Authored by Alasdair Macleod,

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

For now, the dollar appears to be buoyed up by rising bond yields. However, as they rise further portfolio losses for foreign investors are likely to increase, leading to dollar liquidation. It is not generally realised how many dollars and dollar securities are owned by foreigners, the bulk of them being held outside the US banking system. And the quantity of foreign currency owned by Americans to absorb this selling is very small in comparison.

Higher interest rates and bond yields also threaten to destabilise the banking system, a problem equally faced by the Eurozone, the UK, and Japan. But how can the US Government protect itself from this danger?

The only answer is to admit to the end of the fiat era and put the dollar back onto a gold standard. However, the US Government does not have the mandate to take the required actions and officially at least is still in denial over the need to stabilise the currency. The legal position referring to the constitution is briefly touched upon, because laws will have to be considered to secure the dollar’s future.

Unfortunately, the US Treasury’s gold holdings are almost certainly compromised. Furthermore, since the Asian hegemons have accumulated substantial holdings of bullion in addition to their official reserves, there is bound to be a strong reluctance to hand economic power to Russia and China by endorsing a return to gold standards.

My conclusion is that the era of the fiat dollar based global currency system is rapidly ending, and for America and the dollar there can be no Plan B. It will almost certainly lead to the end of the fiat dollar, and the end of the US hegemony.

Introduction

It is dawning on increasing numbers of analysts that the era of the fiat dollar might be drawing to a close. Very few investment professionals know what to expect. Being thoroughly Keynesian in outlook, most still believe that by the Fed managing interest rates consumer price inflation can be contained and that recessions can also be avoided by expanding fiscal deficits. But the contradictions arising from a deteriorating economic outlook and CPI inflation continually rising completely scuppers these macroeconomic theories. Blaming it on Russia and OPEC+ is tempting, but not a good enough argument.

It is becoming clear that fiat currencies have become increasingly unstable. The only solution for the dollar is to fix the value of credit: but to what? It has been gold or silver throughout the history of national economies. But a denial of returning to exchanging the dollar for a fixed quantity of gold is so systemically embedded in the administration that it is difficult to see this solution even as a last resort.

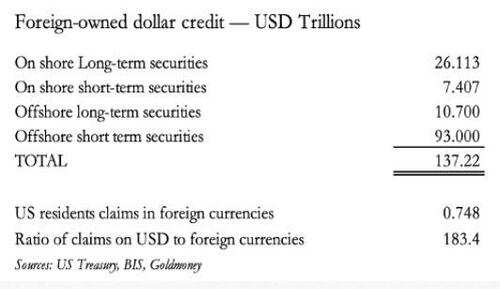

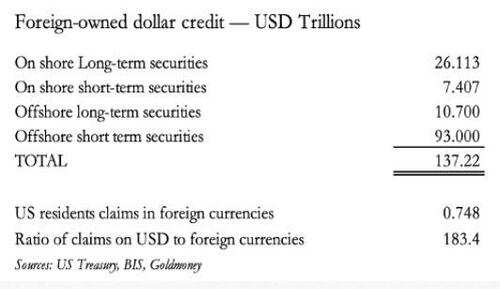

In this article I look at the background to what is sure to become a dollar crisis. The urgency of this matter has been brought forward by America’s declining global influence compared with that of the Asian hegemons, and the US Government’s profligacy. Almost certainly, exposure to the dollar will be unwound by foreign actors, and that exposure, which must include dollar credit originated outside the US banking system is colossal. The table below illustrates the approximate position.

To summarise the evidence, foreigners own or are exposed to a massive $137 trillion dollars. As a cohort, if they decide to begin reducing their exposure US residents have less than a trillion equivalent in foreign currencies to sell in exchange. In the jargon of the markets, the dollar will become “offered only”.

This is the true danger from rising interest rates. As they rise, the declining value of foreign-owned long-term securities totalling $37 trillion will simply accelerate generating widespread investment and dollar liquidation. This will not be offset by US holders of foreign investments liquidating their positions for a simple reason.

US holders of foreign securities hold almost all of them in ADR form, being listed and priced in dollars. In a rising interest rate environment, they will also be declining in value and so we can expect US investors to sell them as well. The sale of an ADR does not lead to a sale of an underlying foreign currency, whereas a sale of a dollar security by a foreign holder will almost certainly do so – unless the foreign investor cohort overall is content to add to its holdings of short-term dollar securities.

Foreign liquidation of dollar investments is a largely unseen danger to the dollar by US-centric commentators who are stuck with the belief that foreigners need to accumulate them. A further rise in interest rates or bond yields, which appears to be underway, far from protecting the dollar will almost certainly lead to portfolio liquidation, dollar liquidation, and therefore its collapse, there being almost no foreign currency in US residents’ hands to absorb it.

And finally, in the run up to a presidential election year it is becoming clear that the US’s proxy war against Russia is turning into a political and military disaster. Ukraine is running out of men, and Russia is reaping the benefit of western-imposed sanctions. Disagreements between NATO members are beginning to surface.

What will that do to the dollar’s credibility? It all feels like a fin de siècle, the end of the fiat era and the beginning of a new currency regime.

The background to a new dollar crisis

It is never wise to pursue political and economic policies to the end of the road. But that is what the US Government appears to be doing.

In 1971, having embarked on a policy of replacing gold with the dollar as everyone’s currency and valuation standard, there is every reason to fear that for the US Government to return its fiat dollar to sound money is politically impossible. The reasons this might now matter are twofold: the dollar is losing its grip as the world’s reserve currency, and interest rates are rising into a recession which could turn into a slump, destabilising the mountain of debt which is the other side of too much unproductive credit intermediated by over-leveraged banks.

In previous articles, I have shown the importance of anchoring the value of credit to gold to ensure its stability, particularly at a time when credit’s instability becomes beyond the state’s control. Such a time has clearly arrived. I have described the practicalities of how to do it, which is to simply ensure that a currency is freely convertible into gold coin and bullion. A modern version of this has been proved to work time and again in the form of currency boards recommended and implemented for a number of governments by Professor Steve Hanke, tying collapsing currencies to a relatively stable dollar. But the dollar itself is now becoming highly unstable.

For the US Government, the urgency of considering a gold standard for the dollar is now upon it, because the Asian hegemons — Russia and China — are in a position to put their roubles and yuan on rock-solid gold standards. The ease with which Russia can do this was demonstrated in my recent article, here. Furthermore, it is increasingly in Russia’s interest to take this step. But if Russia does so, it is bound to fatally undermine the fiat dollar’s position. And it is not widely realised that China is again encouraging its citizens to buy gold. This is from the Jerusalem Post on 7 June:

“Last week an event occurred which was completely missed by the mainstream media. The People’s Bank of China (PBOC) took the next important step to encourage a wider and less wealthy section of Chinese citizens to purchase gold and silver bullion. The PBOC opened the facility for citizens to convert renminbi cash savings held in the public’s own bank accounts to be converted into physical gold at the click of a button.”

Does that indicate that China feels the time has come to protect even her poorer citizens and the yuan from global currency instability?

Perhaps the hegemons are positioning themselves. While putting the rouble onto a gold standard would be seen as an act of extreme monetary aggression against the fiat dollar, Russia urgently needs to stabilise her currency. In a dollar-centric world suffused with anti-Russian propaganda, any weakness in the dollar is simply multiplied in the rouble exchange rate. This the flaw in Putin’s agreement with Saudi Arabia to drive up energy prices. As I put it in the article referenced above, if they shiver in Germany, they will freeze in Russia: that is without massive energy subsidies for the Russian people.

Feedback from readers exposes an erroneous belief that it is the trade balance which matters. They correctly say that higher energy prices improve Russia’s balance of trade. So why should the rouble’s exchange rate not benefit? The answer is that the purchasing power of a fiat currency depends totally in the belief in its validity as a medium of exchange. And while it is true that Russia’s exports benefit from higher oil and gas prices, in a global inflation crisis such as we now face, the rouble’s credibility is unlikely to improve, particularly when it is off-limits for western speculators and the Russians are demonised in capital markets.

Therefore, we should assume that Russia will be forced to take meaningful steps to stabilise the rouble, which can only be done by returning the rouble to a gold standard. Furthermore, Russia’s economy has the low tax environment that would benefit hugely from interest rates that reflect gold as money as opposed to fiat roubles. From an interest rate on one-year rouble credit currently at 16% we can expect this to decline towards 3% over not very much time with enormous economic benefits. There is evidence that senior Russians, including Putin, understand this point.

If only the US could achieve similar benefits from sound money! Unfortunately, it requires a totally different political, strategic, and economic mindset to those currently operating in Washington and Langley. Instead, the Keynesian playbook is for the state to increase its fiscal and monetary support for the economy to prevent it running into a recession. And policy makers are more informed in their policies by the recent price stability at lower interest rates than the instability of the 1970s when the fiat dollar was bedding in. They believe that the consumer price inflation problem is exogenous and not the consequence of earlier monetary policies. And they aver that a period of current interest rates, or at least levels not much higher, will be sufficient to return CPI inflation towards the 2% mandated target.

America is trapped in a political and economic version of Stockholm syndrome. But there are some influential analysts who are beginning to see this as wishful thinking, and that energy prices in particular are not only going higher but will continue to do so. This creeping suspicion is likely to permeate official thinking over time and in the light of developments.

As part of this enlightenment, JPMorgan’s Global Equity Research unit is now forecasting $150 prices for Brent. The consequences for heating oil and diesel prices are particularly pernicious. These values are already rising, as the snapshot of energy and commodity price moves over the last three months indicates.

Other prices rising ahead of the US winter include some basic foodstuffs, indicating that any move towards CPI normality is a long way off. And then there is the widespread ignorance that surrounds the consequences of the bank credit cycle which is entering its contractionary phase. The effects are to wrest control over interest rates from central bankers, as desperate borrowers with deteriorating cash flows scramble for scarce credit: they will simply have to pay up to remain in business.

The consequences of the credit cycle

It is too simplistic an argument to blame depressions, slumps, and recessions on the failings of the private sector. The cause is always a contraction of credit. But that is created by a previous overexpansion of bank credit and by its nature is a correction of a previous condition. The greater and the longer the expansion is prolonged, the more destructive the contraction that follows.

Ignoring this reality, Keynes and others invested in a role for governments to intervene in economic affairs. It required the eventual abandonment of sound money. The original idea was for governments to take up the recessionary slack, stimulating the economy by deliberately running a budget deficit, and recovering public finances subsequently through increased tax revenues when the economy recovers. By these means, it was believed that recessions would be minimised, and government finances would be balanced over the economic cycle.

It was an argument which was applied with apparent success in the post-war years until the end of the Bretton Woods Agreement, when the inflation of the dollar’s M3 had doubled from $27bn in July 1950 to $59bn in August 1971, without the inflationary consequences that followed the suspension of Bretton Woods.

When the Bretton Woods Agreement began to fall apart following the failure of the London gold pool in the late sixties, for America’s high priests of macroeconomics the strictures of a gold standard straitjacket were the problem, not the failures of their economic and monetary theories. Bretton Woods was abandoned, and ever since government-inspired economic theory has doubled down on failure. The FRED chart of the US’s budget position illustrates the consequences of every time things go wrong, blame free markets and just double down on a policy of government stimulation by fiscal deficits.

To put these deficits into context, in fiscal 2021, Federal Government outlays were $6.822 trillion, and revenues were $4.047 trillion. In other words, the deficit on expenditure was 31.4% of revenue. After a brief recovery in fiscal 2022, the current fiscal year which is ending shortly will see a further deterioration in the deficit to $2 trillion. But with the prospect of a now widely expected recession and interest rates higher for longer, fiscal 2024’s deficit will likely be significantly worse.

Clearly, with recession expected and despite record government deficits, the Keynesian stimulation theory has run its course and has failed completely. But that is not all. Lower interest rates are meant to rouse an economy, and in that they have also failed. Macroeconomic theories become so far removed from economic reality that the whole establishment of the economic profession needs to reset its approach to free markets.

The cyclical problem of bank credit

One of the extraordinary failures of modern thinking concerns an almost total blindness to the cyclicality of bank lending. And what is nominal GDP, which is used to measure economic performance? It is no more nor no less than the deployment of credit for qualifying transactions making up GDP. Yet no one appears to understand the consequences of this important fact. GDP rises and falls, not driven by consumers but by changes in the availability of bank credit. Consumer behaviour is not the source of recessions in consumer activity; it is the availability of the credit that drives it.

Those who do not understand the cycle of bank credit and its implications are the large majority of economic actors, both in the financial and non-financial sectors. And the most stubborn cohort of deniers is to be found in governments and their bureaucrats. From the major central banks to banking regulators, a group-thinking blindness to the causes of regular booms and busts is the source of an evolving cyclical credit crisis. Unfortunately, if a government and its agents continue with wrong policies for long enough, instead of being derided public belief in them grows. It is a particular problem in capital markets which have now bought into central bank group thinking policies without reservation.

Bank executives are not immune to this trend. Consequently, instead of sticking to their business objectives properly, they are beholden to central banks and government regulators. Their true business is to be dealers in credit, not to bear responsibility for those who claim to be stakeholders and regulators, but to achieve returns for their shareholders.

Few bankers seem to realise that they are trapped in a cycle of bank credit of their own creation. That is why the cycle has existed for as long as credit statistics have been available. But combine a lack of understanding of the cause of the cycle with the absence of shareholder responsibility, and we can expect the management of large banks to think that with regulatory support they can trade their way out of economic downturns by simply adhering to the regulations. The few banks that have failed this time have been dealt with by the regulators, restoring faith in the regulatory regime for the others.

But when bankers have the wake-up call, that their balance sheets are over-leveraged and producer input prices are rising, unless they urgently reduce their lending exposure they will risk bankruptcy from bad debts and falling collateral values. That is why bank lending is contracting, and why in real terms GDP will decline. And the contraction of GDP feeds into yet more credit contraction, driving up borrowing costs. The pressure on banks to liquidate both on-balance sheet investments and collateral against loans is bound to intensify.

The pressure on the dollar from foreign holders selling down their exposure will naturally follow. As seen in the table in the introduction to this article, the pressure on the dollar from these combined events threaten its continuing existence. Other than accepting the reintroduction of a credible gold standard, what fiscal measures will be required to make a gold standard sustainable?

Cutting out excess spending

The current fiscal year, which ends on 30 September will see a deficit on US Government spending of $2 trillion. $Nearly one trillion of that is debt interest:

The way that debt interest has soared indicates that the US Government is already in a debt trap. Furthermore, in its last estimates of debt interest costs (May 2023), the Congressional Budget Office assumed that the average interest rate on debt held by the public in this fiscal year would be only 2.7%, and in 2024 2.9%. With 3-month T-bills already yielding 4.8% and 10-year Treasury notes over 4.5%, these forecasts are already out of date. And with a recession now more certain than at the time of the CBO’s forecast, on current spending plans plus the fall in tax revenues the budget deficit for 2024 is headed for over $2.5 trillion, even assuming no further rises to borrowing costs. But they are likely to rise to over $1.5 trillion, taking the likely deficit into covid lockdown territory.

In the fiscal year just ending, the average rate of interest paid works out at 2.9%, which compares with a current rate in excess of 4.5%. The consequences of deteriorating tax revenues, increasing welfare costs, rising price inflation, yet higher bond yields, a credit squeeze, and the refinancing of $7.6 trillion of existing debt make the current position unsustainable.

The best solution is to radically cut spending. But given the scale of the problem as part of the solution taxes might have to be increased as well, though the emphasis must be on spending cuts. If there was time to implement these cuts, they could be spread over a few years, but time is of the essence.

Otherwise, the US Government will merely fall deeper and deeper into its debt trap.

This will be the minimum required for the US Government to put its finances in order and to implement and maintain a gold standard for the dollar. Contrary to Keynesian theory, the economic benefits of balancing the budget would be substantial. This was proved in the UK when 364 Keynesian economists signed a letter to London’s The Times criticising the 1981 budget. In that case, at a time of rising unemployment, high inflation and recession, Chancellor Geoffrey Howe raised taxes to close the budget gap. This represented 2% of GDP, which compares with a prospective US deficit of over 9% of GDP. The Keynesian economists opined that tightening monetary policy at a time of recession was wrong. But no sooner was the letter published, than the economy began to improve.

Admittedly, the British deficit as a proportion of the total economy was far less than that faced by the US Government today. But the disproving of Keynesian theories of deficit stimulation, and the benefit to the economy of a balanced budget cannot be denied. Furthermore, if in balancing the budget expenditure is cut allowing taxpayers to keep more of their earnings, the economic benefits are even more obvious. Hence, the recommendation that as much as possible the reduction in government spending is the best way to balance the budget and achieve a better economic outlook.

Not only will balanced budgets have to be run thereafter but spending must be firmly capped in nominal terms. A free market, non-interventionist philosophy must replace state intervention and management of the economy. Central bank credit must be contained, and commercial bank credit allowed to respond to demand for productive credit.

Business must be permitted to dance to the tune of consumers, and not the regulators. Bad businesses hide behind regulation, which through licencing disadvantages competition. Regulators are not motivated by what the consumer wants and is often ignorant of his trade. They produce unnecessary bureaucracy. Where they exist to deter fraudulent and unfair practices, they rarely succeed. Not only should consumers be free to choose the products that they want, but they must be responsible for their actions. The idea that the state can replace the principle of caveat emptor is ridiculous.

The same goes for trade. Traditionally, trade tariffs have been a source of government revenue, but they have evolved into politically driven means of penalising nations which are successful exporters in favour of protecting uncompetitive domestic production. This disadvantages the domestic consumer and manufacturers sourcing raw materials and machinery from abroad.

The setting of interest rates must be to regulate the balance of gold reserves, and not, repeat not to regulate the economy. The source of investment capital in the form of savings should be permitted to return, encouraged by removing all taxation from savings and trading profits. Consumer debt, other than mortgage finance, will wither under these conditions. A savings driven economy, such as Japan’s and China’s, is less prone to consumer price inflation and interest rate volatility. And if savings are not taxed, they become encouraged.

And lastly, government statistics should be banned, because they only serve to encourage state intervention. If there is demand for any particular run of statistics, then private sector actors can provide them.

The US faces problems with a gold standard

As a matter of fact, gold as money is written into the US constitution as well as in the definition of the dollar. It will surprise readers to know that what commonly circulates as dollars are not dollars at all, being Federal Reserve Notes (FRNs). Under constitutional law, United States money is expressed in dollars, while FRNs are redeemable in dollars which is the lawful money. Therefore, the FRN dollar bills in circulation are not lawful money.

It might seem a pedantic point perhaps, but it should be respected and addressed in any future legislation. And the dollar itself was defined in gold. Article 1 Sec. 10, Clause 1 of the Constitution states:

No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts…

There is much to unpack in this clause, but it is money that concerns us. In 1785, Congress unanimously resolved that the money unit of the United States was to be the dollar and that the dollar would contain 375.64 grains of fine silver. The same resolution determined that there shall be two gold coins, one equal to 10 dollars and one equal to 5 dollars. And subsequently under the Coinage Act of 1792, the coinage of gold Eagles was mandated, “each to the value of $10 containing 247.5 grains of pure gold”.

Dollars and dollar-substitutes such as the FRN were the medium for payment because they specifically represented gold and silver coin in the prescribed weights. In 1834, gold became the de facto standard, confirmed in the Coinage Act of 1900 at 23.22 grains of fine gold, the equivalent of $20.67 to the ounce, a standard that operated for nearly a century until 1933.

It would appear to be a simple matter to return to convertibility in accordance with the law, but instead of the earlier fixed weight, a new relationship would have to be determined for the constitutional dollar and the FRNs if they be permitted to continue to exist: the future of the Federal Reserve system must be called into question, having presided over a failed fiat currency of its own issuance. Either way, the Treasury’s promise to pay the equivalent in its gold reserves to the Fed at $42.22 to the ounce, must be addressed.

Some commentators posit that to define the dollar by weight of gold and to make it fully exchangeable requires a substantial devaluation of the dollar, perhaps to $5,000 or $10,000 per ounce of gold. And that in order to do so, it would be declared over a weekend. Presumably, it is thought that this new rate would ensure that gold would be redeemed for dollars, allowing a new gold exchange rate to operate without undermining the Treasury’s bullion reserves. This appears to be a muddled Keynesian way of thinking, in the belief that devaluation is necessary to ensure a favourable exchange rate with other currencies, whether exchangeable for gold or not, and to ensure there is sufficient economic stimulus to support the mountains of debt in the private sector. But it would also be a default on the US Government’s debt by devaluing it in terms of legal money, which is still gold despite current denials by the US authorities.

Such a substantial devaluation is clearly intended to allow headroom for the US Government to continue with its current fiscal and monetary policies. But without the fundamental reforms outlined in the previous section, it would probably be only a very short time before a devaluing dollar forces yet another reset. In short, it would fool no one for long.

Then there is the problem of verifying US official reserves, which at 8,134 tonnes have been almost unchanged since 1980. Rumours about their condition and the extent to which they actually exist makes them uncredible. To what extent have they been swapped and leased over the decades, if indeed they exist in bars of LBMA deliverable standards?

The experience of Germany seeking repatriation of some of its gold reserves stored as earmarked at the Federal Reserve Bank of New York rings alarm bells over the entire situation. And as long ago as 2002, Frank Veneroso, who was a highly respected analyst at the time concluded that between 10,000—14,000 tonnes of central bank gold reserves had been either swapped or leased and sold into the market. The latter figure was half the declared official reserves of the entire world.

Since then, the leasing game and price suppression of gold has certainly continued. But there is a difference today, with increasing numbers of central banks accumulating bullion reserves, currently recorded at 35,731 tonnes. Much of this increase has to do with China, Russia, and their rapidly expanding spheres of influence, who do not lease or swap their gold reserves. Germany’s experience of the US idea of property ownership of gold, and the Bank of England refusing to deliver Venezuela’s gold when demanded plus the leasing shell game amounts to strong circumstantial evidence that the US Treasury and the New York Fed vaults do not have the gold they say they have.

This in itself suggests that there really is almost nothing backing the fiat dollar when the fall-back position becomes a return to gold as the money-anchor for credit. Furthermore, there is the geopolitics of gold to consider. Not only has Russia been accumulating bullion reserves, but informed sources believe that there is further bullion in state funds, bringing Russia’s holdings to about 12,000 tonnes. And China has had a policy of accumulating gold “off balance sheet” since 1983, accelerating mine output, importing large quantities of bullion, and not permitting any bullion to leave the country. Overnight, China could probably increase her official reserves to a level in excess of 30,000 tonnes.

We can be sure that the US’s intelligence services have an idea of this situation, and the geopolitical disadvantages to the US and its dollar of a return to gold as the monetary standard. In London, where the bullion banks offer unallocated gold accounts, a substantial rise in the gold price such as that recommended by some US analysts would lead to bankruptcies among the LBMA member banks with extremely serious consequences. And on Comex, it would be likely to lead to implementation of force majeure clauses.

The consequences for commodity prices from a de facto devaluation of the dollar would also be to drive them significantly higher. On all practical grounds, a substantial gold revaluation/devaluation of the dollar can be ruled out.

Conclusion

The hurdles in the way of the fiat dollar’s survival are steadily mounting, and the US Government does not know how to secure its future. The state theory of money is turning into a total failure. Interest rates, which more correctly are the time preference required to ensure foreign holders of dollars continue to hold them are rising. This tells us that markets expect the purchasing power of dollar credit to continue to decline, so if the monetary authorities attempt to stop them rising, the currency will fall, and foreigners will sell. Equally, as bond yields rise the value of all financial assets will decline, portfolios will be sold, and presumably the currency raised will be as well.

Either way, the days of the fiat dollar are numbered. The politicians have no mandate to protect it by balancing the budget, returning to a gold standard, and taking the economic measures necessary to make it stick. Furthermore, America’s existing bullion holdings appear to be badly compromised – the cupboard is bare.

Not only is it the end of the fiat federal dollar note, but it is the end of empire, which the administration is reluctant to accept. We must hope that some strategic sense prevails, and the Doctor Strangeloves at Langley do not have their way.