Authored by Michael Snyder via TheMostImportantNews.com,

Our standard of living is being systematically destroyed, but for a lot of years many Americans didn’t fully understand what was taking place because it was happening so slowly. But now we have reached a stage where the purchasing power of our money is collapsing and the cost of living has become exceedingly painful. Thanks to our rapidly rising cost of living, the middle class is becoming “the impoverished class”, and the poor are increasingly being pushed out into the streets. If we do not find a way to turn these trends around, it won’t be too long before we have tremendous societal turmoil on our hands.

Earlier today, I came across an article about a woman that found a receipt from Burger King that was dated August 10, 1986.

At that time you could buy a Whopper for just $1.54.

Today, that same Whopper will cost you $6.79…

A woman has been left stunned after discovering a retro Burger King receipt from the 1980s which reveals the staggering price increases that the fast food chain has implemented over the past four decades.

US-based Liza took to social media to share the receipt after her mother found it in a box in the garage while remodeling her home.

The faded paper from the fast food chain dates back to August 10, 1986, and lists three Whopper burgers purchased for $4.62 – which works out at $1.54 each.

A single Whopper burger currently costs $6.79 in today’s money – over four times the price listed on the vintage receipt.

In other words, if you had $6.79 back then, you could buy four whoppers and you would still have money left over.

This is what inflation does.

It destroys our purchasing power.

Another woman named Melanie that makes 34 dollars an hour is so stressed financially that she literally tries to make one loaf of rye bread last her for the entire week…

“What I’ve started doing is I buy a loaf of rye bread, and I work really hard to keep that one loaf of rye bread lasting me the whole week. And I eat peanut butter, so I’ll eat peanut butter toast whenever I’m hungry.”

In the old days, if you were making 34 dollars an hour you were living the high life.

But now most people making 34 dollars an hour are just barely scraping by from month to month.

Of course it isn’t just food that has become absurdly expensive.

At this point, homes in the U.S. have never been more unaffordable than they are right now.

The following was recently posted on Twitter by The Kobeissi Letter…

Inflation adjusted home prices are now 85% above their average dating back to 1900.

Even after accounting for inflation, home prices have never been more expensive than they are now.

In fact, inflation adjusted home prices are now 20% above their 2008 peak, the previous all time high.

The median home now sells for an alarming 530% of the median annual income.

Meanwhile, the median house payment is now a record 49% of median PRE-TAX income.

Affordability has never been worse.

We have never seen anything like this in the entire history of our country.

Since the beginning of 2019, the median price of a home in the U.S. has risen by more than a hundred thousand dollars…

In fact, comparing present prices to levels before the virus panic, St. Louis Fed numbers show a median priced U.S. home rose from $313,000 in the beginning of 2019 to $416,000 today.

Rental prices have gone completely nuts as well.

As I discussed last week, the median asking rent in the United States is now over $2,000 a month.

Over the past couple of years we have seen unprecedented rent hikes, and vast numbers of renters have been getting the boot.

In fact, we are seeing a tsunami of evictions in the Los Angeles area right now…

With COVID-era protections gone, the number of renters facing eviction in Los Angeles continues to climb by the thousands each month.

From February through the end of August, approximately 50,000 eviction notices were filed by landlords in the city, according to figures released on Monday by the L.A. Controller’s Office.

A spokesperson said 96% of them involve non-payment of rent, and landlords were owed $186.5 million collectively.

So where will all these people go?

If they are young enough, perhaps they can live with their parents.

But many will not have that option.

Up to this point in 2023, homelessness in the United States has been rising at the fastest pace ever recorded, and a lot more Americans will find themselves without a home between now and the end of the year.

Meanwhile, those that are still scraping by will find it harder and harder to make ends meet.

The average rate of interest on our credit card balances has risen from about 16 percent in February 2022 to more than 22 percent today.

As a result, an increasing number of Americans find themselves unable to keep up with their payments, and it is being reported that credit card losses are rising at the quickest rate since the last financial crisis…

Credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs.

Credit card losses bottomed in September 2021, and while initial increases were likely reversals from stimulus, they have been rapidly rising since the first quarter of 2022. Since that time, it’s an increasing rate of losses only seen in recent history during the recession of 2008.

It is far from over, the firm predicts.

More Americans are going bankrupt as well.

In fact, the number of bankruptcy cases in August 2023 was 18 percent higher than it was in August 2022.

Millions upon millions of Americans have been turning to debt in order to keep up with the cost of living, but as economic conditions deteriorate financial institutions are starting to get much tighter with their money.

So we are moving into a time when U.S. consumers will find it much more difficult to take on new debt…

Nearly 60% of the respondents in a New York Fed consumer expectations survey said it’s harder to get credit cards, mortgages and other loans than it was a year ago. It was the highest level since the New York Fed started the data series back in 2013.

Another Fed survey of loan officers reveals their fears aren’t unfounded. Banks reported that lending standards tightened across all consumer loan categories and all categories of residential real estate (RRE) loans. Meanwhile, the number of banks reporting tighter standards for credit cards rose by 36%.

Banks have also significantly tightened standards for business loans.

This is a recipe for disaster.

That is definitely true.

Without a doubt, this is certainly a recipe for disaster.

But there is no going back now.

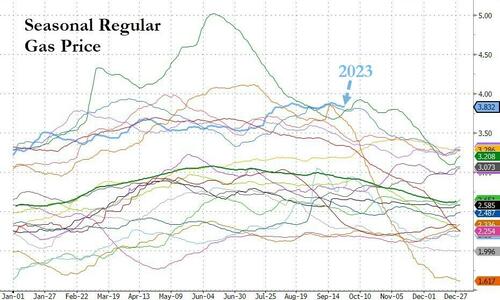

In fact, the rising price of oil is going to cause enormous inflationary pressures throughout our entire economic system in the months ahead.

On Tuesday, a senior market analyst at OANDA warned that it appears that “nothing is going to get in the way of this oil price rally”…

“It looks like nothing is going to get in the way of this oil price rally,” said Edward Moya, senior market analyst at OANDA, in emailed comments on Tuesday. “Energy traders know a bullish trend when they see one and it will take a lot more than a strong dollar, softer Russian ban, and weakening demand, to disrupt this rally.”

When the price of oil reaches 100 dollars a barrel, that will be painful, but we can handle that.

But the chief executive of Continental Resources is projecting that the price of oil could eventually reach 150 dollars a barrel…

That’s Doug Lawler, chief executive of Continental Resources, the shale-drilling giant controlled by billionaire Harold Hamm, telling Bloomberg News on Monday that crude prices are set to remain elevated and could press to the $120- to $150-a-barrel range without new production.

More price pressure is coming, he said, unless policies are put in place to encourage more output.

If the price of oil reaches 150 dollars a barrel and stays there, it will be an unmitigated disaster for our economy, and the cost of just about everything will jump substantially.

That is because just about everything that we buy and sell has to be transported.

We need cheap energy in order to have a high standard of living, but unfortunately the era of cheap energy is coming to an abrupt ending, and that means that none of our lives will ever be the same again.

I kept warning my readers that a lot of the long-term trends that I have been writing about would catch up with us eventually, and now that time has arrived.

So enjoy the current economic conditions while you still can, because they will soon go from bad to worse.

* * *

Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.