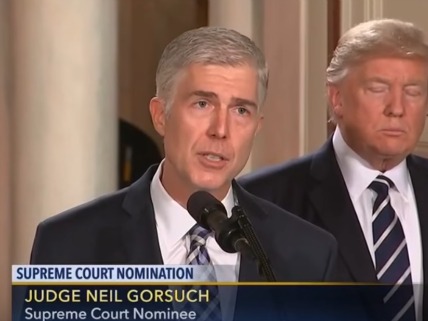

Demand Progress says Neil Gorsuch, President Trump’s choice to replace the late Supreme Court Justice Antonin Scalia, is the sort of judge who “will rubber stamp Trump’s assaults on Americans’ freedoms.” People for the American Way likewise warns that Gorsuch will be “a rubber stamp for the kind of anti-constitutional actions that we have seen over just the last week.” A review of opinions Gorsuch has written since he joined the U.S. Court of Appeals for the 10th Circuit in 2006 provides ample reason to question such claims.

Demand Progress says Neil Gorsuch, President Trump’s choice to replace the late Supreme Court Justice Antonin Scalia, is the sort of judge who “will rubber stamp Trump’s assaults on Americans’ freedoms.” People for the American Way likewise warns that Gorsuch will be “a rubber stamp for the kind of anti-constitutional actions that we have seen over just the last week.” A review of opinions Gorsuch has written since he joined the U.S. Court of Appeals for the 10th Circuit in 2006 provides ample reason to question such claims.

Since the “anti-constitutional actions” to which PFAW refers presumably include Trump’s executive order restricting admission to the United States, the fact that Gorsuch has repeatedly sided with immigrants resisting deportation is particularly relevant in evaluating the suggestion that he would reflexively uphold the executive branch’s decisions. Those immigration cases involved retroactive application of an executive agency’s legal interpretation, which was also at the center of Caring Hearts v. Burwell, a 2016 case in which Gorsuch said a company providing home health services could not be required to return Medicare payments deemed improper based on regulations that were “but figments of the rulemakers’ imagination, still years away from adoption,” when the claims were filed. “Surely one thing no agency can do,” he said, “is apply the wrong law to citizens who come before it, especially when the right law would appear to support the citizen and not the agency.”

And then there is the case of the bothersome burper. Last August, as Nick Gillespie noted at the time, the 10th Circuit upheld the arrest of a New Mexico seventh-grader who burped up a storm during P.E. class, to the amusement of his peers and the annoyance of his gym teacher. Gorsuch dissented:

If a seventh grader starts trading fake burps for laughs in gym class, what’s a teacher to do? Order extra laps? Detention? A trip to the principal’s office? Maybe. But then again, maybe that’s too old school. Maybe today you call a police officer. And maybe today the officer decides that, instead of just escorting the now compliant thirteen year old to the principal’s office, an arrest would be a better idea. So out come the handcuffs and off goes the child to juvenile detention. My colleagues suggest the law permits exactly this option and they offer ninety-four pages explaining why they think that’s so. Respectfully, I remain unpersuaded.

According to the New Mexico Court of Appeals, Gorsuch pointed out, the law under which the kid was charged, which makes “interfering with the educational process” a misdemeanor, “does not criminalize ‘noise[s] or diversion[s]’ that merely ‘disturb the peace or good order’ of individual classes.” He added:

Often enough the law can be “a ass—a idiot”…and there is little we judges can do about it, for it is (or should be) emphatically our job to apply, not rewrite, the law enacted by the people’s representatives. Indeed, a judge who likes every result he reaches is very likely a bad judge, reaching for results he prefers rather than those the law compels. So it is I admire my colleagues today, for no doubt they reach a result they dislike but believe the law demands—and in that I see the best of our profession and much to admire. It’s only that, in this particular case, I don’t believe the law happens to be quite as much of a ass [sic] as they do.

That does not sound like a judge who bends over backward to side with the government.

Further evidence of Gorsuch’s willingness to stand up for the rights of defendants, even when they are indisputably guilty and their crimes make them pariahs, comes from U.S. v. Ackerman, a 2016 child pornography case. Walter Ackerman was charged with possession and distribution of child pornography after AOL reported him to the National Center for Missing and Exploited Children (NCMEC), which opened Ackerman’s email and examined photos attached to it. Ackerman argued that NCMEC, which is authorized by statute and charged with collecting information about possible child pornography offenses, qualifies as a governmental entity, or at least as an agent of the government, and therefore should not have examined his email without a warrant. In an opinion written by Gorsuch, the 10th Circuit agreed that NCMEC should be treated as governmental actor under the Fourth Amendment, although it left open the possibility that the search could be justified by an established exception to the warrant requirement.

Another search and seizure case from last year, U.S. v. Carloss, shows that Gorsuch is not shy about breaking from his colleagues when he thinks they are reading the Fourth Amendment too narrowly. In that case, which Damon Root highlighted last week, the 10th Circuit ruled that police officers needed no permission or justification to bang on a man’s door and question him, with the aim of gaining “consent” for a search, notwithstanding multiple “No Trespassing” signs. In his dissent, Gorsuch emphasized the boldness of that claim:

The government suggests that its officers enjoy an irrevocable right to enter a home’s curtilage to conduct a knock and talk….A homeowner may post as many No Trespassing signs as she wishes. She might add a wall or a medieval-style moat, too. Maybe razor wire and battlements and mantraps besides. Even that isn’t enough to revoke the state’s right to enter.

My point is not that Gorsuch routinely sides with criminal defendants; judging from the majority opinions he has written, he usually rejects their appeals. But contrary to the picture painted by opponents of his nomination, Gorsuch does not shrink from siding with unsympathetic defendants when he thinks the government is wrong. In a 2015 case involving a convicted murderer named Philbert Rentz, for instance, Gorsuch agreed that he was improperly charged with two counts of using a firearm in a crime of violence (each of which carries a five-year sentence) after he “fired a single gunshot that wounded one victim and killed another.”

I doubt the positions that Gorsuch took in these cases, which gave “bad hombres” the benefit of legal niceties, would be endorsed by Donald Trump, who ran on a fearmongering “law and order” platform and has demonstrated little appreciation for the rights of the accused. And I am pretty sure that Trump, who has a long, amazingly petty history of suing people who hurt his feelings and wants to facilitate such claims by “open[ing] up those libel laws,” would not approve of the conclusion Gorsuch reached in Bustos v. A & E Television Networks, a 2011 defamation case.

Jerry Lee Bustos, a prison inmate in Colorado, sued A & E after it used surveillance camera footage of him fighting with another prisoner in a documentary about the Aryan Brotherhood. Bustos complained that the program implicitly identified him as a member of the gang, which he was not. A federal judge rejected his defamation claim, and the 10th Circuit upheld that decision in an opinion written by Gorsuch. “Can you win damages in a defamation suit for being called a member of the Aryan Brotherhood prison gang on cable television when, as it happens, you have merely conspired with the Brotherhood in a criminal enterprise?” he wrote. “The answer is no. While the statement may cause you a world of trouble, while it may not be precisely true, it is substantially true. And that is enough to call an end to this litigation as a matter of law.”

Another Gorsuch opinion dealing with freedom of speech suggests he has considerably more respect for the First Amendment than Donald Trump does. In the 2007 case Van Deeling v. Johnson, the 10th Circuit overturned a federal judge’s dismissal of a lawsuit brought by a man who had irked officials in Douglas County, Kansas, by repeatedly challenging his property tax assessments. Michael Van Deeling claimed that the county commissioners had pressured him into dropping his challenges through threats and intimidation. The judge rejected Van Deeling’s First Amendment claims on the ground that his tax challenges did not address a matter of public concern. “We write today to reaffirm that the constitutionally enumerated right of a private citizen to petition the government for the redress of grievances does not pick and choose its causes but extends to matters great and small, public and private,” Gorsuch said. “Whatever the public significance or merit of Mr. Van Deelen’s petitions, they enjoy the protections of the First Amendment.”

Trump’s critics (including me) were understandably concerned that his Supreme Court nominee would be a judge with authoritarian instincts who almost always sides with the government and would not be inclined to question the president’s power grabs. Judging from Gorsuch’s track record, he is not that guy.

A San Bernardino sheriff’s deputy did not appreciate a citizen videotaping him during a terse exchange in the sheriff’s office, and threatened to arrest the man because of it. When asked on what grounds did the deputy have for making an arrest, the deputy replied, “I’ll create something.”