Authored by by Andreas Steno Larsen and Martin Enlund via Nordea Bank,

Evidence of the risk of a global earnings recession is gathering, but the risk appetite still chugs along decently, maybe in anticipation of a debt ceiling liquidity bailout. Powell’s QT comments will be the key next week…

Earnings recession coming up?

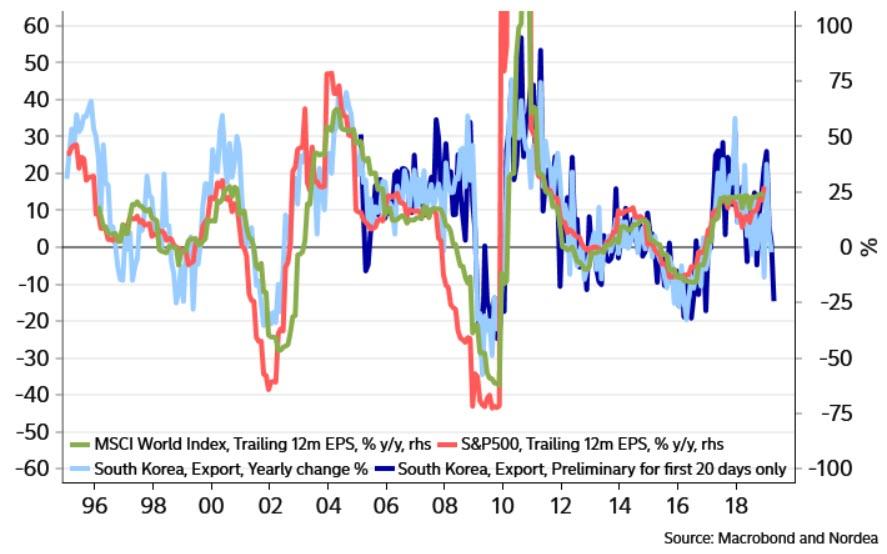

We have warned about a combination of weaker momentum in global trade and GDP growth coupled with higher cost pressures (accelerating wages and higher credit spreads) for a while. We continue to expect more of the same in coming quarters and the early trade data from South Korea this month again underpinned our viewpoint. The preliminary South Korean trade data revealed an apparent collapse in South Korean exports in January (-12% year on year) – this is one of the oldest canaries in the coalmine when it comes to global EPS growth, as South Korean exports are an early indicator of trend changes in global demand.

The trade data hence add to an already growing list of indicators pointing at an elevated risk of an earnings recession in 2019.

Chart 1: One of the oldest canaries in the coal mine, South Korea, now indicates an elevated risk of EPS recession

On top of the combo of slowing trade and rising cost pressures, we also continue to find increased evidence of slowing growth in the broader money supply in the global economy. Tighter liquidity conditions in the US, the Euro area and in Japan show a slowdown in M1 growth – a sign that borrowing demand is slowing. If money makes the world go around, as we think is the case, then the slowing M1 growth is a concern for the global growth outlook (and the outlook for risky assets). There are admittedly early signs in our models that Chinese M1 growth could re-emerge as a lagged consequence of the continued liquidity injections into the Chinese economy (also a driver behind the improving sentiment). The Chinese M1 comeback may still be six to nine months away, though.

We think the current rebound is likely a temporary “bull trap” (Nordea View: High bull trap risk)

Chart 2: “Money growth” is slowing an issue if money makes the world go around.

The debt ceiling liquidity bailout

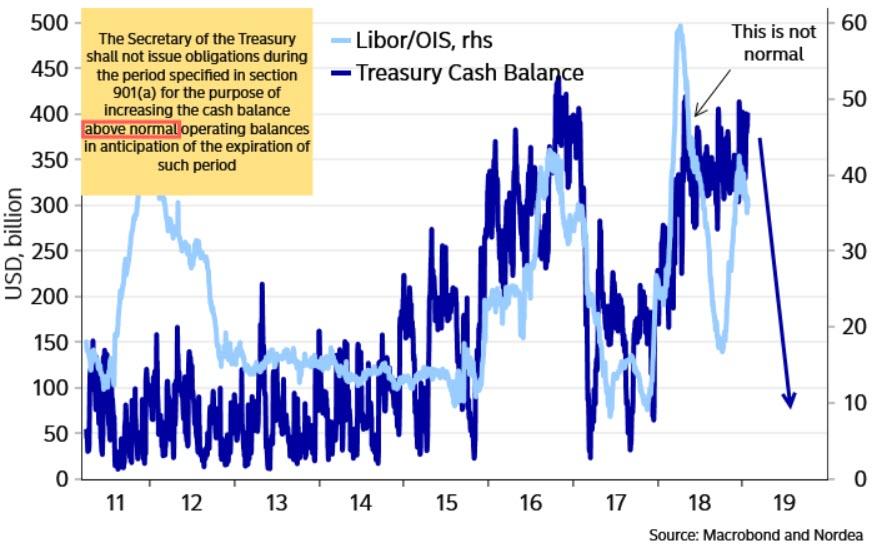

Markets may have rallied on the anticipated upcoming “liquidity bailout” stemming from the debt ceiling deadline 1 March. Over the next four to five weeks, the US treasury is legally bound to bring down the cash balance at the Fed, as they cannot hold an “above normal” liquidity buffer ahead of the expiration of the debt ceiling suspension. The commercial banking system will be on the receiving end of this USD liquidity, which should be temporarily positive for risk appetite.

By how much and for how long this liquidity bailout will be in place is ultimately up to Steven Mnuchin and his team in the US treasury (FX weekly: The Mnuchin Bailout?), but at least four to six weeks of further liquidity easing are likely on the cards (the cash balance will not increase again unless politicians lift the debt ceiling), especially given the deadlocked political situation in the US with the ongoing partial government shutdown.

Chart 3: A debt ceiling liquidity bail-out is coming up

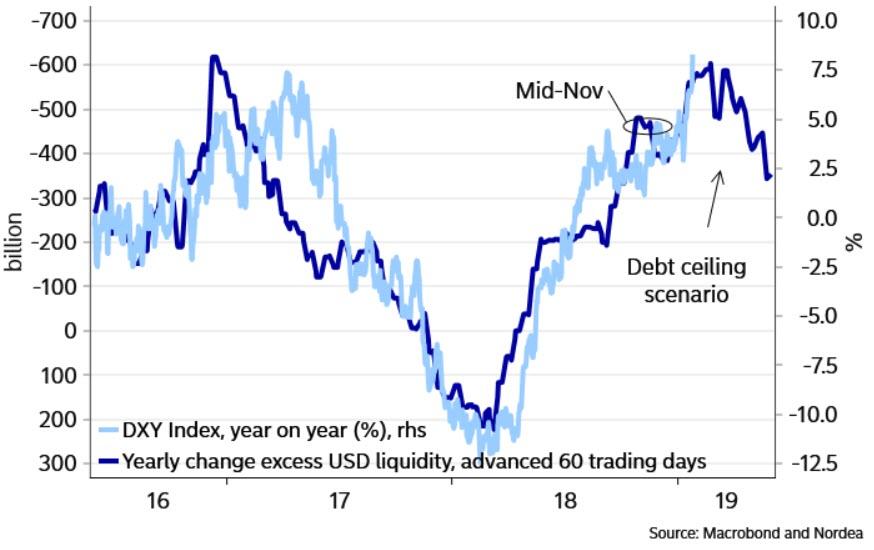

As the amount of USD liquidity is likely to increase over the coming four to six weeks, the chance of a weaker USD also increases. In our models the USD could weaken as much as 3-4 % broadly if Steven Mnuchin and the US Treasury re-adds +300 USDbn worth of liquidity over the next months.

Chart 4: More electronic USD liquidity, weaker price of the existing USD

What is most important next week?

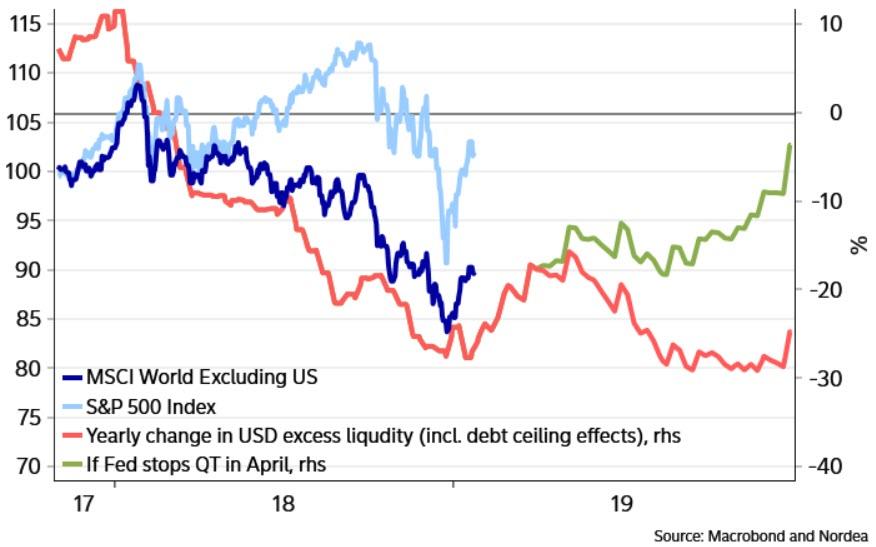

Most eyes will be on the FOMC meeting concluding Wednesday night and many will in particular be looking for clarity from Jerome Powell, who has been uncharacteristically capricious in recent weeks. First it seemed like he back-tracked a little from the otherwise almost robotic neglection of the balance sheet as a policy tool at the December press conference, but then shortly after Powell said that the balance sheet would be “substantially smaller” when the Fed had normalised policy. Flip-flopping at its best. We would be surprised if Powell sounds ready to discuss the pace of the balance sheet run-off as a policy tool already, especially given that the calmer markets have provided him with some leeway (Fed Watch: Explaining patience)

Should the Fed opt to pause the balance sheet rundown at some point during H1 2019, we would consider such an event a positive game-changer for risky assets and consequently a negative game-changer for the USD.

Chart 8: QT comments from Powell will be key for markets next week

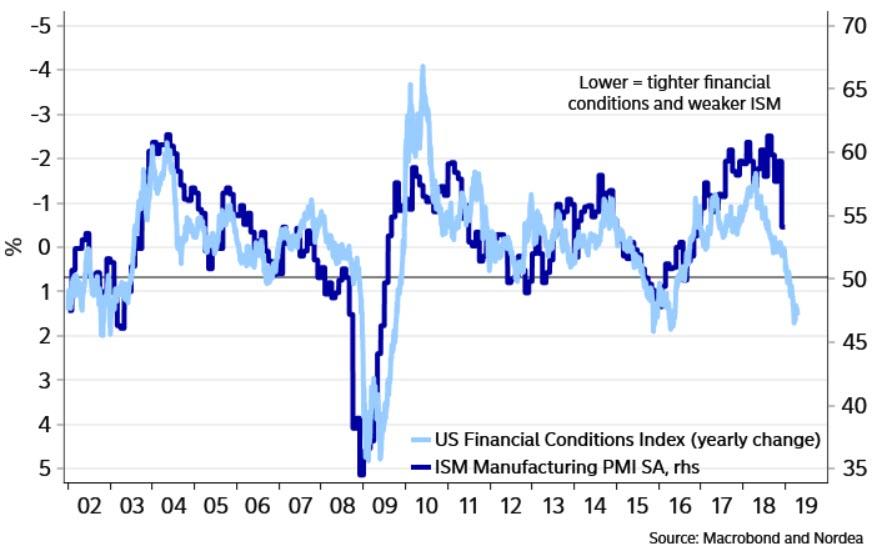

Also, the market will likely be even more sensitive towards the US ISM index than usual (Friday), given the 5-index point drop in December. Even though regional surveys hint of a more benign January report, we see mainly downside risks, as in particular the swiftly slowing import component of the Chinese PMI hints at a weaker ISM index. Also, even with the recent rebound of equities, financial conditions still suggest more medium-term downside in the ISM Manufacturing index. Hence, we see downside risks to the early consensus of an unchanged reading of 54.1 in the ISM Manufacturing index.

Chart 9: Even despite the recent comeback for equities, financial conditions still point to more ISM pain

The monthly US job report has “government shutdown” written all over it on Friday, as data on everything from the size of the labour force to wages could be distorted by the shutdown. Furloughed public workers will though not count as unemployed in the NFP, but the indirect effects on private contractors (working for the public sector) may be substantial.

Chart 10: Some of the most bearish indicators hint that US unemployment has already troughed

However, we still keep an eye on the unemployment rate, as some of our more bearish indicators have started to hint at an upcoming trough in the unemployment rate relatively soon. Our main view that the labour market tightness will drive wage growth even higher (than expected) remains intact.

via ZeroHedge News http://bit.ly/2B1GLiY Tyler Durden