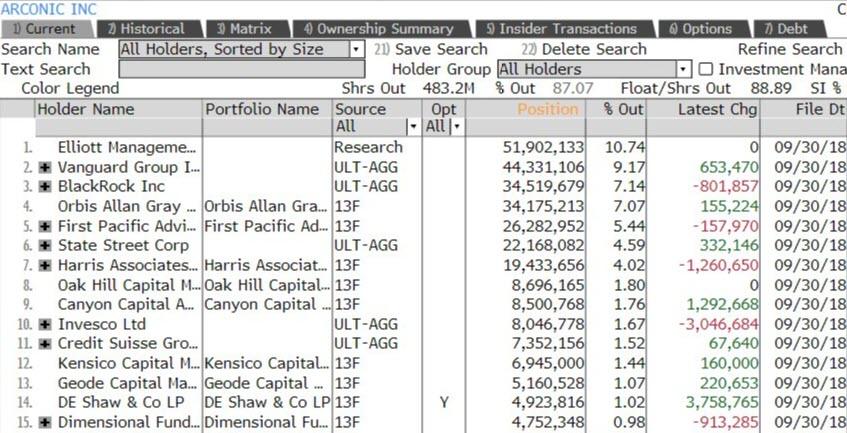

Three weeks into the new years and hedge funds are already having a miserable time: while the sharp rebound in the market has been a boon for the active investing community which is getting crushed every day as billions in funds flow out of active and into passive vehicles, today a prominent hedge fund hotel blew up, when Arconic announced it had abandoned its sale process even as dozens of hedge funds had expected the deal to go through…

… sending its stock tumbling over 26%.

And as the slow, painful death of the industry – which remains on death watch in a time when central banks act as Chief Risk Officers of the entire market, thus making hedging obsolete – continues, one fund decided to throw in the towel when macro hedge fund Atreaus Capital has called it quits, the latest firm to succumb to what Bloomberg called “a hostile environment.”

The hedge fund will shut its New York and London offices and stop trading in its main money pool, according to an investor letter seen by Bloomberg.

The Atreaus Master Fund, which bet on macroeconomic events and commodities, hit $2 billion at its peak, however it has suffered three straight years of declines, losing 4.5% through November 2018.

“There’s more than a little irony in making the decision to close down as we actually feel that the environment for what we do is as good as it has been for some time,” Founder and Chief Investment Officer Todd Edgar said in the letter. “Closing a fund does not equal death (although it may feel a little like that sometimes).”

Prior to founding Atreaus, Edgar was a Managing Director of Barclays as the Global Head of Macro Proprietary trading beginning in 2009. He joined Barclays Capital from JP Morgan where he was Managing Director and Global Head of the Commodities and FX Proprietary Trading group and stayed for about four years. Todd was previously a Portfolio Manager at Tudor Investment Corp, based in Greenwich, CT, and also worked at Morgan Stanley as Global Head of Metals Trading. He started his career at Bankers Trust trading metals and FX in 1993.

Yet while Atreaus is hardly a household name, that of Paulson is, and according to a separate update by Bloomberg, John Paulson – who had one very lucky trade during the financial crisis when alongside Goldman he shorted a bunch of MBS, and who has barely had any positive years since – plans to decide in the next two years whether to turn his hedge fund into a firm that solely manages his personal wealth.

During an interview on Mike Samuels’ “According to Sources” podcast, Paulson said he may split his firm into two parts – one managing his own money and the other running client capital with a type of “profit sharing arrangement with my partners” if they want to continue overseeing the outside capital.

Of course, some will counter that Paulson already is a family office because following massive redemptions in recent years, roughly 80% of the assets at his Paulson & Co. belong to him, something he confirmed in the podcast released Monday. His hedge fund, which at its peak in 2011 managed $38 billion, was down to about $8.7 billion at the beginning of November.

Once Paulson also admits that he too no longer has a clue how to trade this “market”, he will join a long procession of veteran hedge fund managers who have also converted their hedge funds into “family offices” after investors asked for their money back following years of mediocre performance.

And in other news, Paulson will likely be running his own money from Puerto Rico: in November he said he was considering becoming a resident of Puerto Rico in the next few years to avoid taxes, once his teenage children go to college.

via ZeroHedge News http://bit.ly/2S5ET2g Tyler Durden