The Market Is Breaking… Everywhere

Today was historic…

…for a number of reasons.

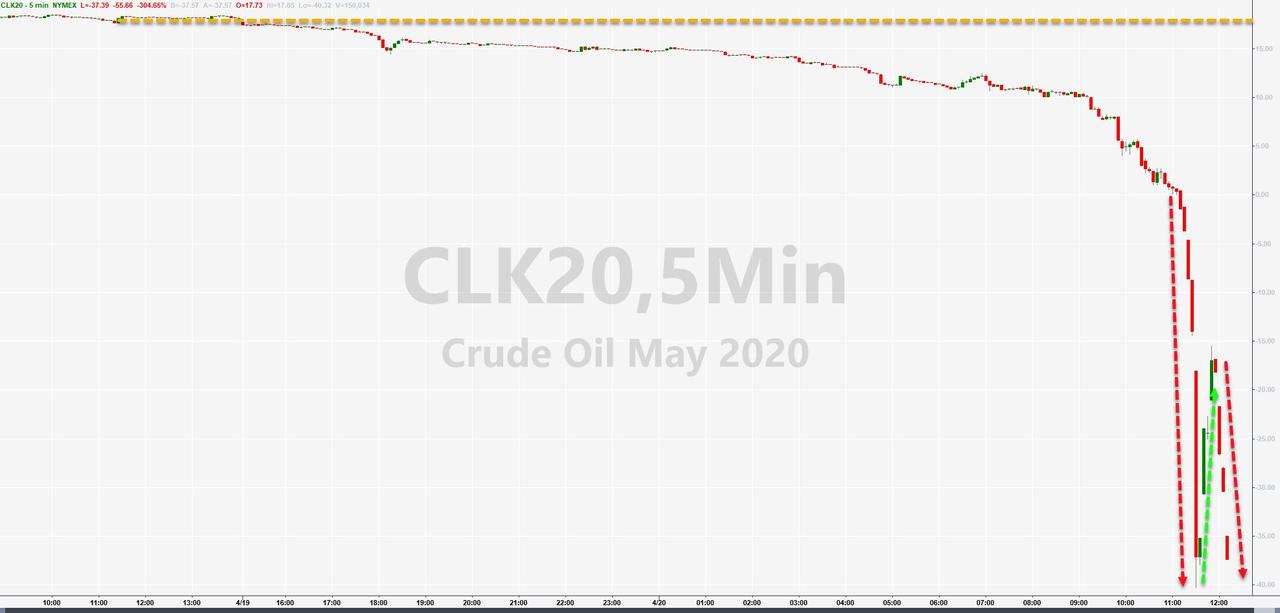

1) Front-month oil traded at an utterly irrational and unprecedented negative $43 intraday (this was not about storage into settlement, this was forced selling into settlement, then notice the bounce, and then later more selling.)

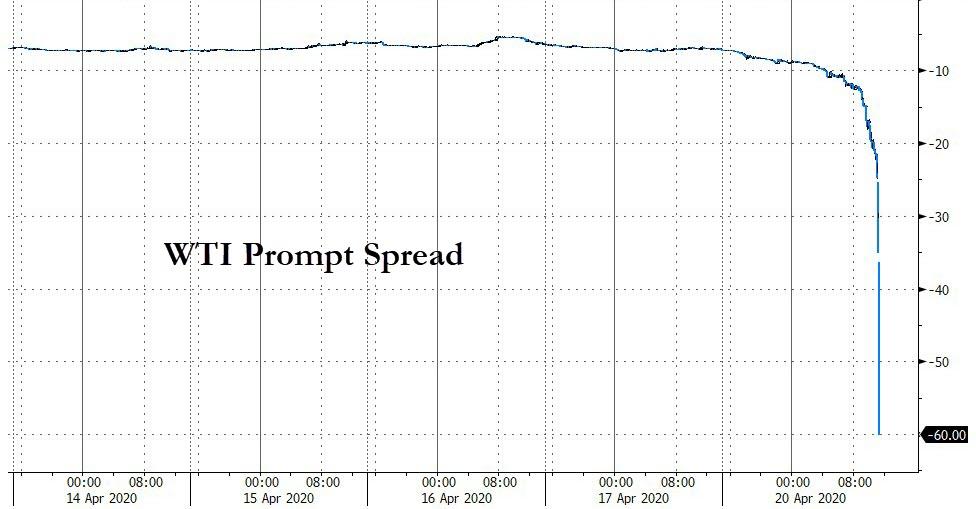

2) Oil’s prompt-spread exploded to a record negative $60 (smells like at least one fund was carried out on an arb)

Source: Bloomberg

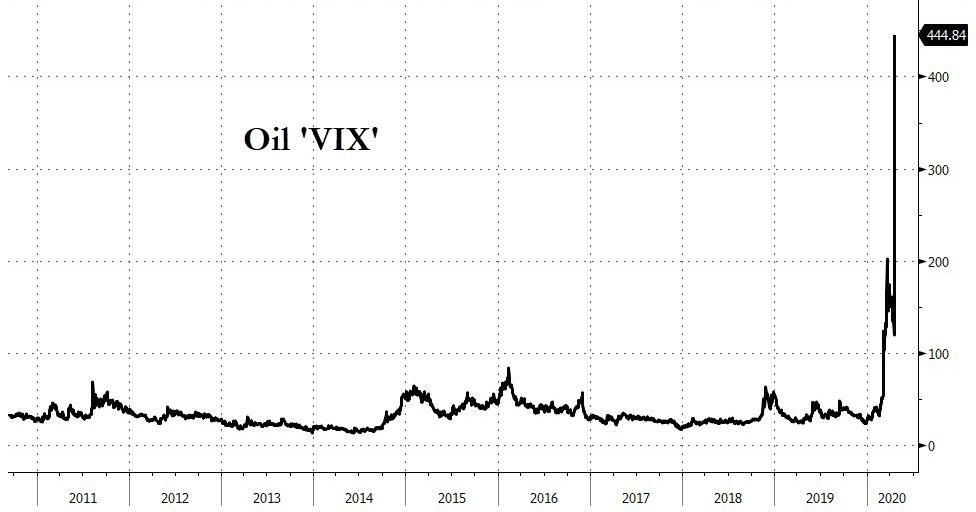

3) Oil ‘VIX’ exploded today to record highs…

Source: Bloomberg

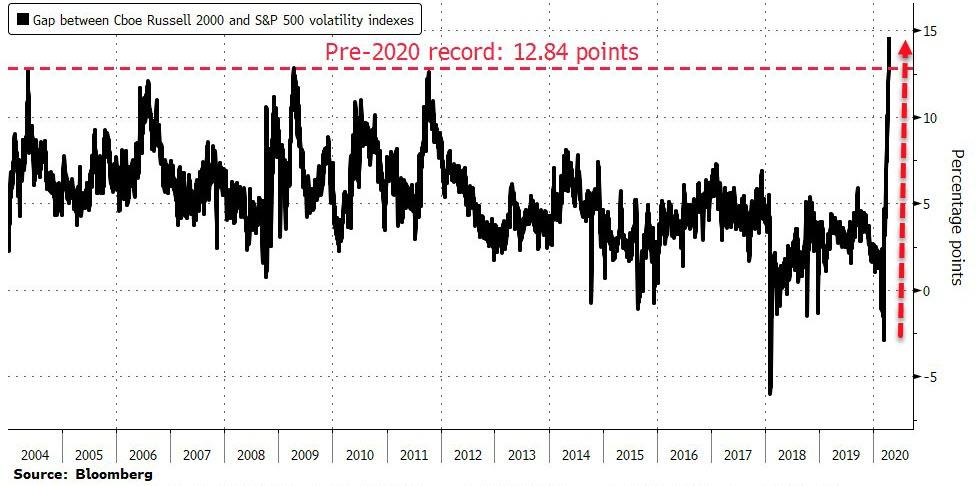

4) Russell 2000 ‘VIX’ has never been higher relative to Nasdaq ‘VIX’ than today (The widening gap reflects the damage being done to smaller companies by the coronavirus, Julian Emanuel, head of equity and derivatives strategy at BTIG LLC, wrote in a report.)…

Source: Bloomberg

5) A AAA CLO tranche failed its O/C test (this is a major liquidity problem – it means that a key pillar of the credit market will be crushed for years: CLOs have been the biggest buyers in the $1.2 trillion leveraged loan market, helping fuel a surge in debt-fueled buyouts and other transactions.)

6) Liquidity shortages reappeared as the 3m FRA-OIS Spread blew out once again… despite the massive injections of cash from The Fed…

Source: Bloomberg

7) US Macro-economic data crashed at a record pace back to the worst levels since the peak of the 2008 financial crisis…

Source: Bloomberg

* * *

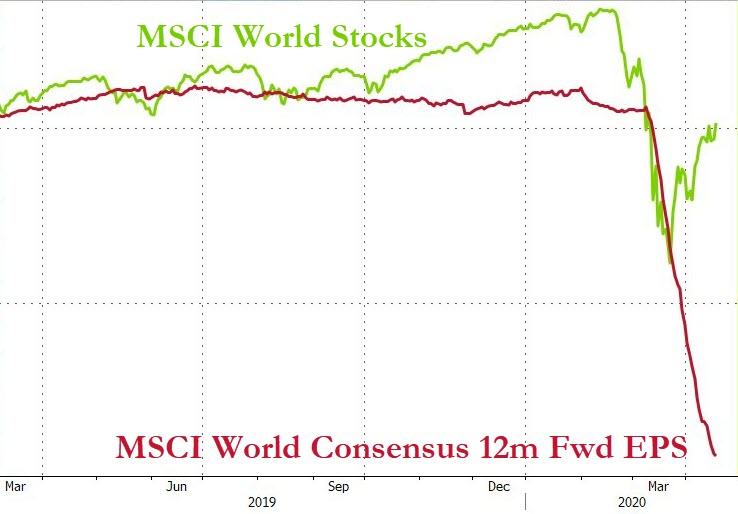

World stocks continue to make a mockery of every rational investor…

Source: Bloomberg

Chinese markets were a shitshow overnight when the CSI-300 Healthcare Index crashed 17% for no good reason, hung around there for hours and then spiked back to the green…

Source: Bloomberg

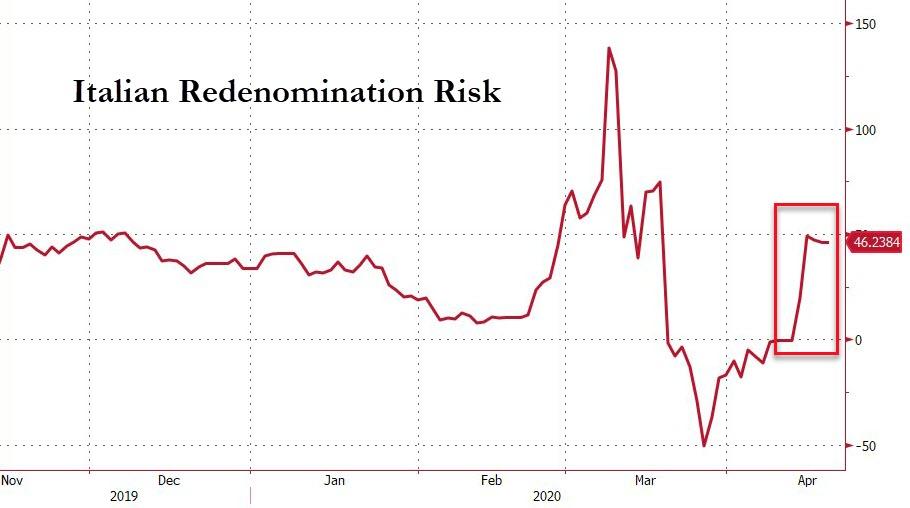

European stocks roundtripped from ugliness overnight to end mixed but all eyes were on Italian credit markets which were once again starting to signal redenomination risk…

Source: Bloomberg

US equity markets were in the red on the day with Nasdaq relatively outperforming once again and Trannies weakest (odd given the huuuge benefits from oil’s collapse)…NOTE the red rectangle shows the drop in all stocks as oil crashed into settlement…

Remember the last few minutes on Friday where The Dow shot up almost 400 points… well that’s all gone now…

The Dow was unable to hold above the 50% retrace level…

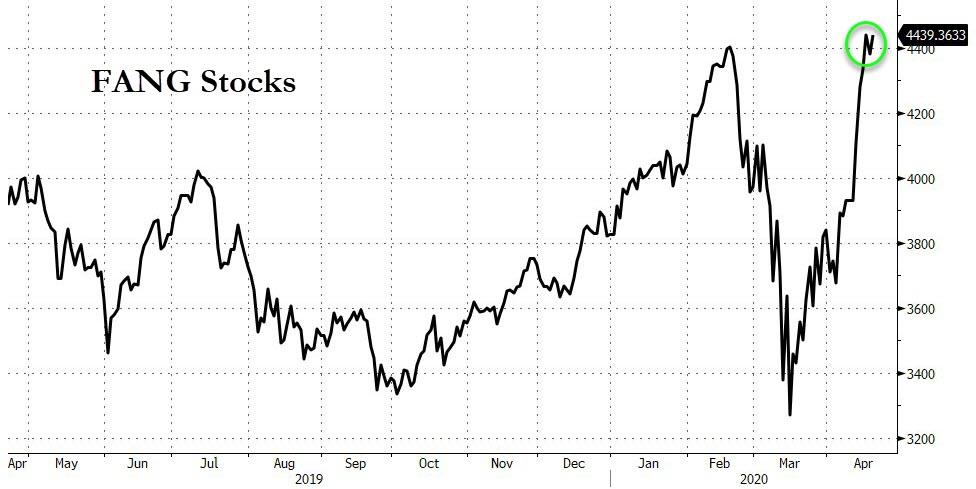

FANG Stocks made another new record high today…

Source: Bloomberg

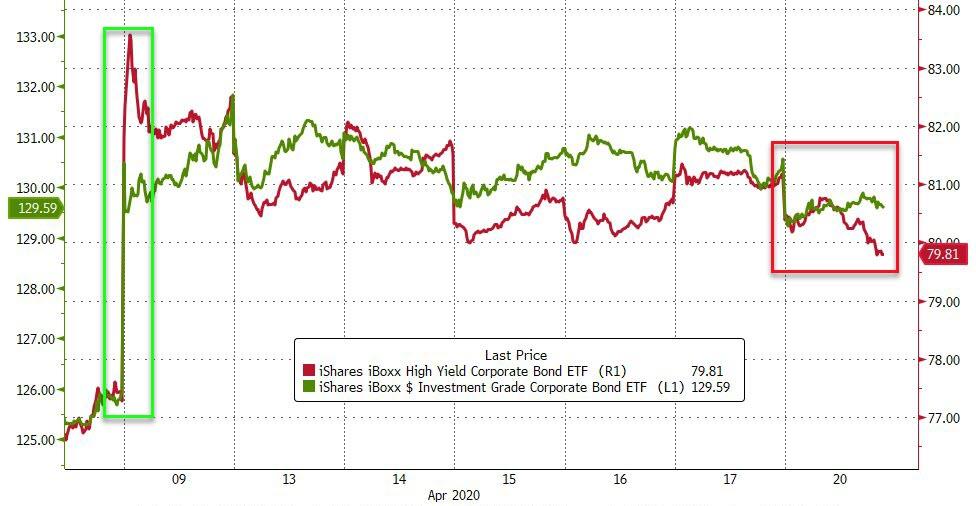

Both HY and IG credit markets stumbled today…

Source: Bloomberg

Treasury yields largely shrugged off everything today ending modestly lower (2Y -1bps, 30Y -3bps)…

Source: Bloomberg

10Y Yield drifted lower…

Source: Bloomberg

The dollar trod water today for a second day, ending slightly higher…

Source: Bloomberg

Cryptos had an ugly day today, erasing gains from the weekend…

Source: Bloomberg

Gold prices rallied on the day (spot and futures) and compressed the premium modestly…

Source: Bloomberg

Finally, the price of a barrel of oil has traded generally between 2.5oz and 5oz of silver for over 40 years… until today – using the June contract, it now costs just 1.3oz of silver to buy a barrel of oil – the cheapest ever.

Source: Bloomberg

Tyler Durden

Mon, 04/20/2020 – 16:00

via ZeroHedge News https://ift.tt/3bock6B Tyler Durden