“Fed’s Last Hike” Triggers Q3 Carnage; Traders ‘Sell All The Things’ In September

The third quarter of 2023 was the first quarter of tightening financial conditions since 2022 with September the biggest monthly tightening of conditions in a year.

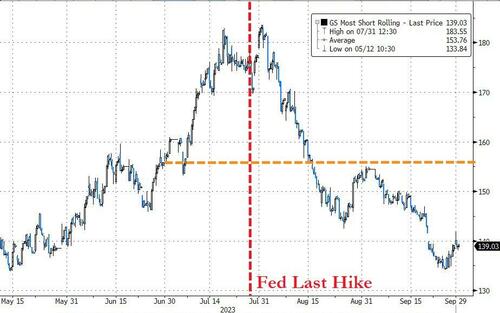

And if you’re wondering why? It’s simple, the low came at almost exactly the time of the last Fed hike (July 26)…

Source: Bloomberg

That tightening of financial conditions in Q3 corresponded to a collapse in ‘hard’ data (its biggest quarterly plunge since Q4 2020) while ‘soft’ survey data soared (its biggest quarterly jump since Q1 2020)…

Source: Bloomberg

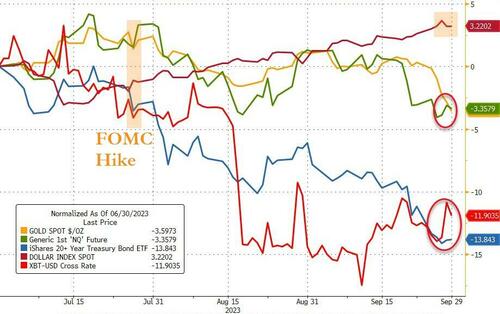

And that left the dollar higher in Q3, but everything else lower (bonds and bitcoin worst, gold and stocks bad)…

Source: Bloomberg

Since making YTD highs in mid-July (last Fed hike), NDX is down 8 of 11 weeks for a cumulative selloff of 7%. Over the same time frame, US 10-year note yields have risen from 3.79% to 4.58% – probably not a coincidence.

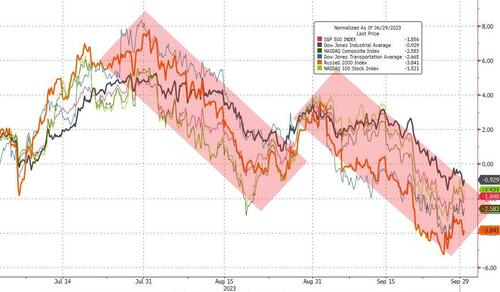

This was the worst quarter for the S&P and Nasdaq since Q3 2022.

All the majors are in the red to close Q3 with Small Caps the laggard and Dow the prettiest horse in the glue factory…

Source: Bloomberg

September was the worst month for the S&P and Nasdaq since Dec 2022.

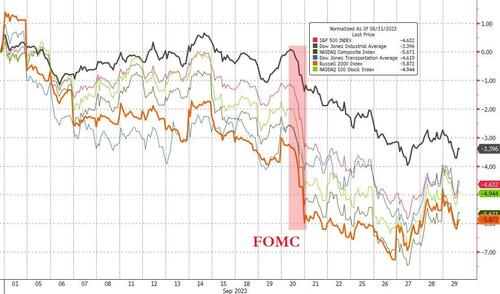

September saw losses accelerate after the FOMC meeting…

Source: Bloomberg

On the week, the Nasdaq ended unchanged, Small Caps eked out a small gain; The Dow was the biggest loser and the S&P was down around 1%…

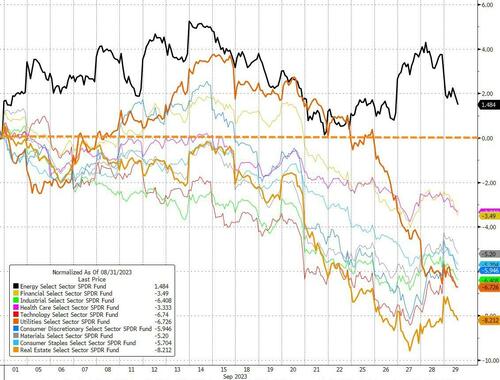

The energy sector was the only equity cohort to end the third quarter in the green with Utes and Real Estate the ugliest horse in the glue factory…

Source: Bloomberg

Similarly, September was even uglier overall with Energy managing to hold green but every other equity sector slammed (again led by Utes and Real Estate)…

Source: Bloomberg

“Most Shorted” stocks dumped for the second month in a row in September (the biggest 2mo drop since Dec 2022). Q3 was the first quarterly drop in ‘most shorted’ stocks since Q2 2021…

Source: Bloomberg

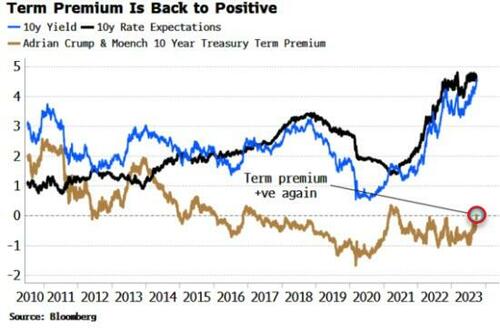

Bonds were battered in Q3 with the long-end yields up over 90bps…

Source: Bloomberg

September was a US bond market bloodbath with the entire curve dramatically higher in yield. The last week has seen the short-end outperform, steepening the yield curve…

Source: Bloomberg

Bonds were battered…globally

-

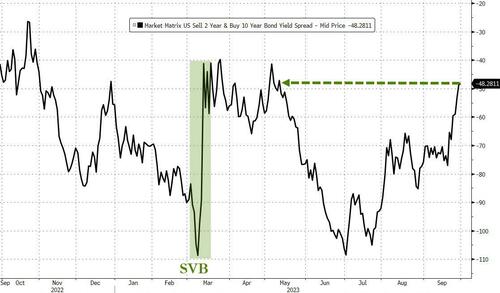

US 2s10s inversion dropped to May’s lows

-

5y US yield highest since 2007

-

10y US yield highest since 2007

-

30y US yield highest since 2010

-

10y German yield highest since 2011

-

Japan 10y highest since 2013

-

Japan 20y highest since 2014

-

Japan 30y highest since 2013

-

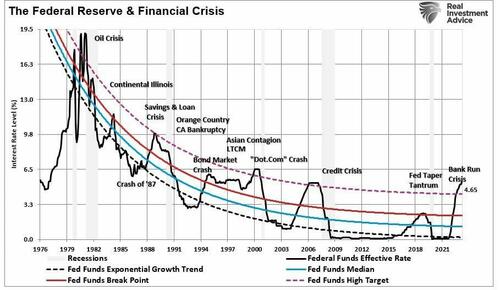

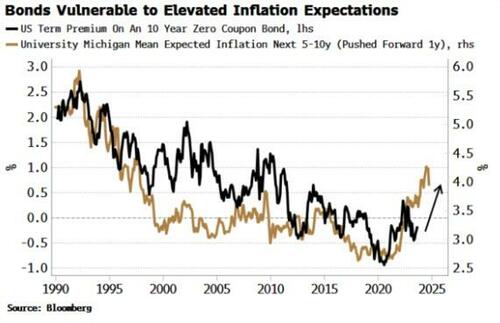

That US 30-year yields extended April 2022’s break out of a downtrend that’s lasted since the 1980s is probably the most significant economic development of the current era.

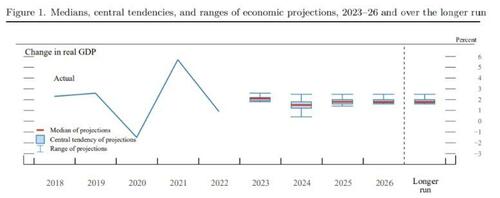

Rate change expectations for 2023 are basically unchanged for Q3 (green lines) but the expectation for rate-cuts in 2024 (blue line) has fallen dramatically (hawkishly higher expectations for rates)…

Source: Bloomberg

The dollar rallied for the second straight month in September to its highest close since Nov 2022. Q3 was the dollar’s first positive quarter since 2022…

Source: Bloomberg

Crypto was basically unchanged in September, rallying back in the last couple of days to erase the puke at the end of August. However, While Solana and Ripple outperformed in Q3, Ethereum and Bitcoin were battered, down 10-11%…

Source: Bloomberg

In commodity-land, Q3 was a great one for crude markets. NatGas also gained… but copper and PMs basically went nowhere…

Source: Bloomberg

September was a shitshow across commodities with energy (crude and natgas soaring) while copper (growth) and precious metals (tightening policy) dumped. Silver was clubbed like a baby seal to end the month…

Source: Bloomberg

Gold suffered ‘Death Cross’ this week…

Source: Bloomberg

Oil has extended its gains since its ‘Golden Cross’ in August, trading back at pre-Putin-Invasion levels…

Source: Bloomberg

The massive outperformance of crude over copper pushed it up to historically key resistance level…

Source: Bloomberg

Also, Gold is at its cheapest to crude in a year and also at a key support level…

Source: Bloomberg

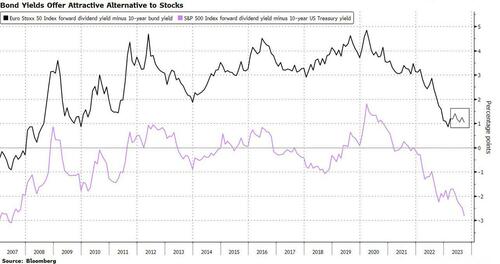

Finally, the disconnect between real yields and the S&P 500’s P/E valuation came into the month at a noted extreme. And while the index has repriced ~5% lower, real yields increased, too…

Source: Bloomberg

As Powell said at Jackson Hole last year, there’s more pain to come here.

Tyler Durden

Fri, 09/29/2023 – 16:00

via ZeroHedge News https://ift.tt/QFHR3ZE Tyler Durden