A hedge fund manager who allegedly made remarkable, and fraudulent, promises to his investors – that he would never lose their money – has seen the Securities and Exchange Commission’s case against him stall as a result of the recent government shut down.

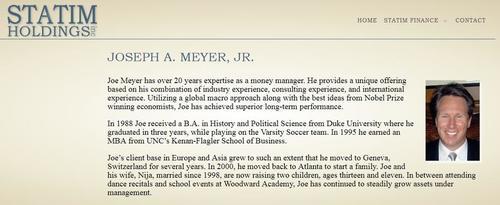

Statim Holding’s Joseph Meyer was accused of stealing from his clients after making the “too good to be true” claim, but that case is now in limbo, according to Bloomberg. The SEC had hoped that Meyer would not pull assets from a Statim hedge fund. Meyer refused the SEC’s request, according to a January 17 court filing, and SEC attorneys are now trying to get an injunction to prevent him from withdrawing even more funds. Meanwhile, Meyer through his lawyer, claims that he hasn’t done anything wrong.

His lawyer, Steve Sadow, said: “Mr. Meyer and Statim Holdings Inc. will respond in detail to the SEC’s allegations. But suffice it to say for now that we dispute the allegations, will vigorously contest them in court and look forward to vindication by a open-minded, fair and impartial jury.”

The halt of this case is yet another example of the tangible ways that the government shutdown is preventing federal agencies from doing their job. The Securities and Exchange Commission has stopped opening new investigations and has seen its staff dwindle to just 300 employees, from its normal 4500, as a result of the shutdown.

The hedge fund’s incredible returns, including a year where it allegedly made 91%, had been previously discussed by Bloomberg. The SEC claims that the profits were a result of misconduct, including the fund manager’s propensity to pay his living expenses using investor capital. They also claim that he doctored financial statements.

The SEC’s complaint says: “The purported guarantees and loss protection were illusory. Meyer simply concocted numbers that had no apparent connection to any share class and then reported these exaggerated returns to investors.”

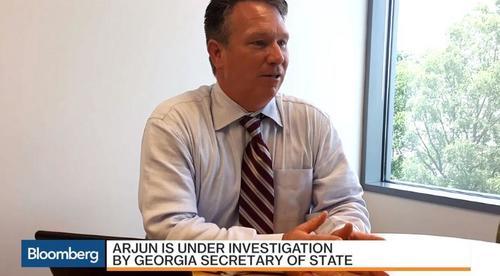

A hearing has been set for February 19 to adjudicate whether or not Meyer can be barred from pulling assets. It had been previously been reported that Meyer was being investigated in Georgia and the SEC opened their case about a week after that report went public.

Meyer’s capital under management is also under dispute. An April 2018 regulatory filing stated that its assets under management were $32.9 million, but Meyer has reportedly told investors that the firm manages hundreds of millions of dollars. In fact, in April 2015, he allegedly told one prospective client that he had $1.8 billion under management.

Meyer had claimed previously that his exorbitant returns were a result of a “computerized trading system” that he designed. He also claimed that most of the fund’s investments were in treasury bonds. His fund returned 24% in 2015, 91% in 2014, and 13% in 2013, according to Meyer, which seems a bit of a stretch for a fund invested in treasurys.

Naturally, the SEC claims that he didn’t own any treasury bonds between late 2013 and August 2016. In fact, as of August 2016, the SEC claims that 33% of the fund was invested in a gold ETF and that 37% of the fund was invested in a 3X S&P 500 ETF. At least he didn’t claim he was using split-strike conversions.

via ZeroHedge News http://bit.ly/2FUAgSp Tyler Durden