Index, a benchmark of onshore Chinese stocks, fell as much as 0.9%. Regional equities extended declines on news the US government has begun an official probe into an advanced made-in-China chip housed within Huawei Technologies’ latest smartphone. Technology stocks also suffered in the US session on Thursday as China’s plan to broaden a ban on the use of iPhones weighed on Apple’s shares and as data on US unemployment benefits fanned speculation that the Fed could turn hawkish again after pausing its rate hikes.

- Hang Seng was shut due to severe rainfall and Shanghai Comp traded subdued amid tech frictions as China seeks to expand its iPhone ban and with the US Commerce Department investigating the ‘made in China’ Huawei chip.

- Australia’s ASX 200 was led lower by continued underperformance in the commodity-related sectors and with strike action beginning in some offshore LNG platforms, although losses in the index were stemmed by resilience in defensives.

- Nikkei 225 fell below 33,000 with risk appetite sapped by disappointing GDP revisions and slower wage growth.

- Stocks in India recorded their biggest weekly gains since June amid optimism for economic growth and earnings, with energy and infrastructure stocks leading the way. The S&P BSE Sensex rose 0.5% to 66,598.91 in Mumbai, while the NSE Nifty 50 Index advanced by a similar magnitude. Both the indexes ended higher for a sixth straight session. The MSCI Asia Pacific index was down 0.4%. The Nifty50 gauge climbed 2% for the week, while the Sensex rose 1.9%. Indian stocks were among the best performers in Asia as the regional index lost about 0.9% for the week.

In FX, the Bloomberg Dollar Spot Index is down 0.1%, dropping for the first time in four days after Federal Reserve speakers discussed whether policy was already restrictive enough while the kiwi tops the G-10 table, rising 0.6% versus the greenback.

- USD/JPY reversed a 0.5% drop to rise 0.1% after Japan’s Finance Minister said he will appropriately address excessive moves in the yen

- EUR/USD climbed 0.1% after industrial production data for France and Spain beat expectations; the pair is still on track for eight-straight weeks of losses, the worst performance since 2014

- USD/CNH gained 0.2% as the offshore yuan weakened toward its lowest on record against the dollar; a PBOC fixing at a two-month low stoked bets China is comfortable with a gradual depreciation of the currency

In rates, treasuries reversed earlier gains, with the US 10-year trading flat at 4.26% after dropping as low as 4.21%, with bunds and gilts outperforming by 0.5bp and 1.5bp in the sector; belly-led gains steepen 5s30s spread by 2bp on the day; it remains near top of session range. Treasuries price action broadly steady with belly outperforming on the curve where 5-year yields are richer by almost 2bp on the day. Core European rates outperform, which also acted a driver for lower Treasury yields on Thursday. Stock futures marginally lower, with focus continuing to be on Apple amid reports that China plans to expand a ban on the use of iPhones in some government agencies. Dollar IG issuance slate empty for the session so far; five names priced almost $5b on Thursday, taking weekly volume over $55b; at least three issuers elected against moving forward with deals on Thursday

In commodities, crude futures are up 0.5%, with Brent trading near $90.60 and unwinding much of Thursday losses. European natural gas priced jump 9% on renewed strike action. Spot gold adds 0.3%.

Bitcoin is well within recent parameters after multiple sessions of near-unchanged closes despite marginally more pronounced intra-day action. Currently, BTC is just below the USD 26k mark with downside of circa. 1.5%

Looking to the day ahead now, data releases include Wholesale Inventories and Trade as well as Household change in net worth and Consumer Credit at 3pm. Central bank speakers include Fed Vice Chair for Supervision Barr.

Market Snapshot

- S&P 500 futures down 0.1% to 4,450.50

- MXAP down 0.4% to 161.10

- MXAPJ little changed at 502.85

- Nikkei down 1.2% to 32,606.84

- Topix down 1.0% to 2,359.02

- Hang Seng Index down 1.3% to 18,202.07

- Shanghai Composite down 0.2% to 3,116.72

- Sensex up 0.5% to 66,606.10

- Australia S&P/ASX 200 down 0.2% to 7,156.69

- Kospi little changed at 2,547.68

- STOXX Europe 600 down 0.4% to 451.86

- German 10Y yield little changed at 2.61%

- Euro up 0.2% to $1.0716

- Brent Futures up 0.1% to $90.03/bbl

- Gold spot up 0.2% to $1,923.72

- U.S. Dollar Index down 0.14% to 104.91

Top Overnight News from Bloomberg

- President Joe Biden does not intend to meet with Chinese Premier Li Qiang during the Group of 20 summit this weekend in New Delhi, a White House official said on Thursday night. BBG

- Xi apparently is resistant to large-scale consumer stimulus as he fears such a move “might make people weak” while foreign companies are increasingly turned off to investing in China by capricious gov’t policies. Washington Post

- US Treasury secretary Janet Yellen said China had the “policy space” to tackle its economic slowdown as Beijing extended efforts to pull the renminbi back from 16-year lows against the dollar. FT

- The US began an official probe into an advanced made-in-China chip used in Huawei’s latest smartphone, a revelation that set off a debate in Washington about the efficacy of restrictions against China’s semiconductor industry. The news also spurred a surge in Chinese chip-gear makers on bets the sector will get increased state support. BBG

- Joe Biden is pushing to secure international support to expand the World Bank’s lending capacity, as Washington comes under intense pressure to fund the fight against climate change and offer a viable alternative to China’s economic influence. FT

- The UN’s food price index dropped 2.1% M/M in August and is 24% below its Mar 2022 peak despite a spike in rice prices. RTRS

- Chevron LNG workers in Australia began partial strikes after talks failed, sending natural gas prices soaring in Europe. A complete two-week halt is expected to start Sept. 14 at Gorgon and Wheatstone facilities, which accounted for 7% of global supply last year. The prospect of disruptions threatens greater competition for cargoes during peak winter demand. BBG

- Pay for new hires is starting to shrivel after years of hefty salary bumps, requiring workers to reset what financial gains to expect from switching to a new job. Wages, especially for people who changed jobs, climbed in recent years as companies competed for workers to fill pandemic-induced labor shortages. Now, as the job market cools and businesses become more cautious in their hiring, many companies are paying new recruits less than they did just months ago—in some cases, much less. WSJ

- Senior Federal Reserve officials signaled that the US central bank would hold interest rates steady at its meeting in September, even as they resisted declaring victory in their fight against inflation. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined amid US-China tech-related frictions and disappointing Japanese GDP revisions. ASX 200 was led lower by continued underperformance in the commodity-related sectors and with strike action beginning in some offshore LNG platforms, although losses in the index were stemmed by resilience in defensives. Nikkei 225 fell below 33,000 with risk appetite sapped by disappointing GDP revisions and slower wage growth. Hang Seng was shut due to severe rainfall and Shanghai Comp traded subdued amid tech frictions as China seeks to expand its iPhone ban and with the US Commerce Department investigating the ‘made in China’ Huawei chip.

Top Asian news

- Chinese Premier Li said in a meeting with UN Secretary-General Guterres that it is necessary to uphold the concept of open and inclusive development, as well as jointly resist the practice of securitising and politicising economic issues.

- Japanese PM Kishida is expected to reshuffle the Cabinet as early as next Wednesday and Chief Cabinet Secretary Matsuno is expected to stay on or take another key post, according to Nikkei; subsequently echoed by NHK.

European bourses are in the red, Euro Stoxx 50 -0.9%, as sentiment has continued to deteriorate following the cash open and spurred on in part by incremental iPhone updates. Sectors are mostly softer, with Chemical names under pressure while Media names experience some slight outperformance. Stateside, futures have drifted in line with the above but magnitude more contained after recent pressure, ES -0.2%; NQ is in line with AAPL unreactive in the pre-market to the mentioned incremental reports.

Top European news

- Germany’s DIW Institute lowers its 2023 GDP growth forecast to -0.4% from -0.2% previously.

- Citi cuts its 2023 EZ GDP Growth forecast to 0.4% (prev. 0.8%)

FX

- DXY slips in tandem with US Treasury yields, but the Dollar remains underpinned as Yen wanes from overnight highs and Yuan continues to depreciate.

- Index off worst levels within 104.750-105.050 range and back towards the 105.00 mark, USD/JPY back above 147.00, USD/CNY pivoting 7.3400 and USD/CNH around 7.3500.

- Kiwi takes advantage of Greenback lapse to probe 0.5900, but Aussie lags after brief breach of 0.6400.

- Euro drawn to more hefty option expiries at 1.0700 vs Buck, Loonie flits between 1.3650-1.3700 awaiting Canadian jobs data.

- PBoC set USD/CNY mid-point at 7.2150 vs exp. 7.3284 (prev. 7.1986).

- NBP Kotecki says 75bps rate cut is interpreted as being part of the election campaign; says “silence fell” at MPC meeting when the proposal of 75bps rate cut came. Rate cut was risky.

Fixed Income

- Bonds run out of gas after extending upside parameters to 131.47, 94.95 and 110-10+ for Bunds, Gilts and the T-note respectively.

- Broad risk aversion likely to underpin debt given a lack of scheduled events, aside from Canadian jobs data that could impact if well outside of consensus.

- UK DMO is seeking market feedback on a potential tender for a Gilt with a maturity in excess of 40 years, to occur on September 27th.

Commodities

- Thus far, fundamentals have been limited for the crude complex with the broader macro narrative digesting the latest data/speaker updates ahead of announcements from key Central Banks in the next few weeks, in addition to US-China tensions via Apple’s iPhone.

- WTI and Brent have spent the morning posting downside of circa. USD 0.30/bbl but have since picked up slightly into the green, with the benchmarks on track to retain around half of the week’s pronounced output-driven upside

- Similarly, newsflow for the gas space has been limited but the updates pertinent as strike action commences and a marked bullish move is seen; Dutch TTF Oct’23 firmer by over 10% as the strike commences.

- Finally, metals are diverging slightly as gold benefits from the tone and incremental USD softness but remains between the 200- & 10-DMAs while base metals succumb to sentiment.

- Australia union confirmed planned strikes by Chevron (CVX) Australia LNG workers from 13:00 local time on Friday and said Chevron is demanding to be given special concessions in bargaining which the union rejected.

Geopolitics

- Russia’s embassy in the US said Washington is meddling in Russia’s internal affairs by calling elections in occupied areas of Ukraine illegitimate, according to RIA.

- US State Department said Secretary of State Blinken and Romanian Foreign Minister Odobescu discussed Romania’s investigation of drone debris found in Romania, close to the border with Ukraine.

- UK is to urge India to ‘call out’ Russia over the war in Ukraine, according to FT.

- North Korea said leader Kim inspected a new strategic nuclear attack submarine, while Kim said they will accelerate the push to build nuclear-powered submarines, according to NHK and Yonhap.

- South Korea’s military said North Korea’s new submarine doesn’t appear poised to operate normally and noted some external features appear to be scaled up to carry missiles, while the Unification Ministry condemned North Korea’s launch of a nuclear-armed submarine and said Pyongyang’s action is hurting its citizens’ lives.

US event calendar

- 10:00: July Wholesale Trade Sales MoM, est. 0.2%, prior -0.7%

- 10:00: July Wholesale Inventories MoM, est. -0.1%, prior -0.1%

- 12:00: 2Q US Household Change in Net Wor, prior $3.03t

- 15:00: July Consumer Credit, est. $16b, prior $17.8b

DB’s Jim Reid concludes the overnight wrap

My EMR routine means as soon as the early morning alarm goes I’m logged in within minutes and frantically typing away. However, the problem with this is that on those rare occasions my alarm interrupts a vivid dream I can be discombobulated for some time while writing this. Today is such a day. I had an actual meeting yesterday about DB’s swanky new building in Moorgate, London that opens soon and we’ll move into in March next year. That was obviously on my mind as I just dreamt that DB had commissioned a state-of-the-art building in Canary Wharf and in order for us to get to the City 3 miles away as quickly as possible, they had a 1200km/hour underground individual travel pod/jet installed. To use it you had to strap yourself in flat and be sealed in. It was incredibly scary. My alarm went off as the g-forces were at their most extreme.

Thankfully in real life our new building is directly above a normal tube station so more sedate travel there is available. Anyway while the discombobulation fades in the background I’m currently running a flash poll on US housing, where I’m keen to get your view on how the current stand-off between affordability and prices resolved over the next few years. You can answer here and it’ll take just a few seconds to fill in. Answers later in CoTD. Yesterday, I also hosted a webinar with Henry on our recent chartbook, and the replay for that is available here. The “Back to School” chartbook we went through is here.

For markets, there were several developments to run through yesterday, but the broad tone was skewed towards risk-off across multiple asset classes. $190bn has been wiped off of Apple shares spread fairly equally over the last 2 days (totalling -6.4%) which hasn’t helped. For context, a company with the market cap of the size of this drawdown would be the 11th largest in the Stoxx 600. It shows the size of the mega cap stocks that even a small jolt can be so consequential.

An element of additional confusion for markets was added with the latest weekly jobless claims data from the US, which fell to their lowest level since February at just 216k (vs. 233k expected). Of course, that’s just one data point, but after the strong ISM services reading on Wednesday, it added to the sense that the US economy might be in better shape than feared. The data initially led markets to increase the prospects of another hike from the Fed this year, but this more than reversed during the course of the day as a risk-off rates rally took hold.

Even with a break in the rates sell-off, the backdrop proved to be a tough one for equities, with the S&P 500 (-0.32%) losing ground for a 3rd consecutive day, and Europe’s STOXX 600 (-0.14%) falling for a 7th consecutive day. But it was tech stocks that saw the biggest underperformance, and as stated Apple (-2.92%) saw further declines after reports that China would be increasing its restrictions on iPhone use by government workers. Those declines were less pronounced across the rest of the tech sector, with the NASDAQ (-0.89%) and the FANG+ index (-0.48%) falling back more moderately. But Europe’s STOXX Technology index (-2.09%) saw a larger decline. On the other hand, defensive stocks outperformed, with S&P 500 utilities up +1.26%.

Whilst the US data has been looking a bit better over the last couple of days, in Europe the newsflow continued to point to the downside. For instance, the latest revisions to Q2 GDP growth for the Euro Area showed a two-tenths downgrade, with the latest estimate now at just +0.1%. So that means we’ve now had a -0.1% contraction in Q4, followed by +0.1% growth in Q1 and Q2, meaning there’s basically been stagnation since last autumn. Alongside that, German industrial production fell by a larger-than-expected -0.8% in July (vs. -0.4% expected).

With the data weakening further, sovereign bond yields fell back across Europe, and those on 10yr bunds (-4.2bps), OATs (-4.6bps) and BTPs (-6.1bps) all moved lower. That said, market expectations for the ECB’s decision next week actually moved in a slightly hawkish direction, with pricing for a September hike now at 35%, up from 33% on Wednesday. So clearly investors aren’t completely discounting the chances that the ECB could move again next week.

Over in the US, yields on 10yr Treasuries were down -3.5bps at 4.25% (4.22% overnight), a notable reversal from their intraday peak above 4.30% just after the jobless claims data. This rally was led by the front-end with 2yr yields down -6.9bp to 4.95% (4.925% overnight), as Fed funds pricing for end-24 declined by 7.9bps from its cycle high reached the previous day. This reversal didn’t have a clear trigger but matched an overall risk-off tone that saw the dollar index (+0.19%) reach a new 6-month high and oil end a run of nine consecutive increases (Brent crude -0.75% to $89.92/bl).

Fedspeak late in the US session did little to lean against the rates rally. Chicago Fed President Goolsbee, one of the more dovish FOMC members and a voter this year, noted that “we are very rapidly approaching the time when our argument is not going to be about how high should the rates go”. New York Fed President Williams said that the Fed is “in a good place”, and “we are restrictive, still an open question whether we are sufficiently restrictive”. Echoing the restrictive policy tone, Atlanta Fed President Bostic (non-voter) commented that “we just need to let that restriction play out”. After US market close we did get some more hawkish comments from Dallas Fed President Logan (voter), who noted that “another skip could be appropriate” in September, “but skipping does not imply stopping” and her base case “is that there is work left to do”.

Overnight in Asia, major indices are selling off following yesterday’s weakness in the US,led by declines in the Nikkei 225 (-1.29%) and the CSI 300 (-0.80%), with the Kospi also losing ground (-0.59%). Hong Kong markets are closed due to severe rainfall. In terms of data, key releases overnight included a miss in labour cash earnings in Japan (+1.3% YoY vs +2.4% expected) as well as downward revisions in the country’s Q2 GDP (4.8% annualised down from 6% at first estimate and 5.6% expected). US Equity futures are fairly flat. WTI is -0.73% this morning.

Back in Europe, gilts outperformed again yesterday, which came as the BoE’s Decision Maker Panel survey suggested that inflation expectations were falling among firms. For instance, 1yr CPI expectations were down to 4.8% in August, having been at 5.4% in July. And 3yr expectations were also down a tenth to 3.2%. As a result, sterling weakened by -0.22% against the US Dollar, whilst yields on 10yr gilts were down -7.9bps on the day. We’ve also seen investors’ conviction in a September hike continue to decline, with an 82% chance of one now priced in, which is the lowest in almost a month. The “Table Mountain” strategy is clearly working for now.

To the day ahead now, and data releases include French industrial production for July and the Canadian employment report for August. Central bank speakers include Fed Vice Chair for Supervision Barr.