Why The US Job Market Is About To Crack In 8 Charts

With the US economy once again rolling over, as various Fed nowcasts see a sharp slump in Q4 GDP and the Citi economic surprise index slumping from a nearly two year high hit at the start of September…

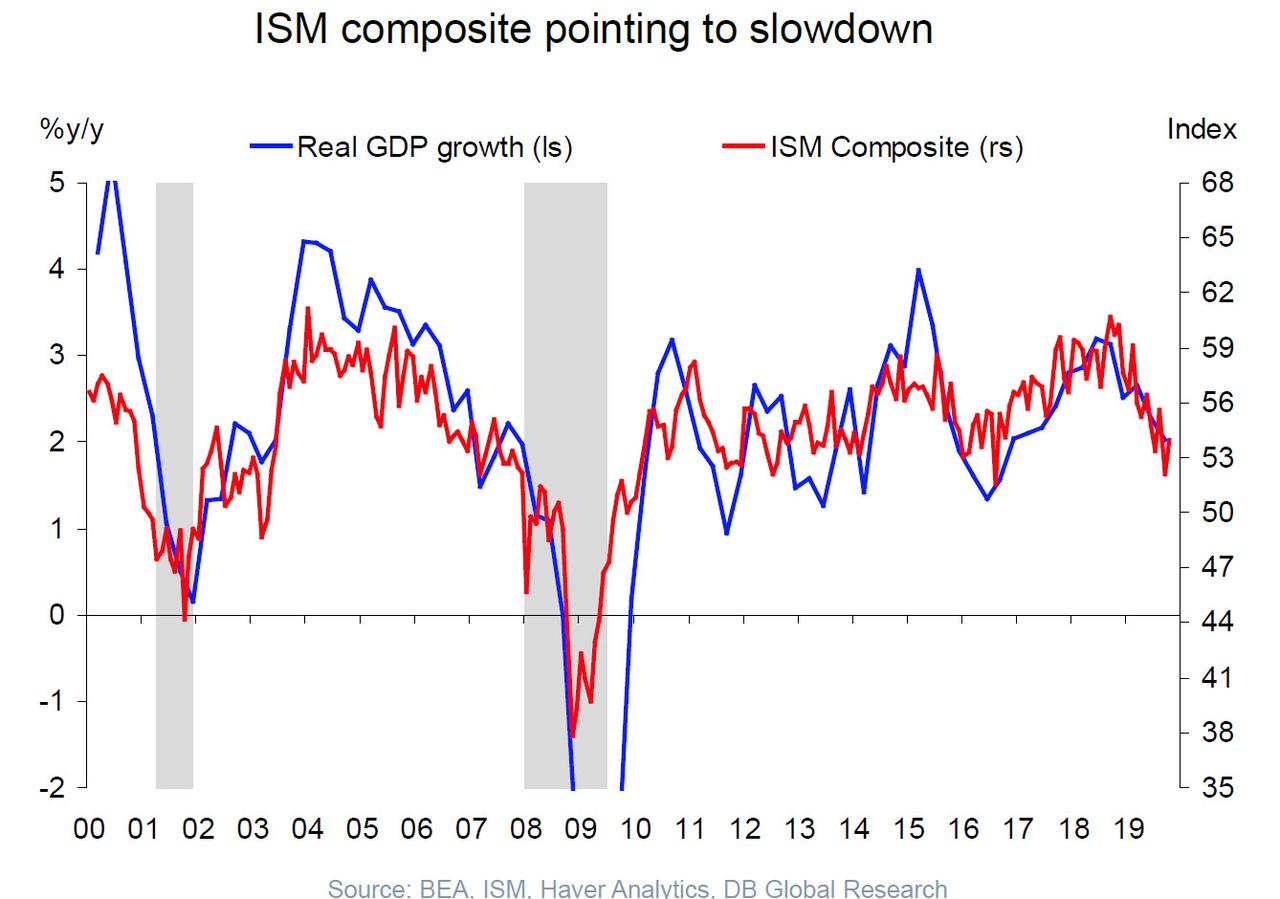

… while real GDP growth is tracking the ISM lower month after month…

… the one part of the US economy that has proven remarkably resilient to the US-China trade war, now in its 553rd day, has been the US jobs market; so resilient in fact, it was an embarrassment to the Fed to have to explain why it is cutting rates with US unemployment at 50 year lows (we will have more to say on the quality vs quantity of US jobs in a subsequent post).

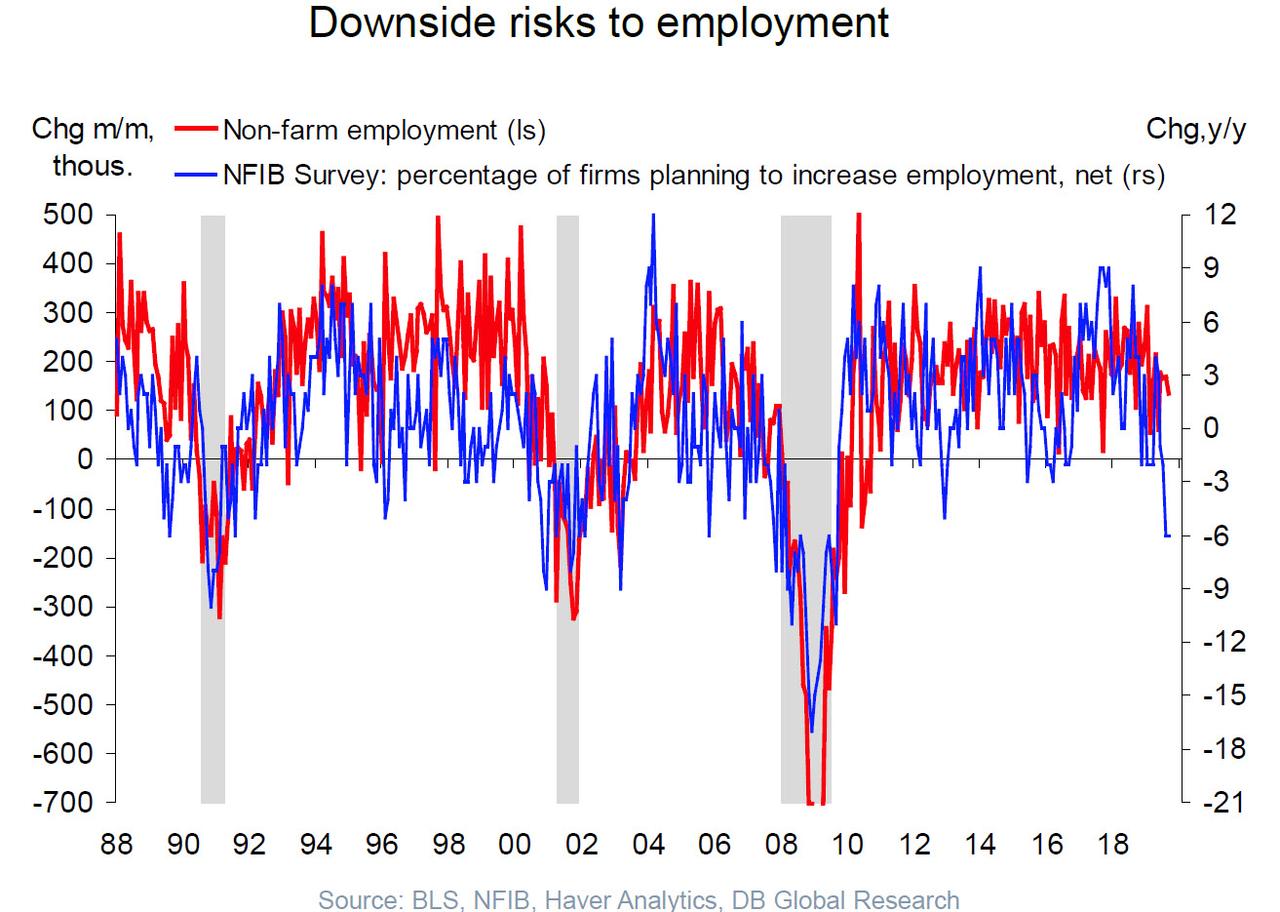

So as we await this Friday’s jobs report where consensus expects another solid 188K job gains for the month of November, it appears that the US labor market is finally starting to crack. Below we present some recent empirical evidence that confirms the growing downside risks to US employment, starting with the recent plunge in percentage of firms who are planning to increase their employment according to NFIB. As this is a leading indicator to nonfarm payrolls, it suggests that the US may be facing a -100K print in the near future – if confirmed, it would be the worst number since the financial crisis.

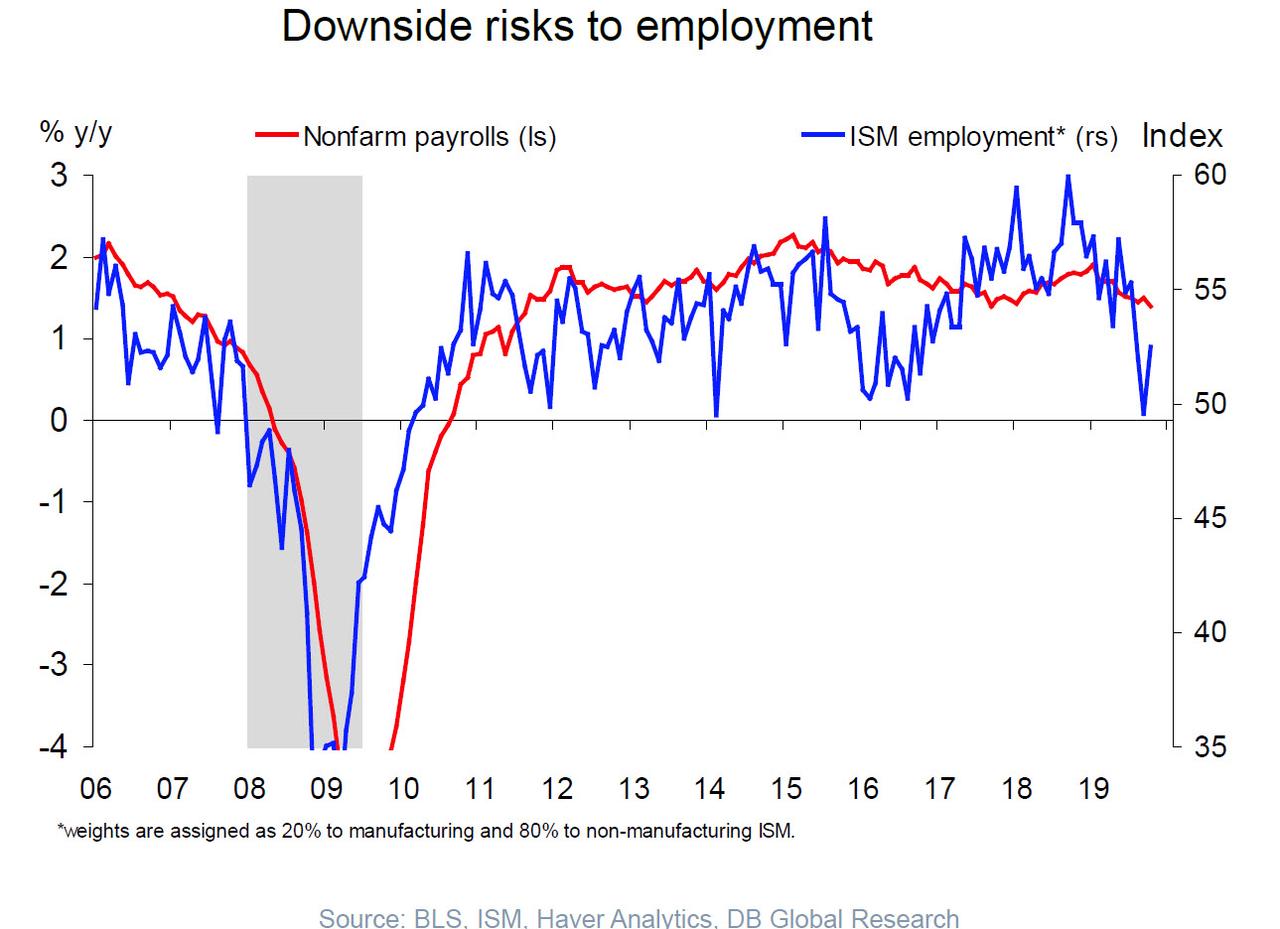

It’s not just the NFIB: the drop in the ISM employment similarly has held a strong correlation to payrolls. Unless this series stages a powerful rebound in the coming months, it is only a matter of time before the US job market dives.

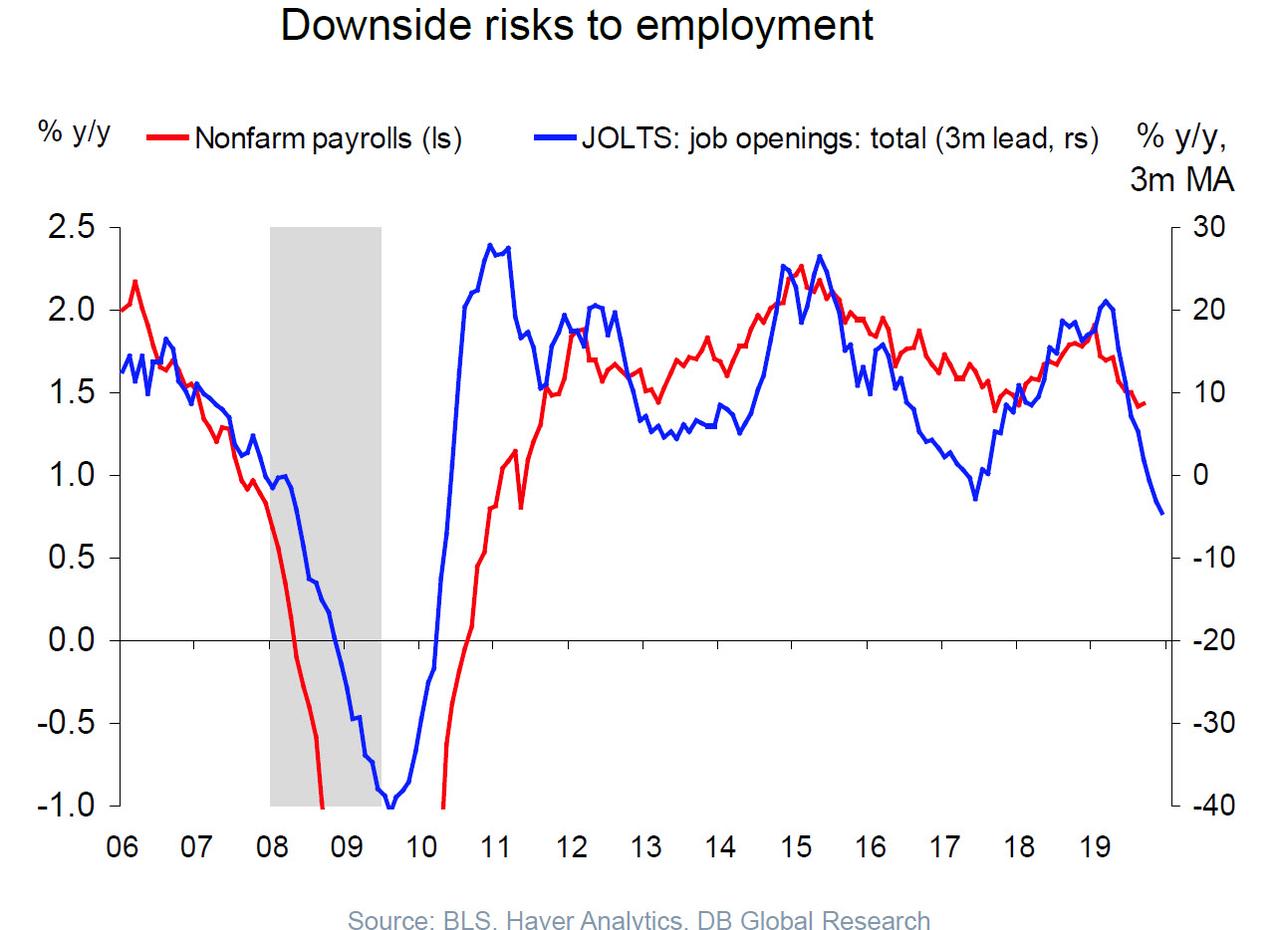

There has been recent notable weakness in the BLS’ other key labor market metric, the JOLTS job openings, long a favorite of Janet Yellen. Here, too, we find an ominous sign as the 3 month moving average in job openings has posted the most negative print since the financial crisis. This, too, leads broader payrolls data:

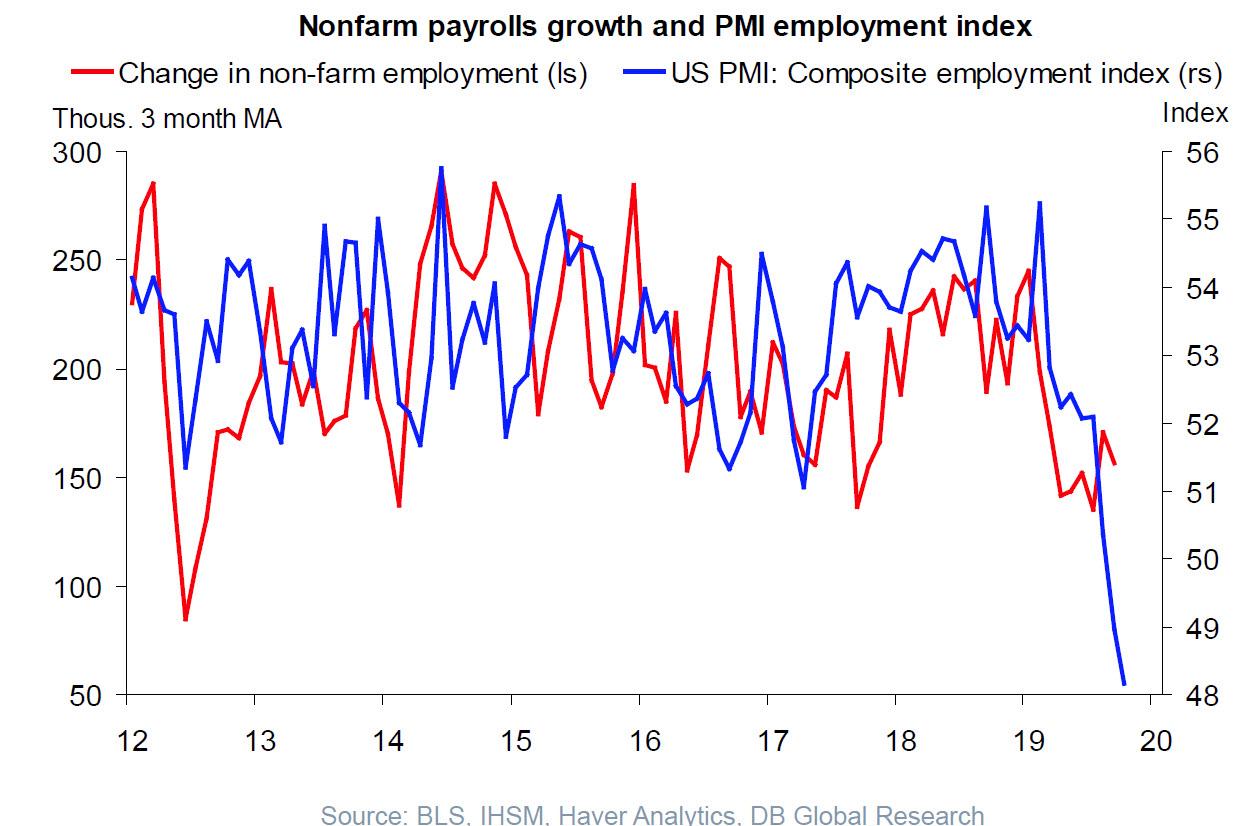

But it is probably the composite PMI employment index, which recently suffered its biggest drop since the financial crisis, that offers the most ominous picture yet:

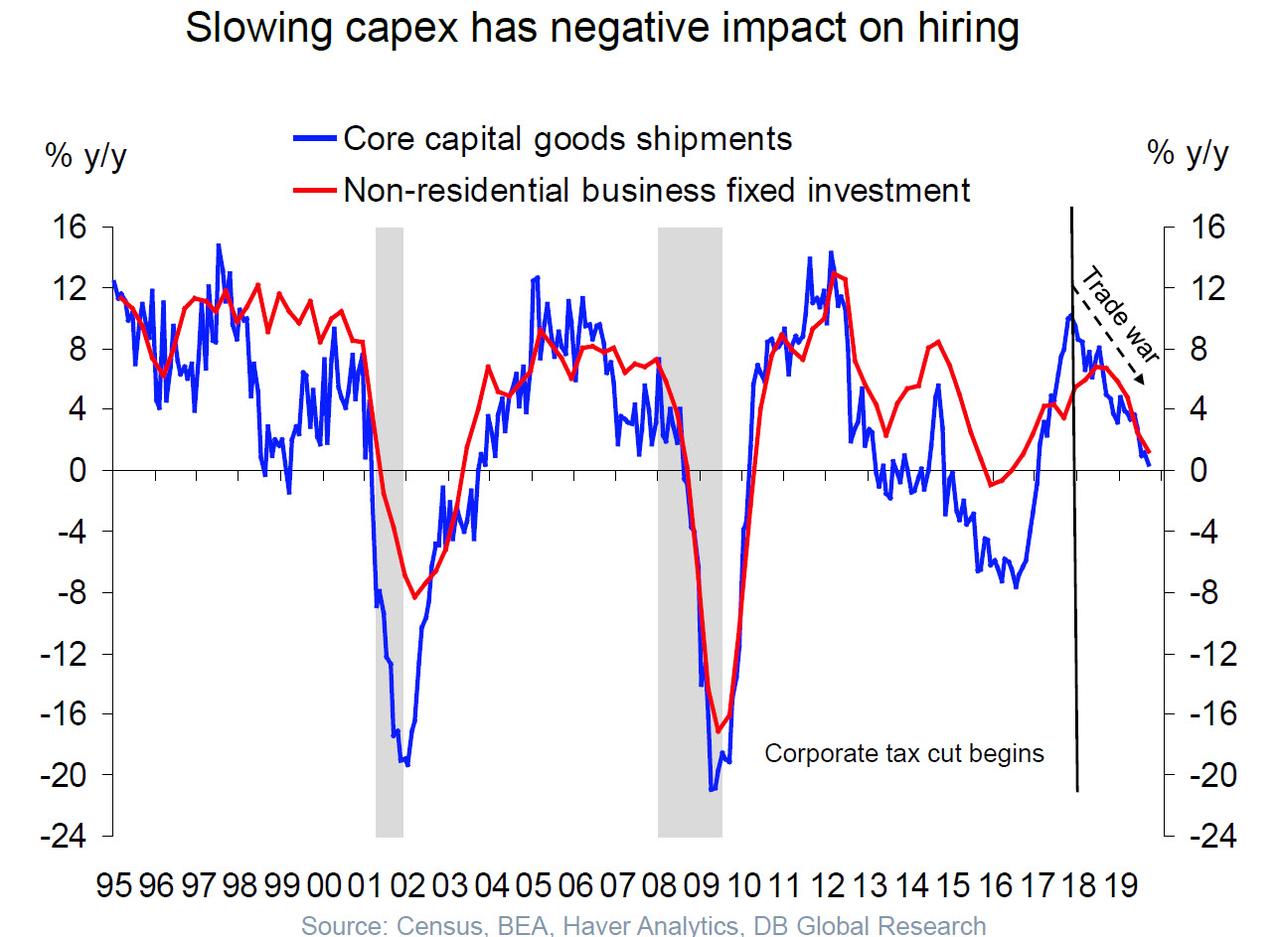

For those asking what may catalyze this coming swoon in the jobs market, blame US companies’ eagerness to repurchase their stock (boosting management comp and stock prices) instead of investing in growth: as the next chart shows, rising capex tends to lead hiring, and by extension, a drop in capex would lead to job cuts.

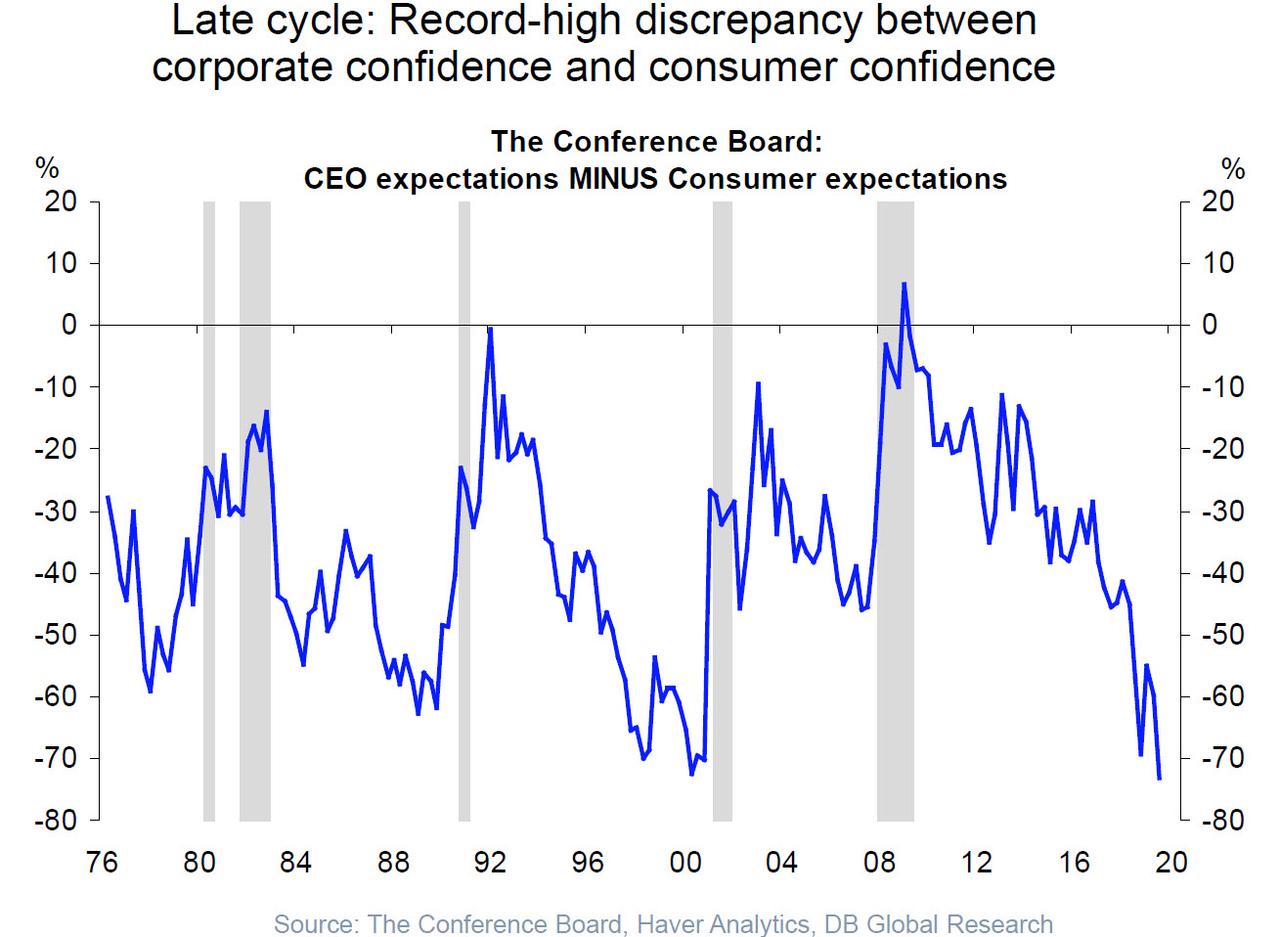

But the biggest red flag comes from the unprecedented divergence between CEO/corporate confidence and consumer confidence. While the latter is no doubt a function of the record highs in the stock market and the historical near record unemployment prints, when it comes to the future, it is what CEOs think that matters, and according to the chart below, they are only seeing red.

Tyler Durden

Sun, 12/01/2019 – 17:00

via ZeroHedge News https://ift.tt/37VzU9s Tyler Durden