Submitted by Charles Hugh-Smith of OfTwoMinds blog,

Ignoring the facts won't help us address the insolvency of pay-as-you-go social programs.

I was fortunate enough to be invited back on Max Keiser's Keiser Report for a wide-ranging discussion of Peak Retirement, currency wars and more. Since the topics Max raises are profound and not always that easy to summarize (if there is another media host who covers complex topics in such profusion and with such a diverse range of guests, he/she is unknown to me), I'm devoting the next few blog entries to offer context for the topics Max and I discussed.

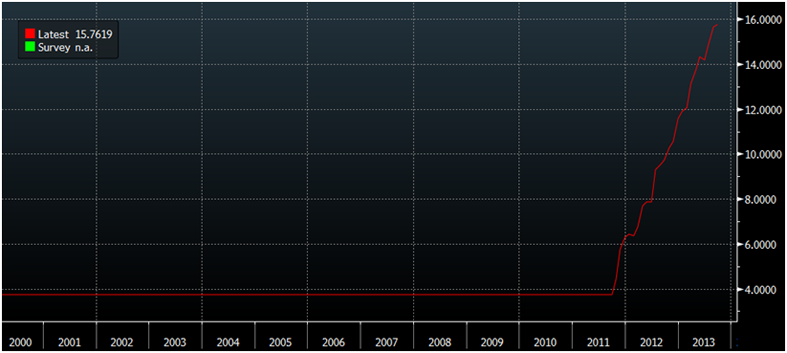

Max's first question related to my entry on Peak Retirement (October 15, 2013) in which I showed that the ratio of full-time workers to Social Security beneficiaries has dropped to 2-to-1.

Why does this matter? It matters because our social programs are pay as you go, meaning that current workers pay current retirees' benefits. There is no "trust fund" and the proof is simple: now that Social Security is operating at a deficit, i.e. payroll tax revenues no longer cover benefits paid out, where does the U.S. Treasury get the money to pay the benefits not covered by tax revenues?

Social Security Ran $47.8B Deficit in FY 2012

It sells bonds, just like it does to fund any other deficit spending of the federal government. The Trust Fund is a politically useful fiction, period, end of story. The bonds in the bogus Trust Fund are non-negotiable, i.e. worthless. The Treasury funds Social Security deficits by selling Treasury bonds.

(Social Security reports "interest earned" on the phony non-negotiable bonds, but where does the U.S. Treasury get the money to pay the interest? It sells T-Bills, adding to the national debt. No matter how you slice it, the programs' deficits are funded by selling debt, i.e. T-Bills, just like all federal deficit spending.)

I bobbled my response to Max's question, so he helpfully stepped in and explained that social programs like Social Security and Medicare are paid by payroll taxes, not income or other taxes. Employers and employees both pay 7.65% of earned income/wages to fund these two monster programs–a total payroll tax of 15.3%. (12.4% is for Social Security and 2.9% is for Medicare.)

Those who receive no earned income (self-employment earnings, wages, salaries, tips, etc.) and only receive unearned income (dividends, capital gains, rents, etc.) pay no Social Security/Medicare payroll taxes. That's one reason why unearned income is so sweet: it avoids the 15.3% payroll tax right off the top.

(Those of us who are self-employed pay the entire 15.3%.)

This means these programs depend entirely on payroll taxes from employed people. The taxes collected are non-trivial: Social Security brought in $725 billion in cash and paid $773 billion for benefits and overhead expenses in 2012.

The Social Security Administration (SSA) publishes a helpful chart of all earned income reported on federal tax returns: Wage Statistics for 2012. This data will help us understand why the system depends not just on those with any old job but those with good-paying full-time jobs.

(Recall that high-income earners only pay payroll taxes on the first $113,700 in 2013 and $117,000 in 2014. So someone earning $1,000,000 a year pays the same Social Security tax as someone making $113,700.)

Let's illustrate the importance of the full-time job/beneficiary ratio by asking: how many workers does it take to fund one retiree's annual benefit? Since even a low-lifetime earnings debt-serf like me can get $2,100 a month in Social Security bennies (if I wait until 70 to collect), and higher lifetime earnings folks get $25,000 a year at full or even early retirement, let's ask: how many workers' payroll taxes does it take to fund one retiree getting $25,000 a year from Social Security?

Over 23 million people reporting earned income made less than $5,000 a year. The SSA reports their average compensation was around $2,000. The Social Security payroll tax is 12.4%, so 12.4% of 2,000 is $248 a year in Social Security payroll tax.

It takes 100 of these workers' Social Security payroll tax to fund one retiree.

Another 14 million workers earn between $5,000 and $10,000, with an average of $7,400. At $7,400, each worker pays $917 in Social Security payroll tax. It takes 27 of these workers' payroll taxes to fund one retiree.

About 12 million workers earn between $10,000 and $15,000 a year, with an average of $12,460. Their Social Security payroll tax works out to $1,545 annually. It takes 16 of these workers to fund one retiree.

Cumulatively, that's around 50 million workers, or a third of the entire workforce.These 50 million people earn about the same amount ($153 billion) as the 1.8 million people who earn between $85,000 and $90,000 a year ($156 billion) and considerably less than the 890,000 folks who earn between $200,000 and $250,000 a year ($197 billion).

Those earning $85,000 a year pay $10,540 a year in Social Security payroll tax, so it takes 2.5 of these workers to fund one retiree.

Those 1.8 million people pay as much Social Security payroll tax as the 50 million low-compensation workers. This reveals how the system depends on full-time, high-paying jobs to fund the program. Adding millions of low-paying part-time jobs simply won't generate the payroll tax revenues needed to keep up with the rising number of beneficiaries (57 million total).

If you want to be in the top 10% of those with earned income, you need to earn about $85,000 a year. Out of 153 million people reporting earned income, 140

million make less than $85,000 a year.

To make it into the top 5%, you need to earn $115,000 or more, and to reach that oft-mentioned 1% (it's really the 1/10th of 1% who holds the power), you need to make $250,000 or more.

As noted earlier, those earning rarefied compensation aren't paying any more Social Security payroll tax than someone earning the limit of $113,000.

We don't have enough workers earning enough and paying enough Social Security payroll tax to support 57 million retirees. There are only 13 million high-wage earners (above $85,000 annually), and those with very high incomes pay no more Social Security payroll tax than those earning $113,000.

This is not sustainable. The average Social Security benefit is $1,230 a month or about $15,000 a year. It takes the payroll taxes of roughly 10 million low-wage workers to fund 1 million retirees receiving $15,000. The system needs another 57 million decent-paying full-time jobs to be sustainable in it's current form, i.e. the ratio of full-time workers to beneficiaries needs to rise back up to 3-to-1.

Unless 57 million Martian workers agree to kick in 12.4% of their quatloos (and assuming quatloos are convertible into dollars), the system is a doomed Ponzi scheme.

System costs will be rising fast as the Baby Boom retires en masse. There is no guarantee Social Security payroll taxes will rise at the same rate. Indeed, a recession or stagnation in the job market could cause payroll taxes to decline even as benefit costs soar.

Ignoring the facts won't help us address the insolvency of pay-as-you-go social programs.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/cCSvWG62fIc/story01.htm Tyler Durden