Following a shockingly strong third quarter, which saw Tesla report a dramatic and unexpected reversal in both profitability and cash flow, which many investors suggested may have top ticked the company’s prospects, and following a recent cut in the cost of its vehicles by $2,000 which skeptics suggested indicated a drop in demand just as many competitors are starting to offer competing products, while also laying off 7% of its global workforce which led to concerns about the company’s lofty valuation which has largely been built around growth, everyone was wondering what would happen to that growth narrative if demand for Tesla’s current lineup is drying up, and the $35,000 version of the car is still months away?

And so, with Elon Musk tweeting up a storm in the hour leading up to the company’s earnings release in which he’s written about black holes, entropy, the end of the universe, the Multiverse, and “the beauty of Fluid Dynamics”, we got a big part of the answer moments ago when Tesla reported Q4 earnings on a day when its stock closed 3.8% higher, its best day in over three weeks, and when the company announced the following numbers:

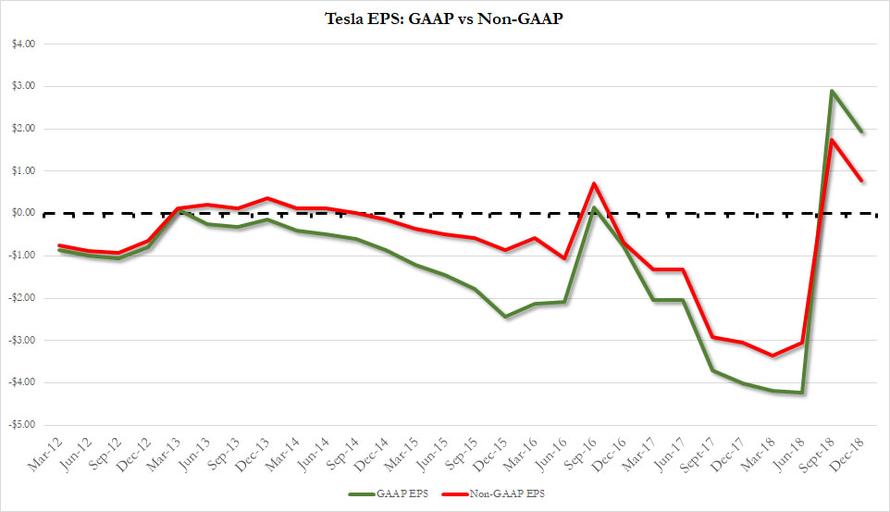

- 4Q adjusted EPS of $1.93 missed the estimate of $2.14

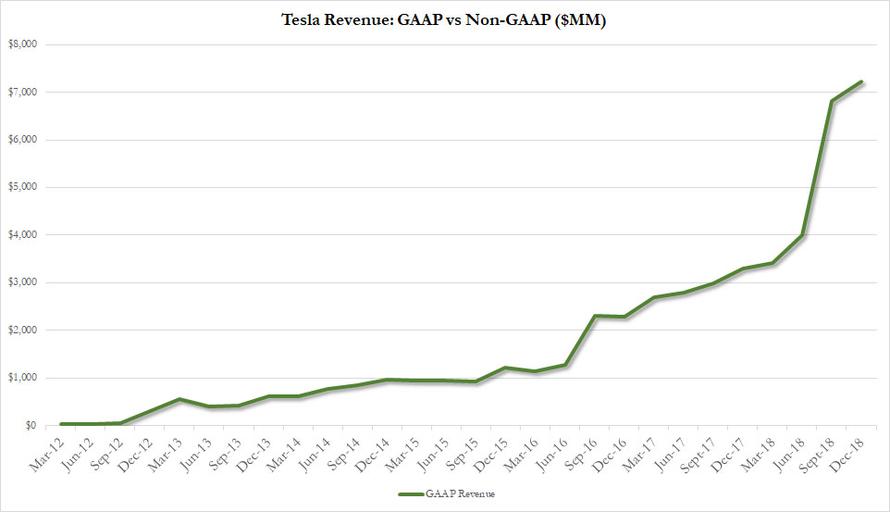

- 4Q revenue of $7.23BN beating estimates of $7.07BN (range $6.79 billion to $7.72 billion)

- 4Q capital expenditure of $325MM, well below the estimate of $604MM

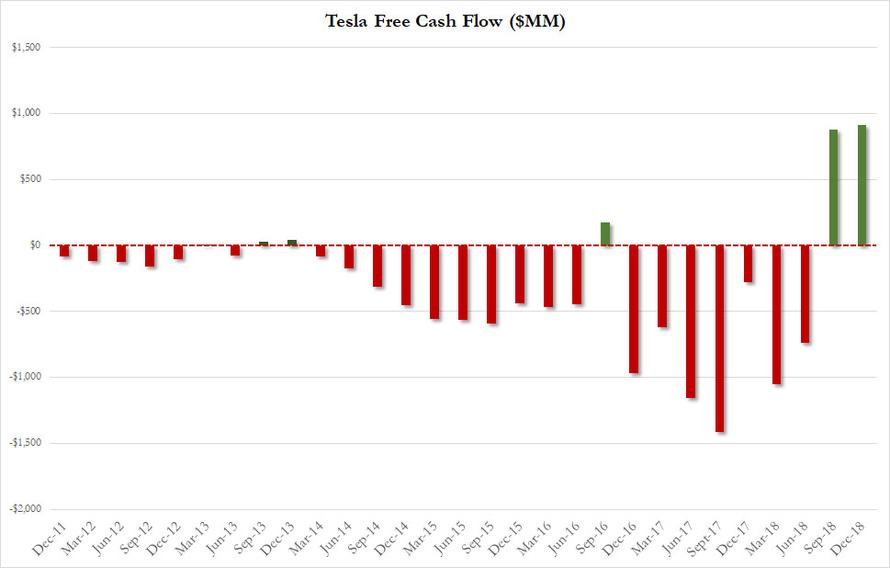

- 4Q free cash flow of $909.6 million, well above the estimate of $411.5 million

This is what revenue looks like:

And earnings, both adjusted and GAAP:

The company also improved a Dec 31 cash balance of $3.7 BN which increased by $718 million in the quarter from $3.0 BN in Q3. The improvement in cash was the result of another quarter of impressive cash flow, with the company reporting $910MM in cash flow, even better than last quarter’s $881MM, which however was largely the result of the abovementioned collapse in CapEx spending, which tumbled from $510MM in Q3 to $325MM in Q4, nearly half the $604MM expected.

While some expressed concerns about Tesla’s ability to repay the upcoming March 1 convertible maturity, Musk does not appear too concerned: “We have sufficient cash on hand to comfortably settle in cash our convertible bond that will mature in March 2019” the CEO said in the investor letter.

Here are the complete highlights from the company’s cash flow and liquidity:

- Our cash position increased by $718 million in Q4, despite the scheduled repayment of our $230 million convertible bonds.

- Cash flow from operating activities in Q4 was $1.23 billion. Operating cash flow remained strong although our days payable outstanding decreased significantly, partially limiting the positive impact of working capital.

- Customer deposits decreased sequentially by $113 million in Q4 to $793 million as we continue to work through our Model 3 backlog.

- Our capital expenditures were $325 million in Q4. Because our acquisition of land in China is a 50-year lease from the Chinese government, our payment of $141 million for it is excluded from capex and reflected in operating cash flow. Capital expenditures, including our China land acquisition payment, were at $2.24 billion in 2018

Looking at auto production, Tesla said Model 3 production reached a sustained rate of 7k cars/week by the end of 2019. That’s a welcome surprise to bulls. Tesla it is “planning to continue to produce Model 3 vehicles at maximum production rates throughout 2019.”

Tesla also reproted that in Q4, it delivered 27,607 Model S and Model X vehicles to customers, and 99,475 Model S and Model X

vehicles for the full year, which was in line with its guidance. The company confirmed that it stopped taking orders for the 75 kWh versions of Model S and Model X “and will focus on the longer-range versions of these flagship products instead, with the recent introduction of a 310 mile range base Model S and 270 mile range base Model X.”

Focusing on Model 3 production, Musk said in his letter that December saw the plant’s best production rate ever, and the company said it still plans to hit Model 3 production of a sustained 10k/week. “We are targeting annualized Model 3 output in excess of 500,000 units sometime between Q4 of 2019 and Q2 of 2020.” Additionally, by the end of 2019, Tesla should be able to build 7,000 of the Model 3 a week. The question, as Bloomberg asks, is can they sell that many? For an affirmative answer, Musk will need to get that $35,000 version to showrooms. So far that has proven to be complicated.

Meanwhile, Bloomberg Intelligence auto analyst Kevin Tynan saw a softer mix of Models S and X in the 4% sequential automotive revenue gain. To Tynan, this “raises questions about demand sustainability for high-priced vehicles and the cannibalization of Model S deliveries by Model 3.“

Most importantly, Tesla is forecasting vehicle sales of 360,000 to 400,000 in 2019. As Tesla points out, that implies a growth of roughly 45%-65% over 2018. However, as Bloomberg counters, that low end implies only a 4% increase over their delivery rate for Q4 2018.

Musk said that the company continues to target a 25% Model 3 non-GAAP gross margin at some point in 2019.

While there are many moving parts that will ultimately determine gross margin, we believe that significant cost reductions combined with better fixed-cost absorption and careful management of mix should enable us to get to this profit level. We expect that gross margin for Model S and Model X should remain relatively stable compared to 2018.

What, however, appears to be most concerning to investors is that the company sees 1Q Model S & Model X Deliveries Slightly Down vs ’18, and expects deliveries in North America to be lower in 1Q “as we start delivering cars in Europe and China for the first time. As a result of the start of Model 3 expansion into Europe and China, deliveries will be lower than production by about 10,000 units due to vehicle transit times to these markets.“

Meanwhile, the company also conceded that it pulled forward some demand into Q4 due to the expiring EV tax credit:

Because of the first scheduled reduction of the federal EV tax credit on January 1, 2019, we likely saw a pull-forward of demand in the US for Model S and Model X into 2018. Both Model S and Model X reached all-time high market shares in the US in the second half of 2018. Model S, for example, accounted for 38% of its segment in the US. Because this high level of demand presumably represented a pull-forward, we are expecting our Model S and Model X deliveries in Q1 2019 to be slightly below Q1 2018

Yet the offsetting silver cloud is that Musk expects to have “positive GAAP net income and to generate positive free cash flow

(operating cash flow less capex) in every quarter beyond Q1 2019.” How will he achieve this promise? ” these results will be substantially driven by our restructuring action and the ongoing financial discipline with which we are managing the business.”

Has Musk set the expectations bar too high once again?

And as investors digest this barrage of news, which saw an earnings miss and a revenue beat, coupled with strong cash flow offset by a collapse in cap ex and warning that Q1 auto deliveries will be weaker than expected, the stock initially tumbled, then spiked, and at last check was unchanged, as trader will likely seek more guidance from Musk during the earnings call.

via ZeroHedge News http://bit.ly/2DIfbZF Tyler Durden