Did investors buy bitcoin because it was trendy, or are they committed to cryptocurrency for the long haul?

As in any new and rapidly-growing market, Visual Capitalist’s Jeff Desjardins explains that this kind of investor intent and the overall feeling of market sentiment matters a lot. That’s because there are no historical averages or ratios to apply as baselines for value, and if things head south there is always the possibility of a mass exodus.

Courtesy of: Visual Capitalist

BUY, HODL, AND PROSPER?

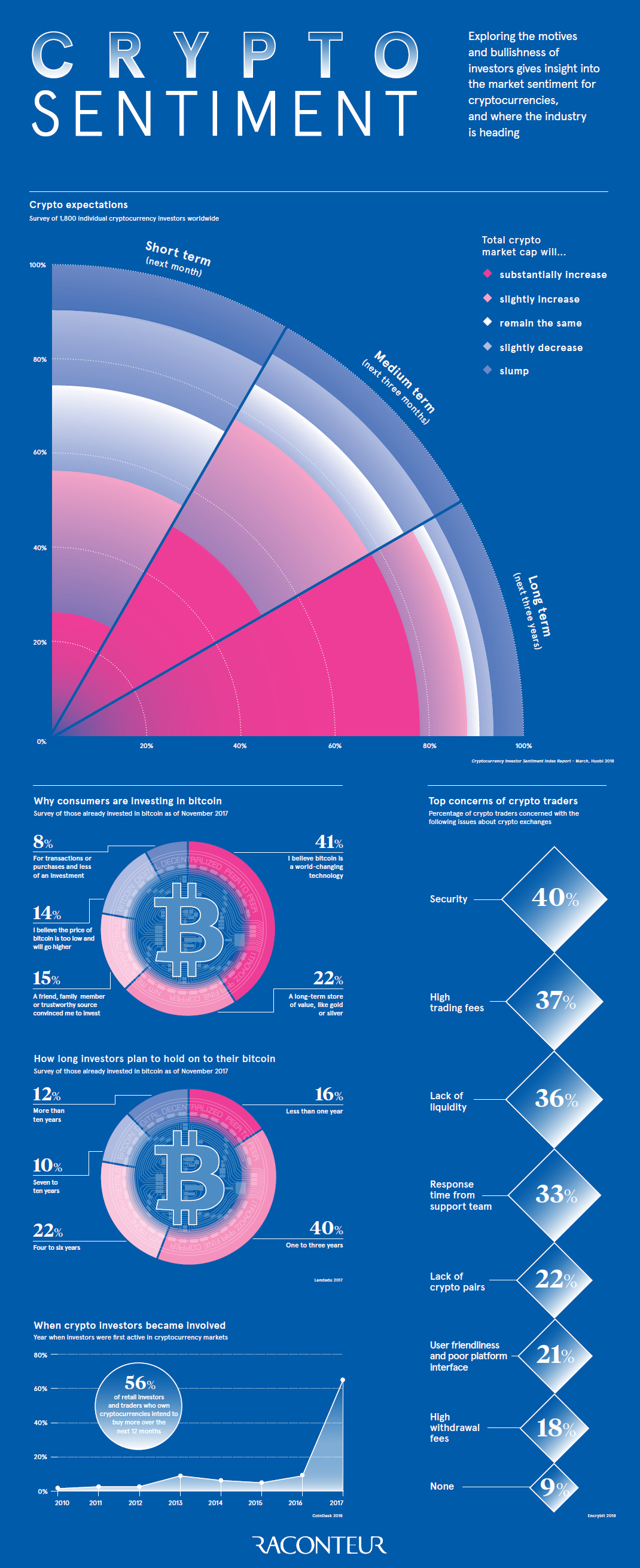

Today’s infographic comes to us from Raconteur, and it helps map out the future price expectations of crypto investors, along with how long they plan to hold onto their digital assets.

But before we get to that, let’s look at why investors bought into the market in the first place:

When did people get into the market?

More than 60% of investors got involved in cryptocurrency in 2017, and 56% of investors that hold crypto plan to buy more in the next 12 months.

FUTURE EXPECTATIONS

What do people expect crypto prices to do in the future, and how long are investors willing to hold?

According to a survey of 1,800 crypto investors around the world at the end of March 2018, a whopping 77.9% see the crypto market gaining more than 30% in value over the next three years.

Meanwhile, another poll from November 2017 asked investors how long they will hold onto their assets:

Only 16% of respondents planned to sell within the next year, and 44% of respondents said they’d hold onto Bitcoin for four or more years.

CONCERNS ABOUT EXCHANGES

Exchanges are the lifeblood for buying or selling cryptocurrency – so what are the major concerns held by investors about them?

Security continues to be a topical issue for traders, which is not surprising since it’s estimated that $1.2 billionof crypto has been stolen since 2017. Other issues like high trading fees and the lack of liquidity and lack of currency pairs also poll high.

via RSS https://ift.tt/2yI9Ilj Tyler Durden