After a week that saw a non-stop barrage of news despite the US government’s shutdown, traders will get no respite in the coming days as the newsflow firehose gets cranked up to 11 and includes:

- Fed meeting/Powell Presser

- Brexit “Plan B” vote

- US-China trade talks

- Huawei CFO extradition notice deadline

- US January Payrolls

- Global PMIs/GDPs

- 26 backlogged US econ events

- Busiest week of earnings season

- And much more.

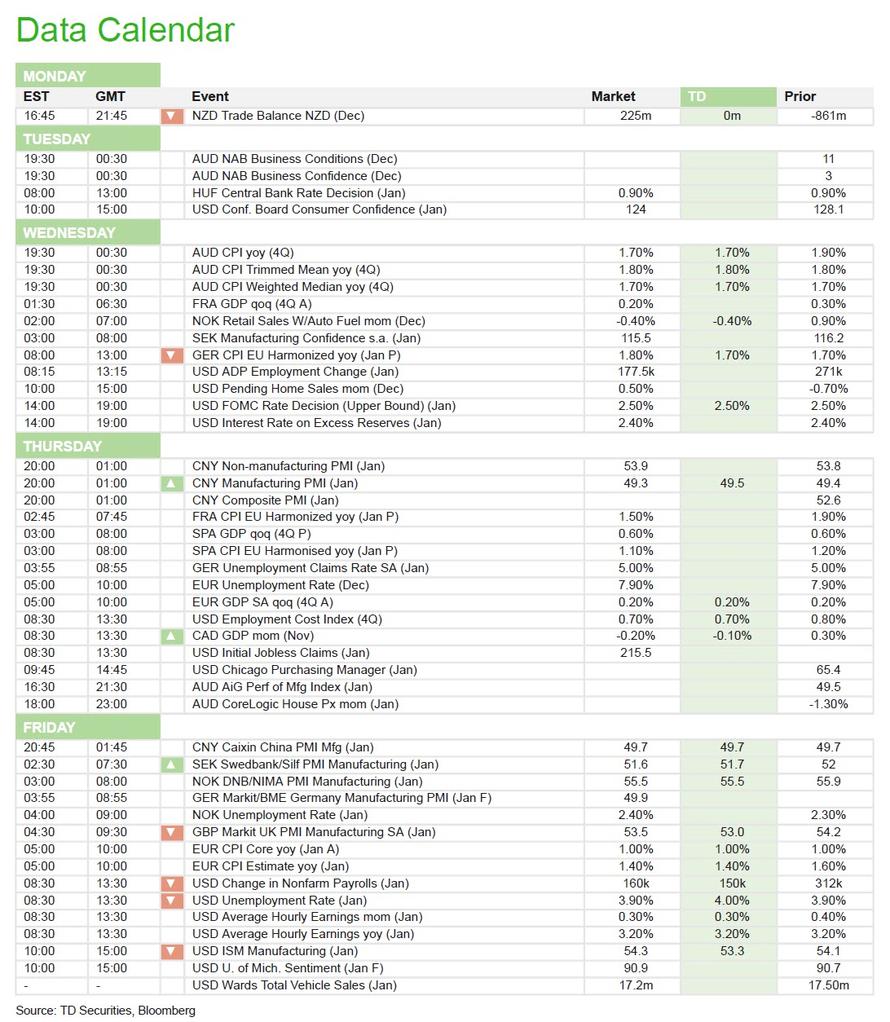

Indeed, as DB’s Craig Nicol notes, as we move into February, with the US government now reopen , markets have “another eventful week ahead” to put it mildly. Highlights will come from central banks, with Wednesday’s Federal Reserve decision and press conference, as well as the ECB’s Draghi speaking on Monday. However, as has been the case recently, politics will continue to be a key driver with the UK Parliament voting again on Brexit on Tuesday and Chinese Vice Premier Liu He arriving in Washington for trade talks. Elsewhere, we have key data releases including US non-farm payrolls, a first look at fourth quarter GDP for the US and the Euro Area as well as the global manufacturing PMIs. Earnings season also continues with almost a quarter of the S&P 500 reporting next week. Finally, dozens of US economic backlogged economic data releases will be published int he coming days.

Some more details via DB:

Investor attention will be on Wednesday’s Federal Reserve meeting, to be followed by a press conference. This will be the first January Fed meeting where Chair Powell will be giving a press conference, as the Fed has moved to holding press conferences after every meeting, rather than every other meeting. No change is expected to interest rates, but investors will be closely watching Powell’s comments as they aim to discern the future path of monetary policy this year.

We will also hear from a number of other central bankers this week. The ECB’s Draghi will be speaking on Monday at the European Parliament. This follows Thursday’s ECB press conference where Draghi said that the risks to the growth outlook “have moved to the downside”. Other highlights include the BoE’s Carney, Broadbent, Ramsden, Place and Woods speaking on Monday, while on Thursday, we have the ECB’s Mersch and Coeure, the Bundesbank’s Weidmann and the Bank of Japan’s Amamiya.

Brexit will likely be in the headlines again next week, with the UK parliament voting on possible next steps on Tuesday. MPs will be further debating the government’s Brexit plan, and have the opportunity to vote on a variety of different amendments, which have been proposed by MPs from across the political spectrum. These include one that says parliament should be able to hold indicative votes on different Brexit outcomes, one that requires the Prime Minister to extend Article 50 if the House of Commons has not approved a Brexit deal by February 26, another simply that the UK should not leave without a deal, and another calls for an expiry date on the backstop. The Speaker of the House of Commons will decide which are to be debated by MPs

The other major political event for markets comes as Chinese Vice Premier Liu He visits Washington for trade talks on Wednesday, meeting with Treasury Secretary Mnuchin and US Trade Representative Lighthizer. This follows the IMF’s warning last week in its updated forecasts that worsening tensions over trade represent a key risk to global economic growth, although US commerce secretary Wilbur Ross warned on Thursday that the US and China were “miles and miles” from a resolution, while also saying there was a “fair chance” of a deal.

Earnings season continues, with 123 companies in the S&P 500 reporting next week. Those reporting globally include Caterpillar on Monday, Apple, Pfizer and SAP on Tuesday, Microsoft, Facebook, Boeing and Alibaba on Wednesday, Amazon and Samsung on Thursday, and on Friday, we have Exxon Mobil, Chevron, Merck and Sony. With 109 companies in the S&P 500 having reported, 75% have beaten earnings expectations and 59% have beaten sales expectations.

Regarding data, some US releases continue to be affected by the US government shutdown, now at a record length, with a number of US data release dates still uncertain. However, the release of non-farm payrolls on Friday will be the highlight, with DB forecasting a gain of 165k jobs, marginally above the consensus forecast for a gain of 163k jobs. Consensus estimates are also expecting that growth in average hourly earnings will remain at 3.2%, the joint highest since the financial crisis. Other releases of note will be the Q4 GDP data on Wednesday and the Core PCE Price Index on Thursday.

Turning to Europe, there are number of data highlights. On Thursday, we have the first release of Q4 GDP for the Euro Area, which will give an indication of whether the slowdown of the European economy continued through the end of the year. Markets are expecting quarter on quarter growth of 0.2%, as in Q3. Otherwise, Wednesday will see the European Commission release its consumer confidence indicator for January, while Friday will see the release of manufacturing PMIs for January as well as the flash estimate of January’s CPI for the Euro Area.

Finally, on Monday, the US Congressional Budget Office will be releasing its Budget and Economic Outlook, including ten-year economic budget projections.

Summary of key events in the week ahead:

Monday: The focus on Monday will be central banks, with the ECB’s Draghi speaking at a European parliament hearing in Brussels, while the BoE’s Carney, Broadbent, Ramsden, Place and Woods will also be speaking. In terms of data, there is the Chicago Fed National Activity Index for December and the Dallas Fed Manufacturing activity for January. We also have earnings from Caterpillar and the US Congressional budget Office will be releasing its Budget and Economic outlook.

Tuesday: The UK Parliament returns to Brexit, with MPs able to debate and vote on a variety of amendments to the government’s Brexit plan. Datawise we have French consumer confidence for January, in the US there is preliminary wholesale inventories for December and and the Conference Board Consumer Confidence, while December retail sales figures for Japan are released. Apple, Pfizer and SAP will also be releasing earnings.

Wednesday: The main event Wednesday will be the Federal Reserve’s interest rate decision and subsequent press conference. Also of note will be the visit of Chinese Vice Premier Liu He to Washington for trade talks. In data, we have the first reading of Q4 GDP from the US and France, as well as Germany’s January CPI data, January consumer confidence data for the Euro Area, and Japanese industrial production data for December. In earnings, reports include Microsoft, Facebook, Boeing and Alibaba.

Thursday: On Thursday, we have a number of central bank speakers, including the ECB’s Coeure and Mersche, the Bundesbank’s Weidmann and the Bank of Japan’s Amamiya. In terms of data, from the Euro Area we have the first reading of Q4 GDP and the December unemployment rate, as well as the French CPI for January. In the US there is personal income and personal spending data for December, core PCE for December and the weekly initial jobless claims, while in China we have the manufacturing and non-manufacturing PMI. In earnings, Amazon and Samsung will be reporting.

Friday: Friday’s main highlight is the US employment report, including nonfarm payrolls, the unemployment rate, labour force participation and average hourly earnings. Other key data includes the latest global manufacturing PMIs as well as January CPI data for the Euro Area. Exxon Mobil, Chevron, Merck and Sony will be releasing earnings.

* * *

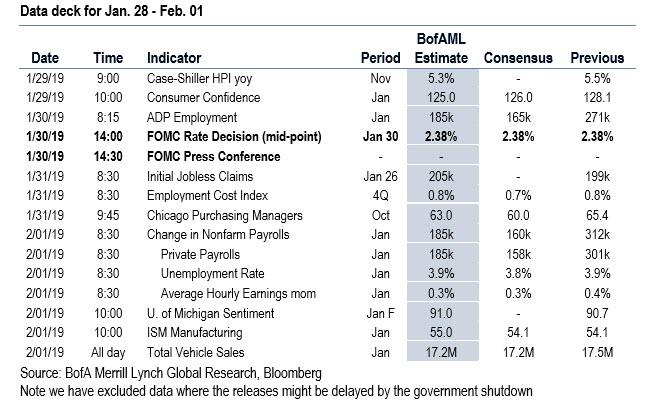

Finally, here is Goldman’s preview of key events in the US alone, where the key economic data releases are the employment report and the ISM manufacturing index on Friday. The Q4 GDP advance estimate and the PCE report may be postponed due to delays from the recently ended government shutdown. In addition, the January FOMC statement will be released on Wednesday at 2:00PM EST, followed by Chairman Powell’s press conference at 2:30 PM. There are two scheduled speaking engagements by Fed officials this week, by Dallas Fed President Kaplan on Friday and by Minneapolis Fed President Kashkari on Sunday. The Census Bureau and Bureau of Economic Analysis will likely begin to release backlogged data this week as the government resumes normal operations.

Monday, January 28

- 10:30 AM Dallas Fed Manufacturing index, January (consensus -2.7, last -5.1)

Tuesday, January 29

- 08:30 AM U.S. Census Bureau Report on Advance Economic Indicators; Advance goods trade balance, December (GS -$77.0bn, consensus -$75.6bn, November unreleased); Wholesale inventories, December preliminary (November unreleased): Likely to be rescheduled to accommodate data release backlog. We estimate that the goods trade deficit was $77.0bn in December, reflecting an increase in inbound container traffic. However, a decline in customs revenue suggests that imports from China declined.

- 09:00 AM S&P/Case-Shiller 20-city home price index, November (GS +0.5%, consensus +0.4%, last +0.4%); We estimate the S&P/Case-Shiller 20-city home price index increased 0.5% in November, following a 0.4% increase in October. Our forecast of a significant increase largely reflects the appreciation in other home prices indices such as the CoreLogic house price index in November.

- 10:00 AM Conference Board consumer confidence, January (GS 122.2, consensus 124.6, last 128.1); We estimate that the Conference Board consumer confidence index declined 5.9pt to 122.2 in January, reflecting recent volatility in stock returns, the impact of a prolonged government shutdown, and declines in some other measures of consumer expectations.

Wednesday, January 30

- 08:15 AM ADP employment report, January (GS +195k, consensus +185k, last +271k); We expect a 195k gain in ADP payroll employment, reflecting a decline in jobless claims. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 08:30 AM GDP, Q4 advance (consensus +2.6%, last +3.4%); Personal consumption, Q4 advance (consensus +3.9%, last +3.5%): Likely to be rescheduled due to lack of source data.

- 10:00 AM Pending home sales, December (GS -0.3%, consensus +0.5%, last -0.7%); We estimate that pending home sales decreased by 0.3% in December based on weaker regional home sales data, following a 0.7% decline in November. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

- 02:00 PM FOMC statement, January 29-30 meeting; We do not expect any change in the funds rate. In the post-meeting statement, we expect a dovish tilt to the language, reflecting recent commentary by Fed officials. We expect the Committee to further water down its guidance (from “some further gradual increases…will be consistent”) and the growth characterization to be downgraded (to “solid” from “strong”). We do not expect formal changes to balance sheet policy, but we expect Chairman Powell to reiterate that balance sheet policy is flexible in principle in the press conference.

Thursday, January 31

- 08:30 AM Employment Cost Index, Q4 (GS +0.8% vs. consensus +0.8%, prior +0.8%); We estimate that the employment cost index rose 0.8% in Q4 (qoq sa). Wage growth measures generally firmed in the quarter, and our wage tracker picked up 0.57pp to 3.4% year-over-year (up from 2.3% at the end of last year).

- 08:30 AM Personal income, December (GS +0.6%, consensus +0.5%, last +0.2%); Personal spending, December (GS +0.3%, consensus +0.3%, last +0.4%); PCE price index, December (GS +0.04%, consensus flat, last +0.06%); Core PCE price index, December (GS +0.20%, consensus +0.2%, last +0.15%); PCE price index (yoy), December (GS +1.74%, consensus +1.7%, last +1.84%) ;Core PCE price index (yoy), December (GS +1.91%, consensus +1.9%, last +1.88%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose 0.20% month-over-month in December, or 1.91% from a year ago. Additionally, we expect that the headline PCE price index increased 0.04% in December, or 1.74% from a year earlier. We expect a 0.6% increase in December personal income and a 0.3% gain in personal spending.

- 08:30 AM Initial jobless claims, week ended January 26 (GS 215k, consensus 215k, last 199k); Continuing jobless claims, week ended January 19 (consensus 1,725k last 1,713k): We estimate jobless claims increased by 16k to 215k in the week ended January 26, following a 13k decrease in the prior week.

Friday, February 1

- 08:30 AM Nonfarm payroll employment, January (GS +180k, consensus +165k, last +312k); Private payroll employment, January (GS +180k, consensus +175k, last 301k); Average hourly earnings (mom), January (GS +0.2%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), January (GS +3.1%, consensus +3.2%, last +3.2%); Unemployment rate, January (GS 4.0%, consensus 3.9%, last 3.9%): We estimate nonfarm payrolls increased 180k in January. Our forecast reflects very low jobless claims and warmer weather than usual in January. We expect the unemployment rate to increase one tenth to 4.0%, reflecting the effect from federal workers furloughed by the government shutdown. Finally, we estimate average hourly earnings increased 0.2% month-over-month and 3.1% year-over-year, reflecting negative calendar effects but some scope for a rebound in the supervisory category.

- 09:45 AM Markit Flash US manufacturing PMI, December final (consensus 54.9, last 54.9)

- 09:45 AM Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will speak at the University of Texas at Austin. Audience and media Q&A are expected.

- 10:00 AM ISM manufacturing index, January (GS 54.0, consensus 54.2, last 54.3): Our manufacturing survey tracker – which is scaled to the ISM index – edged up 0.2pt to 54.0 following mixed, but relatively stable, regional manufacturing surveys so far in January. Following a 4.5pt decline in December, we expect the ISM manufacturing index to decline by 0.3pt to 54.0 in January.

- 10:00 AM Construction spending, December (GS +0.3%, consensus +0.2%, November unreleased): We estimate construction spending rose by 0.3% in December.

- 10:00 AM University of Michigan consumer sentiment, January final (GS 91.2, consensus 90.7, last 90.7): We expect the University of Michigan consumer sentiment index to edge up 0.5pt from the preliminary estimate for January due to recovery in the stock market. The report’s measure of 5- to 10-year inflation expectations stood at 2.6% in the preliminary report for January.

- 5:00 PM Lightweight Motor Vehicle Sales (GS 17.2m, consensus 17.2m, last 17.5m)

Source: Deutsche Bank, GS, BofA, BNP

via ZeroHedge News http://bit.ly/2Tn2aKM Tyler Durden