How To Make Money In This Market: Buy Companies That Are Worthless

Authored by Mike Shedlock via MishTalk,

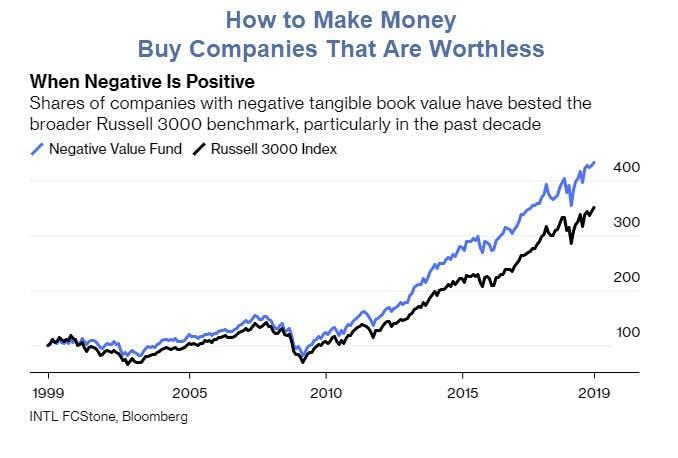

Companies with tangible net value of less that zero have increasingly outperformed the market for decades.

Bloomberg comments Capitalists Without Capital Are Ruling Capitalism

Some 40% of public stocks quoted in the U.S. have negative tangible book value, meaning that their tangible assets aren’t worth enough to repay all their debt. Two decades ago, this was only true of 15% of companies, according to Vincent Deluard of INTL FCStone Inc., who has carried out intensive research on the subject.

Such companies sound dreadful. In tangible, material terms their share certificates aren’t even worth the paper they are written on.

And yet, incredibly, a “negative-value” fund, composed of the shares of companies with negative tangible book value, would have beaten the main U.S. stock market, represented by the Russell 3000 Index, by 24% over the last 20 years. That outperformance has almost all happened since the financial crisis — before that, the negative-value fund had roughly tracked the benchmark.

Extreme Zombification

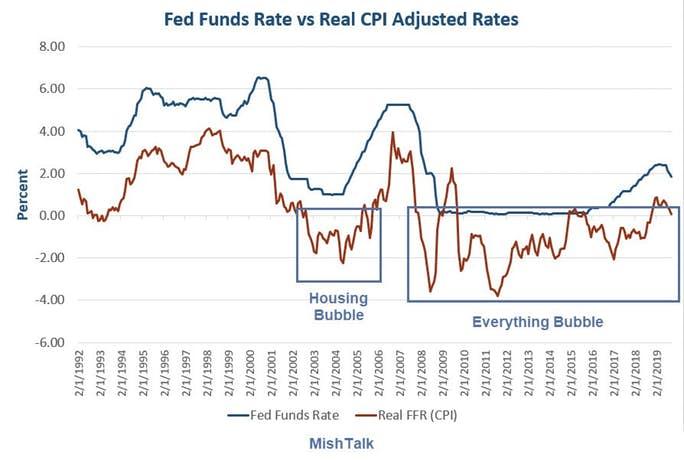

This is of course a result of Fed-sponsored zombification by keeping real interest rates negative for most of the last decade.

Real Interest Rates

Real means inflation-adjusted.

I created the above chart by subtracting year-over-year Consumer Price Index (CPI) from the Effective Fed Funds Rate.

Yet, the CPI is a fatally-flawed measure of inflation.

It fails to factor in housing prices and dramatically understates the rising cost of medical care.

Yet, even though inflation is hugely understated, real interest rates have been mostly negative since 2002.

This encouraged speculation in spades.

Meanwhile, thanks to Fed bubble-blowing policies, companies that have no tangible value can keep rolling over debt and even adding to it to pay the bills.

Tyler Durden

Tue, 12/31/2019 – 09:55

via ZeroHedge News https://ift.tt/37hiwem Tyler Durden