The partial government shutdown is in its 34th day and counting, and it is starting to have a significant effect on the economy.

According to Brian Rose, senior economist at UBS Global Wealth Management, the closure is now costing the economy about $1 billion a day, and if Q1 growth is zero or negative as a result – as administration officials admitted may happen earlier this week – it likely won’t see a sharp rebound in Q2 even if the shutdown ends, for reasons including that it may be tough to replace workers who quit; as a result one should think about that famous hockey-stick graph when projecting the pace of the growth hit from the shutdown according to UBS.

This is what Rose said in terms of calculating the direct impact of the shutdown:

The direct impact from the shutdown-the loss in real government expenditures-is purely mechanical: calculate the loss in aggregate hours worked and you get about a 0.1pp drag to growth every two weeks the government remains shuttered. The indirect impact-how consumers and businesses respond-is harder to quantify. Part of that story will be how consumer sentiment evolves over time to various news flow such as moves in equity markets and updates from DC and how that translates to changes (if any) to demand.

Yet while the direct impact from the shutdown – the loss in real government expenditures – is purely mechanical, which one can calculate simply in terms of the loss in aggregate hours worked (getting about a 0.1% drag to growth every week the government remains shuttered), and which prompted JPMorgan to once again cut its Q1 GDP forecast from 2.0% to 1.75% moments ago (and down from 2.5% two weeks ago), the indirect impact – how consumers and businesses respond – is harder to quantify, but according to Bank of America is becoming a key concern.

As BofA economist Joseph Song writes in a Thursday note, part of that story will be how consumer sentiment evolves over time to various news flow such as moves in equity markets and updates from DC and how that translates to changes (if any) to demand.

Here something troubling emerges: according to the latest data collected by Bank of America, there has been notable deterioration in consumer sentiment since early December, as news of the government shutdown roiled financial markets and disrupted economic activity.

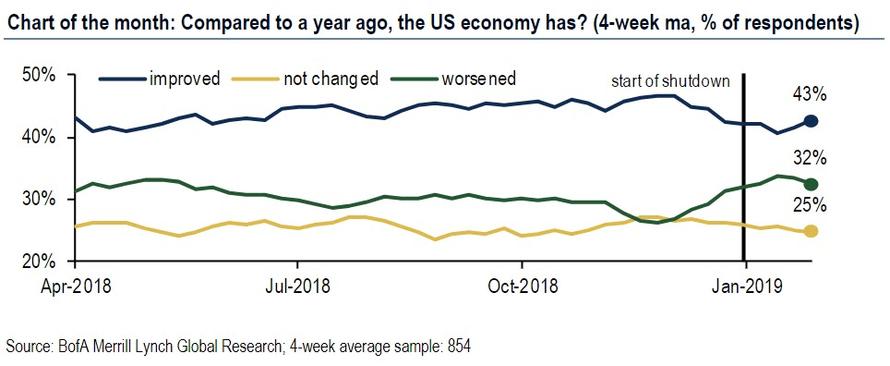

According to the bank’s consumer survey, although the plurality of respondents still feel good about the economy, recent trends show sign of greater concern about the economy. Specifically, when asked how the economy is compared to a year ago, 34% reported that it had worsened as of the week ending January 13, the highest reading in the survey since BofA started asking the question in April.

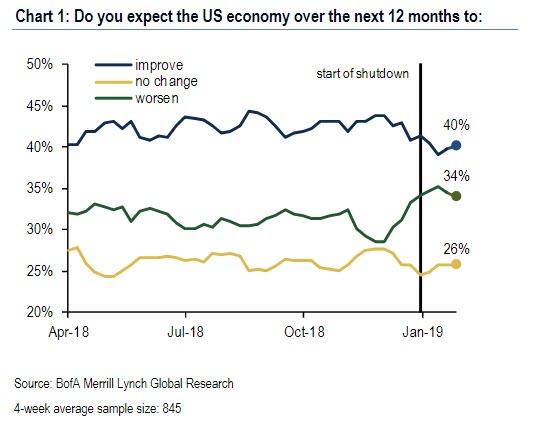

Also, the outlook has dimmed with 34% of respondents expecting that conditions will worsen over the next year, up from a low of 29% prior to the shutdown.

Some of the pessimism has recently lifted, likely owing to a rebound in equity markets but the consumer remains, on net, more downbeat. Other consumer surveys agree with BofA’s dour assessment: the expectations gauge from Bloomberg survey and the U of Michigan’s consumer sentiment indexes have fallen to 2 year lows.

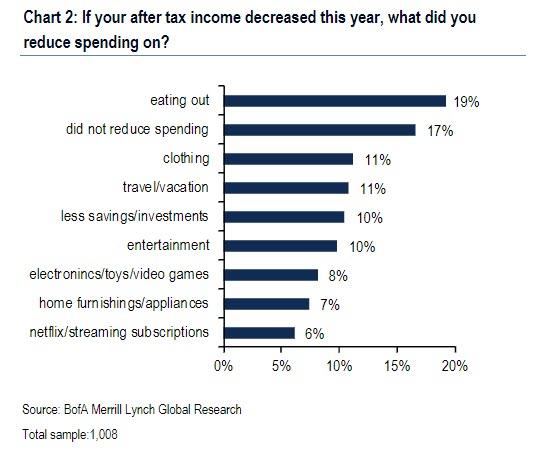

In this month’s rotating questions, BofA also asked how respondents changed or would change their consumption habits on changes to their income. Unsurprisingly, it found that discretionary spending (e.g. eating out, clothing, and travel) is first to get cut when income declines.

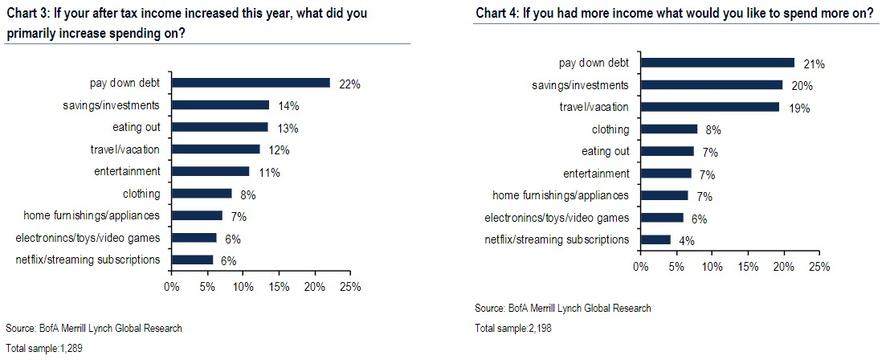

However, when asked what consumers did (or will do) with extra income, the bank found that consumers are relatively conservative with their income, opting to pay down debt or add to savings.

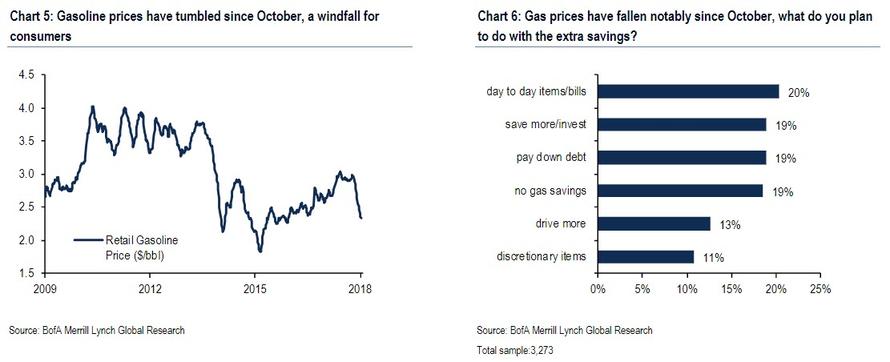

Similarly, when asked about what consumers would do with savings at the gas pump, most respondents reported that they would pay off bills, pay down debt or save more (Chart 5, Chart 6).

The bottom line is that in addition to any lost spending from furloughed workers, a sustained decline in sentiment raises the probability that consumer demand further slows in the near term. However, any lost consumption may not be fully made up once the shutdown ends as we find the consumer more cautious in their spending habits.

The good, if ironic, news is that even if Q1 GDP were to hit zero or turn negative, should the government shutdown extend into Q2, which is increasingly a non-trivial possibility, there will be nobody in government available to report on it.

via ZeroHedge News http://bit.ly/2HswOAI Tyler Durden