Kunstler: “This Is How The Pitchforks Finally Come Out”

Authored by James Howard Kunstler via Kunstler.com,

Happenings Await

“Even Americans who have no particular interest in freedom and independence in democracies worldwide, should be satisfied that we’re getting our money’s worth on our Ukraine investment.”

– Sen. Richard Blumenthal

The Labor Day weekend looms like a gateway into an autumn hell-scape of political psychodrama, so enjoy those last clam rolls of the season before the zeitgeist darkens and events pound the shore like so many waves of hurricane surf. Further inland, where the Swamp lies, unseen hands work overtime to falsify reality in a leaderless nation. Everybody feels the unbearable tension of things as yet unhappened.

“Joe Biden” has LARPed his way to the final act of his performance. The evidence of his high crimes, and the covering-up of those high crimes by our lawless law officialdom, is piled high enough to eject him into the swales of infamy. We know exactly how the Ukraine grift went down — the documentation is stark and florid — as is the rest of family’s bribery operations in other lands not necessarily friendly to our own land. So, add treason to bribery and there you have the complete kit of perfidious treachery against the nation.

“Joe Biden” will be removed most likely by his own party before an impeachment inquiry can be launched in Congress. Not even The New York Times and CNN would able to ignore the horrific spectacle and the party’s own minions might be shamed into learning how they were hosed for so many years. The unseen hands that jammed “JB” into the White House can then figure out what to do about the hapless Kamala Harris while Congress turns its attention to impeaching Merrick Garland, Christopher Wray, Alejandro Mayorkas, and Xavier Bacerra. At least that’s how it might work if the USA was a sane polity.

Otherwise, the people of this land will have to choose between being rolled-over by a globalist coup or find other routes of resistance. One would be for the governors of several so-called Red states to end mail-in voting, get rid of computerized ballot-counting machines, bring back paper ballots, and declare that all voting and hand ballot-counting take place on one election day. Don’t believe those who say it can’t be done. If it’s not done, we’ll never see anything close to an un-rigged election in this country ever again.

In what might be one of his last official acts, “Joe Biden” announced last week that Americans would be “encouraged” to get a new-and-improved mRNA vaccine booster against the new Covid virus strain EG.5 “Eris” (named after the Greek goddess of strife and discord). The “president,” said he asked Congress for funding “for a new vaccine that is necessary, that works…. It will likely be recommended that everybody get it no matter whether they’ve gotten it before or not.”

Say, what…? Did the earlier vaccines not work, Joe? Most assuredly they did not. The shots injured, disabled, and killed a great many people, and it staggers the rational mind that the CDC is still pushing these shots. You might conclude that they’re pretending this didn’t happen to evade responsibility. After all, what would be the consequences if these officials admitted that all the previous Covid vaccines were ineffective and harmful? And what would be the reaction of the 81.3 percent of the population who got at least one dose of the previous vaccines and the 65.6 percent who are “fully vaccinated” with two or more shots? (Note, statistics from the CDC.)

I’ll tell you what would happen: the CDC officials and a great many other persons on the public payroll would be in court on criminal charges. And doctors and hospitals would be subject to so many lawsuits they would never again have time to actually practice medicine, while millions of people with damaged immune systems and wrecked organs take flight like so many black swans flapping into the setting sun of their own prematurely attenuated lives. If you care to be astounded, listen to this talk that Dr. Peter McCullough gave to an audience in New Hampshire a few days ago, calling out all the principals who devised the Covid-19 fiasco by name: Ralph Baric, Anthony Fauci, Peter Daszek, and Francis Collins, and then describing exactly how the dastardly act and the cover-up went down.

Speaking of happenings this autumn, expect the war in Ukraine to come to an end. The news media might omit to inform you about this, but it awaits. Russia will not trumpet its victory, so as to avoid inflaming America’s crazed neo-cons. Rather it will just quietly take charge of its successfully neutralized neighbor, make provision for some sort of administration over what remains of the rump state — in a way that affords Russia a sense of permanent security — at the same time that Russia commences new negotiations separately with several European nations to reestablish realistic relations.

The US will be delicately hung out to dry on this. Short of resorting to nuclear World War Three, there is nothing the US can do about it — except for the Democratic Party to blame the whole sorry thing on “Joe Biden” as he is forced to resign from office pending that aforesaid impeachment threat. No other explanation for the end of our Ukraine project will be required.

The party of chaos will flounder a while in the very chaos that it induced, trying laughably to switch out Kamala Harris for Gavin Newsom — or some other ploy to stay in business. But the party will be so badly damaged by then that it will have no other option except to let Robert F. Kennedy, Jr., in to drive out the remaining demons and save the venerable old org from suicide.

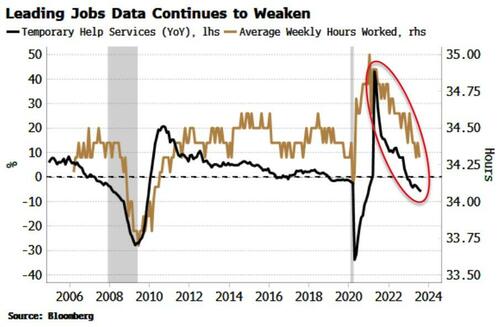

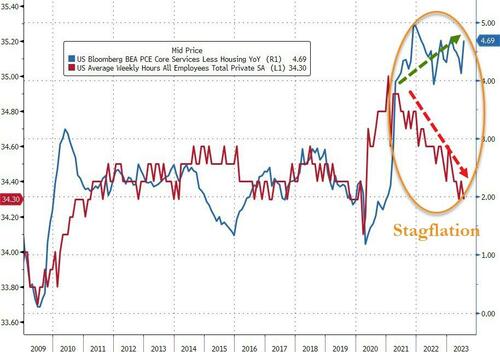

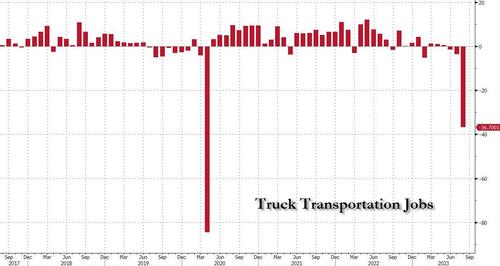

If you think that these various momentous happenings won’t affect the financial markets and the banking system in the coming season, prepare to be amazed. This is how America truly gets to feel the pain, and this might be how the pitchforks finally come out for the people who wrecked our country.

* * *

Support his blog by visiting Jim’s Patreon Page

Tyler Durden

Fri, 09/01/2023 – 16:20

via ZeroHedge News https://ift.tt/k1Sb9xp Tyler Durden