Authored by Matthew Piepenburg via GoldSwitzerland.com,

Have you heard the good news?

The Atlanta Fed GDPNow estimates a 5.9% growth in real GDP for Q3 2023. In nominal terms, we can even boast of an 8.9% surge.

What fantastic news! Growth! Productivity!

This must mean we can all breath a collective sigh of relief as Powell continues his valiant war against inflation as GDP rises, right?

I can almost hear the champagne bottles popping from the Eccles Building to the Bezos-owned Washington Post.

The financial wizards have saved us once again, right?

Wrong.

Oh, so, so, so, so WRONG.

Why?

Debt-Driven Growth is Not Growth, but a Slow Death Trap

As usual, the answer lies in math, history and, of course, THE BOND MARKET.

For years and years, I have tried to make one point (and indicator) almost reflexively clear, namely: The Bond Market Is the Thing.

This is because the bond market reflects debt forces, the most cancerous of all market killers once they metastasize from the acceptable to the fantastical, and the cheap to the unaffordable.

Today, we stare upon the greatest national and global debt bubble in history.

And the cost of that debt is getting higher, not lower.

This should be the key theme of every conversation, but instead, our citizens are arguing over gender neutral bathrooms and exciting politicos (opportunists) scurrying for power like donkeys fighting for hay.

Far better, in my opinion, if the people understood boring things like sovereign bonds…

In particular, they just need to consider and understand yields on Uncle Sam’s IOU (with particular emphasis on his 10-Year UST), which tells us the market’s measurement of the cost of debt.

And given that debt is the sole (rotten) wind beneath the wings of the post-08 American dream, when those yields rise like approaching shark fins, we all need to pause and think deeply, realistically and, hence differently from the consensus pablum which currently passes for financial reporting.

The Open Secret Hiding in Plain Sight (Ignored Shark Fins…)

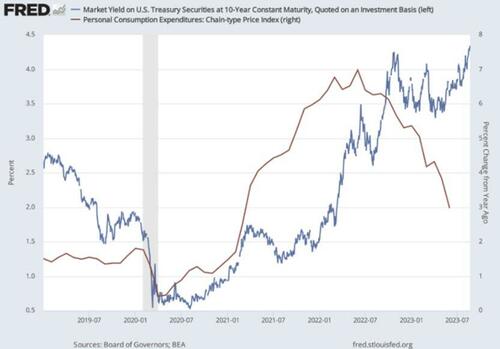

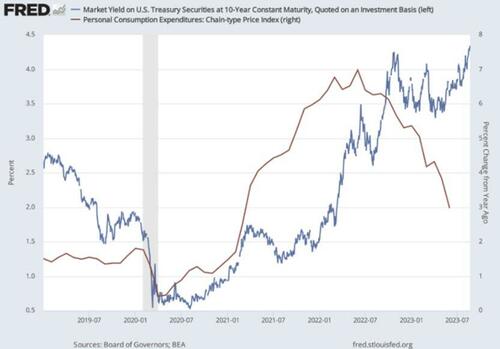

As Luke Gromen has been warning for quite some time, and as my partner, Egon von Greyerz, has been arguing/expecting for even longer, we are now seeing rising yields on the 10Y UST while inflation rates (intentionally misreported) continue to fall—temporarily.

Folks, this is worth understanding. It’s not hard to do. But it’s critical.

That is, we need to understand how scary it is to see GDP rising alongside 10Y Treasury yields.

So, let’s dig in.

Debt-Based Growth is the Oxymoron of, Well…Morons

GDP is rising because government deficit spending (on everything from yet another preventable yet losing war in the Ukraine to stimmy checks for migrants [“asylum seekers”?] pouring through Texas) is rising well beyond sustainable levels.

Near-term, spending always leads to growth. But when that spending is done on a maxed-out national credit card, the short-term growth (i.e., GDPNow forecasts above) come at a comical, yet serious price.

Stated otherwise, spending, even deficit spending, has quick benefits; the debt consequences, and economic pains, however, take longer to show their economic (moronic) effects.

But when they do, the sickening results are as mathematical as they are historical.

A Tale of the Drunk & Stupid

If one, for example, were to hand a college frat boy his rich uncle’s credit card and permit him unlimited credit, that frat boy would undoubtedly throw the kind of seductive campus parties which would ensure his popularity along side many, many weekends of extravagant bacchanalia and a campus filled with smiling, drunk undergrads.

Soon, the frat house would construct its own elaborate bar, with weekly transports of unlimited beer kegs, a billiards room adorned with flat-screen TVs and 24-hour ESPN.

Others, even from universities miles way, would embark upon a joyous pilgrimage, crowding their Friday-night gatherings with shouts of awe and cries for more vodka shots.

The fun would seemingly never end.

Until, that is, the credit card bill came and the rich Uncle was tapped out.

At that point, the frat house’s growth story devolves into a comical escapade of the drunk and the stupid, which effectively describes the profiles and policies of our so-called financial elite.

The DC Frat House

When GDP spikes on the tailwind of deficit spending, the Fed starts to suffer from the beer-goggle effect of blindness to reality.

It then feels even more pressure (or drunken confidence) to raise short-term interest rates, which also sends the USD higher in the near-term but just about everything else (i.e., stocks, bonds, real estate and tax receipts) lower.

This means the risk of a market implosion in a setting of rising GDP increases exponentially, which is precisely what we saw near the end of 2018 when Powell tried to tighten the Fed’s balance sheet and raise rates at the same time.

Net result?

Markets tanked by Christmas, and as the new year rolled in, the Fed was bailing out the repo markets to the tune of hundreds of billions/week and printing inflationary money quicker than Nolan Ryan’s fastball.

Ignored Patterns, Ignorant Polices

But this otherwise ignored pattern, like a fast-ball, is pretty easy to track. The more the Fed hikes rates, the fatter and more expensive are Uncle Sam’s deficits as GDP rises on drunken (deficit) spending.

This leads to a mathematical case of “fiscal dominance,” which even the St. Louis Fed confessed in June (and of which I recently explained here)—namely, the ironic scenario in which the war on inflation (fought with rising rates) actually causes more inflation.

Why?

Because rising rates don’t just stimulate a GDP frat party (as per above), but they make America’s debt costs (interest expenses) skyrocket into the trillion/year category, which can then only be paid by a Fed mouse-clicker, which is the inevitable inflationary consequence of Powell’s deflationary “higher-for-longer” policy.

Stated otherwise, Powell, like Robert E. Lee, Napoleon, Paulus, Westmorland and Zelensky, is fighting a losing war.

Or for you film buffs who recall Maverick “writing checks [his] body can’t cash,” America is issuing IOUs its Treasury Dept. can’t pay—unless, of course, it prints a lot more fake/fiat money.

And those IOUs (i.e., USTs) are rising at a sickening rate, which means bond prices (which move inversely to supply) will fall and yields (which move inversely to price) will rise.

Read that last sentence again. It’s our bond market (and nightmare) in a nutshell.

And when yields on US 10Y USTs rise, the interest expense on Uncle Sam’s $33T bar tab becomes a bayonet wound to the economy and the market.

Horribly, Horrible Bad News

Thus, when we see GDP growth rising at the same time UST supplies (and hence yields) are climbing at a rate not seen in 55 years, this is not good news—it’s horribly, horribly bad news.

Not only are rates rising along side GDP, but our deficits are growing even deeper and hence this vicious circle of debt just gets deadlier and darker.

And this means the need to cover those deficits by printing trillions out of thin air becomes clearer and clearer, which means inflation is no longer a debate, but as fatally foreseeable as Pickett’s failed charge at Gettysburg.

We Need a Bigger Boat

In the coming months, or early into 2024, Egon and I foresee rising US sovereign bond yields and rising rates which will be near-term deflationary for risk assets and disturbing for Main Street economies no longer able to re-finance their way out of a national debt trap.

At some point thereafter, the cost of those debts will demand a monetary response (money printing to the moon) which will be, by definition, inflationary for regular Joes and no help to mean-reverting markets.

In short: We not only see inflation ahead, but stagflation to boot.

In such a setting, the USD, like the stern of the Titanic, will go from rising, and then temporarily pausing, to sinking fast to the bottom.

Again, the bond market is the thing.

Those yields matter. They are the approaching shark fins racing toward our shores which no one wishes to see.

Instead, we get to watch another billionaire running for office bare his naked chest (and hidden will to power) for the camera…

But as warned already, these shark fins matter, and we are most certainly gonna need a bigger boat…