China Divorce From Capitalism Steals Joy From Stocks

By Garfield Reynolds, Bloomberg Markets Live commentator

Investors want to move past the turmoil caused by China’s crackdowns. But doing so risks overlooking the profound shift as Xi Jinping’s government makes a decisive turn away from free markets, radically altering the dynamics in the coming decade, particularly for equities.

I warned before that China would be a big source of disruptions for investors this year, and that has certainly been the case. There are likely some fund managers left bruised after regulatory storms helped wipe out their investments in particular sectors or companies — New Oriental Education is now a $3 billion company instead of a $33 billion one, for example.

However, focusing on particular pain points obscures the real dangers because it makes it all too easy for investors to shrug and move on to trying to find winners and losers.

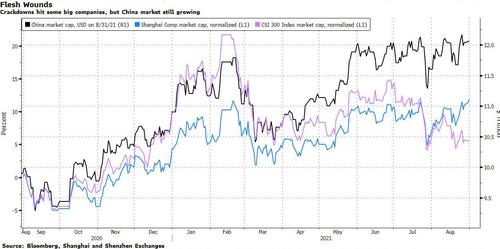

China’s market capitalization just reached a record high above $12 trillion. So what, if the Shanghai Composite and the CSI 300 indexes are still well below their February price peaks? Value has not so much been destroyed as shifted, would be one view. So go out and chase it even if that means poring over all manner of old Communist Party speeches or seeking out new corners of the internet where prophets can offer a guide to where profits can be made.

The problems with that sort of approach are two-fold. First, it downplays the constant refrains that put profits at odds with the needs of Chinese society — or as Li Guangman Ice Point Commentary put it — “a transformation from capital-centered to people-centered.” Clearly, China’s authorities will pay no mind to any losses inflicted on investors, especially foreign ones.

Secondly, this “profound revolution” signals China’s move to play an ever-greater part in the global economy could reverse. That’s an even greater danger for the more gradual increase in its financial markets role, which had been built around expectations a state still run by the Communist Party would move relentlessly to integrate with the reigning capitalist consensus.

The evaporation of those assumptions creates a far more volatile outlook for economies and markets. There are already signs that China’s economic rebound is wilting because of both the crackdowns and the virus.

Rewarding innovative companies by suddenly telling them they are too profitable, or that they have been running their businesses all wrong, won’t result in a stronger economy. Propagating opinion pieces that inveigh against “sissy stars” and the worshipers of the West could also limit creativity and crimp growth.

It is also possible China’s economy ends up stronger than ever, or that its share and bond markets scale ever greater heights. Governments all around the globe are playing a larger role in economies and markets, and a hefty dose of authoritarianism would be one way to accelerate efforts to reduce carbon emissions, for example.

Investors may be setting themselves up for more pain if they switch to traditional dip-buying mode for Chinese assets in particular and EM equities in general. More broadly, expect slower global growth, a much rougher ride for risk assets, and increased volatility that will hurt many passive-investment ETF strategies.

Tyler Durden

Tue, 08/31/2021 – 22:22

via ZeroHedge News https://ift.tt/38ryZ2j Tyler Durden