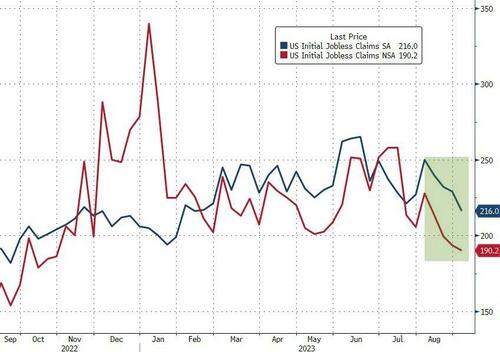

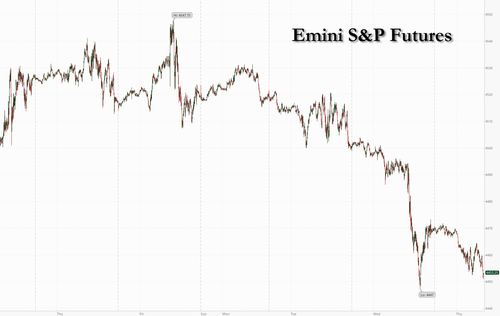

US stocks futures slumped, led by tech shares as Apple tumbled another 3% in premarket trading after Bloomberg reported that China – Apple’s biggest foreign market and global production base -seeks to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies. As of 730am ET, S&P futures were down 0.4%, while Nasdaq futures tumbled 0.7% as a 2% drop in Nvidia added to Apple’s woes. The dollar climbed to a six-month high and the yuan tumbled to the lowest level since 2007 as investors ramped up bets on further Fed policy tightening. Bond yields are lower, following the decline in European yields; commodities are also mostly lower with a modest decline in oil prices. Today, we get jobless claims data (exp. 234K, vs 228 prior), QSS and the revisions to Nonfarm Productivity and Unit Labor Costs. Keep an eye on the bond market moves following claims data. Fed’s Harker, Williams, Bostic, and Logan will speak today.

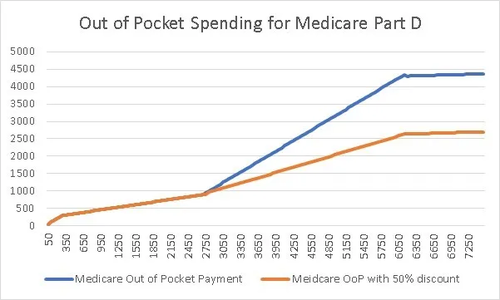

In premarket trading, all eyes are on Apple, which has tumbled by 3% or more for a second session. As Market Ear notes, that means Apple has gone from trading “well” above the 50 day moving average, to trading below the 100 day in 2 sessions. We haven’t seen that in a long time. Note the 200 day is down at 164-ish at the moment.

Nvidia was the other big mover, falling 2.1%, and putting the stock on track for a second session of steep losses, as a weak start to September is making for the worst monthly decline since last December. The entire AI space seems to be having indigestion as C3.ai – with the famous AI stock ticker0 fell 9.6% after the artificial intelligence software company gave a tepid revenue forecast and said that profitability will take longer than expected. Here are some other notable premarket movers:

- Dave & Buster’s shares decline 5.6% after the restaurant and entertainment company reported second-quarter earnings per share that missed estimates.

- Dell Technologies shares fall 3.0% after Barclays downgraded the company to underweight from equal-weight, with the broker saying it still sees macro pressures.

- GameStop shares rose as much as 6.5% after the video game retailer’s net sales for the second quarter beat expectations, while the retail-trader favorite also reported a smaller-than-expected loss for the quarter.

- McDonald’s advances 1.2% after Wells Fargo upgraded the fast-food chain to overweight from equal-weight, expecting the company to “stand tall” as quick-service restaurant trends slow.

- UiPath shares rose as much as 5.9%, after the robotic process automation software company reported second-quarter results that beat expectations and gave an outlook. RBC highlighted profitability as a highlight of the report.

- Roku Inc. shares are down 1.2%, after Loop Capital downgraded the streaming-video platform company to hold from buy.

- ChargePoint fell 10% after the electric-vehicle charging company forecast revenue for the third quarter that missed the average analyst estimate.

- Yext shares slump 15% after the infrastructure-software company’s third-quarter revenue forecast came in below the average analyst estimate at the midpoint.

Stock moves aside, the Bloomberg Dollar Spot Index is on track for an eighth consecutive week of gains, which would be the longest ever run of increases in data going back to 2005. Signs that the US economy is headed for a soft landing are bolstering bets that the Fed will keep borrowing costs higher for longer, which would burnish the greenback’s appeal.

The surging dollar pushed the USDCNY up 0.1% to 7.3275 with the onshore yuan hitting a 16-year low against the dollar as pessimism around China’s economy builds; export data showed China’s trade slump eased in August

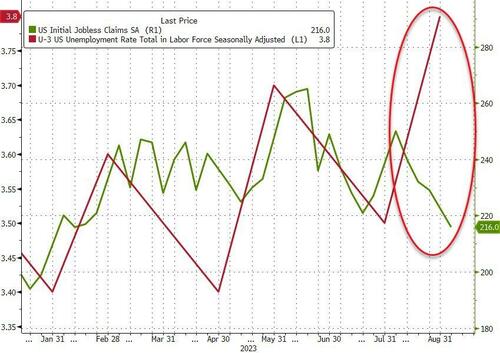

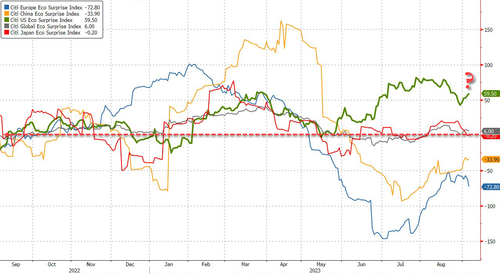

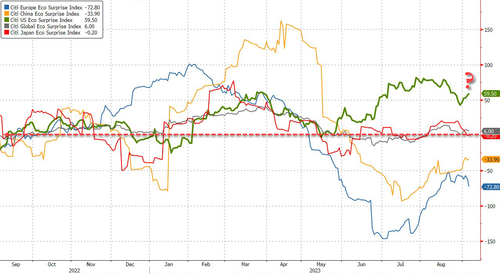

The dollar’s enduring strength has been at the forefront of the market narrative this week, with investors focusing on a string of economic reports that underscore robust US growth while Europe and China weaken. In fact, one can argue that the seasonally adjusted and goalseeked (in bold) US data has made Bidenomics decouple from the rest of the world, in what is one giant political stunt. When reality – and seasonal unadjustments – finally reasserts, watch as US econ data craters in the coming weeks and sends the dollar collapsing.

Meanwhile, the euro sank on data showing German industrial output declined, while the Chinese yuan dropped to a 16-year low in onshore trading.

“You are seeing a clear slowing in growth outside the US so in that context the dollar will do well, especially as you also have ongoing Fed hawkishness,” said Peter Kinsella, head of global currency strategy at asset manager Union Bancaire Privee Ubp SA.

Meanwhile, European stocks erased most of an earlier decline but were still red, as some luxury stocks bounced back and drugmakers rose. The Stoxx Europe 600 fell 0.2% putting the benchmark on course for a seventh consecutive day of losses, in what would be the longest losing streak since February 2018. Here are the most notable European movers:

- Direct Line shares jump as much as 18%, the most on record, after the insurer agreed to sell its brokered commercial insurance business lines to RSA. The asset sale removes the risk of a potential equity raise, according to Citi.

- Jet2 shares gain as much as 8.4%, the most intraday since November, after the UK holiday firm said that it’s on track to exceed current market expectations for profit before foreign exchange revaluations and tax for the year.

- Melrose Industries shares rise as much as 8.9%, the most in more than four months, after the investment firm reported first-half earnings that JPMorgan said beat its expectations and prompted an upgrade to its estimates.

- Tod’s shares gain as much as 5.8%, before trimming their advance, after the Italian luxury shoemaker reported first-half earnings that beat estimates. Mediobanca notes an “outstanding” margin improvement, with the update showing the results of a revamp for the group’s brands.

- Synthomer slides as much as 33% in London trading after the UK-based maker of additives for adhesive products reported a first-half pretax loss and proposed a 6-for-1 rights issue to cut leverage and avoid the risk of breaching debt covenants. Barclays says the rights issue will be heavily dilutive.

- Shares in UK veterinary services company CVS Group tumble as much as 35%, the most in more than four years, while retailer Pets at Home plunges as much as 13% after the country’s Competition and Markets Authority launches a review of the vet sector.

- STMicro and other European chip stocks fell after Bloomberg reported that China plans to expand a ban on the use of iPhones to government-backed agencies and state companies.

Asian equities closed lower, with Chinese stocks among the worst performers, weighed down by property developers. The MSCI Asia Pacific Index slid 0.7%, set for a third day of losses. Tech was the worst performing sector as solid US data overnight spurred bets for further Federal Reserve tightening. The materials sector was also a major drag as Australia’s largest mining stock BHP Group traded ex-dividend. Almost all equity benchmarks in the region were in the red, with the Bloomberg dollar index rising to a fresh six-month high. Focus was also on China’s developer stocks, which rallied Wednesday as bets for further policy support drove speculative buying. The sector retreated Thursday, weighing on the broader Chinese and Hong Kong market. South Korean and Australian indexes slide, while Japanese stocks nurse smaller losses.

- Hang Seng and Shanghai Comp conformed to the downbeat mood as the latest Chinese trade data showed a continued contraction in the nation’s exports and imports but was not as bad as feared, while tech stocks were pressured by frictions after the FCC chair asked US government agencies to address the threat posed by Chinese cellular connectivity modules and a lawmaker called for an investigation into SMIC for potentially violating US sanctions by supplying components to Huawei. Furthermore, China reportedly banned government officials from using iPhones at work and was said to be seeking to extend this to state firms and agencies.

- Australia’s ASX 200 was dragged lower by underperformance in the commodity-related sectors and amid the key data from Australia’s largest trade partner.

- Japan’s Nikkei 225 swung between gains and losses with early support from currency weakness and reports that Japan will put together economic measures around October, although the index eventually succumbed to the selling pressure.

- Indian stocks extended their winning streak to a fifth day, the longest such stretch since mid-July, led by a rally in banks and Larsen & Toubro and triggering confidence among one set of derivatives participants that the guage is set to retest record highs. The S&P BSE Sensex rose 0.6% to 66,265.56 in Mumbai, while the NSE Nifty 50 Index advanced by a similar measure to 19,727.05. Infrastructure giant Larsen & Toubro closed at a record high after rising more than 4% on report that it is likely to win an order worth nearly $3 billion from Saudi Aramco. A sub-gauge of bank stocks saw a late rally led by Axis Bank, HDFC Bank and ICICI Bank.

In FX, the Bloomberg Dollar Spot Index gained 0.1%, heading for its third day of gains and the highest level since March, and record 8th straight week of increases, after US economic data reinforced the case for more monetary tightening. Money-market pricing indicates a 50% chance of a 25 basis point hike at the Federal Reserve’s November meeting; a 60% chance was briefly priced after the release of the ISM survey on Wednesday.

- USD/CNY climbed 0.1% to 7.3275 with the onshore yuan hitting a 16-year low against the dollar as pessimism around China’s economy builds; export data showed China’s trade slump eased in August

- EUR/USD slid 0.1% to 1.0715 after German industrial output fell for the third month in July, spelling concern around Europe’s biggest economy.

- GBP/USD is also underperforming its G-10 rivals, falling 0.3% versus the greenback. Data showing a notable drop in UK house prices and falling inflation expectations in a BOE survey have both played their part.

In rates, Treasuries were slightly richer across the curve, with gains led by front-end as 2-year yields edge back below 5%, following a wider bull-steepening rally in gilts. Front-end yields were richer by 2bp-3bp, with 2s10s and 5s30s steeper by 1bp-2bp; US 10-year around 4.27%, about 1bp richer on the day, with bunds and gilts outperforming by 1.5bp and 6bp in the sector. Gilts lead core European bonds higher, with UK yields richer by 9bp to 6bp across the curve in sharp bull- steepening in early London session. Dollar IG issuance slate includes Slovenia 10Y and five other names; 10 issuers priced a combined $14.4b Wednesday, a day after 20 companies raised $36.2b; issuers paid about 10bps in new-issue concessions, driven by order books that were 2.5 times oversubscribed. US economic data includes 2Q final nonfarm productivity and initial jobless claims (8:30am New York time)

In commodities, crude futures declined, with WTI falling 0.7% to trade near $86.90. Spot gold adds 0.2%.

Bitcoin is essentially flat on the session in a continuation of the recent relatively rangebound performance after last week’s much more pronounced action. BTC currently holding above 25.7k, in tight parameters of circa. USD 200.

Looking to the day ahead now, and data releases include German industrial production and Italian retail sales for July, whilst in the US we’ll get the weekly initial jobless claims. From central banks, we’ll hear from the Fed’s Harker, Goolsbee, Williams, Bostic, Bowman and Logan, the ECB’s Wunsch, Holzmann, Villeroy, Knot and Elderson, as well as BoC Governor Macklem. We’ll also get the BoE’s decision maker panel survey.

Market Snapshot

- S&P 500 futures down 0.4% to 4,455.75

- MXAP down 0.7% to 161.72

- MXAPJ down 0.9% to 503.15

- Nikkei down 0.8% to 32,991.08

- Topix down 0.4% to 2,383.38

- Hang Seng Index down 1.3% to 18,202.07

- Shanghai Composite down 1.1% to 3,122.35

- Sensex up 0.3% to 66,059.18

- Australia S&P/ASX 200 down 1.2% to 7,171.01

- Kospi down 0.6% to 2,548.26

- STOXX Europe 600 down 0.2% to 453.45

- German 10Y yield little changed at 2.62%

- Euro down 0.1% to $1.0711

- Brent Futures down 0.2% to $90.43/bbl

- Gold spot up 0.1% to $1,919.04

- U.S. Dollar Index little changed at 104.94

Top Overnight News

- 1) China’s trade numbers come in slightly better than feared as signs of growth stabilization emerge – exports dropped 8.8% Y/Y (vs. the Street’s -9% forecast and vs. -14.5% in Jul) while imports fell 7.3% (vs. the Street’s -9% forecast and vs. -12.4% in Jul). RTRS

- 2) China plans to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies, a sign of growing challenges for Apple Inc. in its biggest foreign market and global production base. BBG

- 3) The U.S. Commerce Department should end all technology exports to Huawei and China’s top semiconductor firm following the discovery of new chips in Huawei phones that may violate trade restrictions, the chair of the House of Representatives’ committee on China said. RTRS

- 4) Five of China’s major state banks said they will start to lower interest rates on existing mortgages for first-home loans, part of a series of support measures announced by Beijing in recent weeks. RTRS

- 5) A sharp decline in car making fueled a deepening downturn in German industry as production fell for the third consecutive month in July, intensifying pressure on the government to do more to lift the economy out of the doldrums. The 0.8 per cent month-on-month decline reported by Germany’s statistical office exceeded the 0.5 per cent fall forecast by economists. FT

- 6) US and EU are near a deal to resolve a steel tariff dispute and impose new tariffs aimed at curbing excess steel production in China and elsewhere. BBG

- 7) US crude inventories fell by 5.5 million barrels last week, the API is said to have reported. That would bring total holdings to the lowest in nine months if confirmed by the EIA today. Supplies at Cushing declined, while those of gasoline tumbled by more than 5 million — the most in more than five months. BBG

- 8) Disney & Comcast have agreed to accelerate the timeline for Disney to buy Comcast’s stake in Hulu (the goal is to strike a deal by the end of the month, and Comcast says it will direct the proceeds towards accelerated buybacks). Barron’s

- 9) Boaz Weinstein and his group of bidders revised their offer for Sculptor to include beefed up equity commitments and eliminated debt financing risks, people familiar said. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured as the region took its cue from the losses stateside where stocks and bonds declined in the aftermath of hawkish ISM Services data, while participants also digested the latest Chinese trade data. ASX 200 was dragged lower by underperformance in the commodity-related sectors and amid the key data from Australia’s largest trade partner. Nikkei 225 swung between gains and losses with early support from currency weakness and reports that Japan will put together economic measures around October, although the index eventually succumbed to the selling pressure. Hang Seng and Shanghai Comp conformed to the downbeat mood as the latest Chinese trade data showed a continued contraction in the nation’s exports and imports but was not as bad as feared, while tech stocks were pressured by frictions after the FCC chair asked US government agencies to address the threat posed by Chinese cellular connectivity modules and a lawmaker called for an investigation into SMIC for potentially violating US sanctions by supplying components to Huawei. Furthermore, China reportedly banned government officials from using iPhones at work and was said to be seeking to extend this to state firms and agencies.

Top Asian News

- China seeks to broaden the Apple (AAPL) iPhone ban to state firms and agencies, according to Bloomberg.

- FCC chair asked US government agencies to address the threat posed by Chinese cellular connectivity modules and to consider adding Chinese firms Quectel and Fibocom to the list of companies posing national security risks.

- US House Speaker McCarthy said China has the responsibility to repair relations with the world. It was also reported that the US Ambassador to Japan said Japan has done everything right according to science regarding the Fukushima water release and that is in direct contrast with what China has done during the COVID pandemic.

- China’s Big 4 banks adjusted rates for some existing first-home mortgages, according to Reuters.

- Chinese Premier Li says China will further open up and offer bigger market for countries including Australia; both side should properly handle differences in spirit of mutual respect

European bourses spent the morning in the red but have benefitted from a broader yield-induced pick up in sentiment, Euro Stoxx 50 +0.2%. Sectors are now mainly in the green, outperformance in Utilities whilst Basic Resources and Tech continue to lag. On Tech, the sector is impaired by marked pre-market downside in Apple -2.7%, following reports of a further crackdown by China in iPhones. Action which is also affecting US futures, ES -0.2% and NQ -0.5%; though, they are off lows given the mentioned influence of yields and as attention turns to the busy afternoon docket.

Top European News

- BoE Monthly Decision Maker Panel data – August 2023: One-year ahead CPI inflation expectations decreased to 4.8% in August, down from 5.4% in July. Three-year ahead CPI inflation expectations decreased slightly to 3.2% in August, down 0.1 percentage points relative to July. Expected year-ahead wage growth remained the same at 5.0% on the month in August, and the three-month moving average decreased slightly by 0.1 percentage points to 5.1%.

- German IFO Institute maintains its 2023 GDP forecast at -0.4%, whilst lowering its 2024 forecast to +1.4% from +1.5%

FX

- Dollar eases off post-ISM peaks and trades mixed vs peers pre-IJC and more Fed speak, DXY confined to 104.980-800 range.

- Sterling suffers after drop in UK house prices and DMP 1 year inflation expectations, Cable below 1.2500 and Fib support at one stage.

- Euro defends 1.0700 vs Greenback again and aided by 1.85bln option expiries.

- Kiwi regains composure and sight of 0.5900 against Buck as NZ manufacturing sales rebound.

- Yen benefits from retreat in US Treasury yields and bounces from 147.87 to 147.37.

- Aussie draws encouragement from not so weak Chinese imports and exports, AUD/USD closer to 0.6400 than 0.6350.

- PBoC set USD/CNY mid-point at 7.1986 vs exp. 7.3121 (prev. 7.1969)

Fixed Income

- Gilts correct higher and overtake debt peers on UK specifics including weak data and a decline in inflation expectations.

- 10 year bond extends from 93.78 to 94.44, while Bunds and T-note lag within 130.35-87 and 109-21/29 respective ranges.

- OATs and Bonos bid after somewhat mixed French and Spanish auctions, BTPs underpinned ahead of new Valore issuance due in early October.

- Italian Treasury offers a new issue of the BTP Valore from October 2nd-6th, five year maturity.

Commodities

- Another session of consolidation for the crude benchmarks, continuing Wednesday’s pullback, despite bullish inventory data and Saudi lifting its Asia OSPs, with markets broadly looking to Fed speak and US data points.

- Strike action at Chevron’s LNG facilities in Australia has been pushed back from the scheduled start of today until Friday.

- Spot gold is benefitting from the subdued risk tone ahead of data and Fed speak while base metals pullback in-line with APAC trade despite better-than-feared Chinese trade figures.

- US Energy Private Inventory Data (bbls): Crude -5.5mln (exp. -2.1mln), Gasoline -5.1mln (exp. -1mln), Distillate +0.3mln (exp. +0.2mln), Cushing -1.4mln.

- Texas declared a grid emergency as the heat stoked demand for power, while it warned that rolling blackouts may be needed amid grid emergency, according to Reuters.

US Event Calendar

- 08:30: Aug. Continuing Claims, est. 1.72m, prior 1.73m

- 08:30: 2Q Nonfarm Productivity, est. 3.4%, prior 3.7%

- 08:30: 2Q Unit Labor Costs, est. 1.9%, prior 1.6%

- 08:30: Sept. Initial Jobless Claims, est. 234,000, prior 228,000

Central Bank Speakers:

- 10:00: Fed’s Harker Speaks on Future of Fintech

- 11:45: Fed’s Goolsbee Delivers Welcome Remarks at Chicago Fed Event

- 14:00: St. Louis Fed Hosts Public Engagement on Presidential Search

- 15:30: Fed’s Williams Speaks at Bloomberg Market Forum

- 15:45: Fed’s Bostic Speaks on Economic Outlook

- 16:55: Fed’s Bowman Speaks on Panel About Future of Money

- 19:00: Fed’s Bostic Speaks on Economic Mobility

- 19:05: Fed’s Logan Speaks on Monetary Policy in Dallas

DB’s Jim Reid concludes the overnight wrap

Markets witnessed a fresh selloff over the last 24 hours, with bonds and equities losing ground after the latest ISM services index came in much stronger than expected. The headline number was at 54.5 (vs. 52.5 expected), which was above every economist’s expectation on Bloomberg, as well as the highest level since February. So it made a change from the more downbeat data over recent weeks, such as the negative revisions in last Friday’s jobs report. On top of that, the employment component (54.7) hit a 21-month high, new orders (57.5) were at a 6-month high, and there were even signs of fresh momentum on inflation, since the prices paid component rose for a second consecutive month to 58.9.

Whilst the data came in better than expected, the problem for markets was that the release led to growing speculation that the Fed might not be done with their hiking cycle after all. In fact, fed funds futures moved to price in a 50% chance of a hike by the time of the November meeting, up from 46% on Tuesday. So by the close, the market saw it as even odds whether we’ll get another hike. And looking further out, the rate priced in for the December 2024 meeting hit a new high for the cycle of 4.45%, which just shows how investors are becoming increasingly sceptical about the prospect of rate cuts any time soon.

With the prospect of another rate hike in sight, September is sticking to its usual reputation of being a poor month for markets. That included a fresh bond selloff yesterday, which sent the 10yr Treasury yield up +2.0bps to 4.28%, while the 2yr moved back above 5% for the first time since last Monday (+5.6bps to 5.02%). The 10yr real yield was up +1.5bps to 1.97%, just 1bp from its post-GFC high seen last month. The effect of higher yields became increasingly evident in the real economy as well yesterday, as we got the latest weekly data from the Mortgage Bankers Association. That showed that mortgage applications for home purchases fell to its lowest level since April 1995 last week, which just shows how rates at these levels are having an effect.

Those bond moves were echoed in Europe, where yields on 10yr bunds (+4.3bps), OATs (+4.7bps) and BTPs (+6.3bps) all moved higher on the day. That comes with just one week to go until the ECB’s next decision, and as in the US, yesterday brought growing speculation about whether the ECB might hike again after all. For instance, overnight index swaps moved to price in a 33% chance of a hike by the close, up from 25% the previous day. In part, that followed comments from several ECB speakers. The more hawkish members kept the option of a September hike firmly on the table, with the Dutch central bank governor Knot saying that the decision was a “close call”, whilst Slovakia’s Kazimir said that the ECB should “take one more step”, that a hike next week was preferable to waiting in September and delivering another hike later in the year. Meanwhile, Italy’s Visco said he believed “we are near the level where we can stop raising rates”. So by no means full confidence in a pause from one of the more dovish ECB voices.

The main outlier in the bond space was the UK, where gilts outperformed after Bank of England officials struck a more dovish tone than had been expected. For instance, BoE Governor Bailey said that policy was “near the top of the cycle”, and markets moved to price in a slightly more dovish path for rate hikes as a result. Yields on 10yr gilts only ended the day up +0.8bps, with the 2yr yield down -3.2bps, whilst sterling the weakest-performing G10 currency as it fell -0.45% against the US Dollar.

This backdrop proved bad news for equities, with the S&P 500 down -0.70% on the day, though it did partially recover in the US afternoon having traded down -1.21% at its intraday low. Tech stocks were the biggest underperformer, and the NASDAQ (-1.06%) and the FANG+ Index (-1.47%) both saw a decent pullback. It was much the same story in Europe as well, where the STOXX 600 (-0.57%) lost ground for a 6th consecutive session, albeit with sizeable variations among the individual country indices. For instance, the DAX only fell -0.19%, whereas Italy’s FTSE MIB fell -1.54%.

Another factor not helping matters were the latest run-up in oil prices. For example, Brent crude was up another +0.62% to close at $90.60/bbl. That’s its 7th consecutive daily advance and leaves prices up to their highest level since November. In the meantime, WTI prices were also up +0.98% to $87.54/bbl. So that raises the risk that inflation persists a bit more than previously expected, and the recent runup in gasoline prices has already led to expectations of a stronger August CPI print next week.

Overnight in Asia, we’ve seen that negative tone continue in markets, with losses across all the major indices. That includes the Hang Seng (-0.95%), the CSI 300 (-0.86%), the KOSPI (-0.68%), the Shanghai Comp (-0.58%) and the Nikkei (-0.34%). And looking forward, this weakness is also evident among equity futures, with those on the S&P 500 (-0.11%) and the DAX (-0.27%) pointing lower as well. However, there were some signs of improvement in China’s data, with exports only down -8.8% in dollar terms year-on-year in August (vs. -9.0% expected), which is up from a -14.5% decline in July. Likewise, imports were down -7.3% yoy (vs. -9.0% expected), which was also an improvement from the -12.4% reading in July.

Elsewhere yesterday, the Bank of Canada held their target for the overnight rate at 5%, in line with expectations. However, their statement said that the Governing Council “remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed.” Following the decision, yields on 10yr government debt closed -0.6bps lower. Similar to the US, overnight index swaps imply a very close call on whether we see another rate hike, and by the close they were pricing in a 48% chance of a further hike by the end of the year.

Yesterday also saw the release of the Fed’s Beige Book, which summarises anecdotal information gathered by the regional Feds. On the consumer side, this noted strong tourism spending, which “most contacts considered the last stage of pent-up demand for leisure travel”. But it pointed out that “job growth was subdued across the nation”. In other Fed news, the Senate confirmed Philip Jefferson as Vice Chair of the Fed for a four-year term, and Lisa Cook was confirmed for a full 14-year term as a Governor on the Federal Reserve Board.

Finally, data showed that German factory orders had contracted by -11.7% in July (vs. -4.3% expected). That’s the largest slump since the pandemic-related decline in April 2020. Separately, the German construction PMI for August came in at 41.5, which was its 17th consecutive month in contractionary territory.

To the day ahead now, and data releases include German industrial production and Italian retail sales for July, whilst in the US we’ll get the weekly initial jobless claims. From central banks, we’ll hear from the Fed’s Harker, Goolsbee, Williams, Bostic, Bowman and Logan, the ECB’s Wunsch, Holzmann, Villeroy, Knot and Elderson, as well as BoC Governor Macklem. We’ll also get the BoE’s decision maker panel survey.