In the clearest sign yet that a tie-up between struggling German lenders Deutsche Bank and Commerzbank appears to be almost inevitable, despite the protests of executives from both banks, Bloomberg reported on Thursday that senior officials at both banks are bracing for a government-brokered merger as soon as mid-year.

Talks between the two lenders have been intensifying, as was implied by reports about meetings with senior German Ministry of Finance officials in recent weeks.

DB’s inability to reverse its slump in revenue has apparently led the German state to the conclusion that the only way to save both banks is a merger that will allow them to cut costs amid a search for synergies.

And DB investors, while still supportive of CEO Christian Sewing, are growing uncomfortable with their mounting on-paper losses. Though a merger, as one analyst pointed out, would be no panacea.

“If this is true, the economic situation at Deutsche Bank must be worse than seen by the outside,” said Andreas Plaesier, an analyst with M.M. Warburg. “A merger with Commerzbank at this point doesn’t make sense because it offers few possibilities to achieve client growth.”

But with the German economy flirting with a recession, government officials worry that a merger would be the only way to protect the banks from the additional strain of a downturn. The report also notably follows the German government’s decision to slash economic growth forecast for this year to just 1%.

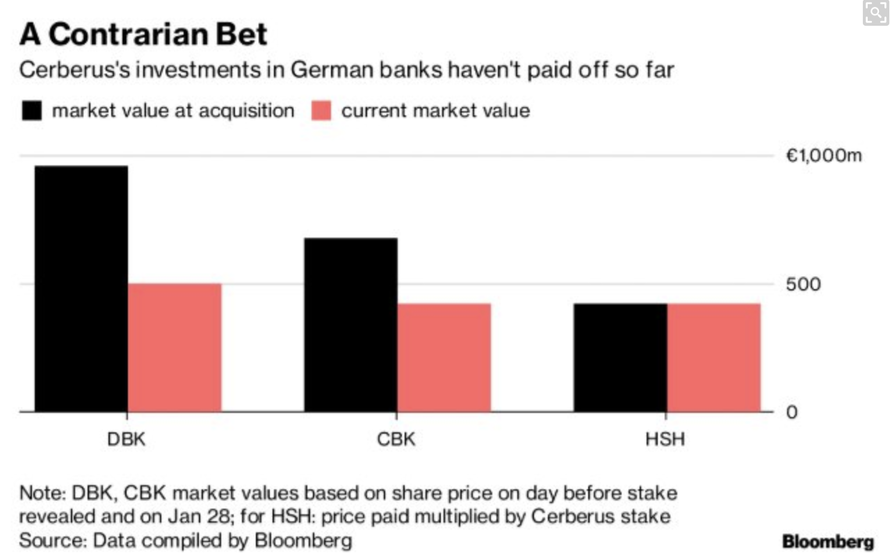

The negative reaction of DB stock – shares slumped more than 3% on the news – notwithstanding, substantive reports of a possible merger are welcome news for at least one firm: Cerberus Capital Management. Back in 2017, the private equity firm sank nearly $2 billion into Commerzbank and Deutsche, believing that “basic blocking and tackling”, like exiting lagging businesses, could help the banks earn their cost of capital and trade closer to their book value (they’re both currently trading at some of the steepest discounts to book value), as Bloomberg’s Elisa Martinuzzi argued in a column published earlier this week.

The private equity firm’s interest in German lenders hasn’t stopped at Deutsche and Commerzbank. a consortium led by Cerberus recently bought state-backed lender HSH Nordbank. Cerberus is also bidding on a minority stake in NordLB, another regional bank. In keeping with Cerberus’s secretive nature, almost nobody stands to benefit more from a merger of the two banks than Cerberus – even if that’s not what the firm has been saying.

The viability of the two lenders isn’t under immediate threat after years of restructuring and capital raising. In betting the two banks can now achieve sustainable profitability, Cerberus will have calculated that its small holdings would give it the ear of management and that the adjustments required would probably not need to be too radical.

It appears to be scoring on one point. Deutsche Bank has appointed Cerberus’s advisory arm to consult on implementing its strategic plan. As part of that engagement, Cerberus has helped sway Deutsche Bank to deploy funds to higher-yielding assets, Bloomberg News has reported.

Meantime, Cerberus representatives have met with German finance ministry officials at least four times in the past six months. The government remains Commerzbank’s biggest shareholder with a stake of about 15 percent.

But since the fund’s 2017 wagers, the outlook for both the industry and German banks in particular has worsened markedly. Deutsche Bank has been dragged into yet another money laundering scandal. It is being scrutinized like no other lender in the U.S. for its dealings with President Trump. And police raids at home in November weighed on revenue in what was already torrid fourth quarter for many banks.

Over at Commerzbank, its core business of serving mid-sized corporate clients – the backbone of the German economy – is struggling as trade wars dent exports and competition from foreign rivals intensifies.

But both banks’ recovery has become fundamentally more complicated. While the European Central Bank has suspended QE, record-low rates are unlikely to move higher any time soon as economic growth sputters, prolonging the squeeze on net interest margins. At Deutsche Bank, cutting costs has so far proved tricky, eroding revenue more than desired, while funding has become more expensive.

In public, DB CEO Christian Sewing has vehemently denied merger speculation (likely because, given the erosion in DB’s share price, any merger would likely leave Sewing as the junior partner). To be sure, Sewing, who was brought in to run the bank less than a year ago, still has its cheerleaders, including Hudson Executive Capital, led by a former JPM banker, who has shared his confidence in Sewing’s plan to cut costs and exit unprofitable businesses during appearances on CNBC.

But at this point, with at least two more criminal probes gathering pace, one of which appears to directly implicate the bank in deliberately ignoring its own AML controls, a tidy merger with Commerzbank appears to be what the German Ministry of Finance wants. Given the prospect of billions of euros in fines – on top of the $20 billion the bank has already paid since the crisis – a merger is increasingly looking like the sensible option.

And we haven’t even gotten into the risks posed by DB’s massive (though not quite as massive as it used to be) derivatives exposure.

via ZeroHedge News http://bit.ly/2B9g1wY Tyler Durden