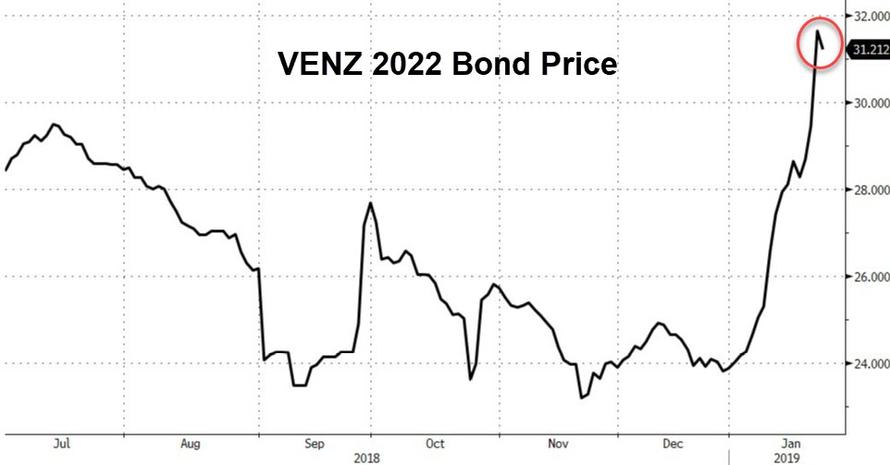

As a growing number of world leaders recognize opposition leader Juan Guaido as the legitimate president of Venezuela, defaulted Venezuelan “hunger bonds” are rallying to their strongest level in more than a year as the brutal socialist regime of Nicolas Maduro – who was sworn in earlier this month for a second six-year term – teeters on the brink of outright collapse.

Venezuela’s 2022 bonds on Thursday halted their biggest three-day rally since October, but the rally so far has been nothing short of stunning, though many LatAm investors have opted to steer clear for now.

“I prefer to stay out until things get better,” Francisco Ghersi, managing director at Knossos Asset Management, told Bloomberg. He added that Maduro – who has kicked out all US diplomats and insisted that he will retaliate against demonstrators – will do “whatever it takes to be in power.”

While Maduro is still technically in control of the levers of power and the country’s collapsing energy infrastructure, Guaido has one key advantage: The US could unfreeze millions of dollars in Venezuelan assets and turn them over to him. The US could also impose an oil embargo on Venezuela, which would add to the financial strain from US sanctions against Maduro and his regime. In Latin America, only three countries, – Cuba, Bolivia and Nicaragua – still recognize Maduro as the legitimate leader of Venezuela.

Here’s a roundup of what analysts are saying about the bonds, courtesy of Bloomberg:

Siobhan Morden, head of LatAm fixed-income strategy at Nomura in New York:

- “U.S. recognition will come with responsibilities. It’ll be a game of chicken to see if incremental pressure works for an internal rupture. If not, then look for full blown economic sanctions”

- DVSA bonds could jump to 30 cents on the event of a regime change

Sean Newman, a portfolio manager at Invesco Advisers in Atlanta:

- “The U.S. recognition is a game changer. It may prompt Maduro to do something radical like try to remove him, which will leave the international community no choice but tighten grip around country, leaving the military to abandon him”

- Invesco owns Venezuelan bonds, but is not adding more at this moment given the spike in prices Wednesday

Francisco Rodriguez, chief economist at Torino Capital:

- The bond rally will probably fade if the military reiterates its support for Maduro

- Market has been betting on regime change, yet it depends on military

- Unclear how long Maduro would survive if Venezuela loses capacity to sell oil to U.S.

- Consequences could be similar to U.S. decision to freeze Libyan assets in 2011 and Muammar Gaddafi losing power several months later

Ahmed Riesgo, chief investment strategist at Insigneo Securities in Miami:

- “The quicker Maduro’s out, the better it will be for bondholders. I think what you’ll have is you’ll have a new government come that will want to enter into a restructuring”

- “The market is anticipating that a little bit, especially with the move in the prices over the last few days”

- “The new government is probably going to have a bit of a honeymoon period with bondholders, where they may be a little more amenable to terms”

- Says credible range for recovery value is between 30-40 cents

Shamaila Khan, director of emerging-market debt at AllianceBernstein in New York:

- Has a long-held view that regime change would happen “We think regime change is likely in the near term”

- It’s possible that debt may overshoot amid the positive news, but not there yet

Patrick Esteruelas, a senior analyst at Emso Asset Management in New York:

- It’s potentially “the beginning of the end” for Maduro’s regime amid increasing foreign and domestic pressure

- Emso is long Venezuelan bonds

- Favors lowest priced PDVSA bonds

Michael Roche, a strategist at Seaport Global Holdings in New York:

- “Any and all ‘positive for regime change’ information coming to light will add pressure on participants to accumulate an exposure to the Venezuelan sovereign given the likelihood that prices could close in on recovery values – in the $40 area – quickly”

- Investors should buy “on a tactical basis – it’s best to buy any weakness so as not to push prices up too quickly”

- “The market will now look to see the reaction of the Maduro government to the protest and diplomatic moves”

Ray Zucaro, chief investment officer at RVX Asset Management in Miami:

- Recent actions by the U.S. and other governments to recognize Venezuelan opposition leader Guaido as the interim president are a “game changer” for the nation’s bonds

- “All the avenues are closing” for Maduro

- Sees value in PDVSA 22s, PDVSA 23s and PDVSA 24s

James Gulbrandsen, a Rio de Janeiro-based asset manager at NcH Capital:

- “This time feels very different from previous moments when Maduro seemed at risk.Bolsonaro’s election in Brazil may be the difference maker as Maduro can be squeezed not only from the north but also now from the largest power in Latin America”

Though Venezuelas’ benchmark bonds ticked lower on Thursday, they remained near their one-year highs.

As Forbes Ken Rapoza pointed out in a column about the turmoil in what was once Latin America’s wealthiest country, nearly every Venezuelan bond issue is in default, offering a potentially massive payoff for any political arbitrageurs brave enough to accept the risk.

Every Venezuelan government bond is in default except for the PdVSA 2020s. The defaulted bonds are being bought in the secondary market at discounts of around 80% as an option on regime change. It’s a relatively illiquid market. Investors who bet Maduro would have been gone by 2017 are still holding those bonds. Selling them now just locks in a loss. Some funds are suing Venezuela.

“Those bonds double in value if Maduro goes,” says Jan Dehn, head of research at the Ashmore Group, and a PdVSA investor. “He might go because the election was illegitimate.”

The Organization of American States recognizes Juan Guaido, president of the Venezuelan National Assembly, as the top democratically elected leader of the country. Vice President Mike Pence said yesterday that Maduro was a “dictator.” And later in the day today, President Trump chimed in to make it uber-official: Washington does not recognize the presidency of Maduro.

But if Maduro does fall, it wouldn’t be too difficult to imagine a scenario in the not-too-distant future where bondholders are made whole, as Rapoza pointed out in a tweet.

Think about what Cristina Kirchner did to #Argentina. Fake economy. Fake currency rate. Subsidy overload. And no money to pay for it. Outcome $57 billion IMF loan. Now think about #Venezuela…look into your crystal ball and you will see the future.👽

— Kenneth Rapoza (@BRICBreaker) January 24, 2019

To be sure, the death of the Maduro regime isn’t a foregone conclusion. Russia has threatened the US not to intervene in Venezuela, and we imagine the Chinese, who have pumped billions of dollars of money for oil loans into the country, wouldn’t be too keen on losing their investment.

via ZeroHedge News http://bit.ly/2UdSUs5 Tyler Durden