But, but, but last week the China talks were going great and everything was awesome? Now, talks are off and The IMF says the global economy has shit the bed?

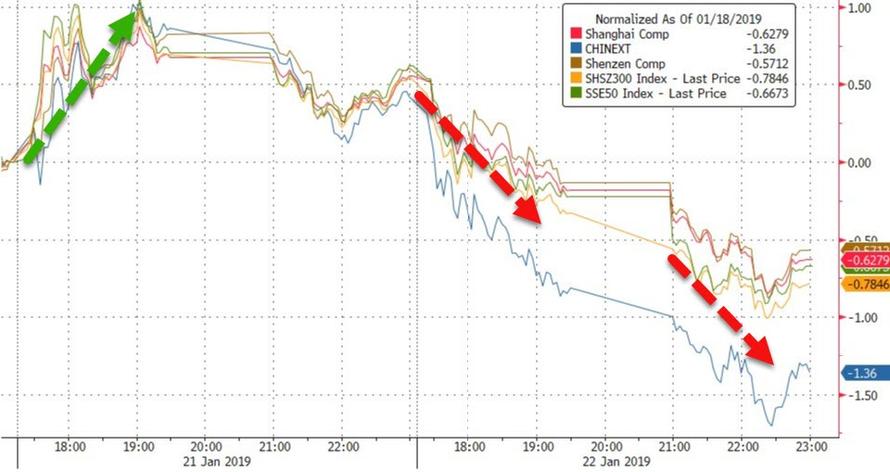

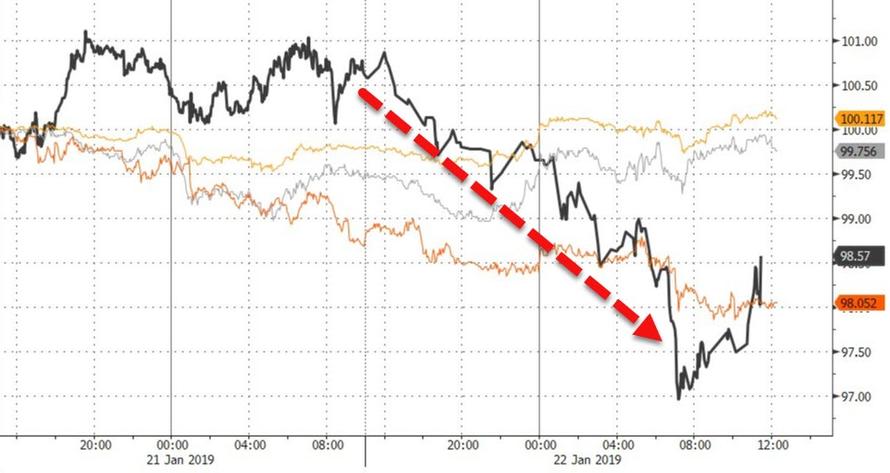

China stocks started badly and never got any better after the shitty data hit… No National Team?

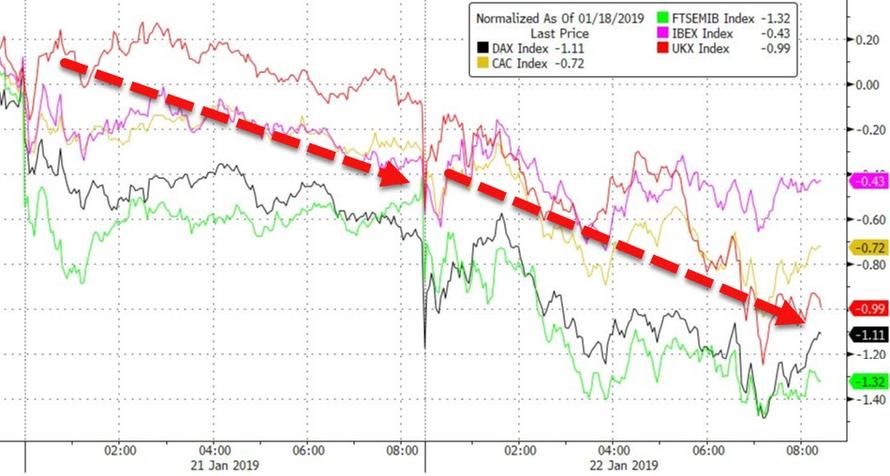

European stocks extended yesterday’s losses…

US markets were weak overnight after dismal China data (worst annual GDP growth in 28 years) and trade talks headlines (confirming “little progress”) but when the “U.S. TURNS DOWN CHINA OFFER OF PREPARATORY TRADE TALKS” headline hit, stocks tanked…

And then – as if on cue with the dow down 450 points – Larry Kudlow shows up on TV and proclaims: “REPORT THAT WHITE HOUSE CANCELED CHINA MTG NOT TRUE… KUDLOW REJECTS FT REPORT ON U.S. TURNING DOWN CHINA PREP TALKS” which sent stocks spiking higher.. but that did not last…

By the close, Nasdaq and Trannies were worst (both down over 2%)…some panic buying in the last few seconds…

From Friday’s cash open, the Nasdaq has erased all the trade hope gains…

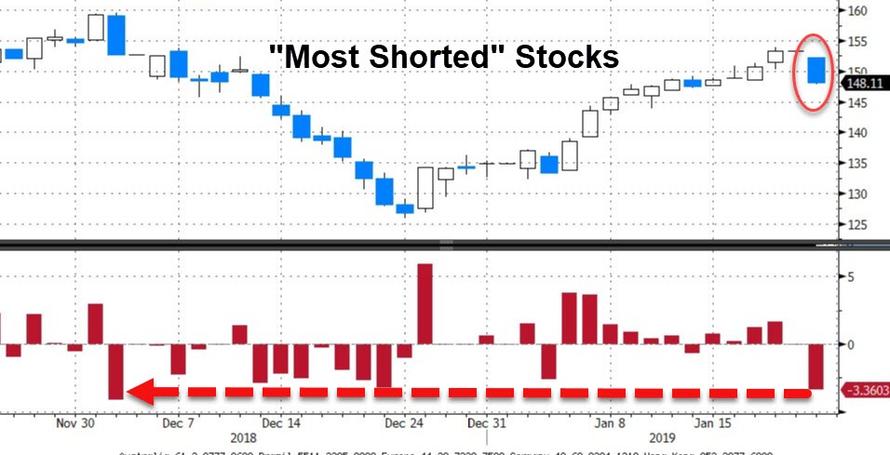

“Most Shorted” stocks fell over 3% today – their biggest drop in six weeks…

Volume was above average today but not huge.

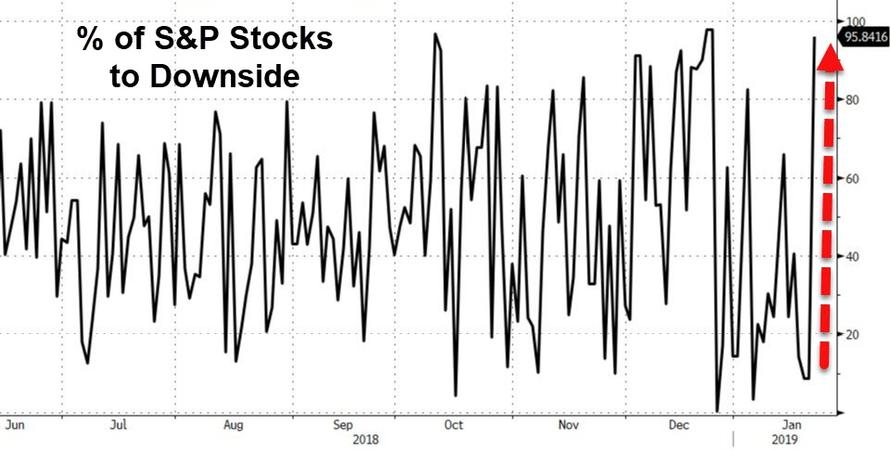

But…95% of S&P 500 stocks were to the downside today – this is the worst tumble, breadth-wise, since December 24.

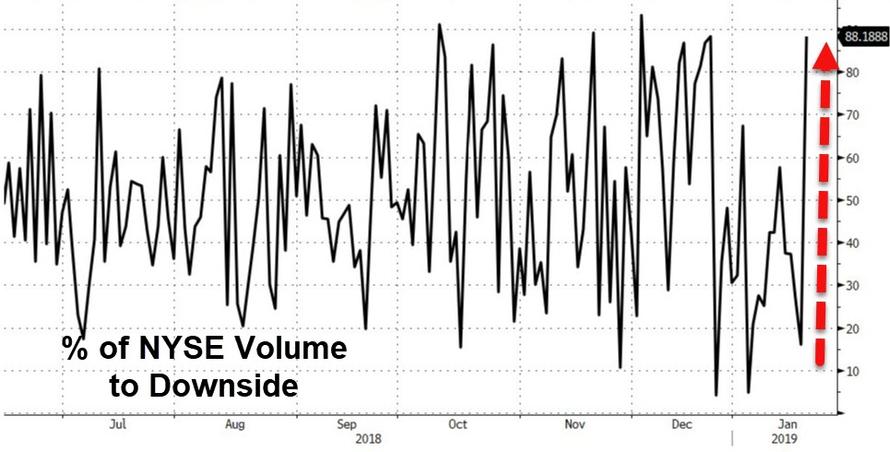

From a volume perspective, it’s also an ugly day... 88% of NYSE volume is in declining stocks, which rivals the 88.4% seen on December 24…

All the major US equity indices broke back below their 50-day moving averages…but bounced back above it thanks to Kudlow and some panic-buying at the bell.

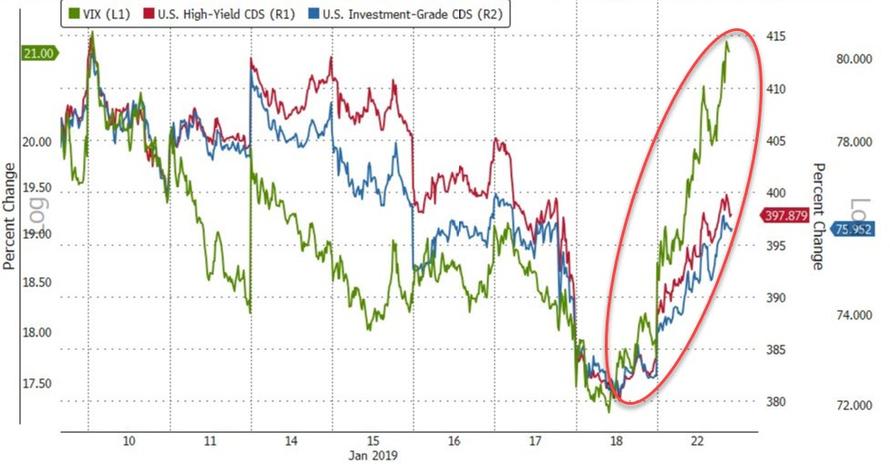

Equity (VIX) and Credit (CDX) protection markets soared higher today…

Treasury yields tumbled between 3 and 5bps on the day…

30Y Yields fell to one-week lows before Kudlow hit…

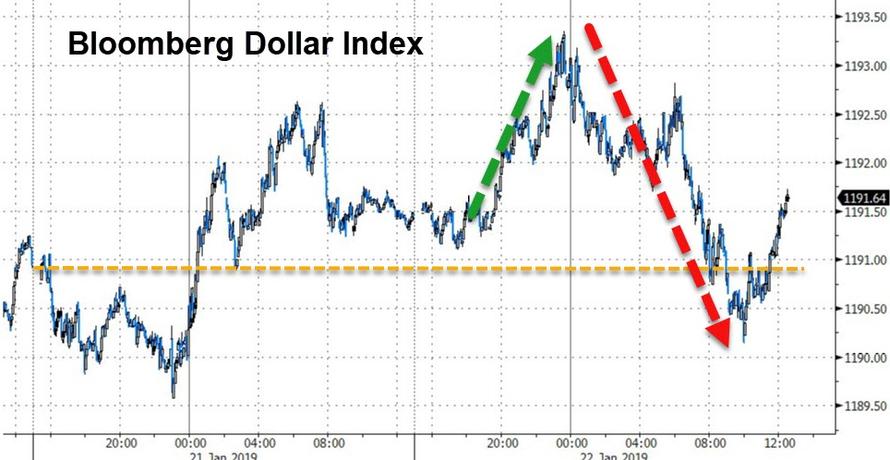

The dollar is up from Friday’s close but roundtripped today to close almost unchanged (The dollar was bid as China data hit)…

Cryptos bounced today pushing Litecoin and Bitcoin Cash green for the week…

PMs managed modest gains as copper and crude were clubbed after China data…

WTI rebounded to $53 after sliding all day…

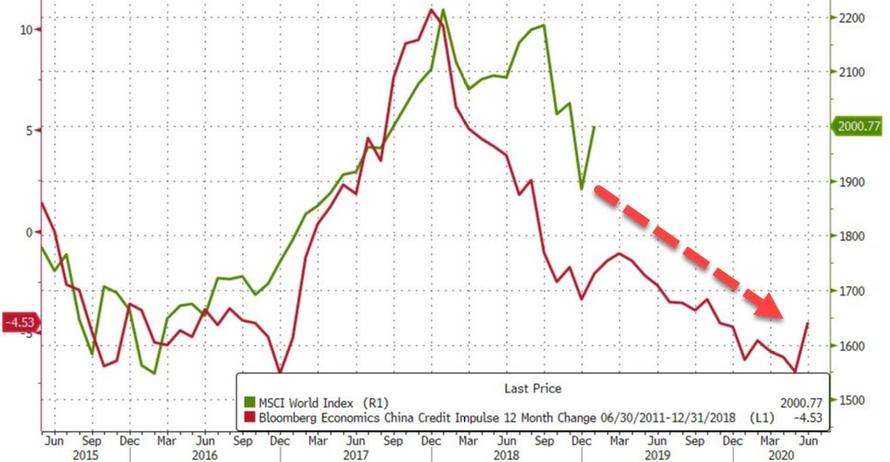

Finally, history appears to be written as the lagged effects of China’s collapsing credit impulse (not offset by central bank balance sheet expansion) are not sending happy signals for global shareholders…

But in the US, it’s time for some catch down…

via ZeroHedge News http://bit.ly/2DtxrGd Tyler Durden