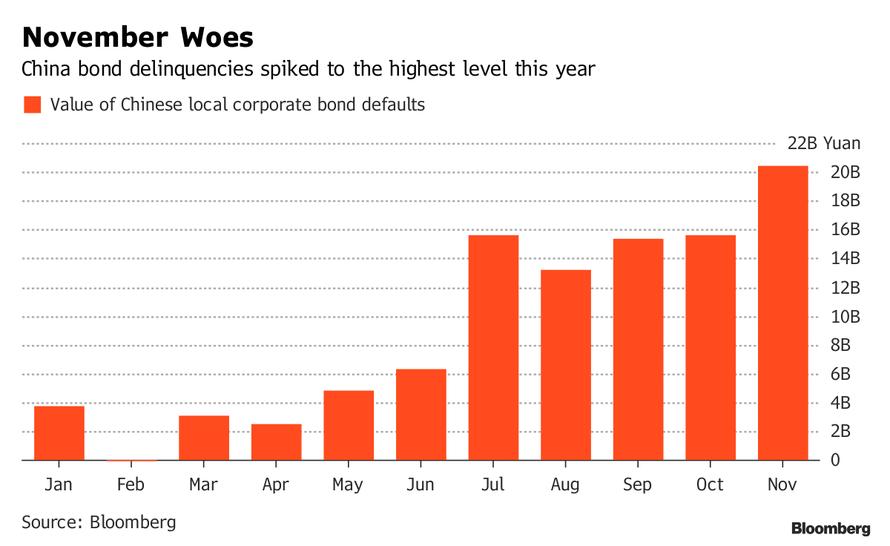

That China has had a problem with rising defaults is not news: as we reported back in October, 2018 was already set to be a record year for Chinese bankruptcies. Things only got worse in November and December when defaults spiked to 20.4 billion yuan ($3 billion) confirming that the supportive policies from the People’s Bank of China announced more than a month ago have yet to yield the intended effect.

“Defaults will stay elevated [in 2019] because the Chinese economy is expected to slow and off-balance-sheet lending has been shrinking,” said Yang Hao, analyst at Nanjing Securities. The funding environment has yet to improve significantly for certain corporations, he added.

Predictably, just like in the US, Chinese investors have shunned lower-rated notes, and only relatively stronger firms were able to access the local bond market in recent months. Non-finance companies rated below AA publicly sold 1.27 trillion yuan of notes for the first 11 months of 2018, the lowest in four years. In contrast, companies with above AA+ ratings sold almost 3.28 trillion yuan bonds, up about 40 percent from last year.

None of this is news. What is surprising, however, is what happened when the latest Chinese corporate default took place on Tuesday: that’s when Jiangsu-based Kangde Xin Composite Material Group, failed to pay a 1 billion yuan ($148 million) local note due Jan. 15 due to a liquidity crunch, according to the company. What was shocking, however, is that as research analyst Tim Yup caught earlier this week, as of end-September the company reported that it “had” 15.4 billion yuan in cash and equivalents, more than double the total amount of its short-term debt, and more than 15 times the amount of debt that it just defaulted on!

$002450.SZ Kangde Xin just announced it has trouble repaying onshore RMB 1Bn bond maturing tomorrow, despite “having” RMB 15Bn cash on balance sheet in 3Q18.

It has a USD bond “listed in @HKEXGroup “, Moody’s & Fitch initiated Ba3 and BB not even 2 years ago. Quote at 40 now

— Tim Yip (@timdayipper) January 14, 2019

As usually happens in China (recall the Hanergy fiasco) the latest default was until recently one of the most beloved names by local hedge funds, with Kangde Xin’s stock soaring until late 2017 when its largest shareholder’s pledged stock loans blew up in early 2018.

Meanwhile, its bond were trading around par until mid-2018, when questions started to emerge about the company before collapsing to 35 cents currently.

Yet while the company’s collapse is a classic case of yet another overleveraged Chinese company keeling over once the money ran out, with the insolvency catalyst in this case being the massive stock loans taken out by management – a 5 trillion yuan “ticking time bomb” which we discussed previously – the latest default raises far more troubling questions about the quality of financial reports from Kangde Xin, and Chinese companies in general, and also highlights risks of investing in junk-rated bonds from the country.

The consequence according to Manulife Asset Management, is that investors will tend to shun risky issuers even more, or simply demand a higher premium just when Chinese cash-strapped firms need funding the most. As noted above, liquidity crunch in China already sparked record local bond failures in 2018.

“There have been too many companies with poor credit quality tapping the bond market in recent years,” said Jimond Wong, senior portfolio manager for Asia fixed income at Manulife Asset Management.

And the bigger issue: “Very often, their problems are not easily captured by financial statements,” especially when companies openly fabricate their numbers while local auditors fail to (or are paid not to) notice any glaring misrepresentations.

Like pretending that you have 15 billion yuan in cash and being unable to pay a 1 billion debt maturity.

As Bloomberg elaborates, Kangde Xin caught the attention of Chinese regulators last May, when the Shenzhen Stock Exchange asked the company to elaborate on its cash holdings which had jumped to 18.5 billion yuan at the end of 2017 from 10.1 billion yuan two years earlier. In October, China Securities Regulatory Commission launched an investigation into Kangde Xin on inadequate information disclosure on dealings among its shareholders.

Then, once it became clear that the company’s cash was just smoke and mirrors, on Wednesday, Kangde Xin’s credit rating was cut to Ca from B3 by Moody to reflect the default and expectation of the “high economic loss for bondholders when compared to the original promises on payment.”

When Bloomberg reached Kangde Xin for comment, the company referred it to its public statements… which we now know were worthless. The company’s account receivable collection slowed since the start of October due to unfavourable financial market conditions, and its liquidity ran into temporary difficulties, the firm said on the Shenzhen Stock Exchange website on Jan. 15, in response to investor queries about its ability to repay the local bonds and whereabouts of its cash.

Kangde Xin “is a timely reminder that it is dangerous to stray too far into” lower rated Chinese names and private firms from the country still face rising default risks, said Owen Gallimore, head of credit strategy at Australia & New Zealand Banking Group Ltd.

This is not the first time a company grossly misrepresented its liquidity: a month ago, investors had a similar encounter with another Chinese junk-rated borrower called Reward Science and Technology Industry Group. The detergent and dairy producer reported having 4.15 billion yuan in cash and equivalents at the end of September before reneging on a 300 million yuan local bond payment in early December. Calls to Reward’s official in charge of bond information disclosure went unanswered.

“There are big issues with Chinese issuers’ financial disclosure and much more stringent regulation is need to change the situation,” said Lv Pin, a credit analyst at CITIC Securities Co.

“Right now, investors can’t rely on issuers’ financial statements at all and some have even disregarded them altogether.”

Which is to be expected: after all Chinese companies are merely doing what Beijing has been doing for years: fabricating, making up and generally reporting bullshit numbers. The problem for investors is that China, the country, can afford to do it to “represent” that it is stronger than is in reality; however when Chinese companies do it, it is only a matter of time before investors end up paying the price. Meanwhile, thanks to episodes like Reward Science and Kangde Xin, confidence and sentiment in Chinese corporations has now officially vaporized.

via RSS http://bit.ly/2TVXdbG Tyler Durden