There is only one clip for this…

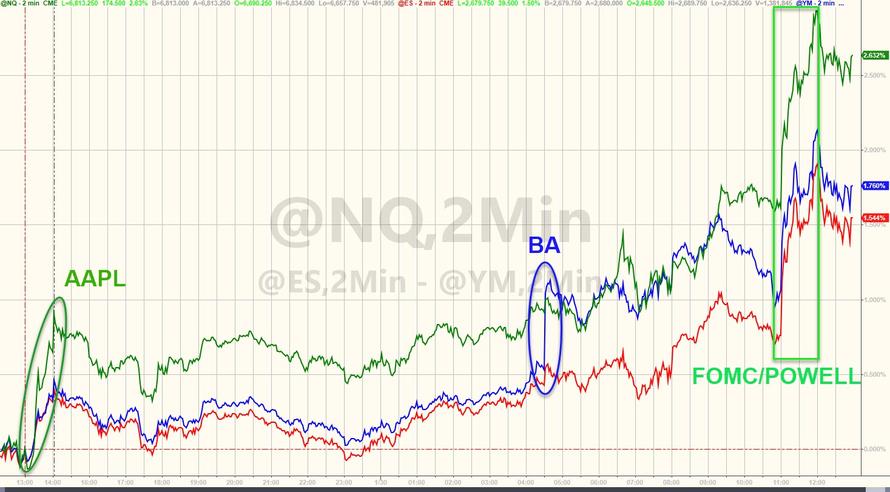

Jay Powell Broke the curse – after 7 straight losing sessions on FOMC days (the most ever for a Fed Chair), The Fed’s total capitulation today was greeted with a rally (helped dramatically by Apple and Boeing)

-

Oct 3: Powell – “economy is overheating“

-

Nov 2: Trump – “not even a little bit happy with my selection of Jay.“

-

Jan 30: Powell: – “economy is slowing“

Stocks legged up further when Powell said during his presser that he “doesn’t want the balance sheet unwind to cause market turbulence.”

But he tried to reassure:

“We don’t react to most things that happen in the financial markets. … When we see a sustained change in financial conditions, then that’s something that has to play into our thinking.”

But markets knew better – gold and stocks (and bonds) bid as the dollar dumped…

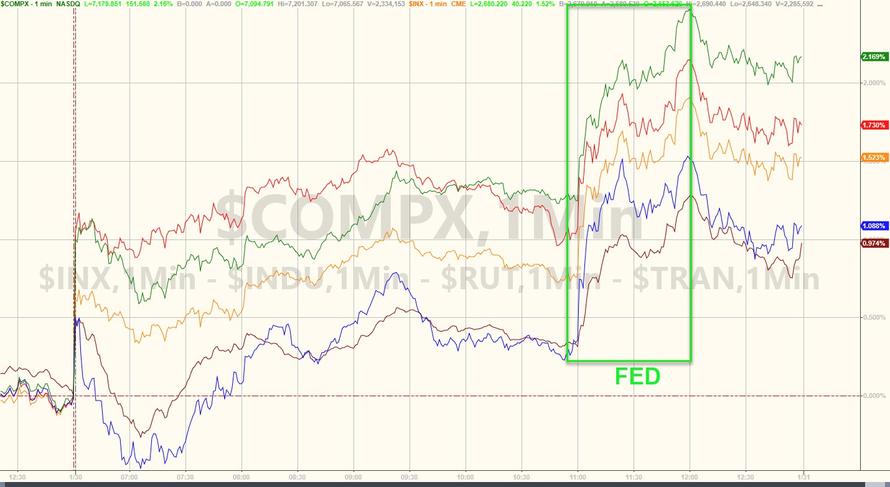

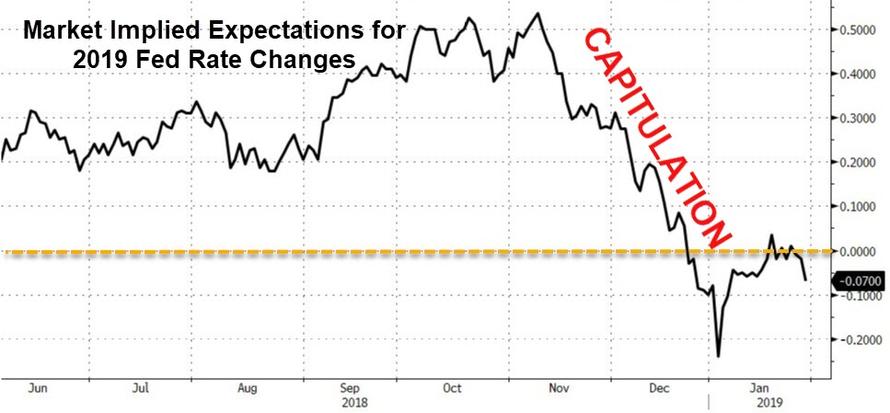

Rate trajectory expectations tumbled and stocks soared on that dovishness…

The Dow is up 16% from the day Trump said it’s “tremendous opportunity to buy” (and Mnuchin called the plunge protection team).

Over 50% of the Dow’s gains today came from Apple and Boeing…

All the major indices broke above key technical levels today (Dow > 200DMA, S&P and Nasdaq > 100DMA) but were unable to hold them…

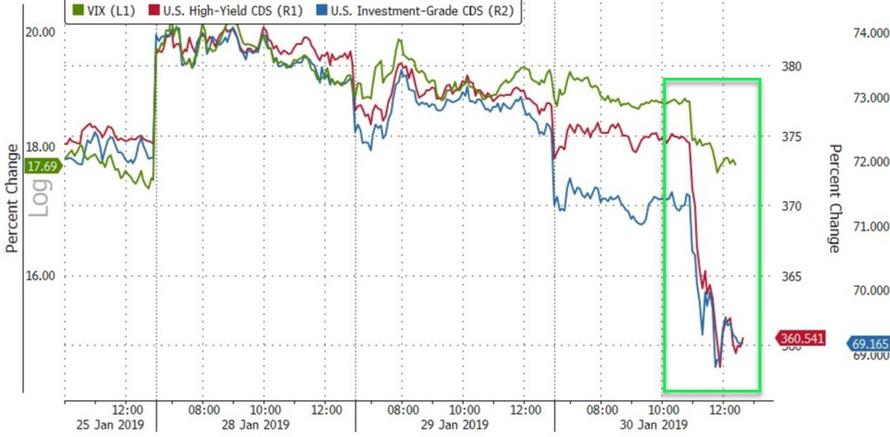

VIX tumbled along with credit spreads…

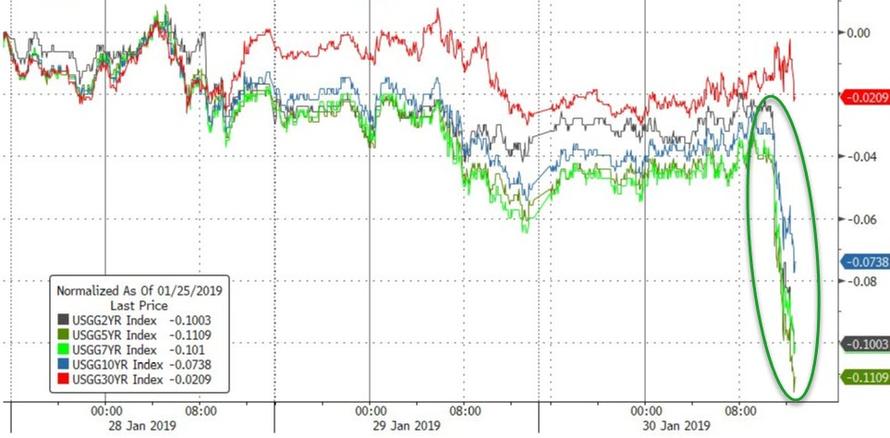

Treasury yields tumbled after The Fed statement…

10Y Yield closed at 2.69% – breaking the 18-day streak of 2.7x% handles…

2Y Yields tumbled and are near to generating a ‘death cross’ implying further downside to rates…

The yield curve bull-steepened up to 55bps (2s30s)…

And we note that TLT just generated a “golden cross” suggesting Bond prices are set to rise further…

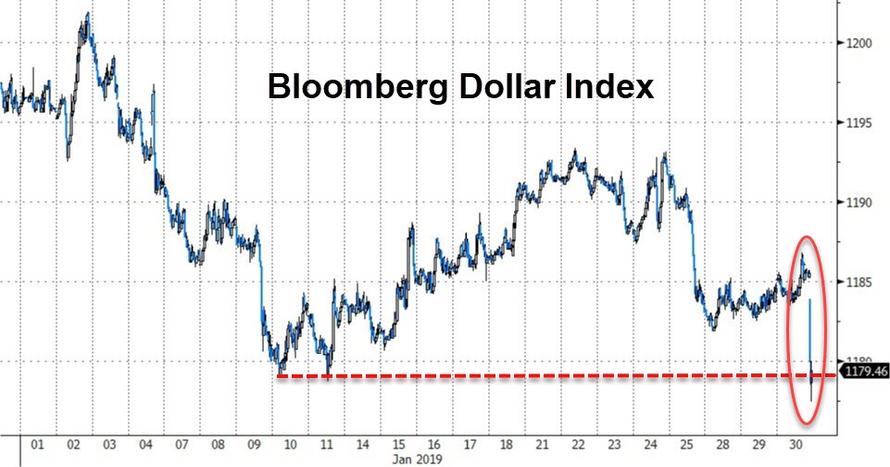

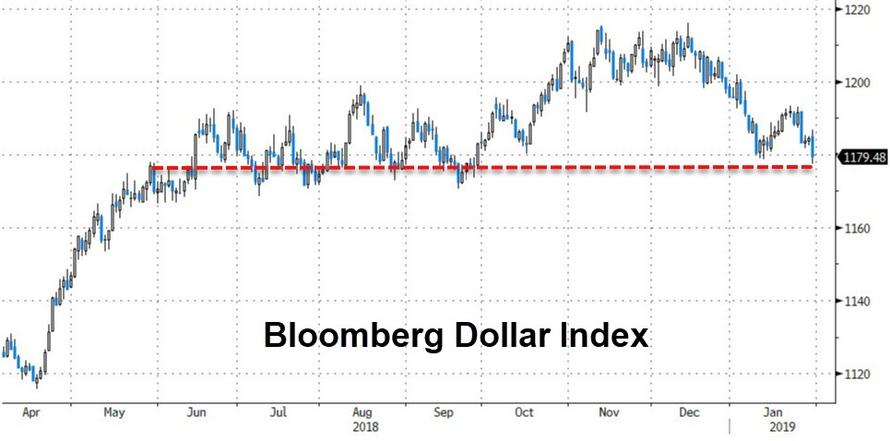

The dollar puked on the dovishness…

Tumbling to its weakest close since September…

Cryptos surged overnight…

Which sent yuan surging – not good for Chinese exports – to its strongest against the dollar since July 2018…

Commodities are higher across the board as the dollar dumped…

Gold soared above $1325 on the back of the biggest 4-day gains since Brexit…

WTI surged above $54 today pushing January’s gains near 20% – the best month since April 2015 and best January ever…

Finally, this is what capitulation looks like – The Fed today confirmed the market’s shift from anticipating 50bps of rate-hikes in 2019 to now expecting rate-cuts…

So much for Fed independence – its rescue the market at all costs…

We give the final world to Peter Schiff (@PeterSchiff):

“Powell’s finale statement was that the markets wanted clarity on the balance sheet reduction, and that the Fed was now providing it. The truth is that until recently the markets had clarity and did not like what they saw. So it’s not clarity the Fed is providing, but relief! “

via ZeroHedge News http://bit.ly/2BlPo8n Tyler Durden